High inflation and consumers’ concerns about the cost of living may have impacted jewellery stores last month.

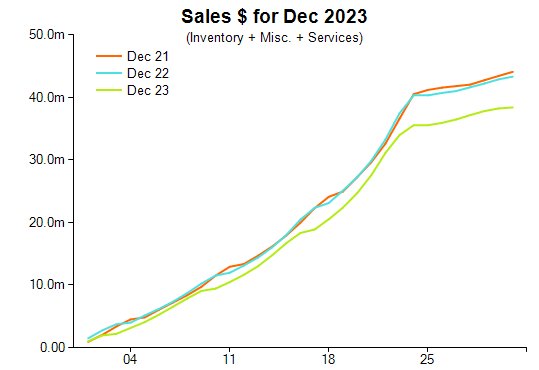

Sales dollars in December declined by 11 per cent on a year-on-year comparison and decreased by 13 per cent when compared with 2021.

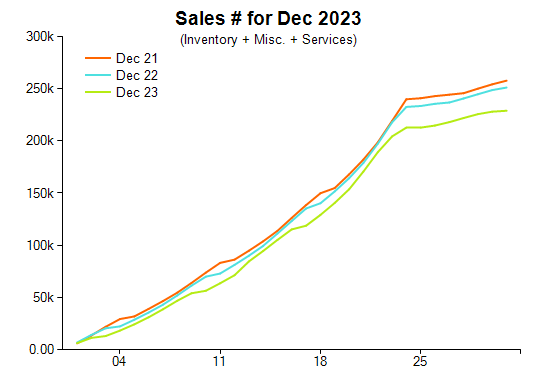

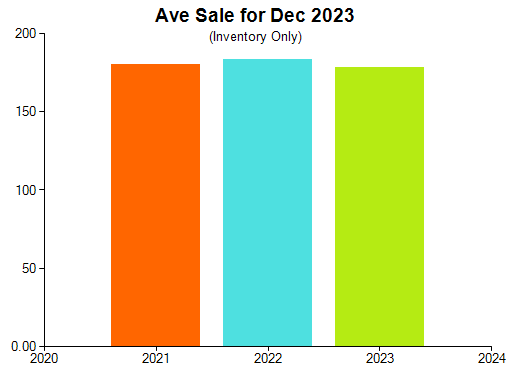

Total units sold decreased by nine per cent compared with the previous year. The average sale fell by 2.7 per cent on a year-on-year comparison, dropping from $183 to $178.

Retail Edge general manager Leon Van Megen said these results were evidence of evolving consumer patterns.

“Interestingly, it appears that Christmas comes early as sales in November were relatively strong - driven by the various sales events now established as part of the November retail calendar,” he said.

“The changes in department sales are reasonably stark; however, and while consumers are still purchasing jewellery, they are changing what they are buying."

Diamond precious metal jewellery declined by 24 per cent in December, in line with trends from September and October.

Precious metal jewellery without a diamond or gemstone declined by six per cent, while colour gemstone jewellery decreased by five per cent after a positive showing in November.

Silver and alternative metals jewellery increased by 0.6 per cent as a key positive.

“The trends over the second half of 2023 are clear: consumers are shifting their spending between categories and are buying a little less jewellery than they were. This might be attributed to the cost of living,” Van Megen added.

“A focal point for early 2024 is to adjust your range to reflect what your customers are buying and exit your slow-moving stock, especially from those departments where sales have materially slowed.”

The pattern in laybys showed a decrease of 22.1 per cent in dollar terms between new orders and pickups or cancellations, while services such as repairs decreased by 45.1 per cent.

Special order figures demonstrated a decline of 27.1 per cent in dollar terms between new orders and pickups or cancellations.

2023 Jewellery Retail Sales December Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Pleasing trends in jewellery sales ahead of holiday season

Silver linings in latest Australian jewellery market analysis

Australian jewellery retailers wrestling with decreasing sales

Tough sledding: Australian jewellery sales decline in August

Jewellery sales decline in July, consumer confidence on the rebound

Cause for celebration for jewellery retailers

Retail Edge urges caution in the latest market assessment

Weakened sales headlines April for jewellery retailers

Modest sales wins for Australian jewellery retailers

Surprise reversal pattern observed in Australian jewellery sales