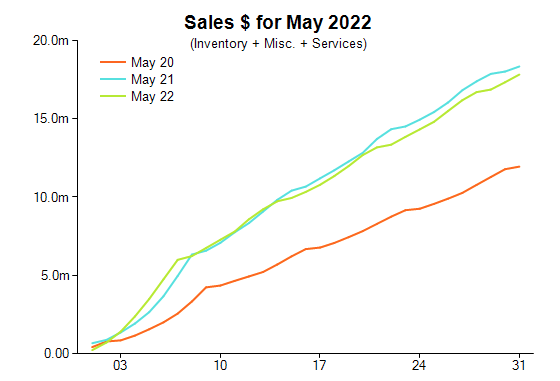

The latest Retail Edge Consultants sales performance report indicated a significant 54 per cent decrease from 2020. However the report shows a wide array of mixed results.

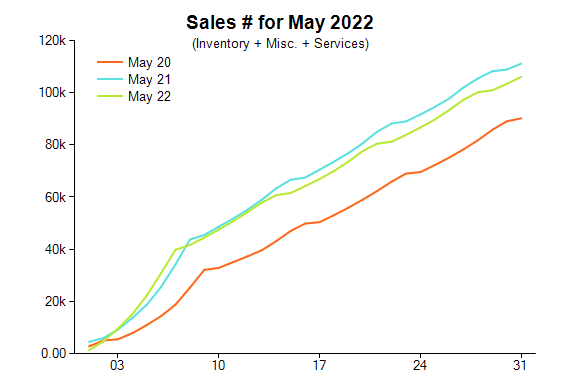

For example, there was a slight decrease in comparative units sold by 4.6 per cent compared with May 2021 but a strong increase by 23 per cent when measured against May 2020.

The report indicates a significant change in Mother’s Day sales this year.

According to Mike Dyer, sales manager, Retail Edge, “It appeared the Mother’s Day celebrations were more centred around face-to-face contact and meeting and eating rather than jewellery gift-giving.”

“It’s possibly a reflection on the changed circumstance from last year around social distancing.”

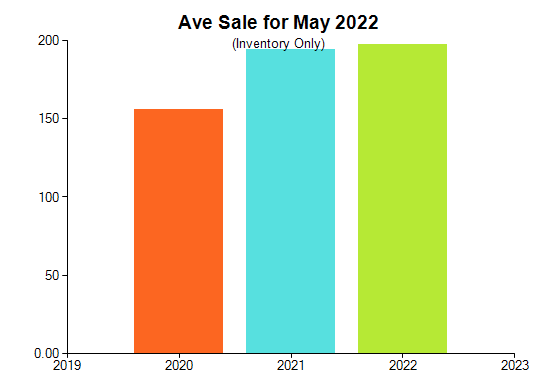

Comparative average sales based on inventory continued to sustain the growth momentum as it steadily increased by 1.6 per cent compared to the same period last year from $194 to $197 and a much stronger increase by 27 per cent ($156) when measured against May 2020.

Dyer noted “mixed results across the product categories” led by diamond set precious metal jewellery which saw a significant decline in sales dollars by 21 per cent compared with May 2021 but saw a much higher increase by 66 per cent based on a two-year difference.

“The overall drop in unit sales and the Mother’s Day shift from jewellery gifting to socialising would have an influence on that,” he said.

Colour stone set precious metal jewellery sales dollars were down by 10 per cent compared with May last year but revealed a much stronger increase by 68 per cent compared with May 2020.

Non-stone precious metal jewellery sales also went down by 6 per cent when measured against May last year, but saw a good increase compared with May 2020 by 27 per cent.

Silver and alternative metal jewellery saw a sustained uptrend marked by an increase of 3.1 per cent compared with May last year, as well as a significant increase of 69 per cent when measured against May 2020.

Laybys also increased by 4.5 per cent between new pieces and pickups/cancellations which, according to Dyer, “indicates that there will be potential increased cashflow and customer visitations as a result.”

Services and repairs fell by 25 per cent based on dollar values between new pieces and pickups/cancellations.

Dyer said that dollars for special orders remained steady with no variance, adding “maybe it’s time to bring these activities (services) you offer back into the forefront of your marketing and social media.”

Retail Edge’s data is gathered from its POS software across more than 400 Australian independent retail jewellery stores. It is intended to present a representative sample of the wider jewellery industry.

2022 Jewellery Retail Sales May Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Positive signs continue in March for jewellers

Golden Connection: the ups and downs of gold jewellery in a topsy-turvy world

Consumer demand for jewellery seen to drive strong December trading