Provenance, otherwise known as proof of origin, has been one of the hottest topics in the jewellery and diamond industries for the past 12 months; however, in reality, one must ask: does anyone really care where diamonds come from?

It is true that some people care; however, the degree to which provenance impacts sales of diamond and gemstone jewellery is undoubtedly questionable.

Indeed, some might argue that it has been embellished to enhance the sales activities of businesses that promote and sell provenance services.

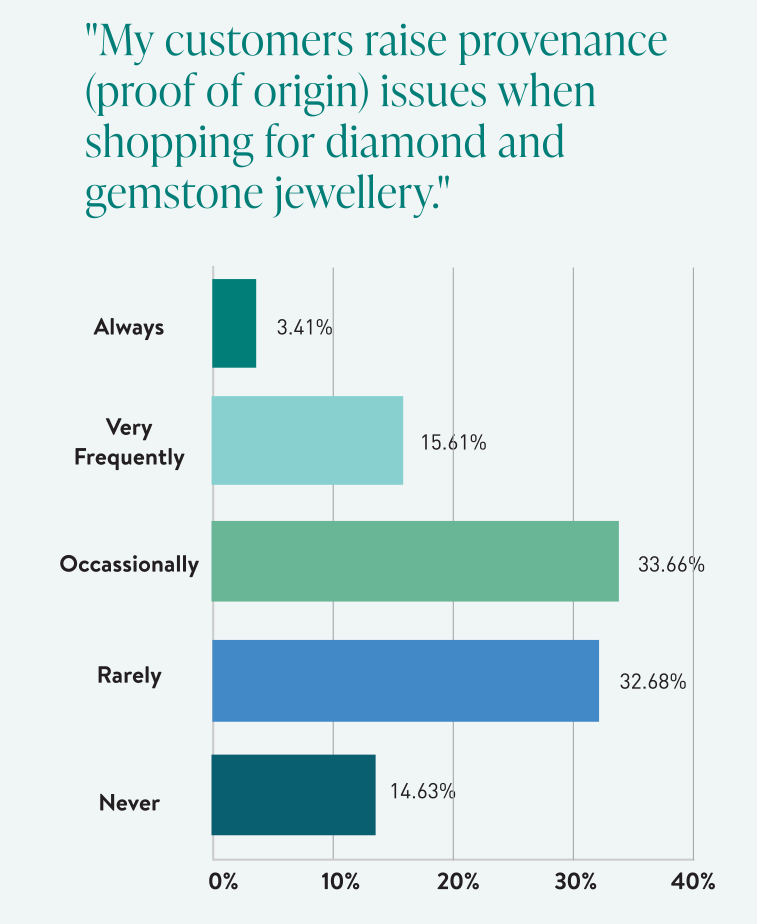

During the preparation of this study, Jeweller surveyed retailers and suppliers about the importance of provenance to the consumer. Jewellers were asked whether their customers raise provenance (proof of origin) issues when shopping for diamond and gemstone jewellery.

More than 200 Australian retailers participated in the survey, and startlingly, only three per cent suggested that provenance is ‘always’ raised by customers.

A further 15 per cent suggested that customers raised the topic ‘very frequently’; however, the consensus seems to be that jewellery shoppers do not care about proof of origin.

About 15 per cent of jewellers said that when shopping for diamond and gemstone jewellery, customers never discussed provenance, and more than one-third of responses revealed that customers ‘rarely’ raise the topic.

A similar quantitative survey of suppliers confirms this insight.

When asked whether their retail customers and stockists raise provenance (proof of origin) issues when considering their diamond and gemstone jewellery orders, fewer than 20 per cent agreed that it was a topic raised by retailers.

The majority (52 per cent) were indifferent to the question, neither agreeing nor disagreeing that it was important to retailers.

Given widespread industry sentiment, these responses may surprise some readers; however, a clearer picture emerges when considering the ‘identity’ of the average jewellery customer.

Eye-opening exercise

What does the typical customer shopping for an engagement ring look like?

Is it mostly likely a woman aged between 21-30? The younger the customer, the higher the likelihood that they have a low or modest income.

According to a recent survey conducted by Diamondport Jewellers, a retailer in Queensland, most people shopping for an engagement ring had a budget in mind. Of those with a budget at the outset, 77 per cent stuck to it when buying the engagement ring.

Returning to the original question, is this hypothetical engagement ring customer a young man instead of a young woman? If so, they would most likely belong to the same demographic in terms of age and income.

According to that same survey, 85 per cent of proposals were made by the man, 10 per cent by the woman, and the final five per cent of engagements were a ‘mutual decision’ between a couple.

And what about the political beliefs of these hypothetical customers? Younger people tend to vote ‘progressively’ and have more ‘liberal’ beliefs; however, conservatives tend to marry earlier than their left-leaning counterparts.

Younger people with progressive beliefs are likely to consider environmentalism and ‘ethical’ concerns when shopping for an engagement ring; however, how does this contrast with the issue of budgets?

It’s well-known that young consumers are looking for ‘bang for their buck’ above all else – when money is tight, everyone wants value.

So what wins, value or values? Well, according to a study by The Harvard Business Review, it’s value.

In a report titled The Elusive Green Consumer, what’s known as an ‘intention-action gap’ is described at length.

Of those surveyed, 65 per cent said they desire ‘purpose-driven’ brands that advocate for sustainability; however, only 26 per cent said they actually purchase these types of products.

“On the surface, there has seemingly never been a better time to launch a sustainable offering. Consumers — particularly Millennials — increasingly say they want brands that embrace purpose and sustainability,” the report reads.

“Indeed, one recent report revealed that certain categories of products with sustainability claims showed twice the growth of their traditional counterparts.

“Yet a frustrating paradox remains at the heart of green business: Few consumers who report positive attitudes toward eco-friendly products and services follow through with their wallets.”

External threats

So, why does this information matter to the diamond industry and jewellery retailers?

The topic of ‘provenance’ has been widely discussed in the diamond industry for many years, and it’s common for ‘talking heads’ to preach about its importance to consumers.

Proof of origin has always been an important topic for the diamond industry for different reasons than that for consumers; however, it first seeped into the public consciousness during the ‘Blood Diamond’ movie period.

Due to ethical concerns, suppliers and retailers feared the award-winning 2006 film would drive customers away from diamond jewellery.

Fortunately, despite the increasing public awareness of conflict diamonds, these fears never amounted to any substantial change.

Indeed, the movie came and went, and diamonds remained as popular as ever.

The provenance discussion resurfaced again as lab-created diamonds increased in availability and popularity; however, this time, it was focused on protecting retailers from mixing.

Earlier this year, De Beers senior vice president Feriel Zerouki told Jeweller that the industry was still grappling with the impact of these events.

“At the other end of the supply chain, where diamonds once spoke to financial status, end clients are now focused on making sure their purchases reflect their priorities and show them to have a consumer conscience. In short, value is increasingly connected to values,” she said.

“We have made huge strides forward; however, regrettably, consumer perception of the industry has potentially moved in the opposite direction.”

She added: “This can be credited in part to the legacy of highly visible cultural reference points such as the Blood Diamond film and misrepresentations of the natural diamond industry by some companies seeking to boost demand for lab-created diamonds at the expense of natural diamonds.”

Following the Russian invasion of Ukraine in February of the past year, the provenance ‘frenzy’ reached new heights.

As Western nations placed sanctions on the Russian diamond industry as punishment for the invasion, the need for proof of origin was clear.

Many said that consumers not only support this push for provenance - they demand it. It was noted that younger consumers, in particular, expect clear evidence of ethical practice.

The Responsible Jewellery Council suffered greatly from the invasion of Ukraine, losing major members due to an inability to terminate the membership of the diamond miner Alrosa.

Executive director Iris Van Der Veken resigned and was replaced in January by Melanie Grant, who said that ‘sustainability’ would be the key focus of her tenure.

“We are today with sustainability where we were with digital transformation 20 years ago. Those who embraced it thrived but also gained new and younger clients,” Grant says.

“Those who dismissed it in many ways got left behind. Sustainability is the greatest single issue facing watches and jewellery today, and I want to help everyone understand what they can do to be part of this movement.”

David Kellie, president of the Natural Diamond Council, has also discussed the importance of provenance in the relationship between consumers and retailers.

“Despite the transformation and reform that has occurred in the natural diamond industry over recent decades, many myths surrounding the industry’s operations, its standards, and its ‘players’ continue to linger,” he told Jeweller.

“Unfortunately, these misconceptions erode trust, and, in the long run, can be harmful, not only to the diamond industry but especially to those who most depend on the positive impact of natural diamonds: the communities from where they originate.”

He added: “Through the influence of the internet and social media, today’s consumers are more informed than ever before. They wish to align their values with those of the products they purchase. It is therefore vital for us all to support these consumers by providing information transparently.”

| RETAILER - SURVEY QUESTION | RETAILER - SURVEY QUESTION | SUPPLIER - SURVEY QUESTION |

|  |  |

| Only 19 per cent of retailers surveyed said that customers were concerned about provenance issues relating to diamond and gemstone jewellery, while more than 47 per cent said they were not. | Retailers advised that customers ‘always or ‘very frequently’ raised concerns about eco-friendly and sustainability (seven per cent) while more than 54 per cent answered ‘never’ or ‘rarely’.

| When it came to suppliers, fewer than 20 per cent of their retail customers raised provenance issues, while 27 per cent were unconcerned. More than half had no opinion.

|

Disguised motivations?

There’s been a common theme throughout these repeated pushes for provenance within the diamond industry – the suggestion that proof of origin is required to meet the demands of consumers.

But is this true?

Experiences will differ, of course, and many jewellers would suggest that provenance is important to their customers. With that said, many on the coalface say otherwise, as our survey demonstrates.

Further, even if consumers say provenance is important, is it followed through in their shopping decisions, or does the intention-action gap come into play?

In other words, ‘it’s all talk’.

“Provenance is a tricky question because of the Russia-Ukraine situation. From our perspective, we probably get one, maybe two customers each month who ask us where the diamonds come from,” Garry Holloway, owner of Holloway Diamonds, tells Jeweller.

“Even then, I don’t think anybody has ever specifically asked [us] if the diamond they were inspecting came from Russia. Most people don’t know where diamonds come from. Most people don’t know that Russia is the world’s biggest source of diamonds in terms of nations.”

Holloway wasn’t the only person consulted for this story who questioned general consumer knowledge of Russia’s importance in the international diamond industry.

Rod Criddle is a director of the Independent Diamond Values International (IDVI), a US-based company that offers industry consultancy services.

“Provenance is a fascinating topic that will increase in stature over time. How many people know diamonds come from Russia or that they are the largest producer? From my interactions - not many,” he says.

“If you were to ask a consumer, ‘would you buy this diamond if it supports the Russian war in Ukraine’ I would think most people would say they don’t want it.

“Currently, I see few at retail stores differentiating diamonds, which suggests most retailers are unaware of the provenance of specific stones. I can see it potentially being a real selling point in the future.”

Political perspective?

During this research, Jeweller offered a simple hypothetical to several members of the diamond industry to consider the typical diamond ring customer, perhaps a younger woman who is recently engaged.

They were asked: How much do her political views outweigh her desire for a large diamond ring – regardless of the origins of the stone?

Paul Zimnisky, analyst with PZ Analytics, an independent diamond industry analyst and consultant covering the diamond industry, says this was a perspective that needed more consideration within the industry.

“It’s a fair question and one that should probably be discussed more thoroughly by the industry,” he says.

“As far as the point concerning signalling a political affiliation, this is something interesting to think about. The human desire for rare and valuable things goes deep with humans, though, and I certainly know people who tend to be quite progressive and still want a natural diamond.”

Holloway agreed with Zimnisky, suggesting that political interests far outweigh consumer concerns in the push for provenance.

“In answer to the initial question – who cares? – from a consumer point of view, there’s significant anecdotal evidence that the only people in the world who care about diamond provenance live and work in Washington DC or Canberra,” he explains.

“It’s not just the politics; it’s about the type of person. I’m not saying that’s wrong; it should be that way. Everybody should care, but not everybody does.”

Fiery crash

One of the most important stories of this year was the chaotic collapse of Everledger, a Brisbane-based technology company.

The company preached bold ambitions, claiming that: “The diamond industry has reached a broad consensus that greater transparency is the right thing to do, with blockchain diamond tracking one of the key ways to achieving that end.”

If provenance was, and is, a significant issue for consumers shopping for diamonds and jewellery, the success of Everledger would have been almost guaranteed.

However, despite attempts to save the ‘diamond tracing’ company, Everledger Australia was placed in liquidation with unsecured creditors totalling more than $AU19 million.

At the time, industry pundits speculated that an explanation for the collapse was that Everledger’s business model was flawed. Indeed, the financial results and subsequent failure suggest a misguided business model, a ‘solution looking for a problem’.

An administrator's report indicated that over the previous five years, only a tiny portion of Everledger’s total revenue ($AU5.3 million) had been generated from its jewellery industry products or services.

During the same period, the company incurred losses in excess of $AU8.2 million.

In its initial round of fund-raising, Everledger raised more than $AU54 million. Therefore, it seemed surprising when it was revealed the company failed to generate a second round of funding and subsequently collapsed.

Among the company’s most ardent supporters was Tencent, the owner of Chinese social media app WeChat. Tencent has a stockmarket valuation of more than $US400 billion, and it previously led Everledger’s $US20 million Series A funding round in 2020.

In June, Jeweller contacted founder Leanne Kemp, raising this issue, and subsequently asked if investors withdrew funding - and therefore the ensuing collapse - because they had no confidence in the company’s management or withdrew because they had no confidence in the future success of the business model – or both. Kemp never responded.

It stands to reason that, if provenance is such a vital issue to the industry, Everledger would not have been allowed to collapse.

Despite the uncertainty around the failure of her company and questions about the legitimacy of claims about provenance, Kemp has continued to tour the world, attending various industry events to promote provenance technology.

Hence, the point is whether such services are products looking to solve a problem or solutions looking for a problem.

Who are the real beneficiaries of the debate around provenance? It could be argued that it isn’t the consumer, especially if they, ultimately, must pay for it.

Robert Bouquet, director at Botswana Diamonds, suggested that the failure of Everledger might reveal a need for a realignment of values within the diamond industry.

“The collapse of Brisbane-based diamond tracing company Everledger – entering liquidation with more than $AU19 million in debt – may support the idea that ‘movement’ around provenance is fleeting rather than permanent,” he says.

“Indeed, the trade discusses provenance much more than the consumer.”

What do the numbers say?

The provenance issue should also be viewed from a data perspective. There seems to be little evidence to support the notion that provenance is as vital to the industry as some believe.

Rob Bates, news director of JCK Online, says he’s unaware of any evidence that consumers prioritise provenance; however, he also suggested that it can’t hurt to have more information.

“There's no real data, at least that's been shared with me, on whether consumers care about diamond provenance,” he says.

“That said, it's pretty safe to say that they care about diamond provenance more than, say, gold provenance, even though there are plenty of issues in the gold supply chain.

“If a consumer is choosing a lab-created diamond over a natural, it's quite possible that the fear of ‘blood diamonds’ is lurking in their minds, even if it's not explicitly expressed. It doesn't hurt to be able to show diamonds with verified provenance.”

Earlier this year, the Natural Diamond Council highlighted a ‘mystery shopper’ study commissioned in the US that demonstrated that education for retailers is critical to sales.

According to the report, 93 per cent of customers were more inclined to purchase natural diamond jewellery when they felt sufficiently educated by a salesperson. This was contrasted with 19 per cent of consumers who remained inclined to purchase despite feeling ‘uninformed’.

“This report highlighted the value placed on an understanding of their creation and provenance, as well as the beneficiaries throughout the world from each sale of a natural diamond,” Kellie explains.

“This demonstrates that the biggest opportunity to increase sales in the industry is to ensure that frontline sales staff are properly equipped to share the true values and stories of natural diamonds.”

This report could be interpreted as highlighting the value of provenance for jewellery retailers as a marketing tool, thus proving its significance beyond a method to mitigate consumers' fears around conflict diamonds.

Secret weapon

Many experts contacted during our research highlighted the value of provenance in marketing.

“There is an opportunity for marketing and branding around provenance. Don't forget that diamonds are not a practical purchase; they are a discretionary item, it's an emotional purchase, people buy diamonds because they make them feel good,” Zimnisky says.

“People gift diamonds because they make a statement or communicate a profound message.

So, as with other luxury items, it's not just about the biggest and cheapest, or at least it shouldn't be, as that flies in the face of what makes luxury what it is: something special.

“So, I just see provenance as another way for the diamond industry to convey that message while at the same time providing the customer with the assurance that they are buying the real thing and it's also not a conflict or illegally sourced stone.”

Criddle says that marketing that highlights the specifics of a diamond could prove valuable to both major and independent retailers.

“It’s about selling the story – from where it came from, both the location and formation over billions of years and the local communities supported by the industry,” Criddle says.

“Information such as rough shape and weight, as well as how, who and why the diamond was polished and how it was made into the final piece of jewellery, is all valuable.

“This information might be more valuable in relation to expensive diamonds or exclusive retailers, though I feel it can certainly filter down to general retailers to some degree.”

This message was reiterated by De Beers’ Zerouki, who says that retailers have a crucial role in sharing the entire story behind diamonds.

“The good news is that the natural diamond industry has an amazing story to tell in terms of how these miracles of nature are supporting the lives and livelihoods of millions of people worldwide,” Zerouki says.

“Jewellery retailers are at the vanguard of consumer education, and jewellers need to consider the importance of their long-term futures in communicating these two positive and complementary propositions.”

Voice of the industry

Provenance may have an important role in the diamond industry's future; however, it’s unlikely to be in response to consumer demand.

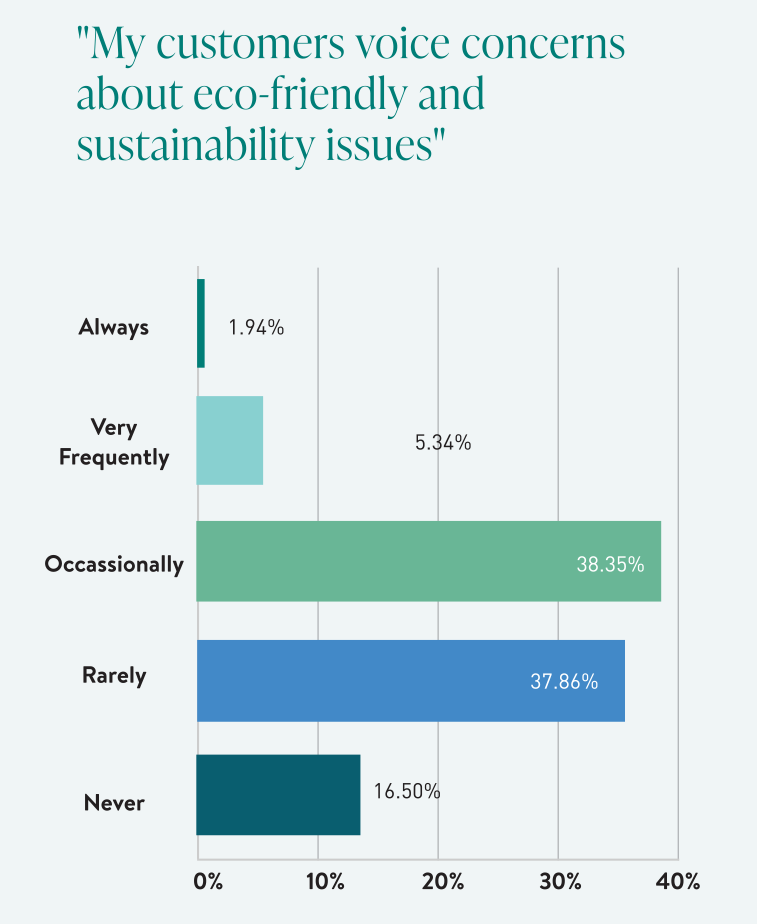

A second question in the retailer survey sought comments to clarify the following: My customers voice concerns about eco-friendly and sustainability issues.

More than 16 per cent replied ‘never’ while a further 38 per cent responded ‘rarely’. Only a little more than 7 per cent of retailers answered ‘always’ or ‘very frequently’. The results were echoed by wholesalers and suppliers selling products to retailers.

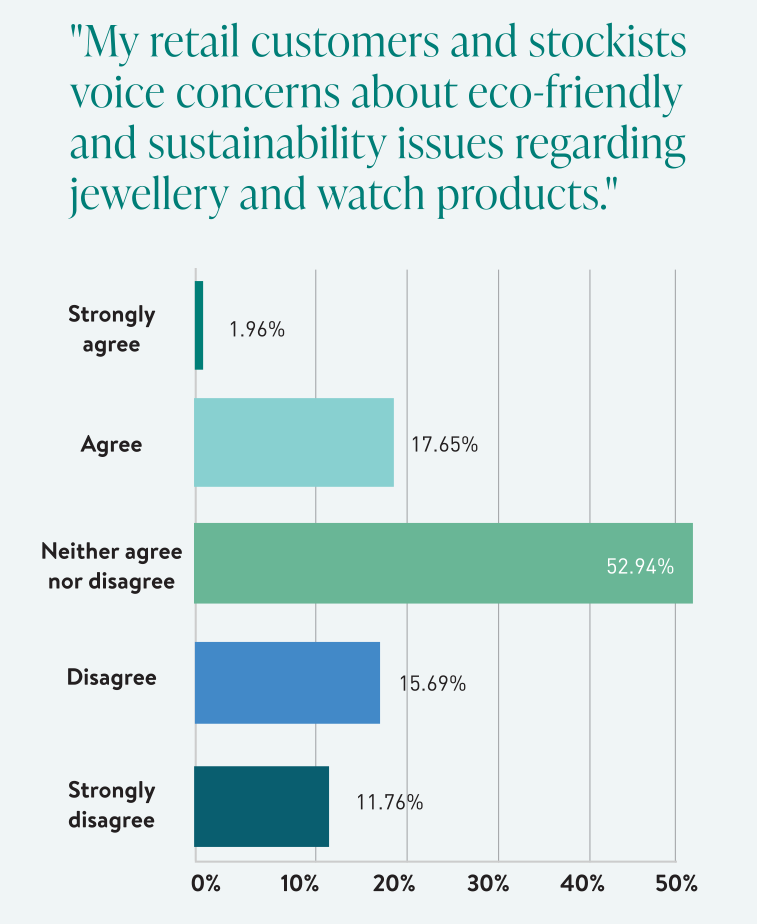

When asked to respond to the statement - my retail customers and stockists voice concerns about eco-friendly and sustainability issues regarding jewellery and watch products - only 3.85 per cent answered ‘very frequently’. Nobody responded to the question stating ‘always’.

On the other side, 65 per cent of retailers responded ‘never’ or ‘rarely’.

So, who is pushing the issue of provenance if it isn’t consumers or retailers? Indeed, proof of origin may well be a solution to a problem that doesn’t exist.

What did we learn?

Provenance may prove to be a powerful tool for the jewellery industry as far as marketing is concerned.

That said, there’s no reason to pretend that provenance is vital because consumers require it.

As Bouquet explains, there’s little evidence to suggest it’s a factor that weighs heavily on consumers during the decision-making process.

“I still think that until the consumer really insists on knowing where their diamonds come from, this focus on origin will remain internal to the trade. We always hear consumers rarely ask where their diamond originates from,” he explains.

“That said, this will change over time - and it makes sense. Our natural diamond industry has some compelling stories to tell regarding the positives of our business worldwide.”

He added: “Indeed, the industry promoting information about natural diamond provenance could set the standard and almost drive the consumer to expect this information. Some vertically integrated retailers are already doing this.”

The industry feared the worst when Blood Diamond was released nearly two decades ago; however, the trade was largely unaffected when all was said and done.

It would seem reasonable to assume that by the time the conflict in Ukraine is resolved – whether in six months or six years – the reputation of natural diamond jewellery with consumers will be largely unaffected. Those who understand this relationship – diamond producers, suppliers, and the political class – have a vested interest in expanded provenance capabilities.

It’s hard to find fault with a desire for more information, and retailers may well benefit from marketing created using improved provenance technology.

With that said, there’s no reason to misrepresent this need for data as being consumer-driven if it simply isn’t. And if the industry continues to do so, it could result in more spectacular collapses such as Everledger.

UPDATES - SIGNIFICANT NEWS SINCE PUBLICATION

Pandora CEO: Sustainability not a priority for consumers - March 2024

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES