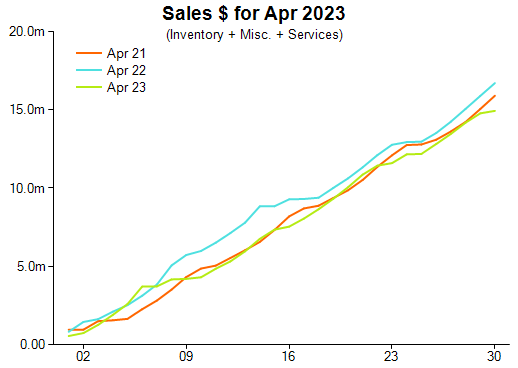

The data from April shows comparative overall sales dollar performance fell into negative territory with an 11 per cent decline on a one-year comparison.

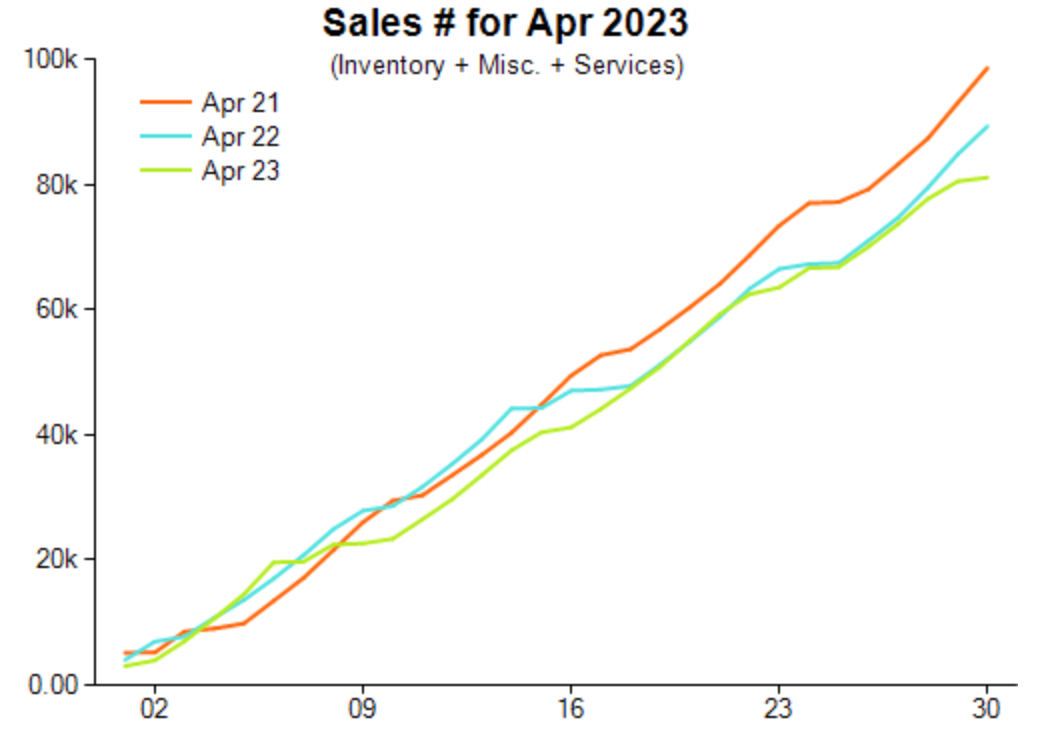

Comparative units sold showed a decline of nine per cent compared with 2022 and a decrease of 18 per cent on the two-year difference.

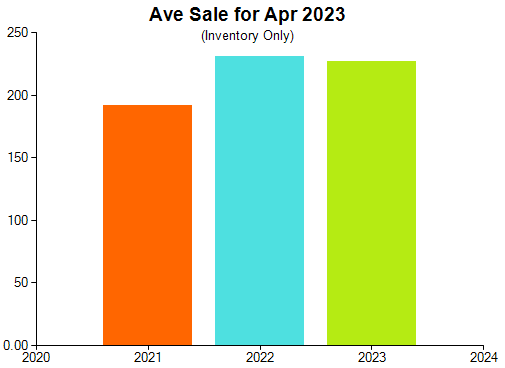

Retail Edge sales manager Mike Dyer said comparative average sale (inventory only) was in a modest decline of 1.5 per cent; however, it improved by 19 per cent on a two-year comparison.

“April typically is a challenging month with the public holidays and school holidays making for broken weeks and interrupted trading patterns,” Dyer said.

“However to get a negative impact of these proportions reinforces that a retail slowdown on consumer spending is now in place.”

Diamond-set precious metal jewellery declined by 24 per cent on a one-year comparison, while colour gemstone jewellery declined by six per cent.

Precious metal jewellery decreased by 11 per cent, while silver and alternative metals were down three per cent. Discounts were given on 30 per cent of sales lines.

The pattern in laybys was close to neutral between new orders and pick-ups and cancellations. Dyer drew particular attention to a pattern in services and repairs.

“This is the third consecutive month of double-digit negative movement and removes any doubt about the consumer caution about spending,” he said.

“As previously stated, it is time to chase up the outstanding quotes that haven’t been confirmed yet and to lift the marketing exposure of the expertise of your services to lift the volume of new intakes.”

He added: “Customers in stores attract other customers into stores. Remember it’s not just about the repair job, it’s also the traffic flow and the opportunity to strengthen the customer relationship as well as sell product.”

Special order numbers were positive, improving by five per cent compared with the past year.

2023 Jewellery Retail Sales April Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Modest sales wins for Australian jewellery retailers

Optimism following February’s retail jewellery analysis

Surprise reversal pattern observed in Australian jewellery sales

Australian jewellery sales steady in December

Sales dip during November for Australian jewellers