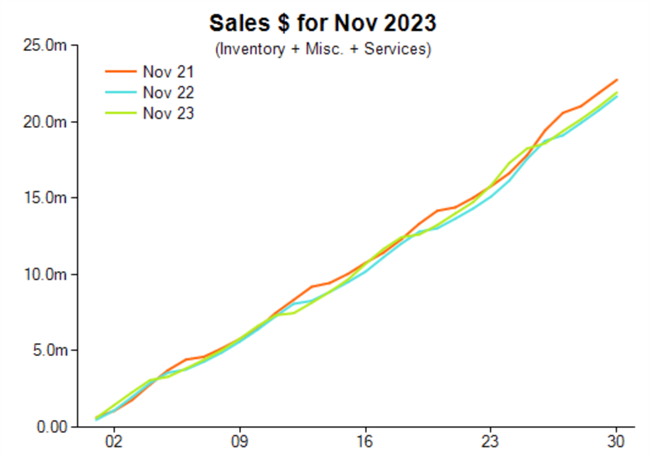

Across more than 400 independent retailers in Australia, overall sales dollar performance improved by 1.2 per cent compared with the past year.

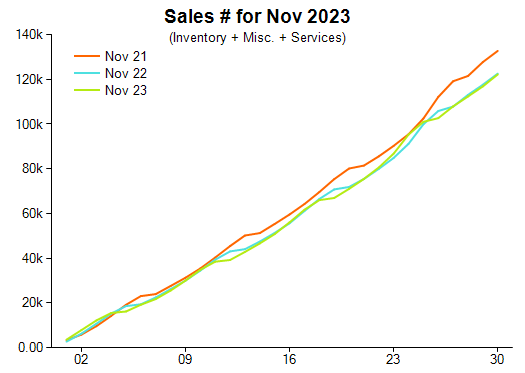

Comparative units sold were close to neutral (0.3 per cent) on a year-on-year comparison and decreased by eight per cent compared with 2021.

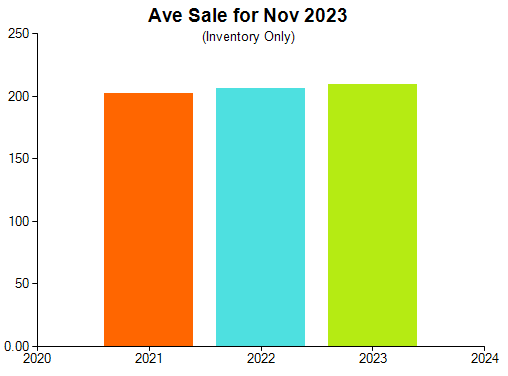

The comparative average sale – inventory only – increased by 1.5 per cent on a year-on-year comparison and improved by 3.9 per cent compared with 2021.

Retail Edge general manager Leon Van Megan said that there were several positives to be taken from the analysis.

“The November average sale is at $210 compared with $206 last year and $202 in 2021,” he said.

“This result shows the industry is doing relatively well considering the economy, cost of living challenges and the fact that the retail industry, in general, recorded a relatively poor November.”

Unit sales were nearly flat compared with 2022, while a two-year comparison reveals an eight per cent decline.

Diamond jewellery sales decreased by 10 per cent on a one-year comparison, while colour gemstone jewellery sales increased by 3.2 per cent.

In another positive discovery, sales of precious metal jewellery without a gemstone or diamond increased by 16 per cent. Silver and alternative metal jewellery sales also improved by six per cent.

“Shifting consumer tastes is illustrated by the continuing changes in department performance,” Van Megen explained.

“This is one of the few times in the second half of the year that we have had positive news to report. Not only did the total industry experience sales increases, but so did the colour gemstones, precious metal jewellery, and the silver and alternative metals departments.”

Regarding laybys, sales increased by 10.3 per cent in dollar terms between new orders and pick-ups or cancellations. Services, such as repairs, decreased by 29.2 per cent.

Special order figures improved by four per cent on a year-on-year comparison.

2023 Jewellery Retail Sales November Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Silver linings in latest Australian jewellery market analysis

Australian jewellery retailers wrestling with decreasing sales

Tough sledding: Australian jewellery sales decline in August

Jewellery sales decline in July, consumer confidence on the rebound

Cause for celebration for jewellery retailers

Retail Edge urges caution in the latest market assessment

Weakened sales headlines April for jewellery retailers

Modest sales wins for Australian jewellery retailers

Surprise reversal pattern observed in Australian jewellery sales