The data from April showed comparative overall sales dollar performance declined by 11 per cent on a one-year comparison.

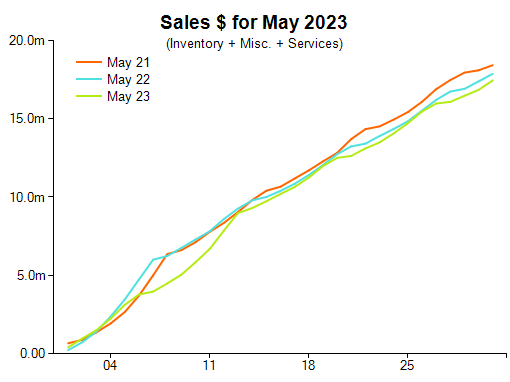

It was a similar, although less severe, story in May. Comparative overall sales dollar performance decreased 2.3 per cent compared with 2022. There was a five per cent decline in the two-year comparison.

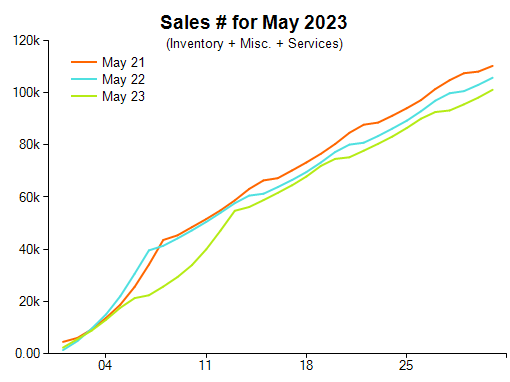

Comparative units sold declined 4.4 per cent on a one-year comparison and decreased by eight per cent on the two-year difference.

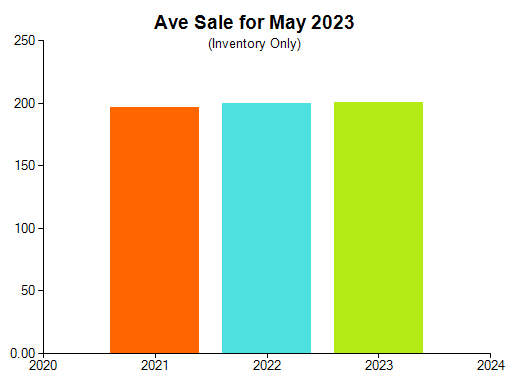

The comparative average sale in inventory managed to reach positive territory, improving by half a per cent to $200 from $199.

Retail Edge sales manager Mike Dyer said: “The drill down into the diamond precious metal jewellery section shows sales dollars numbers were down 15 per cent compared to May 2022 and 36 per cent on the two-year difference to May 2021.”

“Colour gemstone set precious metal jewellery sales dollars were down 23 per cent compared with 2022 and 31 per cent on the two-year comparison.”

Sales of precious metal jewellery without a gemstone or diamond declined 3.5 per cent on a one-year comparison.

Silver and alternative metals jewellery sales improved by 2.9 per cent on a one-year comparison and by 8 per cent compared with 2021.

The pattern in laybys was positive, improving by five per cent between new orders and pick-ups or cancellations.

Dyer said this suggests a pattern of cautious and managed consumer spending.

The analysis of services such as repairs revealed a decline of 23 per cent in dollar value between new orders and pick-ups or cancellations.

“This is the fourth consecutive month of double-digit negative movement in this area,” Dyer said.

“What action have you taken to chase up any outstanding quotes that haven’t been confirmed yet, as we have reinforced for the past couple of months?

“You can sit and wait for the work to ‘maybe’ fall into your hands at some time in the future, or you can shake the tree to get a result sooner.”

The special order numbers showed a flat pattern with a 0.2 per cent difference in dollar terms between new orders and pick-ups or cancellations.

2023 Jewellery Retail Sales May Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Weakened sales headlines April for jewellery retailers

Modest sales wins for Australian jewellery retailers

Optimism following February’s retail jewellery analysis

Surprise reversal pattern observed in Australian jewellery sales

Australian jewellery sales steady in December

Sales dip during November for Australian jewellers