The trials and tribulations facing the general retail sector are hardly a secret. Yet, somehow, fine jewellery chain stores appear to be resistant to many of these external pressures.

The 2010 edition of the State of the Industry Report (SOIR) documented the surprising resilience chain stores appeared to have in the fallout of the 2008 Global Financial Crisis.

Despite stiff competition for the consumer dollar, fine jewellery chains performed exceedingly well as they consolidated considerably over three years.

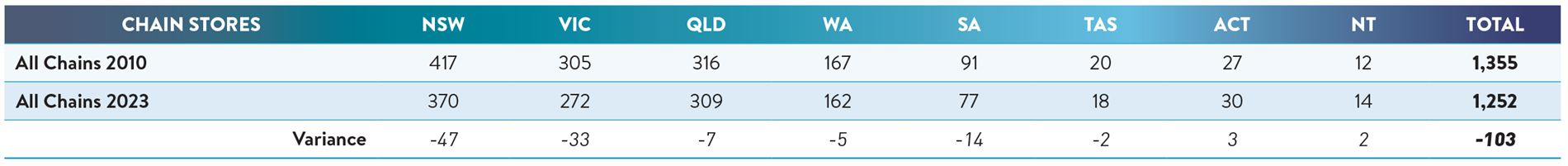

At the time, there were 1,355 fine and fashion chain stores in Australia, occupying 32 per cent of the overall jewellery market.

Of that figure, 977 were fine jewellery chain stores, with these figures not accounting for Pandora (41 stores). There were 378 fashion chain stores.

Fast forward to December 2023, and the landscape has shifted dramatically.

While the store count of Australia's fine and fashion jewellery chains accounts for 1,252, the makeup has changed significantly.

That is, 13 years later, the fine chain store count has changed by five compared with 2010 (972) contrasted with only 265 fashion.

This means that fashion chain stores hold just 21.3 per cent of the market, a stark contrast to the 27 per cent share held a little more than a decade ago.

While the decline of fashion chains is explained in detail, in short, six of the seven major chains that existed in 2010 collapsed within a decade, with Lovisa the sole survivor.

While Lovisa held a modest store count of 35 in 2010, that figure has expanded to 175 stores – occupying 84 per cent of the total fashion chain market.

What is most curious about this data is that while Australia’s overall jewellery store count (fine and fashion chains, brand-only and independents) has consistently declined in the past decade (18 per cent), fine chain stores have stood tall and weathered the storm.

What is it that makes these chain stores so resilient to the kinds economic pressures that force other retailers to close?

TABLE 1: AUSTRALIAN JEWELLERY CHAIN STORE COMPARISON 2010 V 2023 |

|

| Chart shows a state-by-state comparison of fine and fashion jewellery store counts in 2010 and 2023. While fine jewellery chains have fared well in adverse economic climates, several fashion chains have suffered significant collapses in the past decade. |

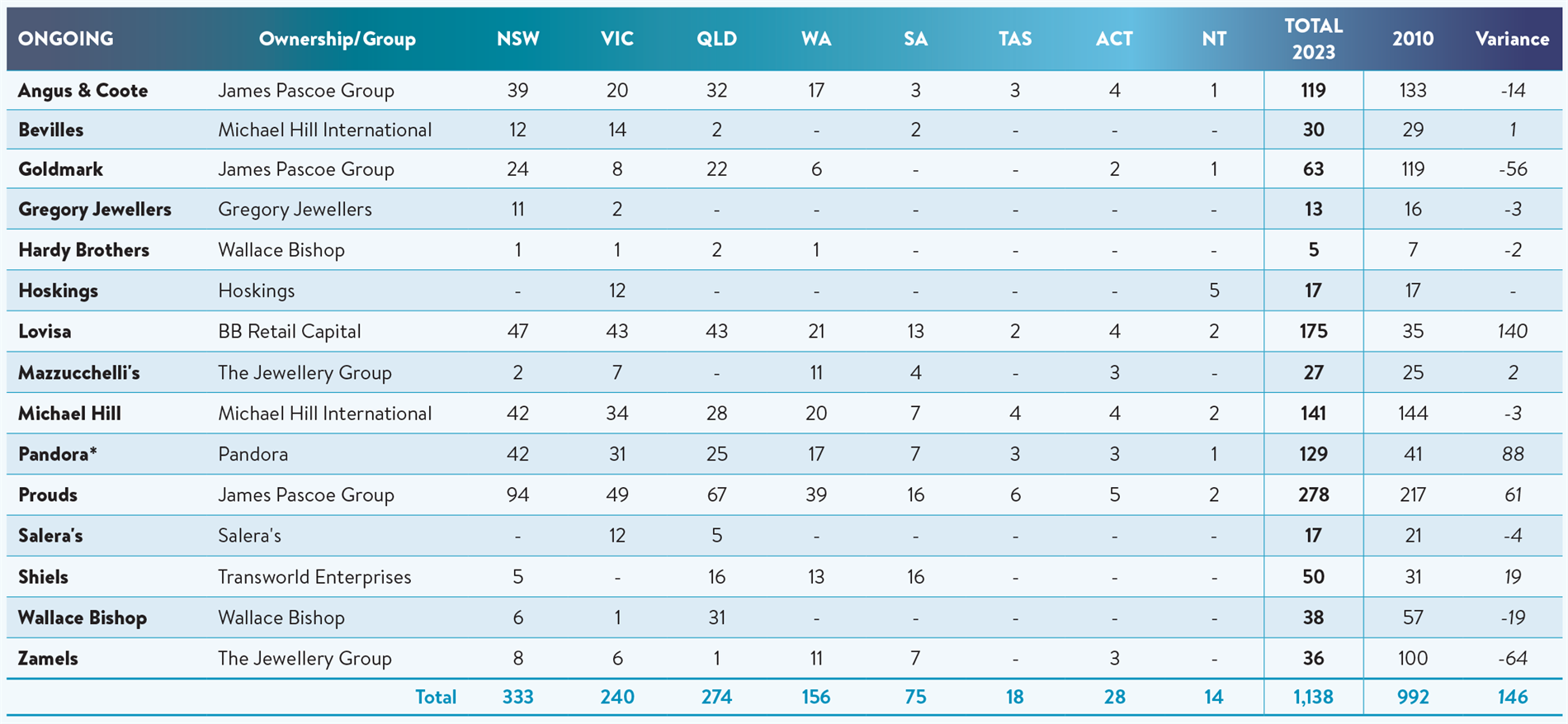

TABLE 2: 'STILL IN BUSINESS' - COMPARISON OF FINE AND FASHION JEWELLERY CHAINS 2010 V 2023 |

|

| After the collapse of a number of chains over the past decade, this table compares fine and fashion jewellery chains that have remained in business since 2010. It shows they have increased their store counts by 146. These stores, paired with the new chain stores that have emerged in the past decade, bring the total count to 1,252. |

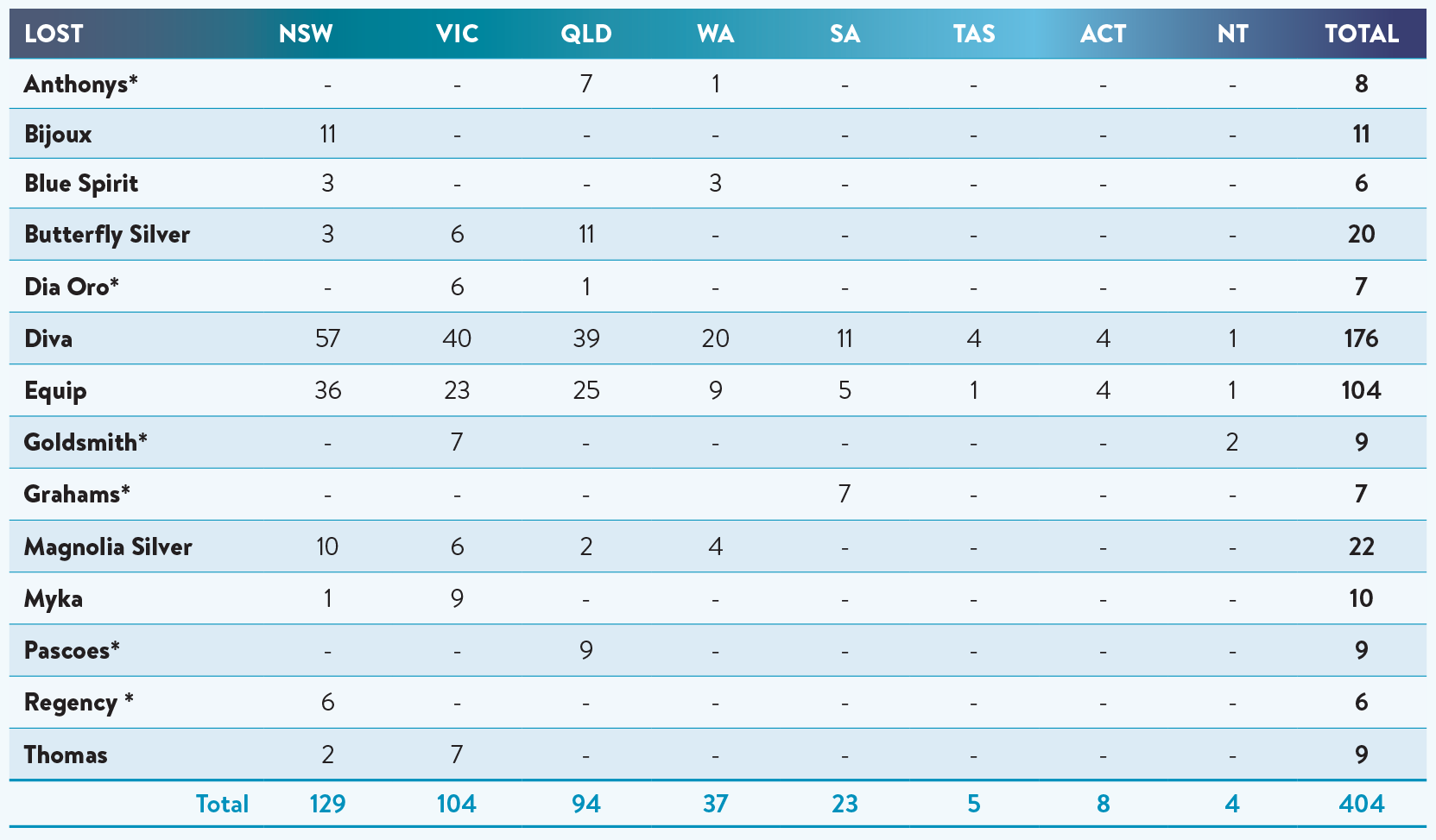

| TABLE 3: LOST CHAINS FROM 2010 |

|

HISTORY LESSON: LOST CHAINS FROM 2010This table records chain stores from 2010 that are no longer in business or those that no longer qualify as a fine or fashion jewellery chain. Those marked with an asterisk - Anthony’s, Dia Oro, Goldsmith, Graham's, Pascoes, and Regency - have continued trading; however, their store counts have fallen below the required level (five stores) to be classified as a ‘jewellery chain’ to qualify as a chain. It is with noting that of the total (404) 280 fashion jewellery stores (69 per cent) were lost following the collapse of Diva and Equip Accessories. Another notable loss was that of Thomas Jewellers. In October 2017 it confirmed the closure of its nine stores just one month after the chain announced a renewed focus on regional locations and the roll-out of new store designs. The business had traded since 1896 when James Thomas founded his first store in Ballarat, Victoria. |

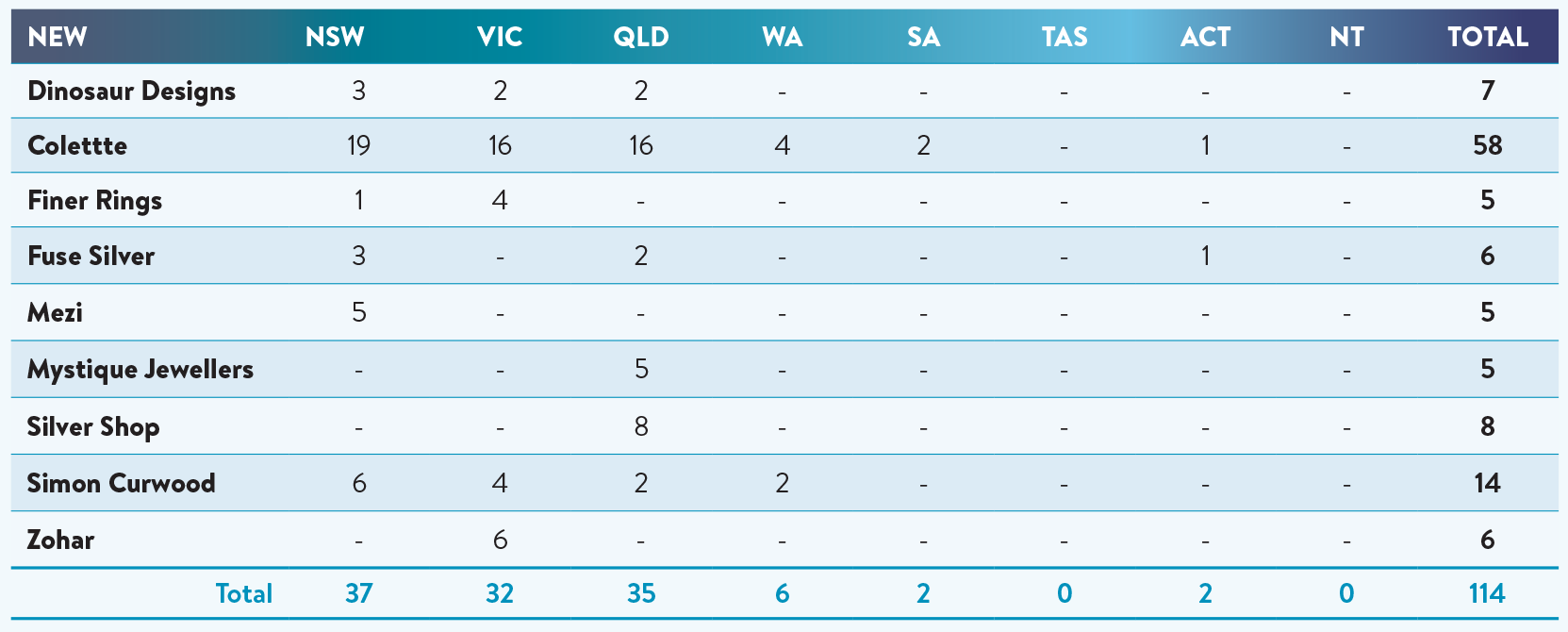

| TABLE 4: AUSTRALIA'S NEWEST FINE AND FASHION JEWELLERY CHAINS |

|

NEW KIDS ON THE BLOCKSome of the jewellery chains shown on Table 4 were not even in business when Jeweller published its first State of the Industry Report (SOIR) in 2010. Business, like nature, sees the old making way for the new and these emerging chains are a good example of this, as well as the philosophy that 'old ways won’t open new door's. Consider Simon Curwood Jewellers that began in 2016 with one store and which has quickly risen to 14 store stoday, compared to, say, Thomas Jewellers that closed in nine stores in 2017 after 121 years trading. |

Papa Bear

To understand the factors that have made fine jewellery stores so resistant to economic pressure, it’s worth closely examining the changes in the industry’s major players on a case-by-case basis.

Unsurprisingly, the James Pascoe Group (JPG) remains the dominant force in Australia. It has been relatively stable for the past decade (469 stores in 2010), with a decline in Goldmark locations (63 stores from 119 stores) outweighed by a focus on Prouds (278 stores from 217 stores).

Today, the New Zealand-based retailer operates 460 locations, only nine less than in 2010.

However, it is JPG’s recent past that is most interesting. Since 2020, and following the COVID pandemic, its Prouds stores have expanded to 17 new locations (278 stores from 261 stores).

At the same time, JPG’s Angus & Coote brand decreased by three stores (119 from 122), and Goldmark also declined - by 13 stores (63 stores from 76).

This leaves JPG with 460 stores, an increase of one store from our pre-COVID study in 2020 (459 stores).

Michael Hill International (MHI) - another Kiwi-founded jeweller - has been busy. Earlier this year, the company shocked the jewellery industry by acquiring Bevilles, the Victorian-based jeweller founded in 1934.

MHI operated 144 stores in Australia in 2010 and, over the next decade, expanded that network to 156 by 2020. However, since the pandemic, that figure has decreased to 141, but by acquiring Bevilles, the group's total ownership is now 171 stores.

As previously mentioned, Lovisa has evolved into a dominant market force, expanding its store network in Australia by 400 per cent in 13 years. The company has opened 35 new stores since 2020, despite the impact of the pandemic.

Pandora, meanwhile, has slowed its roll – after jumping from 41 stores to 125 between 2010 and 2020, the world’s largest mass-market jewellery brand has opened just four new stores in the past three years.

It should be noted that Pandora was defined and listed as a ‘brand-only’ chain in the 2010 SOIR – rather than a fine jewellery chain.

The distinction is vital because Pandora was, and remains, both a supplier to the broader jewellery market and a prominent retailer of its brand.

For this reason, the 2010 SOIR listed Pandora as a ‘brand-only’ operator, defined as “one, or more, fine or fashion jewellery stores that sell and market its brand of jewellery and/or watches.”

A brand-only retail network is usually a vertical-market operation, does not utilise local suppliers, and stores are often owned and operated by the proprietor of the brand or under license via franchise agreements. Because Pandora is somewhat unique - it is a supplier and simultaneously a retailer - with its own stores, it has been reclassified as a chain store rather than a brand-only store.

Mama Bear and Baby Bear

The fine chain store category has always contained large, medium and small chains.

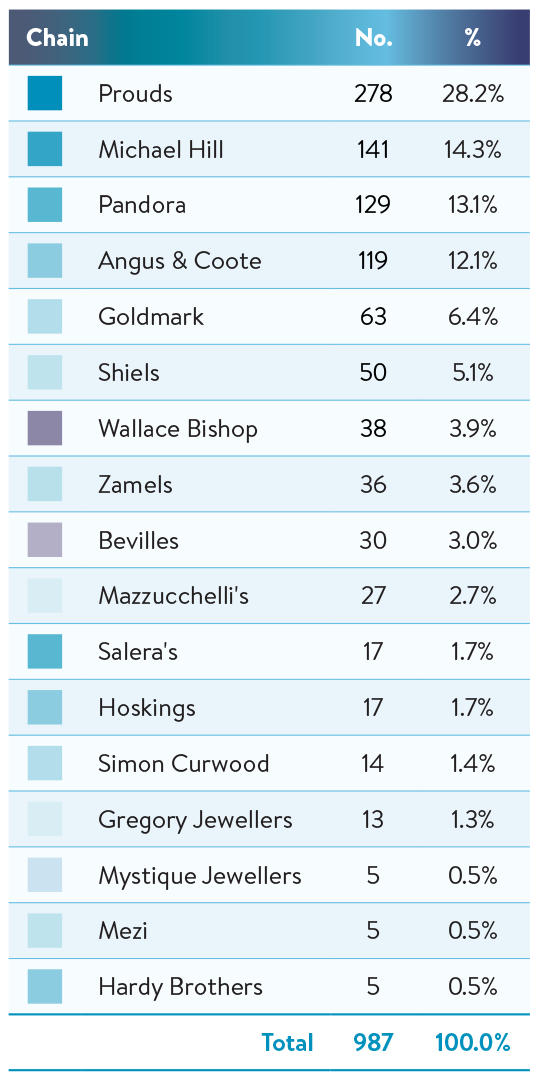

FINE JEWELLERY CHAINS King of the Castle |

|

Jeweller continues to define a ‘chain’ as: A group of five or more fine or fashion jewellery stores trading under a single (brand) name, with one ownership entity – either person or company – coordinating buying and marketing activities across the group. This could include a franchise operation.

A chain store usually has central management and standardised business methods and practices. It will purchase products from local suppliers and/or import its products.

In recent years, the middle ground of the fine jewellery market has been relatively stable. Since 2020, The Jewellery Group’s (TJG) two brands have settled comfortably into this bracket, with 36 Zamels and 27 Mazzucchelli stores, leaving TJG with 63 locations in total.

Of course, the 2023 Zamel’s store count sharply declined from when the family business was sold. Zamels was founded in 1954 and, after evolving into a household name in Australia over the next half century, was sold in 2007 to Quadrant Private Equity.

In 2010, Zamels had 100 locations as the nation’s third-largest jewellery chain.

Industry speculation valued the Quadrant deal at between $75 million and $100 million; however, when all was said and done, the final figure was believed to fall well short – somewhere around $50 million.

Even at this price, it was still considered an overpay. This was seemingly proven accurate when Quadrant Private Equity sold the company in 2012 to Mumbai-based M Suresh Group DMCC, one of the world’s largest jewellery manufacturers.

“In a stunning depreciation, Quadrant is tipped to be offloading the group for less than $20 million – a loss of around $30 million in just over four years,” Jeweller reported.

At the time of the second sale (2012), there were 102 Zamels locations. Before the pandemic in 2020, there were 37 locations.

Today, there are 36 stores, leading its ‘sister’ chain Mazzucchelli, which, in 2010, accounted for 25 stores.

While Zamel’s has fallen from large chain to medium, the past 13 years have been productive for Transworld Enterprises. Shiels has not only remained in the medium-sized area; it has expanded from 31 locations in 2010 to 50 stores today.

The group also owns Grahams, which has been reduced from five stores to four since 2020, meaning it no longer qualifies as a chain under Jeweller’s definition.

Stability has also been the common theme for the Bishop family in Queensland, maintaining a store count of 38 for Wallace Bishop and five for Hardy Brothers.

Wallace Bishop held a store count of 57 in 2010, meaning this figure has declined by one-third in the past decade; however, since 2020, it has not changed.

It’s a story of stability among the smaller players, too - see table. Gregory Jewellers, Hoskings, and Saleras have all had negligible changes, rising or falling to small degrees.

What’s on your mind?

In Jeweller’s most recent special report – What Do Jewellers Think – chain store owners and managers were asked what they believed the largest challenges of the coming 12 months would be.

Many predictions have proven accurate and will likely continue to plague chain stores heading into the new year.

|

| The pie chart shows that Prouds continues to be Australia’s largest chain, with 28.2 per cent of the market (278 stores), with its nearest rival, Michael Hill, with 141 stores (14.3 per cent). In 2010 Prouds accounted for 34.6 per cent of the category. It should be noted that James Pascoe Group owns three of the top five chains - Prouds, Angus & Coote, and Goldmark. |

Trying to predict sales volume amid an unpredictable and erratic market was a common complaint – making ordering from suppliers difficult.

These concerns were reflected in Jeweller’s recent survey of suppliers – who were asked about the quality of their retailer customers' product planning, ordering, and restocking habits.

Just 13 per cent of suppliers described the situation as ‘excellent’ or ‘above average’. A startling 82 per cent said product planning and ordering was ‘average’ or ‘below average’.

While these figures almost certainly reflect interactions with independents and chains, the overall sentiment remains the same – ordering from suppliers is difficult because of the unpredictability of the market.

Staffing issues were by far the most common complaint. Recruiting has become challenging since the pandemic, and employees are increasingly asking for more.

In September, the Australian Bureau of Statistics published data detailing a 14.4 per cent increase in retail job vacancies since May.

Australian Retailers Association CEO Paul Zahra said this news was particularly troubling as the holiday season approaches – the busiest time for jewellery retailers.

“Unfortunately, this situation is exacerbating during the most critical time of year on the retail calendar – the Christmas trading period,” he said.

Conductivity

If, as our new study finds, independent stores have declined by 26 per cent since 2010, how do chain stores weather these economic burdens?

Craig Woolford is a senior retail analyst with MST Marquee, a platform hosting investment experts' research. He suggests that the saving grace for jewellery chains is ‘scale’.

|

| Above: Some companies own multiple retails brands. This table shows chain store market share by ownership. |

“Across all retail sectors, scale has become increasingly important, even in a category like jewellery. Consumers will do their research online beforehand, and a retail business needs scale to ensure that they have a profile with the consumer,” he explains.

“You need to be able to stand out and have a brand that produces good recall with consumers to ensure that you’re the first consideration for consumers.”

Put another way, for example, the Prouds website offers digital marketing support for every store in the network – 278 in total. This means that each consumer marketing activity increasing the business profile is evenly shared among many stores.

Conversely, for neighbouring independents, efforts to promote the business online benefit that store alone – and in a crowded market, standing out is difficult.

“It all comes back to digital marketing, and remaining a first consideration for consumers because of this promotion is why independents are finding it harder,” Woolford continues.

“This is a matter of scale – a single dollar spent by a chain promoting the company online can impact every store in the network, whereas a single store operator enjoys no such benefit.”

Another essential matter to consider is that chain stores now dominate retail space in the major shopping centres.

Whereas, 20 years ago, jewellery chain stores shared a shopping centre with a small number of independent jewellers; however, the dramatic increase in tenancy costs has all but driven family jewellery stores out of the major shopping centres.

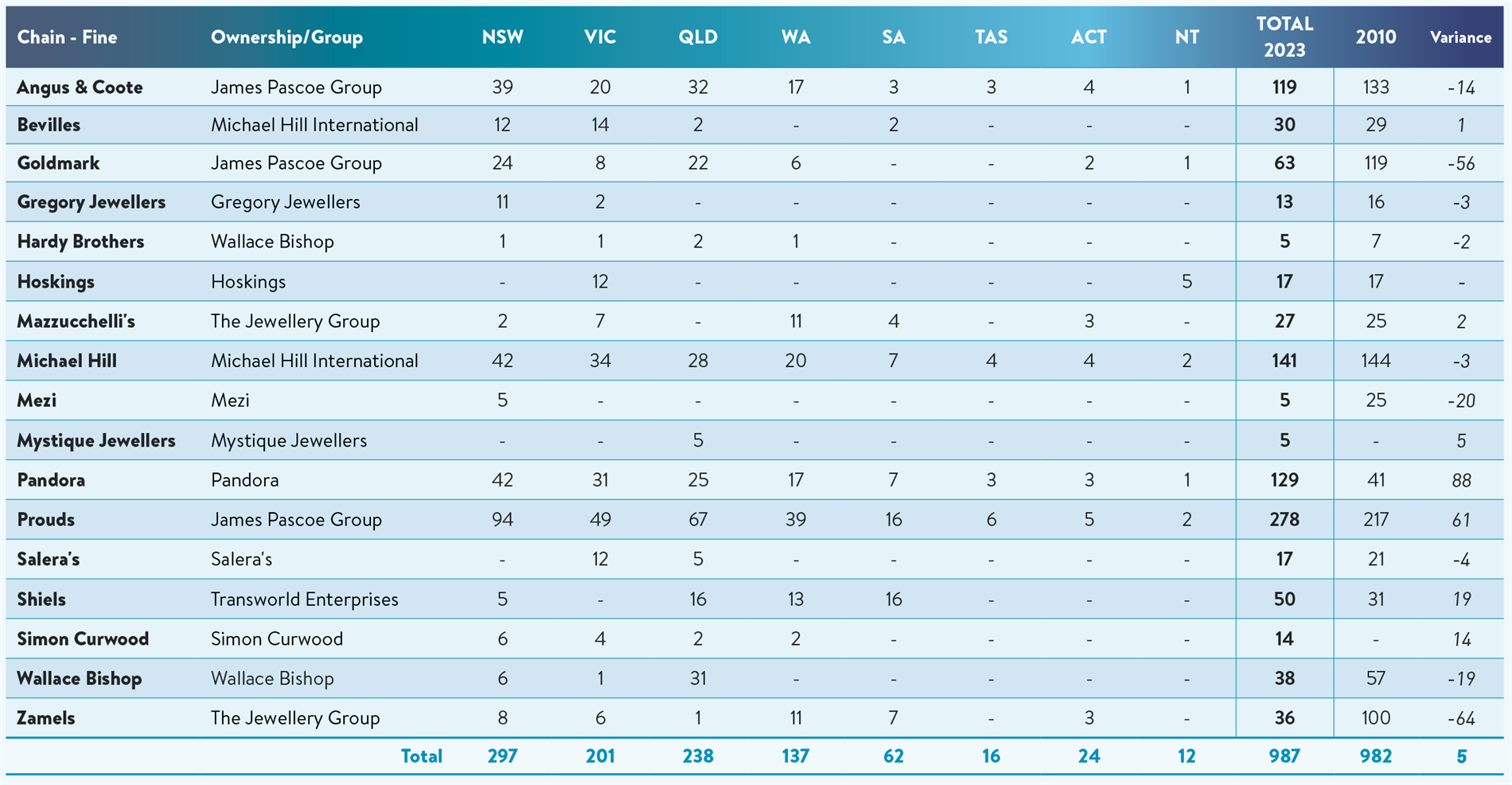

TABLE 5: FINE JEWELLERY CHAINS - 2023 STORE COUNT |

|

| This table compares the 2023 stores counts of the fine jewellery chains to their 2010 totals. *Pandora was changed from its 2010 classification of brand-only to a chain store status for this report. |

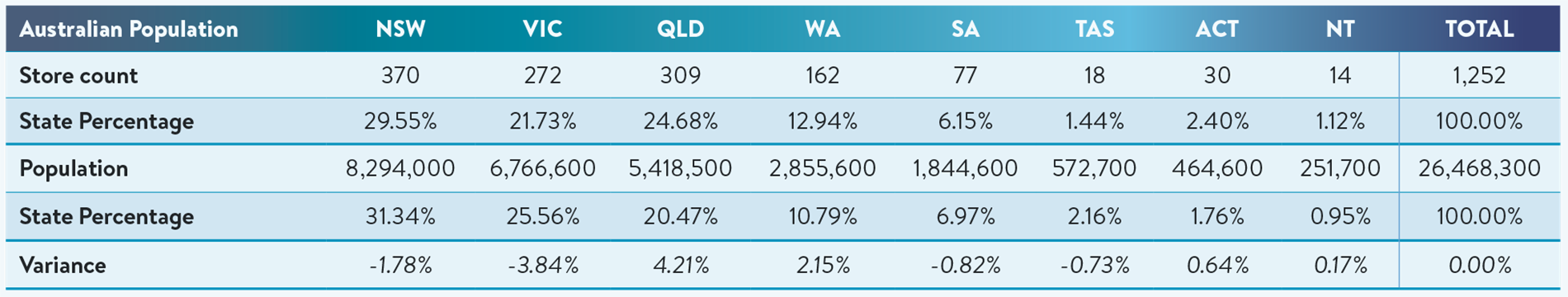

TABLE 6: JEWELLERY CHAIN STORES AND POPULATION |

|

| Australia's fine and fashion jewellery chain store count compared with state-by-state population data from March 2023. Census March 2023 |

UPDATES - Significant news since Publication

Michael Hill opens new flagship store in Chadstone - May 2024

Michael Hill announces store closures, job cuts - January 2024

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES