Retail Edge’s data is gathered from POS software located in more than 400 Australian independent retail jewellery stores.

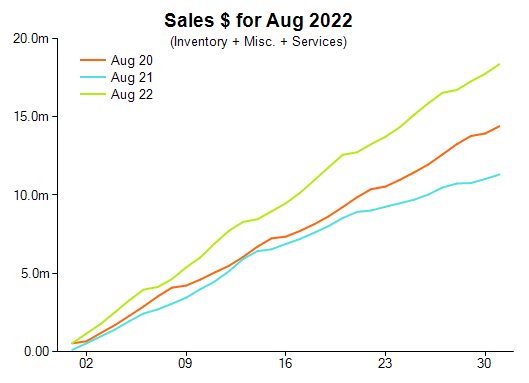

In August, comparative overall sales dollars rose by 62 per cent compared with 2021.

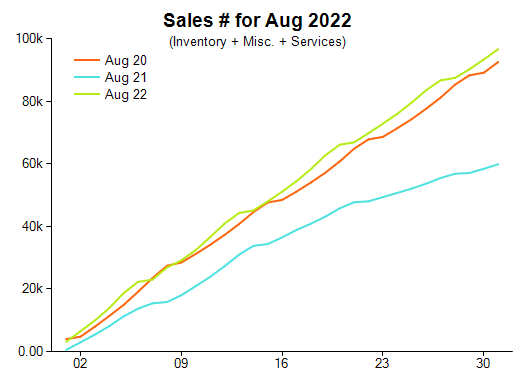

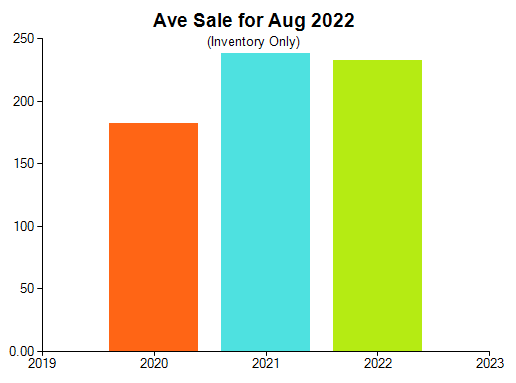

The comparative units sold category was a similar story, rising by 61 per cent compared with 2021. Comparative average sale (inventory only) dropped 2.6 per cent, from $238 to $232.

Retail Edge sales manager Mike Dyer said the data was pleasing while noting the importance of context.

“As stated last month, when reviewing the numbers to remember that July, August and September 2021 and 2020 were impacted by lockdowns and so will have had an influence on the growth numbers,” he explained.

“There were very good results across the product categories. The drill down into the sales dollars numbers shows diamond set precious metal jewellery was up 27 per cent compared to August 2021 and a healthy 39 per cent on the 2-year difference to July 2020.”

He added: “This is the first month comparative average sale drop that I can recall.”

Coloured stone set precious metal jewellery sales dollars rose an impressive 106 per cent compared with August 2021. No stone precious metal jewellery sales dollars were strong with a 63 per cent jump compared to August 2021 and a 40 per cent growth on the 2-year difference to August 2020.

Silver and alternative metals jewellery sales dollars were also a positive contributor with a 77 per cent rise compared with 2021.

"The pattern in layaways [laybys] showed an increase of 4 per cent in dollars between new ones and pickups or cancellations,” Dyer said.

“This continues to indicate good cashflow and customer visitations as a result. For the third consecutive month it also indicates that consumers may be planning and budgeting their jewellery purchases.”

He continued: “The pattern in services [repairs] shows the reverse pattern with a decrease of 26 per cent in dollar values between new [incoming] and pickups or cancellations. This is the second consecutive month of this pattern.

“If this pattern is also reflected in your business, it points to the need to lift the volume and frequency of your marketing noise around the services area of your business.”

Retail Edge’s data is intended to act as a representative sample of the wider jewellery industry.

2022 Jewellery Retail Sales August Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Major increase in sales for Aussie retailers

June jewellery sales achieve mixed results; need for planning pushed

Jewellers see mixed sales results for May

Strong retail jewellery sales continue in April

Positive signs continue in March for jewellers

February jewellery sales remains strong after the holiday rush

January jewellery sales shows interesting trends