February’s data showed comparative overall sales dollar performance finished in positive territory with an increase of 1.6 per cent compared with 2022.

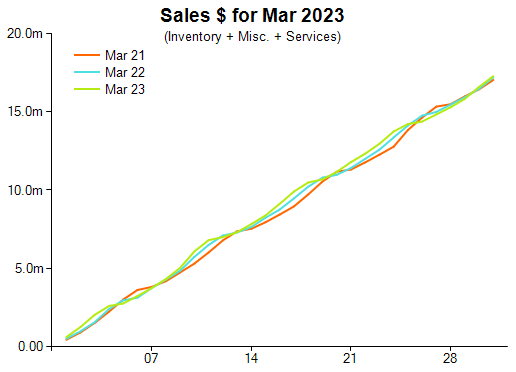

It was a similar story in March, with comparative overall sales dollar performance narrowly improving by 0.4 per cent on a one-year comparison.

The increase was more profound compared with 2022, improving 1.4 per cent.

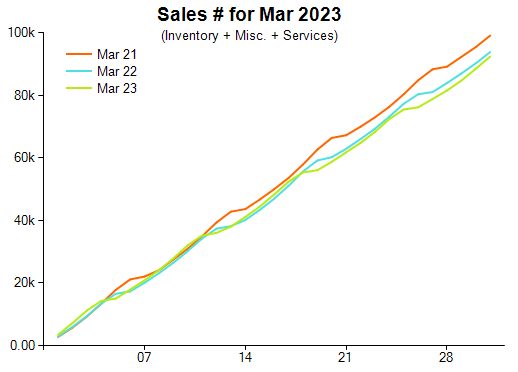

Retail Edge sales manager Mike Dyer said: “The comparative units sold showed a decline of -1.6 per cent compared with March 2022 and a decrease of 7 per cent on the two-year difference to March 2021 units.”

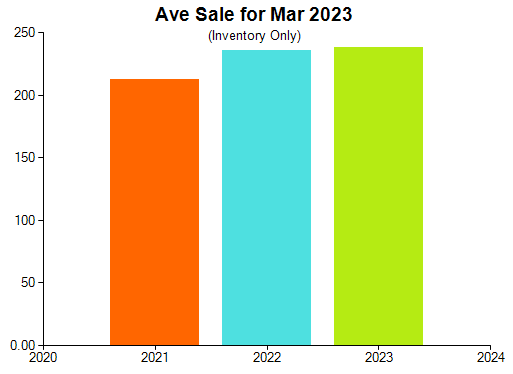

He continued: “The comparative average sale in inventory only was again in positive territory, increasing 1.3 per cent compared to 2022 - $238 from $235. It was a strong 12 per cent increase on the two-year difference compared to 2021, up to $238 from $213.”

Sales of diamond-set precious metal jewellery declined by 12 per cent compared with the past year, while gemstone-set precious metal jewellery decreased by 22 per cent.

Meanwhile, silver and alternative metals jewellery sales dollars decreased by 4.9 per cent compared with 2022 and increased 9 per cent on the two-year comparison.

The pattern in laybys was positive, while services and special orders saw a sizable decline.

Retail Edge’s data is collected from more than 400 independent Australian jewellery stores and of note in the March analysis, 27 per cent of sales lines were discounted.

2023 Jewellery Retail Sales March Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Optimism following February’s retail jewellery analysis

Surprise reversal pattern observed in Australian jewellery sales

Australian jewellery sales steady in December

Sales dip during November for Australian jewellers

Third consecutive month of strong sales for local jewellers

Another major month of rising sales for Aussie retailers

Significant rise in sales for Australian jewellery retailers