Over the past decade, Australia’s fashion jewellery chain stores have proven to be something of a dramatic ‘flash in the pan’.

At the time of the 2010 State of the Industry Report (SOIR), seven major companies accounted for 378 stores – representing a remarkable 27.8 per cent of all chain stores in Australia.

This sharp rise to prominence occurred within three years, with fashion chain stores expanding by 95 per cent between 2007 and 2010.

By the decade's end, just one of the seven companies would remain standing – Lovisa. This means that of the 378 stores operating in 2010, 343 no longer exist.

Interestingly, the trends of the second half of the past decade - which may have explained the rise of the category - have spiked again.

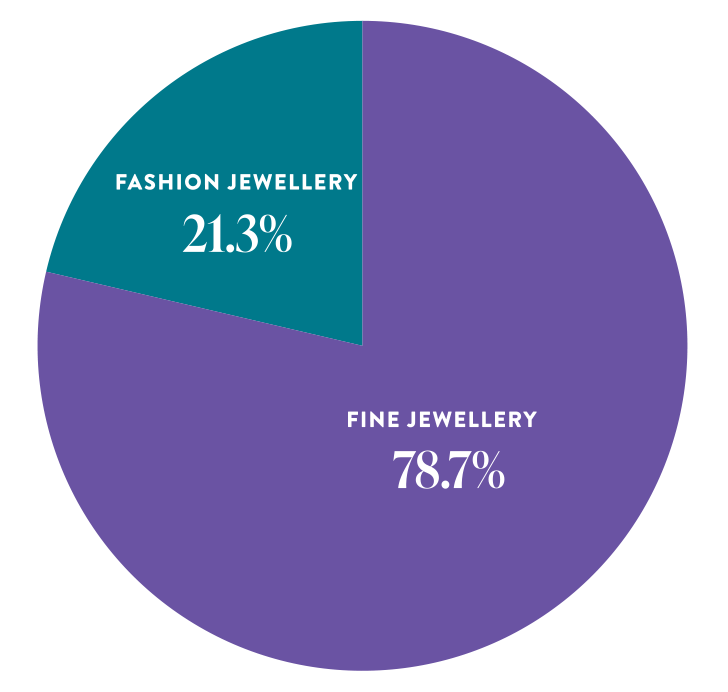

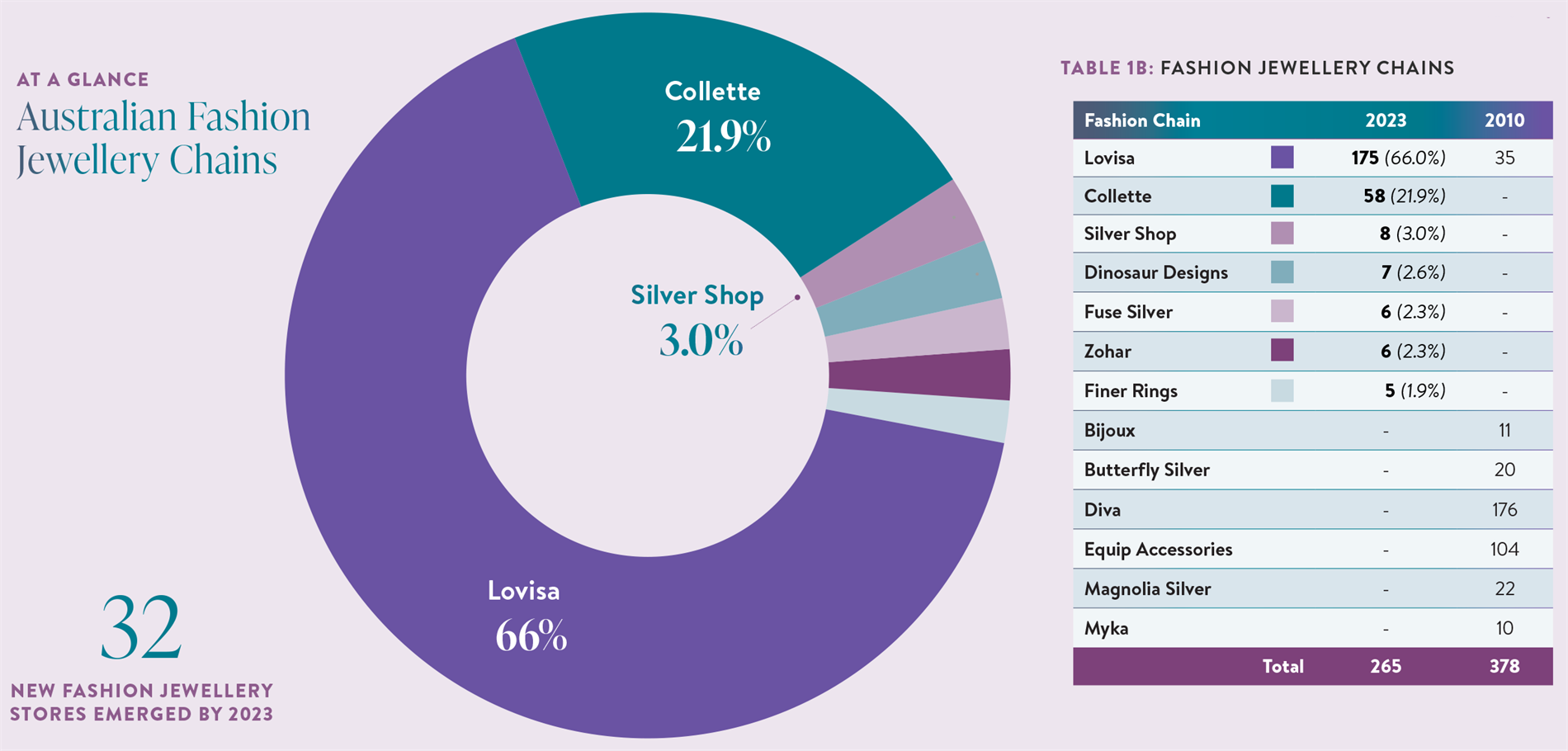

Jeweller estimates that 265 fashion chain stores currently operate in Australia, accounting for just 7.5 per cent of all jewellery stores. In terms of chains, fashion stores account for 21.3 per cent.

Category blurring

To understand what prompted the collapse of so many fashion chains, it’s essential first to explain the factors that drove their initial success. Correspondingly, to do that, one must first understand what differentiates fashion from fine jewellery.

For example, less than 20 years ago, a new and unknown brand found its way to Australia and was quickly dismissed by jewellery retailers.

At the time, Pandora was viewed as ‘cheap fashion jewellery’ manufactured in Asia.

While the range consisted of beads and charms - nothing new given that the first records of charm bracelets date back to the Assyrians, Babylonians, and Persians from 600-400 BC - Pandora was also viewed as ‘too fiddly’ for fine jewellery stores.

However, in less than five years, the company was credited with pioneering a brand revolution in the Australian and international jewellery industry. And it did that courtesy of a vast network of independent fine jewellery stores!

Just like the line between fine and fashion jewellery has blurred over the years, so has the retailing divide; there once was a clear delineation between the look and feel of a store that sold fashion jewellery and fine jewellery.

While it’s somewhat irrelevant to consumers, the industry broadly defines fashion products as made from base metals such as copper, brass, leather, or plastic. It could include ‘simulated gemstones’ made from glass, crystal or even plastic.

Fashion jewellery also includes gold-plated and silver-plated base metal products.

Pandora’s products - along with other brands - have moved up the ladder and now include silver and gold and, more recently, lab-created diamonds.

Origin story

The term ‘fashion jewellery’ is an evolution of a phrase popularised in the 1930s during the Great Depression – that being ‘costume jewellery’. Jewellers had begun making pieces with inexpensive glass around 300 years earlier.

With personal budgets tighter than ever before, discretionary spending plummeted during the 1930s. This limitation on purchasing occurred simultaneously with mass production and manufacturing expansion.

The human affinity for jewellery and adornments is thousands of years old and inevitably survives any economic hardship. Precious metals were replaced by cheaper base metals, and diamonds and gemstones were replaced with whatever budget-friendly alternative was available.

|

| Comparison of fashion and fine jewellery stores within the Australian jewellery industry. Fine jewellery chains remain the dominant force within the market, despite the expansion of Lovisa to 175 stores. |

The philosophy behind these designs was simple – fashionable for a time, then discarded and replaced with the next ‘flavour of the month’.

In 2008, the Global Financial Crisis devastated countries worldwide as the largest economic crisis since the Great Depression.

Predatory lending practices, excessive risk-taking by global financial institutions, and the rupture of the US housing bubble shattered international trade.

In response, consumer discretionary spending again took a hit, and arguably, these conditions assisted the rise of fashion jewellery.

Jewellers still viewed the category as something of an abomination – the ‘cheap and easy’ substitute for quality craftsmanship; however, retailers' offerings must reflect consumers' demands.

Why argue about semantics when there were great profits to be made from the ever-returning Pandora customers looking for the newest bead or charm?

That said, it is important for industry studies to attempt to define fashion and fine jewellery to measure and record statistics.

This is done from an industry perspective because when it comes to the consumer, they are largely unconcerned about industry jargon and nomenclature, as the rise of Pandora perfectly illustrates.

Indeed, from a humble beginning in the fashion market, Pandora is now the world’s largest jewellery brand.

Major players

In the years that followed the 2010 report, many of Australia’s fashion jewellery chains endured a dramatic demise. While the specific circumstances of each collapse vary, there were many repeating themes.

As online shopping became increasingly popular and accessible, fashion jewellery naturally gravitated away from bricks-and-mortar stores.

This was partly because of the low-margin, high-volume nature of the business model and, as a result, the target demographic for these products – teenage girls who live on their smartphones.

Once online, the chains faced brutal opposition from established competitors – often based abroad but able to penetrate the Australian market due to the increased globalisation of international trade. Many of these competitors were already well-seasoned in e-commerce.

Another challenge the fashion chains faced – shopping centre tenancy costs - stemmed partly from this target demographic.

Speaking broadly, shopping centres were once the cultural ‘place to be’ for teenagers, whether on weekends or after school. Naturally, these fashion chains focused on capturing that market.

As social media became increasingly popular, Australian teenagers moved away from shopping centres as cultural hubs. By extension, the profit generated from already low-margin products disintegrated further.

Equip Accessories operated more than 100 stores nationwide in 2010; however, it was placed in liquidation before the end of 2017. All stores were closed.

Butterfly Silver, a fashion jewellery business established in 2002, operated 20 stores in 2010. The company collapsed in 2018, closing all locations.

Three additional fashion chains failed to see out the decade - Magnolia Silver, Bijoux, and Myka.

At the time of the 2010 report, Diva was Australia’s largest fashion chain, operating a network of 176 stores.

The company was launched in 2003 by husband-and-wife Colette and Mark Hayman and was sold to BB Retail Capital in 2005.

At the height of its power, more than 500 Diva stores operated worldwide; however, in 2015, the company was placed in liquidation.

If the name ‘BB Retail Capital’ sounds familiar, that’s because it is the company that owns Lovisa – the ‘sole survivor’ among these fashion chains.

Diva long promoted itself as a retail chain targeting teenage girls, while the intention of Lovisa – launched in 2010 – was to “fill the void for high quality, fashion-forward and directional jewellery.”

The apparent intention was for the two companies to complement one another; however, just a few years later, it appeared that Lovisa had become the ‘favourite child’ following the collapse of Diva. A steady stream of Diva stores closed while others were converted to Lovisa locations.

Around the time of Lovisa’s launch in 2010, Colette Hayman returned to the Australian jewellery industry after a three-year hiatus courtesy of a non-compete clause following the sale of Diva to BB Retail Capital.

Hayman launched Colette Accessories, beginning with a single store in the Sydney CBD before blossoming into a network of 120 stores within the next three years. It was a dramatic rise, perhaps too dramatic!

Colette Accessories remained active until February 2020, when the company was renamed Colette By Colette Hayman and was placed into administration.

The fate of 99 Australian stores and 41 New Zealand stores was placed in the hands of Deloitte Restructuring Services. After an initial deal fell through, the business continued trading through administration until former Myer boss Bernie Brookes moved to acquire the failing business.

Brookes was to own 90 per cent of the business, with the remaining 10 per cent owned by an unidentified silent investor.

As an indication and confirmation of the relationship between the rise of the internet and the demise of fashion jewellery bricks-and-mortar stores, following the acquisition in 2020, Brookes told The Australian Financial Review that Colette’s focus would be to become a ‘true omnichannel business’ which would position itself for an upturn once the pandemic passed.

He explained that if someone were establishing Colette as a fashion jewellery chain now (in 2020), “They wouldn't need 140 outlets - a network of 35 stores was the right size”.

Today, Colette by Colette Hayman has 58 stores nationally.

As Bill Gates once observed: “Every change forces all the companies in an industry to adapt their strategies to that change."

|

| In 2010, there were seven fashion chains with a total of 378 stores. By 2023 five chains had closed; however, five new fashion chains with 32 stores had emerged by 2023. This is an overall decline of 113 stores. |

Top dog

From humble beginnings as the ‘little sister’ of Diva, Lovisa has blossomed into the leading fashion chain in Australia and a dominant figure in the fashion jewellery category.

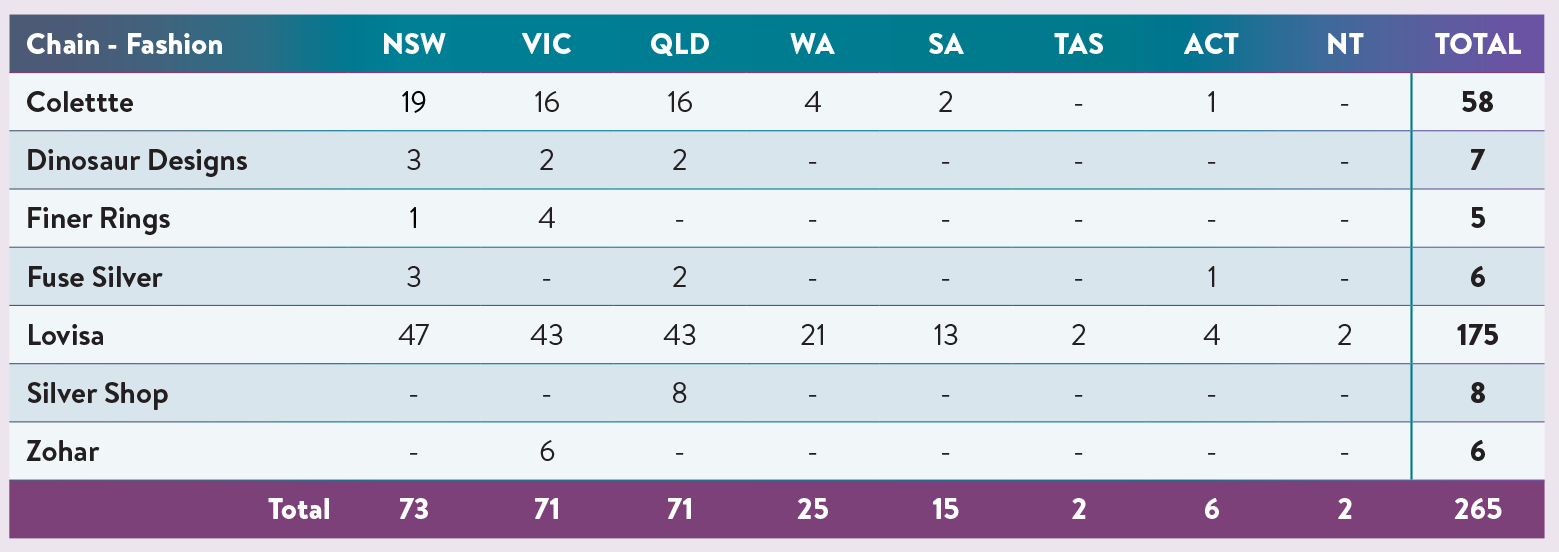

Lovisa has 175 stores in Australia, with a powerful presence in Victoria (47 stores), New South Wales (43 stores) and Queensland (43 stores).

This is a particularly impressive expansion given that Jeweller had compiled chain store data as recently as 2020 when Lovisa had 140 stores.

With that said, it hasn’t always been smooth sailing for the company, with persistent negative press undermining Lovisa’s reputation with Australian consumers.

- In September, the Australian Financial Review revealed that Lovisa had been forced to pay more than $NZ150,000 to underpaid employees when leave and public holiday entitlements were ‘miscalculated’.

- Earlier that month, a report from Yahoo News shed light on allegations that possible legal action was pending against the chain as former employees accused the company of ‘bullying’ and ‘demoralising’ staff.

- Around the same time, reports on social media circulated where former Lovisa employees alleged that they were forced to work in ‘horrible conditions’ and even paid in gift cards.

- Over the past 12 months, the pay of Lovisa CEO Victor Herrero has drawn public scrutiny. Herrero is paid approximately $AU30 million annually – more than the CEOs of Qantas, Coles, and Woolworths.

These consistent jabs at Lovisa’s reputation and the company’s management are nothing new.

Under Brett Blundy’s management, Diva hit the media headlines in October 2011 when it launched a range of Playboy-branded accessories ostensibly aimed at young girls, including pre-teens.

The range subsequently created a consumer backlash.

A company press statement at the time described the new range as "the perfect amount of jewels, and just the right amount of sexiness. Playboy for Diva will have every girl feeling glamorous and red carpet ready".

Social media went into a meltdown, with irate customers, angry fans, and furious parents inundating Diva’s Facebook page with threats of a boycott. At the same time, women’s and children’s advocacy groups mounted vocal campaigns against the company.

Complaints about the Playboy range claimed Diva was purposely promoting a brand that supported explicit, violent, and degrading pornography to 'tweens’ and teenage girls.

Melinda Tankard Reist, an Australian author and advocate for women and girls with Collective Shout, expressed concern over Diva’s new range, saying Diva was endorsing the Playboy brand – alongside Winnie the Pooh charm bracelets, Disney Princess pendants and Cute Cupcakes Best Friends necklaces – to girls as young as nine.

“Diva has become a willing participant in pimping the brand and its values to its young customers,” she said. “We are calling on Diva to remove all Playboy items from sale. Diva is complicit in grooming girls as consumers of a porn brand which portrays women as 'bitches' and 'whores' to be used for men's sexual gratification.”

The intensity of the anti-Diva campaign was unusual, primarily due to the ease with which disgruntled consumers expressed discontent on the company’s Facebook page, which, at the time, had 91,000 followers.

Consumer comments on the Facebook pages included, “Hi Diva. I will no longer buy from your store until the Playboy range is removed.” Another angry Facebook member said, “Shame on you for promoting an adult porn brand in a store that is primarily for young girls.”

These media controversies could explain the company’s baffling decision not to participate in this report, with company directors outright refusing to provide any information.

That is, basic information about store counts is available to the general public; however, for accuracy, researchers approach chains to confirm the data being published to ensure the figures listed online are accurate and up to date.

Despite all other major chains happily cooperating in the best interests of transparency and accurate reporting, Lovisa’s leadership – as well as that of BB Retail Capital - would not confirm public information.

That said, while Lovisa’s public relations and corporate social responsibility (CSR) may deserve scrutiny, the financial results of recent years speak for themselves. The company notched a record 33.1 per cent increase in revenue for the past financial year amid expansion into 12 countries.

Lovisa achieved sales of $596.5 million for the past financial year, with the increase attributed to price rises during the third quarter.

TABLE 2: FASHION JEWELLERY CHAIN STORE COUNTS 2023 |

|

| A state-by-state breakdown of the fashion jewellery chain indicates that Lovisa, with 175, is the market leader. Note that Colette was launched in 2010 with one store. |

Precocious puppies

While the Australian fashion jewellery industry is dominated by Lovisa and, to a lesser extent, a revitalised Colette, many smaller chains are worth keeping an eye on.

Specialising in silver jewellery, Fuse Silver began as a family-owned and operated business in 2002; however, it has since expanded to six locations - Sydney, Canberra, Brisbane, Townsville, and Tweed Heads.

FinerRings is a relative newcomer to the industry, launching in 2018 under the watchful eye of Taiba Ash.

Ash dipped her toes into the waters of the jewellery industry by attending local markets in Melbourne, and just five years after opening the doors at her first store on Chapel Street, she has expanded the business to five locations.

FinerRings prides itself on creating ‘affordable jewellery that doesn’t end up in landfill’.

Other chains are happy to play the long game. Dinosaur Designs was founded by creative directors Louise Olsen and Stephen Ormandy in 1985, and today has seven stores in Australia, as well as locations in London and New York.

It’s a similar story with Silver Shop, with the first store opening in Toowoomba in 1999. Silver Shop is now active in eight Queensland cities, specialising in sterling silver jewellery.

Is the stage set?

While the purpose of this report is not to forecast industry trends, when you consider the factors that led to the rise of costume jewellery in the 1930s and fashion jewellery in the 2000s, an argument could be made that retailers can expect another resurgence in the years to come.

According to a report by the World Economic Forum, almost two-thirds of chief economists entered this year believing that a global recession was likely. The Western world is currently experiencing weak consumer spending and consumer confidence, resulting in discretionary spending plummeting in a similar manner to the economic conditions in the 1930s and 2000s.

That said, it is unlikely that Australia will anytime soon see the number of fashion jewellery chain stores it once did.

UPDATES - SIGNIFICANT NEWS SINCE PUBLICATION

Fashion jewellery chain collapses a second time - April 2024

Lovisa: 74 new stores as global expansion continues - February 2024

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES