In terms of data January was curious, as a decline in comparative average sale was paired with an increase in overall sales dollar performance.

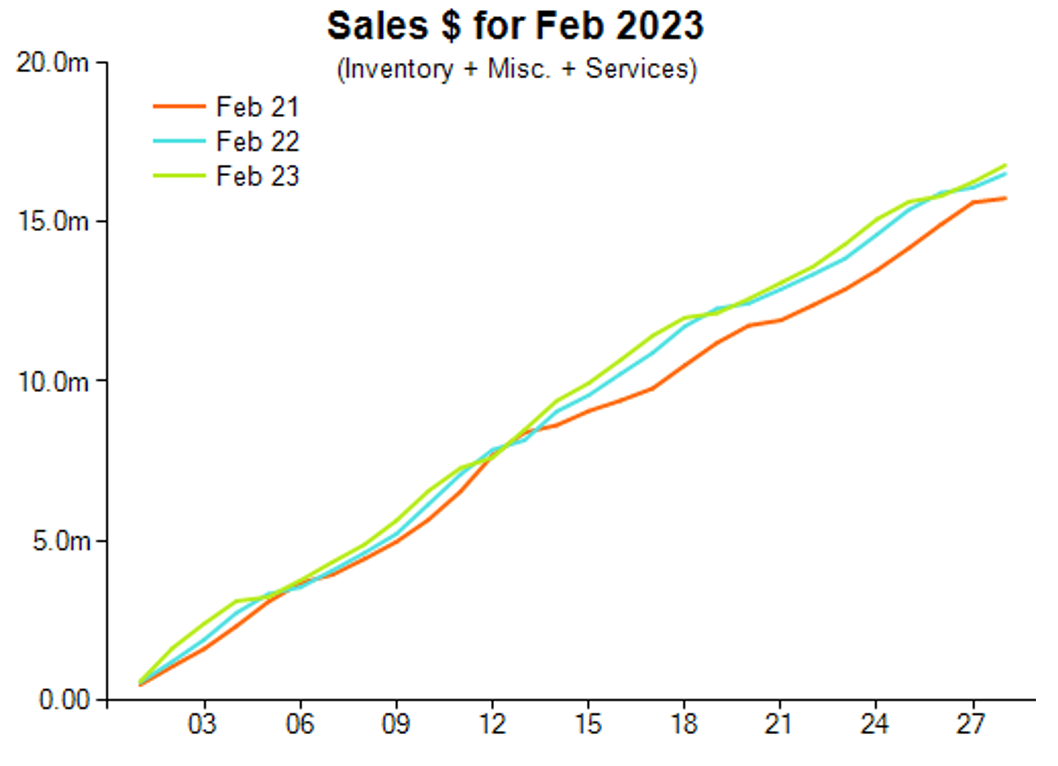

February’s eagerly anticipated data shows comparative overall sales dollar performance finished in positive territory with an increase of 1.6 per cent compared with 2022 and 7 per cent on the two-year difference.

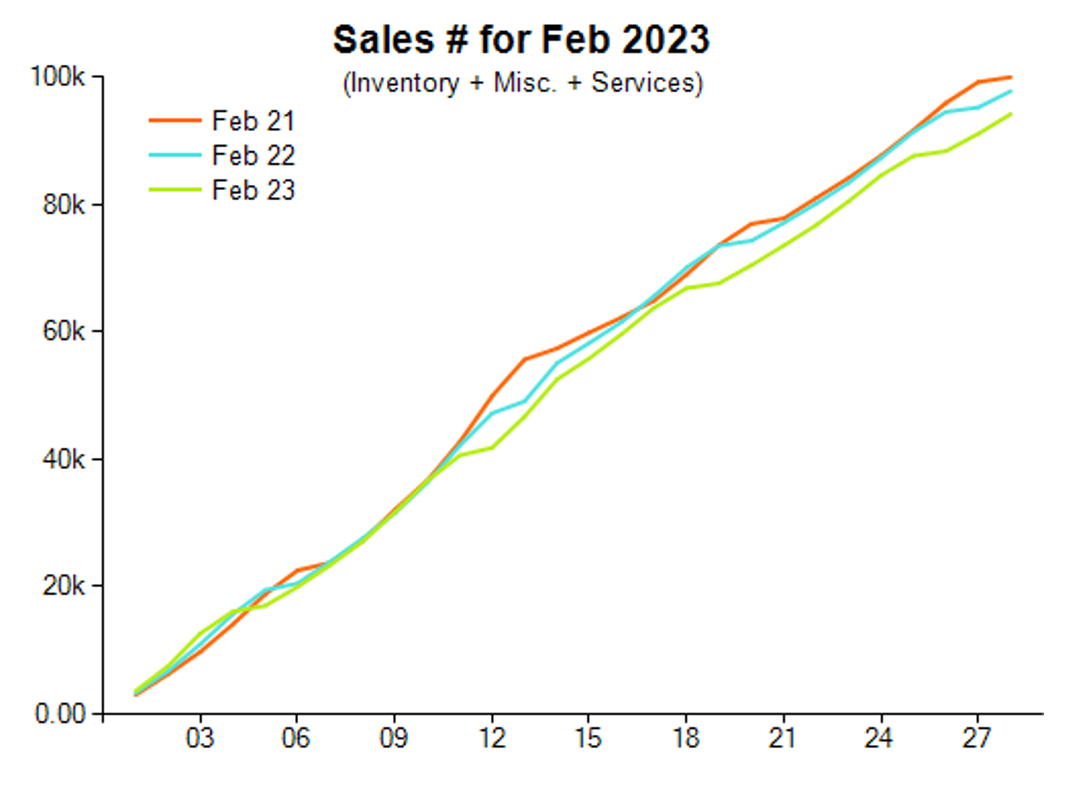

Meanwhile, comparative units sold showed a decline of 3.7 per cent compared with 2022 and a decrease of 6 per cent on the two-year difference.

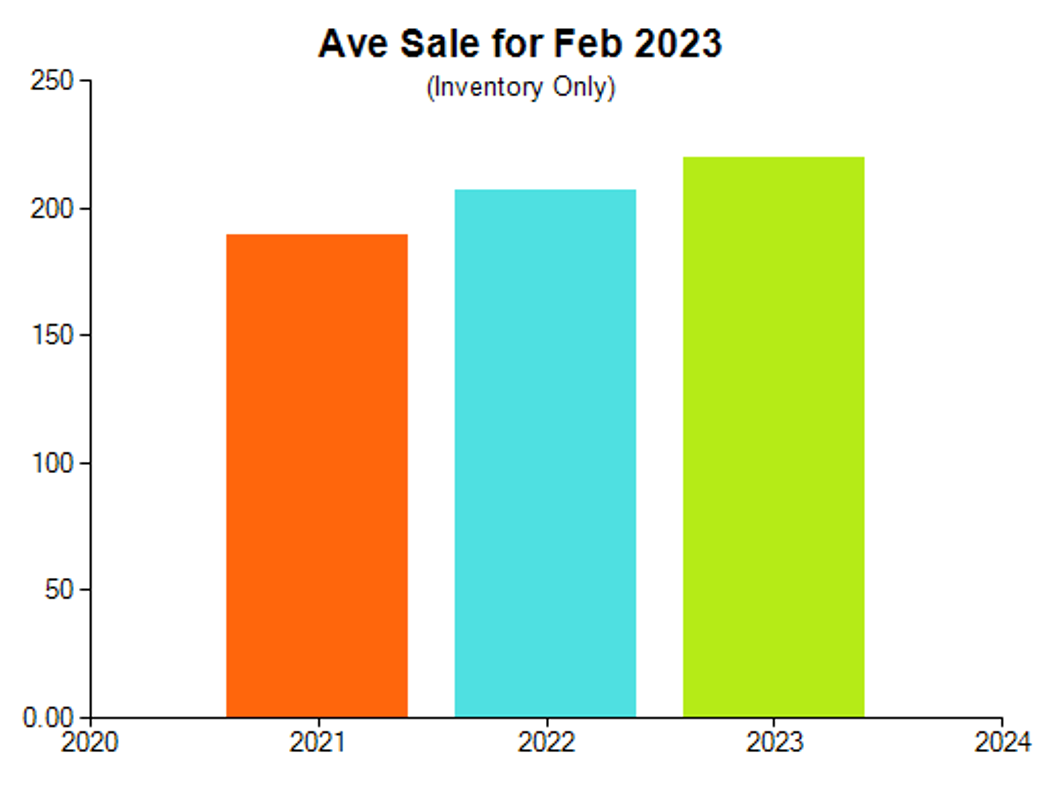

Comparative average sales in inventory recovered with a 6 per cent increase, reaching $220 from $207. The difference was more profound on the two-year comparison, increasing by 16 per cent.

Retail Edge sales manager Mike Dyer said that data from specific categories were particularly noteworthy.

“Looking at the performance across product categories, the drill down into the diamond-set precious metal jewellery section shows sales dollars numbers were down 21 per cent compared with February 2022 and 23 per cent on the two-year difference to February 2021,” Dyer explains.

“Gemstone-set precious metal jewellery shows sales dollars were down 5 per cent compared with February 2022 and 1.1 per cent on the two-year comparison.

"Precious metal jewellery shows sales dollars were up at 13 per cent compared with 2022 and increased 21 per cent on the 2-year difference.”

Meanwhile, silver and alternative metals jewellery sales dollars increased 4.3 per cent compared with 2022 and improved 22 per cent on the two-year comparison.

The pattern in laybys was flat with no difference in dollar terms between new orders and pickups or cancellations.

The pattern in services such as repairs demonstrated a decrease of 20.5 per cent in dollar values between new orders and pickups or cancellations.

“Maybe it’s just a catch-up and your repair box is looking a little more manageable and some of those pre-Christmas or January intakes are finally being collected,” Dyer said.

“If your repair box looks like it has a little more space than usual it may be time to chase up the outstanding quotes that haven’t been confirmed yet and lift the marketing exposure of your services expertise to lift the volume of new intakes.”

He adds: “Remember it’s not just about the repair job, it’s also the traffic flow and the opportunity to strengthen the customer relationship as well as sell product.”

Special order data likewise showed a flat month with no difference in dollar terms between new orders and pick ups or cancellations.

Retail Edge’s analysis is based on data collected from POS software located in more than 400 independent jewellery stores.

2023 Jewellery Retail Sales February Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Surprise reversal pattern observed in Australian jewellery sales

Australian jewellery sales steady in December

Sales dip during November for Australian jewellers

Third consecutive month of strong sales for local jewellers

Another major month of rising sales for Aussie retailers

Significant rise in sales for Australian jewellery retailers