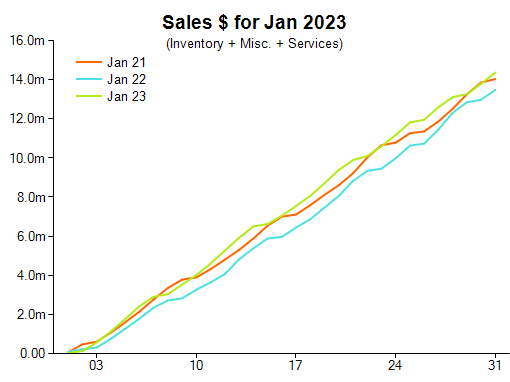

The data for the month was positive with comparative overall sales dollar performance increasing 7 per cent compared with 2022.

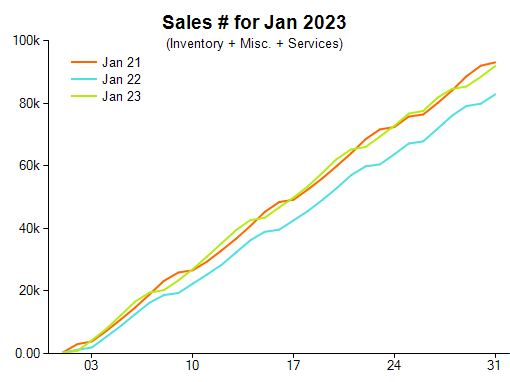

Comparative units sold provided a notable 11 per cent increase on a year-by-year comparison.

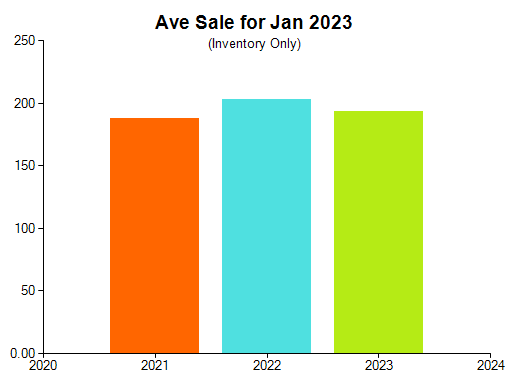

Meanwhile, comparative average sale (inventory only) showed a decrease of 4.8 per cent compared with the same period in the past year, declining to $193 from $203.

Retail Edge sales manager Mike Dyer said the data was an unexpected breakaway from recent years.

“My thoughts on these top-level results lead to cautious optimism, be aware but don't be alarmed. Overall the pattern in the past two to three years has been an increasing average retail of items and a slight decrease in the quantity of items being sold,” he said.

“January 2023 is the first month I can recall that the key indicators of average retail and quantity of items were both reversed on that longer period pattern.”

He added: “This is every reason to check the performance of your store to see what your pattern is. If the landscape is changing then you may need to review, revise and refresh your plan for calendar 2023.”

In terms of product categories diamond-set precious metal jewellery declined 15 per cent compared with January of 2022 and 2021. A similar phenomenon was noted in silver and alternative metal jewellery, with sales increasing 10 per cent on a one-year and two-year comparison.

Gemstone-set precious metal jewellery sales increased 3.7 per cent compared with 2022, while precious metal jewellery climbed 2.7 per cent on a year-by-year comparison.

There was a significant 27 per cent increase in laybys between new orders and pick-ups or cancellations. Data from special orders likewise showed a 33 per cent increase.

The pattern in services, such as repairs, mirrors this with an increase of 11.5 per cent in dollar values between new orders and pick-ups or cancellations.

“This leads us to the question, are consumers planning better and spending with caution?” Dyer asked.

“This repeated pattern across these three areas is exciting in the fact that it points to positive activity and good potential cash inflow as these items are completed, paid and collected. Taking these into account, you need to review your buying and restocking plan, before you get too deep into your buying season.“

Retail Edge’s data is collected from POS software located in more than 400 independent jewellery stores across Australia.

2023 Jewellery Retail Sales January Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Australian jewellery sales steady in December

Sales dip during November for Australian jewellers

Third consecutive month of strong sales for local jewellers

Another major month of rising sales for Aussie retailers

Significant rise in sales for Australian jewellery retailers