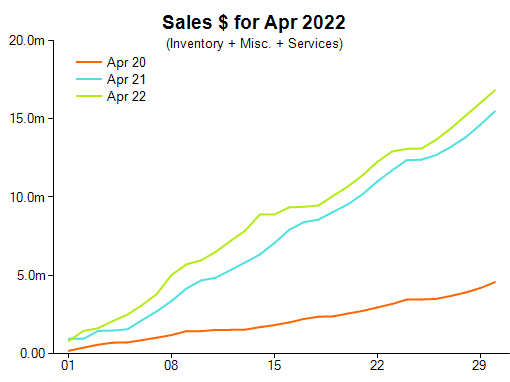

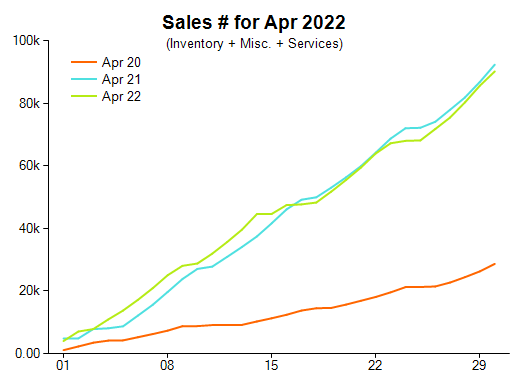

The data collected from retailers in April shows that comparative overall sales dollars have increased by nine per cent compared with April 2021. That’s a huge 240 per cent increase compared with the figures from April 2020, however, it’s important to remember that’s when COVID-19 lockdowns first began in Australia.

Comparative units sold data reveals a small decrease of 2.3 per cent compared with April 2021 but a strong 222 per cent boost compared to April 2020.

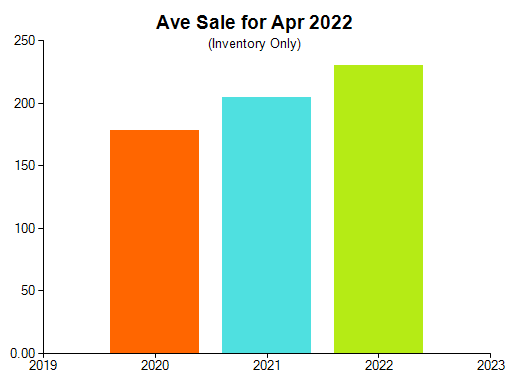

The comparative average sale, in inventory only, continues to climb and has increased by 12 per cent compared with April 2021, climbing from $205 to $230. This pattern is the result of activity through the product categories, with growth in fine jewellery strongly influencing the average sale figures.

April has demonstrated growth across many of the product categories. Further analysis of the sales dollars data reveals diamond set precious metal jewellery was has increased by 17 per cent compared with the same period of time in 2021 and by 292 per cent on the two-year difference looking back at 2020.

Colour gemstone set precious metal jewellery sales dollars have improved, climbing 15 per cent compared with April last year.

That product category shows an even larger increase of 279 per cent winding back the clock to April in 2020, again, because of the impact of COVID-19 lockdowns.

Retail Edge sales manager Michael Dyer said the data was pleasing: “These numbers continue to show a confident and stable consumer mindset.”

“It’s heartening to see that diamond month had period growth.”

Dyer added, “No stone precious metal jewellery sales dollars have also continued strongly again to be 14 per cent improved compared with April 2021, and it was an exceptional result of 253 per cent growth on the two-year difference to April 2020”.

Silver and alternative metals jewellery sales dollars dipped slightly with a 2.2 per cent decrease recorded compared with April 2021.

The pattern in laybys showed a decrease of nine per cent in dollars between new purchases and collections and cancellations. This is emblematic of the collection and enjoyment cycle rather than the preparation and demand cycle.

This also means that anticipated cashflow will be reduced.

Service and repair work demonstrates a similar pattern with a decrease of 29 per cent between incoming and pick-ups and cancellations. The special order numbers also show a similar pattern with a decrease of 22 per cent between incoming and collections and cancellations.

Retail Edge’s analysis is gathered from POS software located in more than 400 Australian independent retail jewellery stores. The data is intended to present a representative sample of the wider Australian jewellery industry.

2022 Jewellery Retail Sales April Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Positive signs continue in March for jewellers

February jewellery sales remains strong after the holiday rush

December jewellery sales still upward despite drop in volume

Consumer demand for jewellery seen to drive strong December trading