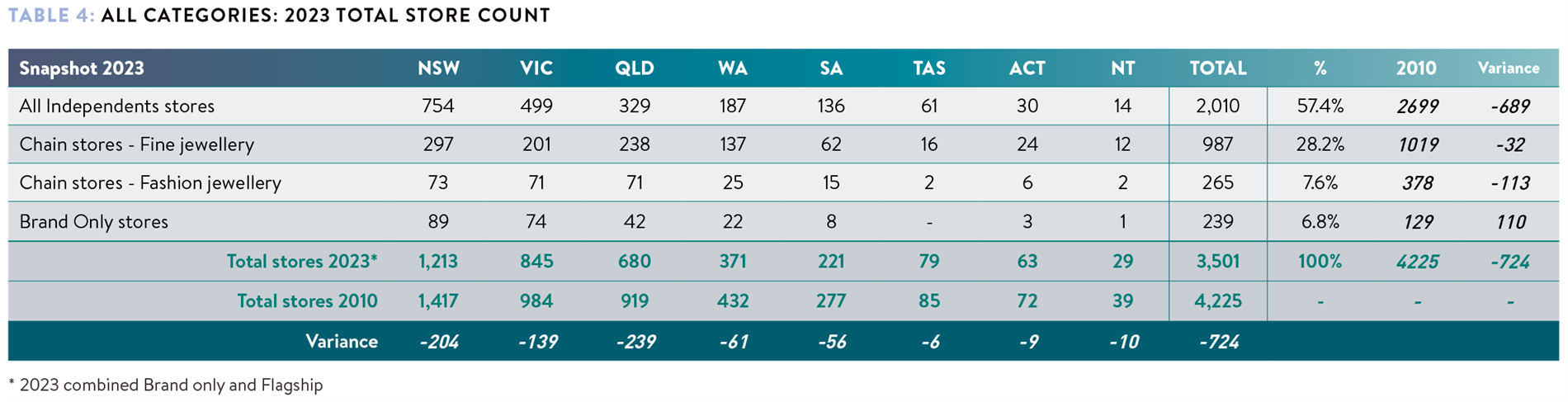

The objective of the State of the Industry Report (SOIR) is to establish how many jewellery stores operate in Australia and compare this with data from previous reports to develop an understanding of the evolution and future of the industry.

Since the release of the landmark report in 2010, Jeweller has continued to monitor and measure changes in the industry over the past 13 years.

This included noting expansion and contraction within specific categories and the rise and decline of industry trends.

The complexities associated with compiling such a report are wide-ranging and varied. To measure something, it must first be defined, and in an industry as diverse as jewellery retail, creating objective criteria is an arduous task.

Every business documented by this report sells jewellery and/or watches, including fine jewellery and fashion jewellery stores; however, unsurprisingly, many differ in minor but significant ways.

To develop and collate the data in a consistent manner, creating definitions for different categories must be clear to guarantee that meaningful comparisons and insights can be measured.

Since the 2010 report, the consumer market and, therefore, the industry have evolved dramatically, including how people view and define jewellery products.

There are a few crucial ways this report differs from those in the past, which are important to understand.

‘Flagship stores’ are no longer an important consideration in the State of the Industry Report. During the research phase, it became evident that the criteria associated with a particular store's ‘flagship’ status are too unclear to be measured.

Any store can be labelled the ‘flagship’ of the business; however, the nature of these stores differs greatly from business to business and brand to brand.

Indeed, many have remained true to the original definition – the largest store with the strongest marketing presence and the widest range of products. Others appear to be described as ‘flagship’ stores based on location alone and do not differ significantly from other stores.

While the 2010 report attempted to identify retail kiosks separately - mainly because of the large number of franchised watch battery and repair businesses in shopping centres. Most of those no longer exist, and we now include kiosks as retail stores, or at least in the store counts.

An important note impacting any comparison between 2010 and 2023 data is the reclassification of Pandora from a brand-only store in 2010 to a jewellery chain.

The distinction is vital because Pandora was, and remains, both a supplier to the wider jewellery market and a prominent retailer of its own brand.

Brand-only stores are largely vertical market operations.

|

|

|

MethodologyThe current study was undertaken by dedicated researchers updating the 2010 data by gathering the records of all jewellery retail businesses in Australia using various methods, including online search platforms. These records were then compared against existing databases to identify closed and new businesses, those not previously held in the databases. Each business was identified under the categories listed over page. Then, the number of jewellery stores of each business was counted - noting that one jewellery retailer can have many jewellery stores. The data collection ended on 31 October 2023. In addition, and to complement the research undertaken for this report, Jeweller also conducted a survey of retailers and suppliers. Two sets of 10 questions were provided using Survey Monkey, a digital research platform and emailed using Jeweller’s comprehensive database. The retailer survey began on 31 October 2023 and ended on 17 November, with more than 200 independent retailers responding. This is estimated to be around 10 per cent of the market. The supplier survey was opened on 9 November and closed on 17 November, and 51 responses were received, estimated to be between 8-10 per cent of the supplier market. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES