For more than three decades, Australia’s independent jewellery retailers could choose membership in one of three buying groups: Nationwide, Showcase, and Leading Edge Jewellers.

Traditionally, a retail buying group is a member-based organisation created to leverage the collective purchasing power of independent stores to obtain discounts from suppliers.

These groups also provide business advice and support services in areas such as marketing, management, and accounting.

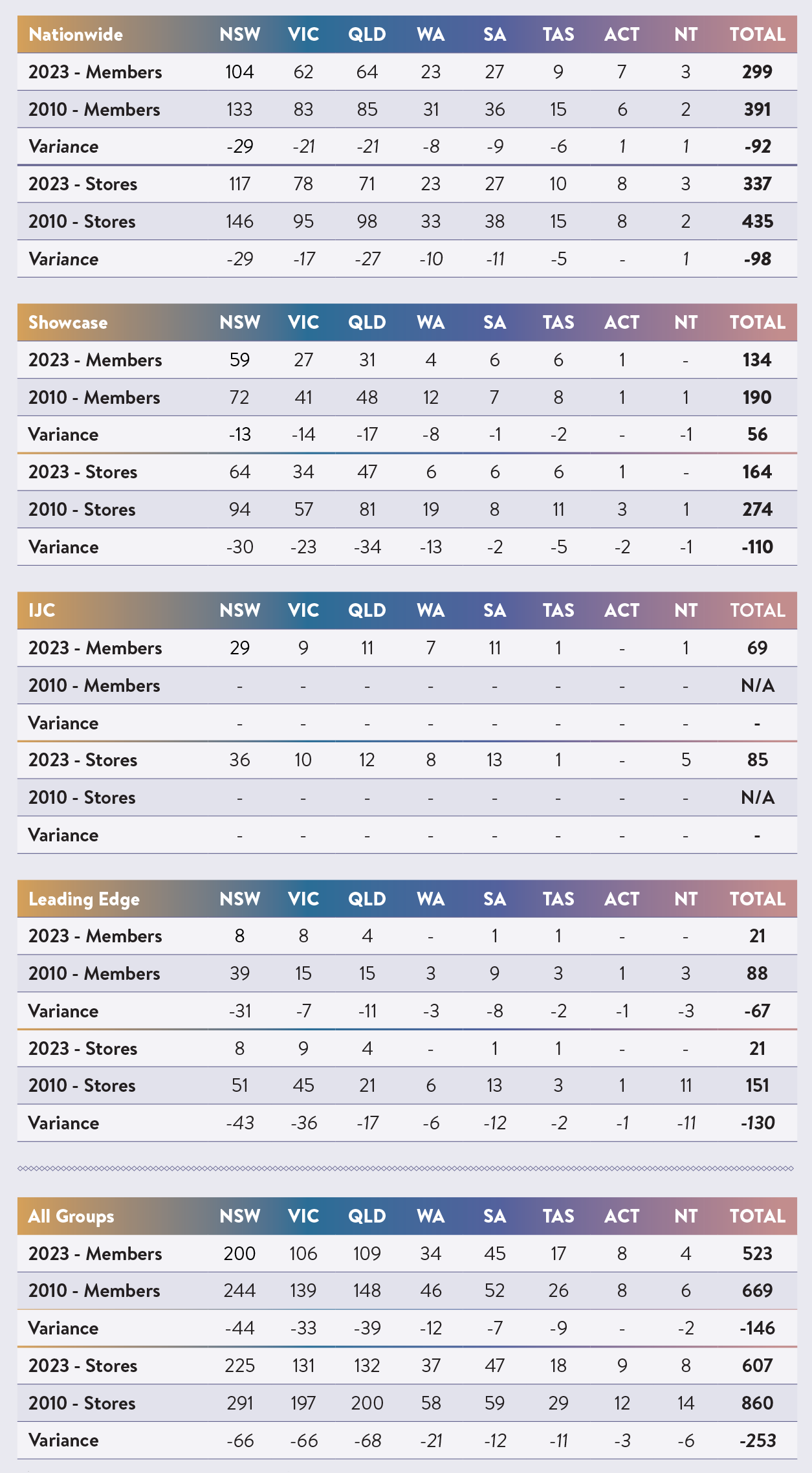

In 2010, the three jewellery buying groups combined to represent 860 stores, accounting for 32 per cent of the independent market (2,699 stores).

However, everything changed in early 2020 when the Independent Jewellers Collective (IJC) was established by Joshua Zarb – a former managing director of Leading Edge Group Jewellers (LEGJ).

Independent retailers now had a fourth avenue to pursue supplier discounts and business consultancy, and the market seemingly responded positively as IJC expanded quickly.

At the time, there was concern and industry speculation about the viability and need for a fourth group.

This was driven by the widespread belief that the market was adequately covered by three groups serving a base of jewellery stores that found membership suitable. Indeed, not all retailers are suited to the philosophy of buying groups.

That said, by March 2020, IJC reported that it had reached its two-year goal of 60 stores, following an influx of new memberships, and in only three years, it has expanded to 85 stores (69 members).

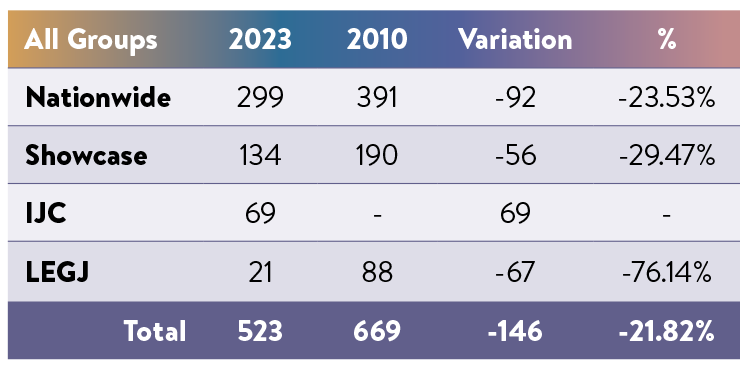

TABLE 1: AUSTRALIA ONLY MEMBERSHIP |

|

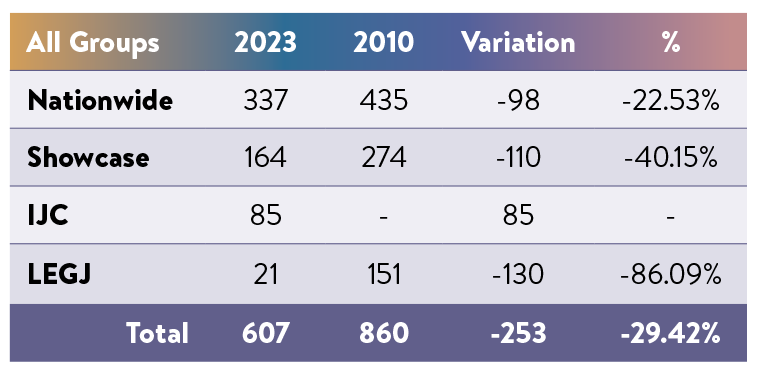

TABLE 2: AUSTRALIA ONLY STORE COUNT |

|

| The above tables compare 2023 membership statistics to 2010. |

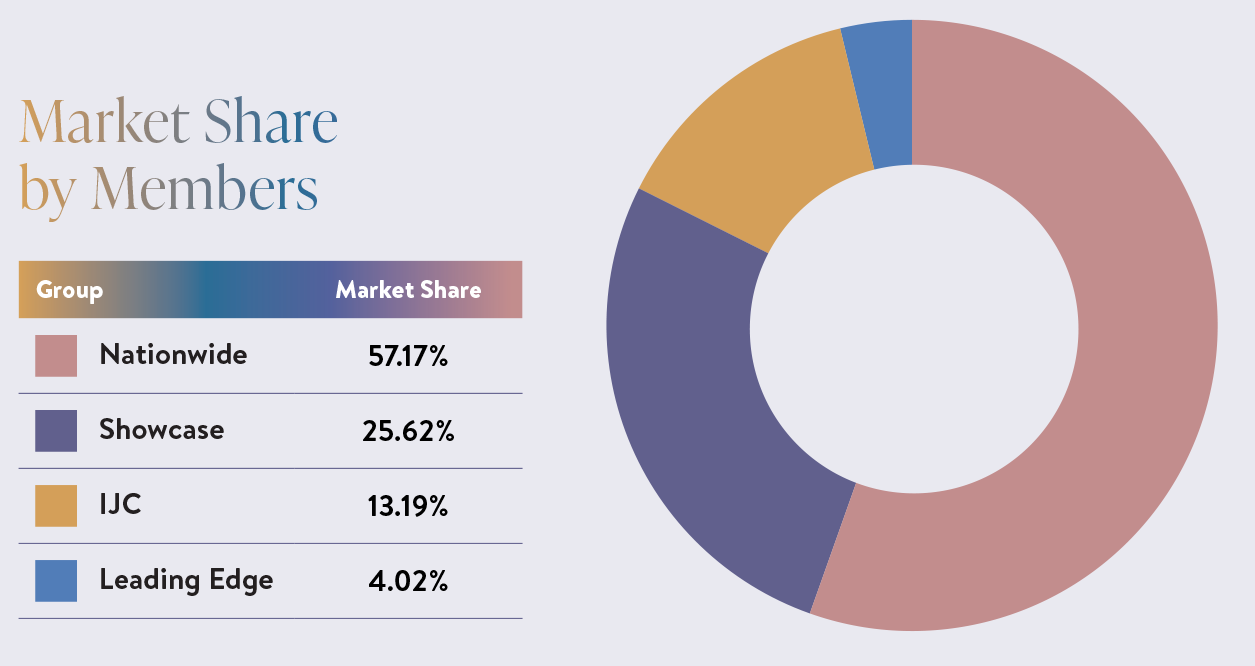

While IJC appears to have overtaken LEGJ in size, Nationwide Jewellers remains at the top of the food chain, with 299 local members representing 337 stores. However, since our 2010 study, its base has declined in members and stores by approximately 22 per cent.

Despite these changes, Nationwide remains Australia’s largest buying group.

Meanwhile, membership decline has also been a theme for Showcase Jewellers, which now represents 134 members and 164 stores. This marks a 29 per cent decrease in members and a 40 per cent decline in stores over the past 13 years.

However, when compared with a contraction of the overall number of jewellery stores in Australia, this becomes a less concerning tale.

That is, the current study indicates that there are currently 2,010 independent stores in Australia, a decline of approximately 26 per cent.

This means Nationwide, Showcase, and IJC account for around 29 per cent of Australia’s independent jewellers – a figure not dissimilar to that of 2010 (32 per cent).

That said, the most alarming decline has been with LEGJ.

When IJC was launched in 2020, there was no doubt that the most vulnerable buying group - running the risk of losing members - was LEGJ, which our study appears to confirm three years later.

Indeed, LEGJ has had a staggering fall in members since the introduction of a fourth group. Worse, it appears that the buying group’s management is doing its best to avoid scrutiny on the matter.

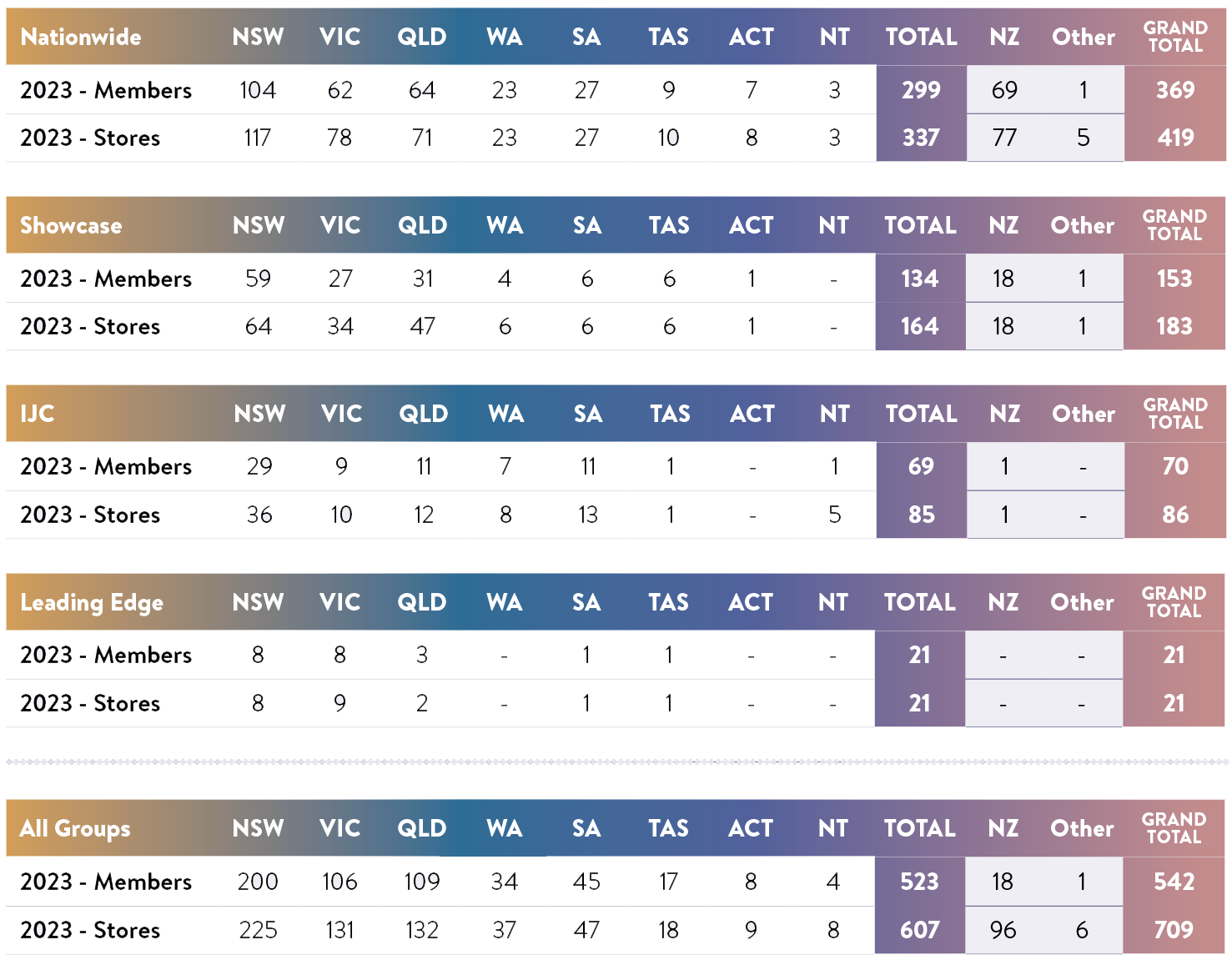

TABLE 3: BUYING GROUP MEMBERSHIP AND STORE COUNT IN 2023 |

|

| The above tables record the number of members and stores of each buying group, including overseas members. The data was accurate as at November 30, 2023. |

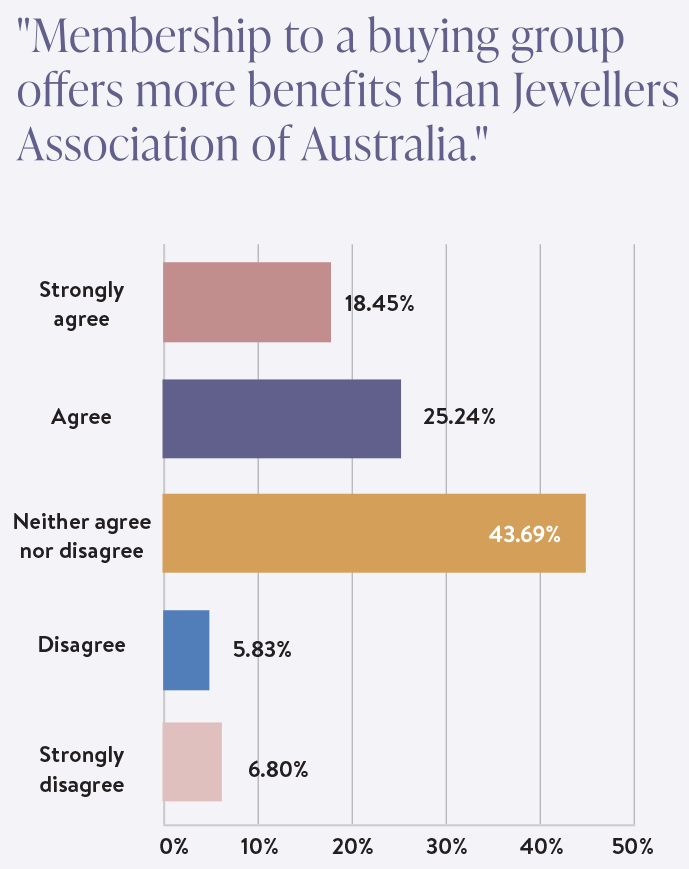

RETAILER - SURVEY QUESTION | SUPPLIER - SURVEY QUESTION |

|  |

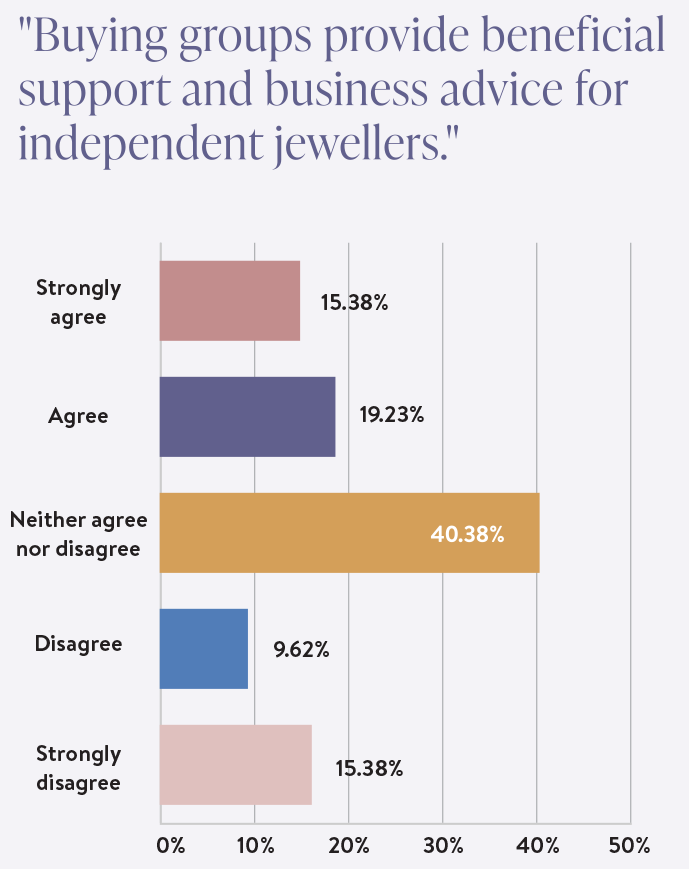

| More than 43 per cent of respondents believe that membership to a buying group offers greater benefit than membership to the JAA. Interestingly, even though JAA members were over-represented in the survey, less than 10 per cent preferred the JAA. | Industry suppliers believe that buying groups provide beneficial support and business advice for independent jewellers (36 per cent) while 25 per cent do not. |

Public perception

As part of this current study, Jeweller conducted a quantitative survey of more than 200 Australian-based jewellery retailers in November 2023.

The ten questions sought responses on various issues and topics, including respondent’s views of the buying groups.

When asked which offers more benefits – membership to a buying group or membership to the Jewellers Association of Australia – 43.69 per cent of respondents either ‘strongly agreed’ or ‘agreed’ that the buying group was the better prospect.

Only 12.63 per cent believed the JAA offers more benefits (strongly disagreed or disagreed).

This could also explain why buying group member stores outstrips the JAA’s retail members by far - 520+ compared to around 300.

Interestingly, in a similar survey of jewellery industry suppliers, respondents were asked their views as to whether buying groups provide beneficial support and business advice for independent jewellers.

While a smaller sample size, the result was 34.61 per cent either ‘strongly agreed’ or ‘agreed’ compared to 25 per cent who ‘strongly disagreed’ or ‘disagreed.’

Industry feedback

It’s hard to argue that times aren’t tough for independent retailers, and recent research from the Australian Retailers Association suggests that 55 per cent of small to medium-sized retailers are concerned or uncertain about their financial prospects.

When presented with information about the reduction in independent jewellery retailers over the past decade, Showcase Jewellers managing director Anthony Enriquez wasn’t surprised.

While troubling, he suggested that this data confirmed the importance of buying groups.

“Sadly, I’m not surprised to hear these figures at all. This might seem easy to say given my position; however, I think this data underlines the importance of buying groups and what we can offer,” he tells Jeweller.

“It’s true, times are tough for independents. Your shopping centre data highlights what we hear all the time – independents are facing rent increases from shopping centres that are unworkable. While major chains can negotiate from a position of strength, independents aren’t always able to.”

He added: “It’s always been about strength in numbers, and for independent jewellers, that’s more important now than ever.”

When undertaking a study of this nature, it’s essential to reflect on the past and outline a vision for the future.

Nationwide Jewellers managing director Colin Pocklington makes an astute observation about the state of the industry, suggesting the nature of buying groups – and what they offer independent retailers – has changed significantly since the pandemic.

“I was talking with a supplier recently, and he told me that buying groups have a clear need to evolve. Once upon a time, what we offered was trade discounts ahead of everything else. The industry now needs support in other areas,” he explains.

“Small business owners often don’t have training in things like marketing and business management. The way things are going, I think it’s clear that jewellery stores need to be engaged with digital marketing – now more than ever before.”

Pocklington continues: “What we are now as a business is different from what we once were, and I think we will get better as time passes.”

IJC’s Zarb strongly agrees with Pocklington and says that digital marketing has been one of his key focuses over the three years IJC has operated.

“Your social media activity should reflect the themes of your website, which in turn should reflect your store image, which is represented by your merchandising,” Zarb says.

“Those are principles I work very closely on with all our stores to ensure they present professionally across all channels.”

He adds, "I still think the biggest opportunity for all stores is understanding how to leverage their databases properly. I think that the jewellery industry could improve on that as a whole.”

During adversity, people crave forward-thinking leaders with a strong commitment to success. It doesn’t matter if we are talking about sports, business, or family life – these traits offer reassurance when smooth sailing becomes a distant memory.

Despite the overall decline of the jewellery industry in Australia and the pessimism about future trading conditions, it should be reassuring for local retailers to know that the three major buying groups not only have a plan for today – but also a vision for tomorrow.

2024 STATE OF THE INDUSTRY REPORT - BUYING GROUPS |

|

2010 VS 2023: COMPARISONS - AUSTRALIA ONLY |

|

| A state-by-state comparison of buying group membership and store count from 2010 to 2023. |

LEADING EDGE:

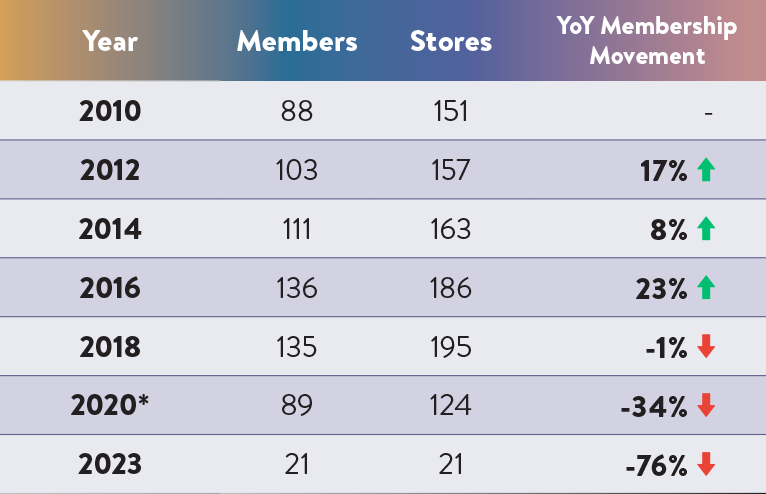

WHAT GOES UP MUST COME DOWN Leading Edge Group Jewellers (LEGJ) has always been the smallest of the three buying groups, in part because it is not exclusively focused on the jewellery industry. Unlike the Nationwide and Showcase business models, which only deal with fine jewellery retailers, LEGJ is a product division of the ‘parent entity’ Leading Edge Group, which has members from seven retail categories, including computers, appliances, electronics and books. When Joshua Zarb launched IJC in 2020, there was no doubt that the most vulnerable buying group - running the risk of losing members - was LEGJ, which this study now appears to confirm. Indeed, LEGJ has managed to experience a staggering fall since the introduction of a fourth group, and it is something that its staff and management are reluctant to admit, to the extent that some in the industry query whether it can legitimately claim to be a buying group. Ironically, in the inaugural State of the Industry Report - and under Zarb’s leadership - LEGJ generated the most significant increase in membership among the competing groups. LEGJ represented 88 members, accounting for 151 stores in 2010, and by 2018, those figures had peaked at 135 members and 195 stores. However, since then, it has been nothing but bad news for the smallest of the three jewellery groups; its store count has declined by nearly 90 per cent. It seems that the concerns about the viability of four buying groups competing in a relatively small and specialist market may be ringing true. The matter is not helped by LEGJ management doing its utmost to obfuscate its falling numbers and mask an almost non-existent membership base. It is believed that many members have left the group in the past few years, and the decline seems to coincide with the launch of IJC. For more than a decade, each buying group would freely volunteer its latest membership and store count for publication; however, earlier this year LEGJ began reporting figures which included something it called ‘subscribers’. LEGJ members pay a monthly buying group fee of $89, whereas subscribers were meant to be stores that had purchased products from LEGJ’s wholesaling division but were not paid group members. Jeweller disapproved of this ‘subscriber’ terminology for many reasons. For example, it was akin to claiming a store that stocked Pandora jewellery or Seiko watches was a ‘subscriber’ to Pandora or Seiko. TABLE 5: LEGJ MEMBERSHIP AND STORE COUNT |  | | Can Australia support four buyings groups? Since 2018 LEGJ membership has fallen by 84 per cent and its store count has plummeted by 89 per cent. |

These stores are simply ‘customers’ or ‘stockists’, not ‘members’ or ‘subscribers’. At the time, LEGJ management claimed they could not separate the two types of businesses to accurately reflect the paid membership to the buying group. When Jeweller contacted Charlie Davey, general manager of members and category management, as part of the research for this report, he again claimed that the company or staff could not easily distinguish between a paid buying group member and a retailer that had purchased a product. Instead, he provided data suggesting LEGJ had 70 members with 101 stores; however, when that information was questioned, he dismissed Jeweller's method of defining members as “complex”. There was no doubt that LEGJ’s membership has plummeted since 2018 despite Davey’s insistence that members and stockists fall under ‘one umbrella’. Davey was asked to rethink LEGJ’s policy and accurately and openly report its genuine paid membership numbers. Following a refusal to do so, Jeweller sought the information from other sources. Based on a recent membership list, it appears that LEGJ can now only lay claim to 21 members and 21 stores. The list included other businesses that cannot be classified as jewellery retailers in accordance with this report's definitions. Jeweller presented the research to Davey for confirmation; however, he did not reply, instead directing the email to CEO Lee Scott. If the data is accurate, LEGJ’s motivation for obfuscation concerning its membership decline is obvious; it has plummeted by 84 per cent since 2018 (135 to 21), and its 2018 store count has declined from 195 to 21 (89 per cent). Interestingly, in an email dated 11 November, Davey was more than happy to claim that there is a "healthy member group across the Leading Edge Business, of over 400 members and growing”. This comment came despite the refusal to provide an accurate number to the jewellery arm of the LEG because it is “too complex”. Other factors point to the demise of LEGJ’s jewellery division and buying group. For example, the Facebook page for ‘Leading Edge Group Jewellers’ has not been updated since December 2020. The last post on 23 December 2020 reads: "And on the last day of Christmas, my true love said to me "Which diamond does your heart desire?" The Facebook post added: “Find your closest Leading Edge Jewellers store for last-minute Christmas shopping.” With that said, the group’s website (legj.com.au) is non-functional. The site appears to have been taken down. Further, the store locator on the parent company’s website (leadingedgegroup.com.au/jewellery) also appears non-functional. No stores can be located. In addition to these anomalies, other issues may have eroded LEGJ’s dealings and reputation in the Australian jewellery market. Of note is Troy Australia, a new jewellery supply business formed in 2021 and which was headed by former Showcase Jewellers managing director Carson Webb. Webb had previously worked at LEGJ and left in 2015 to join Showcase. Following his departure from that buying group, Webb rejoined LEGJ to launch Troy Australia. The new business’ mandate was to create a “retail initiative for independent jewellery retailers offering guidance, advice, and exclusive products to help businesses grow”, including exclusive jewellery collections, CAD, business assistance, and training. At the time, it was announced that LEGJ members would have access to Troy Australia’s jewellery ranges, which had been named a preferred supplier in late 2021. According to Australian Securities and Investments Commission records, it is the business name of another entity called Australian Jewellery Warehouse with the registered address of 72 Archer St, Chatswood, the same address as Leading Edge Group. Australian Jewellery Warehouse was registered in May 2020, and the director and secretary are recorded as Simon Richard Lane, former Leading Edge CEO. LEGJ had appointed its own company as a preferred supplier! Then came the launch of Diamond Republic in February of this year – a jewellery supplier spearheaded by former Lane. Interestingly - and confusingly - the Troy Australia website (troyaustralia.com) is non-functioning too and, instead, diverts to the Diamond Republic website (thediamondrepublic.com.au) without explanation. Even though ASIC records indicate The Diamond Republic was first registered only 12 months ago (22 November 2022), its website claims: “We are an Australian wholesale jewellery supplier with a long and proud history of supporting jewellery retailers. We have partnered with some of the largest international suppliers and manufacturers to provide quality products at competitive prices.” It is well known that, after many years of supporting LEGJ, many industry suppliers have not been happy with LEGJ creating competing businesses while simultaneously demanding and receiving discounts. Most say that LEGJ should decide whether it is a jewellery buying group representing its members or a jewellery product supplier; regardless, it appears that the importance of the group as a buying collective - with only 21 members - has waned if not become redundant. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES