The Jeweller’s Association of Australia (JAA) began the new decade in good shape, bolstered by strong membership figures and largely respected leadership.

With little doubt, the JAA could claim the title of ‘peak industry body’.

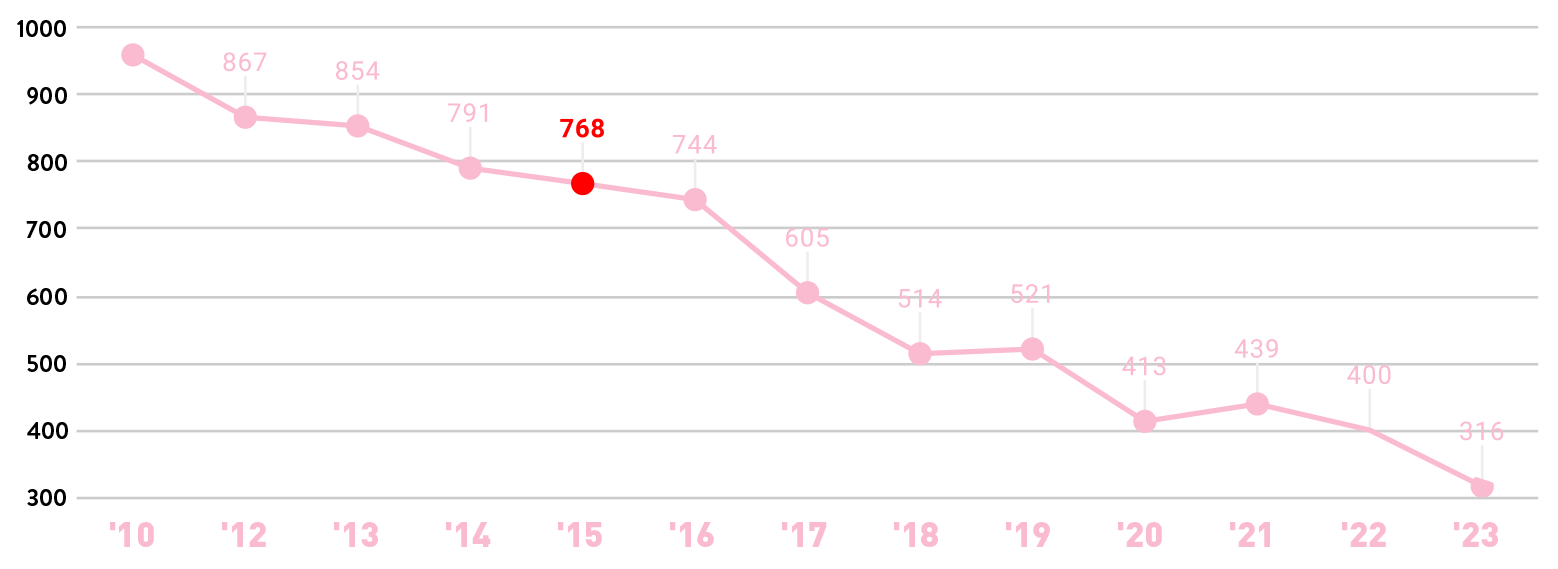

That was in 2010 when it had nearly 1,000 members, and its retail membership accounted for 1,039 jewellery stores across Australia; however, in a few short years, it fell apart to the extent that the organisation today is a shadow of its once proud, former self.

In fact, things have become so dire that the JAA would not provide a precise membership figure for this study – and, as you will discover - refuses to answer basic questions to measure the support it has today against its heyday.

This flies in the face of its new Mission and Vision statement.

Indeed, the JAA no longer refers to itself as the ‘peak industry body’ and, as this research indicates, there is nothing to suggest that the association can rightfully claim to represent the broader Australian jewellery trade.

Not only is the current six-member board the most unrepresentative of the industry in at least three decades, it also fails its mission statement; which is to: “lead through the representation of the various sectors of the jewellery industry and their interests”.

There are many reasons why the JAA fell from grace, which can explain why its current retail members account for around 356 stores, a 73 per cent collapse since 2010. And that is just retail membership - the supply (wholesale) members have deserted the organisation in droves.

The JAA’s decision to sever ties with Expertise Events in 2016 and its attempt to launch its own competing jewellery fair provided a tipping point in its decline. The turmoil created by the JAA has been documented at length, and for the sake of brevity, this report will not detail that topic or other JAA controversies in-depth.

With that said, this report can reveal one previously unknown detail in the catastrophic decision that divided the industry for two years - the size of Expertise Events’ financial commitment to the JAA at the time.

For the ten years before the 2016 jewellery fair, Expertise Events paid the JAA $1,155,005 in cash and around an additional $100,000 in non-cash support and sponsorship.

Put in perspective, the JAA had earned more than $1.2 million by lending its name to Expertise Events in return for its financial support - noting that its effort was negligible, and its risk non-existent. The JAA ended this partnership on its own accord and as this study shows, it has not recovered since.

CHART 1: JAA MEMBERSHIP DECLINE FROM 2010 - 2023 |

|

| Chart shows the decline of JAA membership from 2010 to 2023. The figure highlighted in red is the point where the JAA chose to end its 25-year sponsorship agreement with Expertise Events that had earned it $1,1555,005 in cash over the previous 10 years.* 2023 membership figure is a calculation because the association would not supply the information. |

Unprofessional management

The study deals with data first and foremost, documenting the rises and falls within the trade’s many sectors. In terms of the JAA, two sets of data are particularly interesting – membership and finance; however, the JAA has been unwilling or incapable of providing an accurate membership number. Its financial records remain on the public record; however, the JAA’s membership figures are no longer.

The matter is of sufficient concern to warrant detailed reporting on the JAA’s lack of transparency. It should be noted that its mission statements reads: “We are committed to ethics by way of demonstrating professionalism, transparency and fairness in our dealings and conduct.”

As background, in February, president Joshua Sharp was contacted about the JAA’s financial reporting. During this exchange, and 10 months ahead of time, Sharp was informed that a SOIR would be published in December.

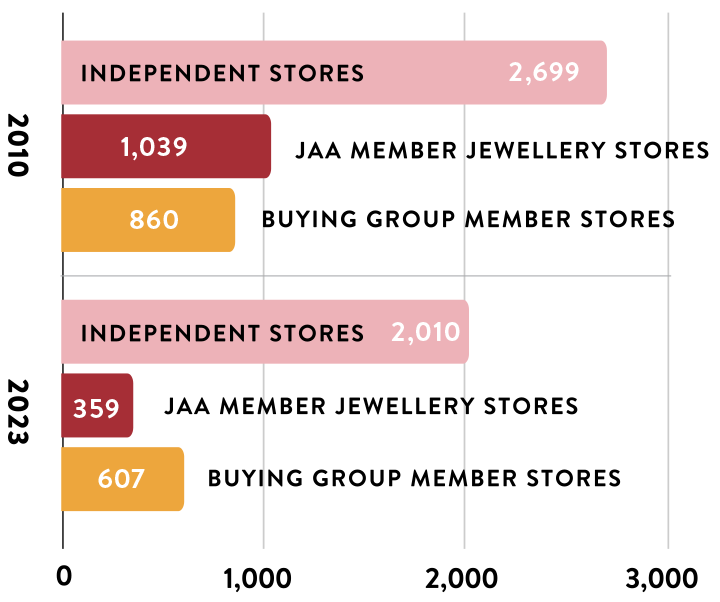

CHART 2: JAA MEMBERS 2010 V 2023 |

|

| The above chart shows how the buying groups have overtaken the JAA as a percentage of the wider industry since 2010, and which correlates to the industry survey. |

At the time, a request was made for the JAA’s most recent membership figures. Sharp did not provide precise information; however, he did advise that the JAA had ‘approximately 400 members in 2022’.

Given this occurred well before the publication of this report, the figure, while not exact, was accepted.

In July, during the research stage of the collapse of Everledger, Jeweller contacted the JAA about a specific member in Queensland. The website of this business not only lists itself as a JAA member it goes as far as having a copy of the association’s Code of Conduct on its website.

Despite this apparent support for (and promotion of) the JAA, the Queensland business is not listed in the JAA’s online Member Directory. For that reason, Jeweller contacted the association to confirm whether the business was a member or was misusing the JAA’s logo.

On 12 July, this matter was raised with operations manager Megan Young, who replied the following day, confirming that the business is a current member of the association and clarifying that “not all members appear in the online directory.”

This raised an obvious question – why aren’t all members in the online directory? There could be a legitimate reason why a small number of members might not want to publicise their membership to the JAA, such as security concerns.

However, in the case of this specific member – the business’ connection with the JAA is detailed in-depth on its website. So why are they not in the directory?

Jeweller sought clarification from Young on whether there had been an oversight or error in the online directory. This clarification was needed because the JAA Member Directory has many errors in the form of blank records. The email also requested the latest membership figures, given that the Members Directory was evidently not a reliable source for that information.

This request was made on 13 July, the same day the JAA informed Jeweller that not all members are listed on the directory. Young didn’t reply; therefore, the request was resubmitted the following day (14 July), and again, there was no reply.

On 1 September, Jeweller contacted Young again, providing advance notice of the publication of this study, and again requested updated membership details. After a week of no reply, the request was resubmitted.

DIVING INTO THE SURVEY RESULTS

WHAT DOES THE INDUSTRY THINK OF THE JAA? During the completion of this qualitative analysis, Jeweller conducted a quantitative survey of independent jewellers and a second of industry suppliers. The surveys garnered more than 250 responses - which amounts to about 10 per cent of each market. The two sectors were provided with ten questions covering various topics about their beliefs and attitudes to specific issues, including the JAA. Under a Likert scale, respondents were asked whether they ‘strongly agreed’, ‘agreed’, ‘neither agreed nor disagreed’, ‘disagreed’, or ‘strongly disagreed’ to various prompts. The following was put forward: Membership to a buying group offers more benefits than membership to the JAA. Of the respondents who had an opinion, more than 43 per cent of retail respondents said they ‘strongly agreed’ or ‘agreed’ while only 12.5 per cent said they ‘strongly disagreed’ or ‘disagreed’. This indicates that jewellery retailers do not see much benefit in the JAA compared to buying group membership. This observation is supported by Table 2, which records the buying groups as representing 69 per cent more stores than the JAA. The second prompt was as follows: The JAA is my first point of contact for business advice and retail best practice. About 21 per cent of respondents said they ‘strongly agreed’ or ‘agreed’ while 58 per cent said they ‘strongly disagreed’ or ‘disagreed’. These findings are particularly concerning given the JAA’s recent re-drafting of its Mission and Vision statement detailing the organisation’s ‘core values’, one of which states: “We aim to be a reliable and knowledgeable source of education for consumers and the industry.” The intrigue behind these results is two-fold. While the critical insight is that the perception of the JAA and its board is negative, the more important note is that there was an over-representation of JAA members in the survey results. That is, while it has been shown that the JAA membership base only accounts for around 10 per cent of all jewellery stores, JAA retail members comprised 29 per cent of survey respondents. Explained another way, one would think that a survey that was ‘dominated’ by JAA members would have provided a more encouraging result for the association. However, this is not a new issue for the JAA. The industry’s negative views of the association are consistent with a previous qualitative (telephone) survey of 100 JAA and 100 non-JAA members in 2017. In fact, the second question of the 2023 survey was a ‘check question’. Namely, the same question was asked in 2017 because it formed part of the JAA’s (then) mission statement. When the following question was asked six years ago: The JAA is my first point of contact for best practice advice for my business, 72 per cent of JAA members disagreed, while 63 per cent of non-members disagreed. Extraordinarily, fewer members ‘agreed’ (23 per cent) that the JAA was the first point of contact than non-members (27 per cent), meaning that non-JAA members had a better perception of the JAA than its own members! Since March 2017, when the survey results were published under the title ‘JAA fails own Vision and Mission Statement’, membership has continued to fall. While the most recent survey did not investigate other matters concerning the JAA, it’s clear the perception of the association remains problematic, even among its supporters. This continuing membership decline correlates to a survey question about membership fees. The result should have been a significant concern for the JAA at the time; however, the continuing decrease in members indicates the earlier results were accurate. Of those surveyed in 2017, fewer than 40 per cent of members were satisfied with how the JAA supports their business. Given these previous survey results, it is easy to see why retailers see membership to a buying group as offering more benefits than membership to the JAA. Do suppliers report similar feelings about the JAA as retailers? Suppliers were surveyed on the same question as retailers: The JAA is my first point of contact for business advice and wholesaling best practice. More than 65 per cent of supplier respondents said they ‘strongly disagreed’ or ‘disagreed’ while a mere seven per cent ‘agreed’. More than 24 per cent of supplier respondents are JAA members! Suppliers were also polled on a second issue; the prompt was as follows: The JAA's support and promotion of industry wholesalers and suppliers is. Under a similar Likert scale with the following options: ‘excellent’, ‘above average’, ‘average’, ‘below average’, and ‘poor’. More than 84 per cent of respondents answered ‘poor’ to ‘average’ while 15 per cent said it was ‘excellent’ to ‘above average’. Another core value of the association, as listed in its new Mission and Mission statements, reads: “We lead through representation of the various sectors of the jewellery industry and their interests.” The survey results would suggest that the supply sector feels somewhat ‘neglected’, an issue which is further complicated by the current make-up of the board, which details that all industry directors are small retailers. It should be reiterated that these results come from a survey where JAA members were over-represented and could offer some explanation for the decline in supplier membership. » Publishers note: As a matter of transparency, it should be noted that when this publication was launched in 1996, and until 2017, it was the official magazine of the JAA. It was a time when the association boasted more than 1,000 retail and wholesale members, and Jeweller played a vital part in the membership benefits, contributing tens of thousands of dollars annually to the JAA for 20 years. The results of the 2017 survey, as mentioned above, played a significant part in the decision to end Jeweller’s support for, and financial backing, of the JAA. |

This time, Young, who has been with the JAA since 2007, replied the same day, explaining, “Due to numerous conflicting priorities in the previous few months, I have been unable to reply to your emails. I will endeavour to look at them sometime next week.”

Since that date three months ago, the JAA has failed to supply its membership data, raising serious questions about its commitment to transparency.

It is puzzling that someone who has been with the JAA for more than 15 years - and would handle monthly reporting to the board – would not have this information readily accessible. The JAA is, after all, a membership-based organisation.

Compare this professionalism with that of several equivalent international jewellery associations. Unable to obtain this simple information from the JAA, comparable associations in the US, the UK, and Canada were contacted about their membership data.

The National Association of Jewellers in the UK responded within four hours with precise membership figures (2400). The Canadian Jewellers Association responded within eight hours (560), while the American Gem Society replied within 24 hours, asking for a deadline and more information about the story – understandable given the distance between Australia and the US!

What must be said, however, is that the JAA’s apparent complete lack of interest in this report – a study that the association should arguably be undertaking itself – is perplexing at best.

What is the membership number?

Given that the JAA would not provide the requested information, Jeweller used the information published on the JAA’s website under the ‘Find a JAA jeweller’ function.

This takes users to a JAA Member Directory page, which states: ‘Trust all your valued jewellery purchases to a JAA member - when you shop at a Jewellers Association of Australia member store, you can be assured that you are working with some of the most knowledgeable and trustworthy jewellery retail professionals in the industry.’

This is an unusual statement, given that the JAA Member Directory page aims to direct consumers to members’ stores via a link to another page. However, this website page has been non-functional for at least two years. The website meant to promote JAA members to the public - as a member benefit - displays an error message!

So much for its mission statement about aiming ‘to be a reliable and knowledgeable source of education for consumers and the industry’.

It should be noted that the Member Directory page contains around 400 records, some of which were blank or faulty when ‘exported’. Removing irrelevant and faulty data reduced the member list to 384 records. Of these, more than 30 are suppliers and 'other' members such as valuers and other associations.

This leaves a final tally of 356 store listings. Note that 12 per cent of these member stores is held by two medium-sized chains with more than 40 stores combined – Bevilles and Salera’s.

Dubious claim?

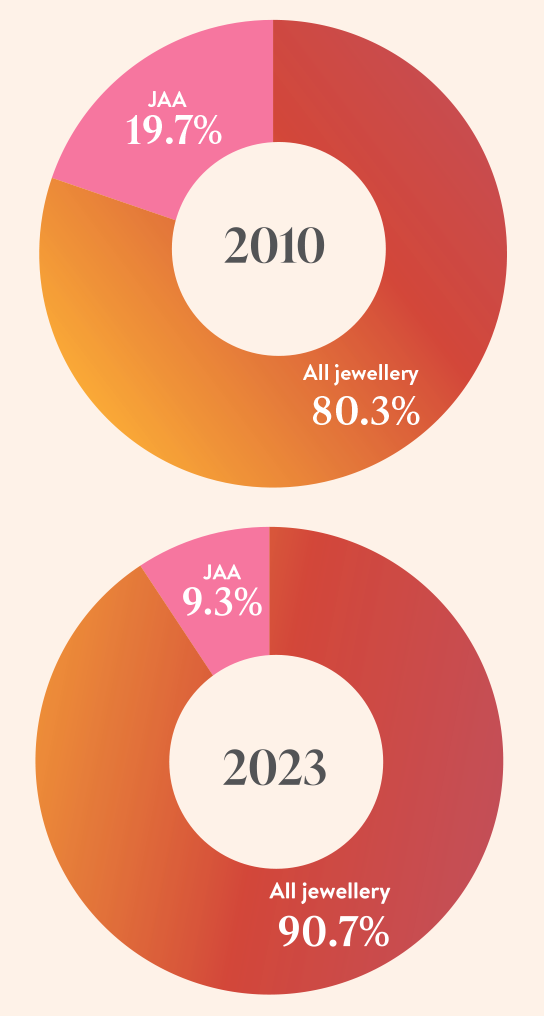

2010 VS 2023 JAA Marketshare |

|

| The above charts compare the JAA’s member stores to the total number of Australian jewellery stores. In 2010 JAA members accounted for almost 20 per cent share of the market which has fallen to less than 10 per cent by 2023. |

This retail membership information flies in the face of another JAA claim and calls its corporate governance into question. If the JAA’s member directory page is up-to-date - and there should be no reason to believe it isn’t - and the number of member stores is 356, then it's difficult to explain why the website boasts a membership of ‘around 650 outlets’.

An outlet is not a member; it is a retail store. Therefore, the JAA does not have ‘around 650 outlets'. If, on the other hand, the JAA wants to suggest that all members are ‘outlets’, it cannot claim the figure of 650 either.

This study cannot determine how the JAA’s statement is true, therefore the JAA’s website is inaccurate or misrepresented.

Regardless of this lack of transparency, there were 4,224 jewellery stores in Australia in 2010, meaning that the JAA previously represented 25 per cent (1,039 stores) of the market.

Today, with 3,501 stores - and using the JAA’s membership data - its numbers have collapsed to under 10 per cent.

Again, if the member directory page is current, and after deleting duplicate (store) records, the confusing website information indicates a total membership of 316, including suppliers and ‘other’ members.

Therefore, whichever way the figures are analysed, it’s hard to conclude that the JAA has ‘around 650 outlets’. It also contradicts Sharp’s claim of around 400 members – although this advice was provided 10 months ago.

The other explanation is that around 80-90 members have requested not to be listed on the JAA website. It’s a little difficult to imagine why 25 per cent of businesses do not want to be listed as a member.

There are other explanations: the website is wrong; it is missing members that should be listed, or, Sharp could be wrong; the JAA did not, or no longer has “around 400 members”.

Either way, this confusion could have been avoided if Young had provided the information - she had three months to do so - just like other (overseas) jewellery associations were able to do, within hours.

Interestingly, one of the core values of its new mission statement is to ‘create unity and collaboration through a preparedness to work with all stakeholders for the benefit and progression of the jewellery industry’.

No longer Australia’s peak industry body

The first thing to note about the JAA’s recently re-issued Mission and Vision statement is that it’s unclear whether the JAA sees itself as - or claims to be - the ‘peak industry body’.

This term no longer appears on the JAA website and does not appear in its new mission statement.

The purpose of a mission statement is to document an organisation's goals, values, and objectives. The aim is to help an organisation (company or association) respond to change and consistently make decisions that align with its goals and vision.

The JAA ‘About Us’ page was recently changed to reflect the new mission statement, which differs dramatically from previous versions.

The previous statement was clear: ‘To be the peak industry body that represents greater than 75 per cent of industry participants’. However, ‘peak industry body’ has been removed. Why?

One explanation could be that it has failed its previous objective - membership. Considering the current circumstances, the JAA’s aim of representing three-quarters of the entire industry cannot be supported by any level of logic.

This is not to suggest that organisations should not set ambitious targets. High performance occurs in an environment defined by high expectations. As the old saying goes, ‘aim for the moon, and you’ll land among the stars’.

However, ambitious intentions are a double-edged sword; when organisations set lofty targets and fail to reach them, the injury is two-fold. There’s both the disappointment of failing to achieve the objective and the embarrassment of making your intentions clear and failing to live up to them.

With that said, clearly, the JAA has not been able to achieve anything near the 75 per cent target it once set itself. For example, the 2010 SOIR recorded the association as having 960 members, with its retail members accounting for 1,039 individual jewellery stores - one member can have many stores.

If the current membership is 316 – this is a decline of around 67 per cent. It’s worse for its store ‘membership’, which has plummeted from 1,039 in 2010 to about 356 (as listed on its website) - a shocking 66 per cent fall.

The JAA claims to cover ‘all areas of the jewellery industry – from manufacturing, wholesaling, distribution to retail’.

In 2010, when the JAA had 960 members, 69 per cent were retail members. Even though it lists three non-retail sectors - manufacturing, wholesaling, and distribution - suppliers accounted for only 31 per cent of the JAA membership base.

If the member directory page is up to date, then it appears that supplier membership accounts for fewer than 10 per cent of the current total membership.

This could explain why the term ‘peak industry body’ has been removed from its mission statement and demonstrates that the aim of representing 75 per cent of the industry was folly. It could also explain why the industry survey results do not paint the JAA in a positive light.

UPDATES - SIGNIFICANT NEWS SINCE PUBLICATION

Membership blow: Major jewellery chain quits JAA - February 2024

Confusion around JAA reporting requirements intensifies - January 2024

JAA: Queries over governance standards; possible breach of regulations - December 2023

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES