As a small business, how do you set the appropriate price for a product?

As a small business, how do you set the appropriate price for a product?

That’s a question that every retailer should be able to answer. Product pricing is an element of trade that will make or break any business.

Surprisingly, this is an area in which many retailers report a lack of confidence.

According to a recent study published by Retail Systems Research, a US market intelligence company, there is a notable difference in the way successful and unsuccessful retailers view pricing strategy.

The study defined ‘winners’ as retailers with a sales growth exceeding 4.5 per cent, and ‘losers’ as retailers who fail to meet that average number.

The study concluded that just 64 per cent of the winners consider themselves satisfied with their capabilities when it comes to accurately pricing products.

According to the study, 67 per cent of the winners said pricing optimisation was “absolutely vital”. Only 42 per cent of the losers agreed. None of the winners surveyed agreed with the suggestion that no price optimising tools were required for a business.

Bizarrely, two per cent of the losers agreed with that sentiment! Perhaps that’s not so bizarre, considering their categorisation.

Brian Kilcourse, managing director Retail Systems Research, says the study confirmed the importance of correct pricing for retailers.

“In the end, retailers should know that closing the pricing readiness gap is now a critical component of overall retail strategy,” he says.

“It is clear that in order to win, precision pricing is a must-have, not a nice-to-have.”

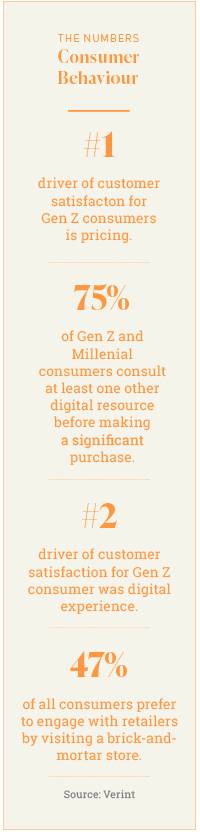

Another recent survey by web data platform Bright Data suggested that consumers are increasingly fixated on price.

When asked which factors typically influence their purchase decisions when shopping online, 82 per cent of respondents said price. In addition, 74 per cent of respondents said they would switch from their usual retailer if they found a better price elsewhere.

Find the balance

What is not commonly known is that there are more than 20 different methods or strategies of price setting. (See below) Some can, or should be, used for specific activites and/or events.

In many ways, product pricing is like walking a tightrope: Success in the pursuit of the appropriate pricing strategy comes down to a balancing act, avoiding the extreme pitfalls of failure on either side.

If the calculations are incorrect and the product is priced too low, the long-term impact is dire. Low pricing may not generate sufficient profit to cover costs, especially in the event that sales volume is down.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

Customers are likely to fear that your product is inferior to those offered by competitors if your product is notably cheaper.

Many customers are looking for value above cost, after all.

Additionally, a retailer who sets a price too low is sending a simple message to the rest of the market “our product isn’t as good as similar products on the market, and thus, is worth less.”

The perils of over-pricing are obvious. Sales volume will drop as customers favour competitors with less expensive products.

While the endgame in business is to produce profit, when it comes to product pricing, this messaging or signalling is just as important. Price setting is communication.

A luxury vehicle manufacturer such as Ferrari won’t drop the price of a car simply to match the prices offered by a major manufacturer such as Toyota.

The way a product is priced is a message regarding the value of that product, and when a retailer makes a product too cheap you’re cheapening the brand of the business in the process.

Tough task for jewellers

Establishing the correct pricing strategies can be more challenging in the jewellery industry for a range of reasons, including issues of transparency on the factors that go into calculating the final value of a product.

Nationwide Jewellers represents more than 500 independent jewellery stores across Australia and New Zealand.

Managing director Colin Pocklington says educating members on the importance of precision in pricing became a major focus many years ago.

“Around 20 or so years ago we recommended to all members that they implement a higher pricing strategy,” he says.

“This was in response to increased operating cost, specifically with rent and labour as a percentage of sales.

“A pricing strategy needs to be based on the businesses financial model, so that the resultant gross margin percentage will result in a gross profit percentage that is within industry benchmarks, and importantly, after covering all overheads provides a profit before tax [as a percentage of sales] that will give an adequate return on investment.

Pocklington says that since education around product pricing became a priority, Nationwide has explored options for best communicating the information with members.

“Our benchmark surveys revealed that many members were not achieving an adequate profit as a percentage of sales.

“We also introduced our Repair Price Book, as the vast majority of members were not charging enough on repairs,” he explains.

“Prices in the book are ‘scientifically’ calculated and based on labour and material costs, and the number of minutes required for each type of repair. We issue a new book about every two years, or annually if needed, based on changes to material or labour costs.”

So, with the importance of accurate product pricing firmly underlined, it’s time to explore some of the most valuable strategies.

Cost-based pricing

Cost-based pricing is by far the most common strategy employed by retailers. It’s a tactic that is easy to implement and given a healthy sales volume, all but guarantees a profit.

A retailer calculates the total expenses associated with operation, including direct material cost, direct labour cost, and other overheads, and then adds an additional percentage to the final sales price to ensure that a profit is returned.

Competera contributor Vladimir Kuchkanov explains “such a pricing strategy ensures that a company receives a profit margin that meets the anticipated rate of return.”

“Cost-based pricing is widely used because of its simplicity and the degree of information required to anticipate the profit.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

At this point, cost plus pricing is better than value-based pricing in cases when the data on costs and demand cannot be obtained easily. Experts label cost-based pricing as one of the most rational approaches toward profit maximisation.”

Cost-based pricing is not only easy to implement, but it’s also easy for customers to understand. There are a number of important disadvantages associated with the practice, however.

Cost-based pricing fails to factor in the pricing of competitors, and if a competitor is producing the same product at a cheaper cost, that competitor will generate more profit in the long term.

In the same vein, consumers may be willing to pay more than a minor percentage increase for a particular product, such as luxury watches.

If a product is mispriced, profit may be missed by a retailer or a store may be viewed consumers as having an inferior product by selling a product at a far cheaper rate than that of competitors.

Premium pricing

As a small business, how do you set the appropriate price for a product?

As a small business, how do you set the appropriate price for a product?

The premium pricing strategy is centred on communicating the message that a retailer’s product is superior to those offered by the competition.

Implementing premium pricing is simple. Retailers assess the market and their direct competitors and then price similar products higher.

The aim of premium pricing is two-fold – as a retailer offering the most expensive price, customers may infer that product is of the highest quality compared with its cheaper counterparts.

In a scenario where two retailers have matching sales volume over a similar product, the retailer implementing premium pricing will have superior profit.

Jim Woodruff, Small Business Chron, says half-hearted commitment to premium pricing will end in disaster.

“While it's natural to focus on and point out the weaknesses of the competition, companies have more success with premium pricing when they concentrate on creating value that makes their products worth the higher prices,” he says.

“Establishing a product with a high-priced image takes time, money, and the efforts of everyone in the business. The entire marketing program must project high quality, and the consumer must be convinced that the product is worth every penny.”

Loss leader pricing

Hoping to attract new customers to your store? A loss leader strategy could be an option, at various times.

Loss leader pricing is a marketing strategy in which products are sold at a retail price set lower than the wholesale price in order to attract new customers to a store.

The hope for retailers who employ loss-leading practices is that once a customer is in a store, they will be enticed to purchase additional products which are not priced below wholesale price.

The most popular example of loss leading is supermarkets selling milk. Milk as a product rarely generates profit for supermarkets, however with fridges commonly located at the rear of a store, customers are exposed to products that do generate a profit while inside.

Deal Avo writer Aleksandra Holownia, says “the assumption behind this strategy is quite straightforward.

“Some companies try to lure customers with prices for specific products that are irresistibly low. This way, at least according to their thinking, customers will more eagerly walk in the store and buy more products, including those that have normal prices.”

Keystone pricing

Another common strategy that aims to simplify the sales process is keystone pricing.

Keystone pricing is a simple equation, with a retailer setting the price of a product at exactly double the wholesale price.

Simplicity isn’t the only advantage that comes with this approach, as keystone pricing also offers a high-profit margin and flexibility in range if minor adjustments needs to be made at a later date.

Matt Ellsworth, Act On Intelligence, says it’s a common approach for retailers with a new product and little background on the market.

“The most common use of keystone pricing is when a retailer brings a new product to its shelves,” he says.

“Without historical pricing data on the item, it’s hard to know the ideal sales price you should launch with.

“That’s where keystone pricing comes in. By doubling the wholesale cost and setting your initial sale price at that level, you can generally get some kind of profit margin, while gathering data on how customers reacted to the initial price.

“If you find that customers aren’t buying at the markup level, you can use markdowns and discounts until the selling price is more in line with customer expectations. Likewise, if your sales volume is extremely high at launch, you could raise the selling price to increase your margin.”

There are a number of retail scenarios where keystone pricing is inappropriate. Keystone pricing suffers in that it doesn’t factor in prices used by the competition, and if other stores are notable less expensive, customers may

be driven away.

Competitive pricing

A competitive pricing strategy is a process of selecting price points for products based on competitor pricing

in a particular market or niche.

Retailers who utilise competitive pricing move away from pricing based on business costs or profit targets. The competitive pricing strategy incorporates three other pricing strategies – premium pricing, loss-leading pricing, and equalling pricing in one, all-encompassing strategy.

When a retailer commits to competitive pricing, they will lower the prices of products to undercut competitors on some products, while also raising the price of other products to establish a premium or prestige brand.

The third aspect of premium pricing is price-matching – offering customers a discount to match the price offered

by a competitor.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

Profit Well contributor Vivian Guo, says competitive pricing is difficult to get wrong. “It’s rare to royally screw up using this form of pricing,” Guo says.

“If you have a fairly solid grasp on your product’s quality, target audience, and cost of production, this method will most likely never lead to bankruptcy. It’s kept your competitors afloat, so similarly, it should do the same for you.

“In saturated industries like retail, competitor-based pricing can be fairly accurate. After all, for most consumer products there are millions of customers and enough data to move pricing closer towards a methodology based on market price and market share.”

Recommended Retail Price

Recommended retail price (RRP), also known as manufacturer suggested retail pricing (MSRP), is a strategy commonly used by car dealers, while retailers of other high-priced goods such as appliances, electronics, and jewellery also employ the approach.

As the name suggests, a RRP is provided to a retailer by the manufacturer or supplier of the product. The price is supposed to reflect the costs incurred during production and sales.

The use of the RRP strategy is effective at reducing inventory and generating sales in a sluggish economy. Some retailers offer prices at or below RRP as a part of clearances.

The downside to the strategy is a conflict with the theory of competition. RRP also passes on the responsibility of pricing to an external party, while the consequences for error will only be experienced by the retailer in most circumstances.

James Gordon, The Business Professor, says establishing uniformity in the prices of products from store to store is an important part of the process.

“Although such standardised prices ensure that consumers do not have to overpay for the goods purchased, several retailers actually sell products for lower prices than the MSRP [RRP],” Gordon says.

“This is typically done to move inventory from the shelves during periods of slow sales or as part of competitive pricing strategies aimed at outdoing the prices offered by competing retailers.

“Since retailers usually purchase products from [suppliers] at wholesale prices that are well below the MSRP, it is possible to offer huge discounts on the listed prices and still turn a profit.”

Penetration pricing

Penetration pricing, as the name suggests, is a marketing strategy that aims to attract new customers to a product or service. Retailers offer lower prices than those offered by competitors – sometimes accepting an initial loss – in exchange for engaging with a new demographic.

Implementation is simple for retailers, beginning by researching the prices offered by competitors, and adjusting prices in-store to undercut the competition. The aim of the strategy is to build market share with the hope of retaining customers once prices are eventually raised to generate profit.

Francesca Nicasio, writer for Vend, says that switching brands isn’t a popular practice for consumers and that penetration pricing can encourage a transition.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

For any collector of luxury goods, few things matter more than a guarantee that you’re getting what you pay for.

“90 per cent of people consider themselves equally [brand] loyal or more [brand] loyal than they were a year ago. For new brands or companies releasing new products, this isn’t good news,” she explains.

Nicasio continues by explaining that this issue is exacerbated for small business that find themselves in competition against large chain stores and international corporations.

“It’s hard to bet on new entrants when you’ve been using the same products from long-standing brands. Penetration pricing provides a solution to both problems.”

Penetration pricing has some immediate and obvious shortfalls for jewellery retailers.

Unsuccessful attempts at gaining more market share can lead to insufficient funds for business operations long-term, as well as lost opportunities with customers who associate higher prices with higher quality products.

Penetration pricing is commonly used by supermarkets, streaming services, hotels, and banks.

Weighing it up

While the pricing strategies listed above are all important, there are many more to choose from.

When it comes to selecting the right pricing strategy, it’s important to start by setting targets that are both measurable and attainable.

With those in place, you can then perform market research, determining what methods your competitors are using and what degree of success they’re having.

That kind of information won’t be readily available, but can be gleaned by speaking with customers and analysing how they view competitor pricing.

With targets in mind, knowledge of how your competitors are approaching pricing, and an understanding of how customers perceive the market, a retailer is then ready to weigh up the pros and cons of different pricing strategies and determine which one best suits the market.

Edge Retail Academy provides highly specialised consulting services to US, Australian and New Zealand retail jewellers.

David Brown, president and Jeweller contributor, says involving an outside perspective can improve the pricing process.

“In my experience, the biggest barrier to business owners setting the correct price is

their own mindset,” Brown says.

“In many cases, items are set lower than they could be because of assumptions and expectations the owner held.

“The business owner put up barriers that aren’t necessary. Often the most successful pricing strategies are the ones set by other people who don’t have an emotional ‘buy-in’ to the decision. One of the most effective ways of pricing is to ask someone who has no knowledge of the cost of the item to tell you what they think it is worth.

Brown continues: “Again, this has often led to higher pricing policies than a ‘cost-plus’ mentality, especially where the staff are involved and don’t know the inputs. At the end of the day, they are the ones who will be selling it!”

Just as there are different horses for different courses, there are different pricing strategies

for different businesses.

In the same way that sending a champion thoroughbred to an unsuitable racetrack could end in disaster for all involved, so will adopting the wrong pricing strategy for a retailer.

Every retailer has it’s own unique factors and quirks and failing to take them into consideration when pursuing the correct pricing strategy is opening the door to a nasty dismount!

read emag