Nobody thinks they’re neglecting customers, but many do. Some of us live, breathe and constantly think about the customer experience. But most businesspeople, believe it or not, don’t spend their time that way.

Nobody thinks they’re neglecting customers, but many do. Some of us live, breathe and constantly think about the customer experience. But most businesspeople, believe it or not, don’t spend their time that way.

Unfortunately, business leaders have not been trained, educated, or even asked to consider customer experience. Traditional business education, and even standard business plans, don’t focus on the customer’s total interaction or ‘journey’ beyond the basics of getting the sale and delivering a product or service.

Think of a customer journey as a detailed map that shows the full experience a person has when dealing with your business.

Many customer journey maps can neglect key phases of the customer experience. They are sometimes focused on the ideal scenarios where issues don’t happen: All customers are happy, all products are delivered on time, and there’s no need for customer service to resolve complaints.

One of the questions I love to ask business owners and managers who are exploring customer experience is how much they know about their ‘at-risk’ customers.

For example, do you know who you’re at risk customers are, where they are in the journey, and to where they might drift? The answer I tend to get from people who aren’t succeeding at customer experience is a blank stare and maybe a shrug.

The relationship between a brand or retail store and its customers is like any other relationship. There is often a love story in the beginning, and then throughout the relationship, the love and even loyalty can wane and drift. That’s human nature.

Neglect is an emotion that is more powerful at driving human behavior than we think.

A research study published by the International Journal of Applied Business and Economic Research identified four antecedents to customer loyalty. They were defined as satisfaction, commitment, trust and image. All of these factors require attention and intention. Neglect is the antithesis to each.

And yet business leaders are often asked to focus on customers-yet-to-be, those they don’t have; all too often heavy emphasis (along with financial incentives) is placed on acquiring new customers. Once customers become great customers, there might be an emphasis on customer advocacy programs or customer loyalty initiatives.

Those are important parts of the customer journey, but the overlooked opportunities may lie in the customers who are drifting away from the brand due to neglect. They don’t get attention and they usually don’t make a fuss. They just leave.

Leaders need to challenge their staff to consider those quiet, but almost-gone, customers. They are the ‘at-risk’ customers.

Most businesses used to lump customers into two simple categories: New customers and ‘the rest of them’. New customer acquisition is often used to gauge success – the more we gain, the better we’re doing!

And what about ‘the rest of them’? They’re all getting automatically e-charged and they seem happy because they’re not complaining. This is how we get lulled into thinking everything is working well.

But meanwhile, we have at-risk customers who are ready and willing to defect to competitors when the right opportunity presents itself.

Who are your at-risk customers?

Before you can develop a strategy around at-risk customers, you first need to identify them. These are customers who are not happy or just have a ‘meh’ attitude about what your brand does for them. Not since they were shiny new customers have they felt cared for.

At-risk customers don’t have a strong opinion about what you think are the best features of your product or service. They may have had one bad experience with your staff and decided that was enough to open the door to consider switching. Or maybe they have been trying to share feedback, but don’t feel heard.

If you don’t know who this group is, here are a few ways to identify these customers:

• Evaluate sales data and investigate the customer journey for those who didn’t buy. Did they seek support at similar times or stop engaging with the store or staff?

• Review milestones along the customer journey. Is a customer more likely to drift away after one year, two years, or after a significant change in their life or in the way they interact with the store?

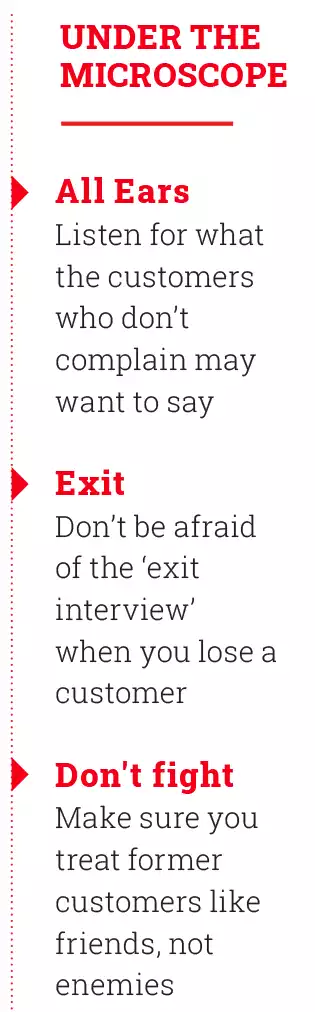

• Turn complaints into opportunities to listen for what the customers who don’t complain may want to say. It’s often thought that one loud complainer may be speaking up on behalf of many, many others.

Now that you have identified your at-risk customers, it’s time to take action to not only stop them from leaving but also keep them truly engaged with your brand.

Understanding at-risk customers

You may not be able to stop all of your atrisk customers from leaving you, but you can learn a lot about how to avoid putting future customer relationships at risk!

1. Identify what happens when a customer defects: Every company has some hard-to-forget stories about those customers who left for your competitors. Have a place to capture those stories. Share them as part of your customer experience updates. Don’t shy away from those painful discussions. Embrace them!

Find out if there are common themes among those who left. Determine if there is a moment in your business relationship when they are most likely to leave. Those moments are sometimes more tied to the customer’s life events like moving, buying a house, or needing different options. Customer interviews can be helpful here in discovering those moments.

Look for trend lines with product renewals versus cancels or those who leave after X number of months or years. This type of data will offer some insight into where to prioritise efforts to keep those customers from drifting away!

2. Set up alerts to get more details: If one of the identifiers is a customer who has only bought on a single occasion, then dealing with that is imperative.

Set up triggers at intervals throughout during or after the purchase process to ascertain if that customer needs support. Ask for input – don’t just offer training or webinars that are solely product centered. Ask for what might be missing. Those post-event surveys can also be a great place to look for what customers are missing.

Are they asking for followup communication or training and not getting it? Time to set up more processes to close the loop with those customers

3. Know the ideal customer journey: Know it, understand it, and watch for ways to support it.

Your best customers probably use your store more often than those who will leave. If you know what the ideal journey looks like through customer journey mapping, then it will stand out when your customers veer away from the ideal and lapse into not relying on your brand.

Product usage is a great indicator of customer engagement. But some products, like a savings account at a bank, don’t require active usage. Get proactive about how to engage with customers who might receive statements or invoices but little else.

That bank savings account customer might be interested in financial education, or not. Others might be motivated by gamification. Engagement varies based on the industry and relationship – especially for jewellery retailers - but neglect still feels like neglect. A little attention and intention in the customer journey can go a long way.

4. Don’t be afraid of the exit interview: ‘You win some, you lose some’, seems to be how many organisations avoid thinking about at-risk customers. “We’re not for everyone,” some businesses will say.

The best retailers never shrug this off as insignificant. Seek feedback when a customer leaves. Ask the hard questions about why they left and who ended up serving their needs. Use that information to inform your roadmap for improvements.

5. Treat former customers like friends, not enemies: Without a plan for atrisk customers, stores lump former customers back into the 'prospect' category. This means those who had relationships started receiving communications as if they didn’t.

Even after years of loyalty, the customer who leaves might receive an email offering new customers a special promotion, sign-up deal, or an email explaining why the service is so great, which the customer obviously thinks differently about now that they’ve left.

It can be offensive to a loyal customer who suddenly is treated like a stranger. We have to do better than sending promotions and offers to them as if they have no idea what it’s like to be a customer.

Address these customers as who they are. They know your store or brand, they were a customer, and now it’s time to stay in touch. Staying in touch doesn’t mean just sending promotional or sales offers. It can mean closing the loop with them even after they’ve left the organization.

One technology provider sent an email to former customers who had requested a certain feature once the feature was rolled out. Instead of an offer, it was a letter from one of the product designers thanking them for the input and sharing their success with the former customer directly. That led to a lot of personal replies and former customers coming back to a brand that no longer was neglecting them.

This may seem overwhelming, but it doesn’t have to be done at once. I challenge you to pick one of these five methods to try implementing first. Then add more as you can over time.

At-risk customers are still customers, for now. Instead of hoping, they don’t leave, why not learn from them instead? What you learn can help them - and future customers like them - stick around instead of drifting.

Read eMag