Revenue decreased by 6.1 per cent on a year-on-year comparison for the three months ending 3 February, achieving a total of $US2.49 billion ($AUD3.26 billion) in sales.

Same-store sales at locations open for at least one year declined by 10 per cent.

For the year, Signet reported a 8.6 per cent revenue decline, reaching $USD7.17 billion ($AUD10.87 billion) in sales. Same-store sales declined by 11.6 per cent, while net profit more than doubled to $USD810 million ($AUD1.22 billion).

With engagements and weddings expected to increase in the US over the coming years, CEO Virginia C. Drosos said the retailer remains well-positioned to succeed despite these results.

"As we look to fiscal 2025, we are expecting sequential same-store sales improvement over the year as engagements gradually recover,” she said.

“We believe we're positioned to win new customers through our marketing personalisation, growing consumer-inspired product newness, and aggressive expansion of our service business."

On a conference call with analysts, Drosos said the company’s data platform now features information on 17 million consumers in romantic relationships. This will allow the company to personalise marketing strategies and document engagement trends.

“Engagements reached a trough [last year],” she said.

“We are seeing engagements recover, as we were expecting they would. We expect a gradual improvement in engagement trends over the next three years. It takes a bit to recover.”

Signet owns more than 2,800 stores and oversees brands such as Kay Jewelers, Zales, Jared, Diamonds Direct, JamesAllen.com, Rocksbox, Ernest Jones, and Sterling Jewelers.

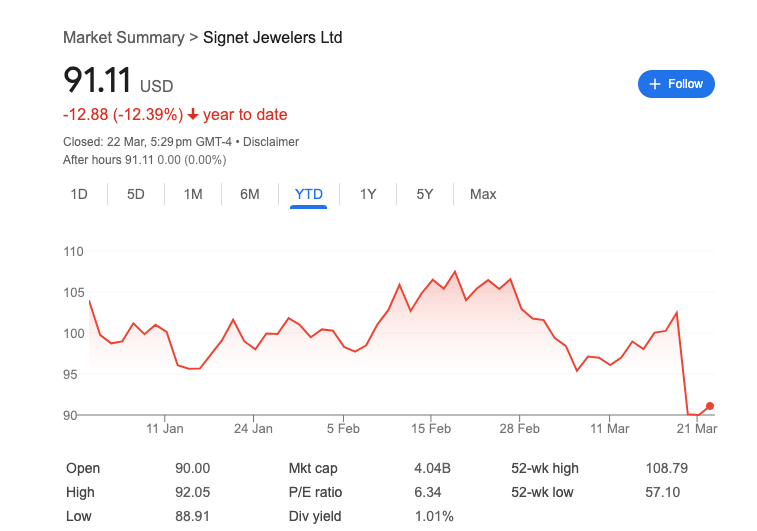

Fluctuations in Signet Jewelers share price over the past 12 months. |

More reading

Kings of luxury: New research highlights Pandora's dominance

Sales decline for retail jewellery giant

Signet maintains guidance despite declining jewellery sales

Signet reviews forecast following sales decline

Signet CEO says excluding Russian diamonds will prove fruitful

Sales slump for US diamond jewellery giant