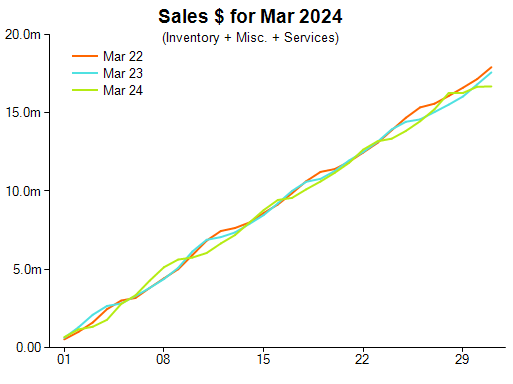

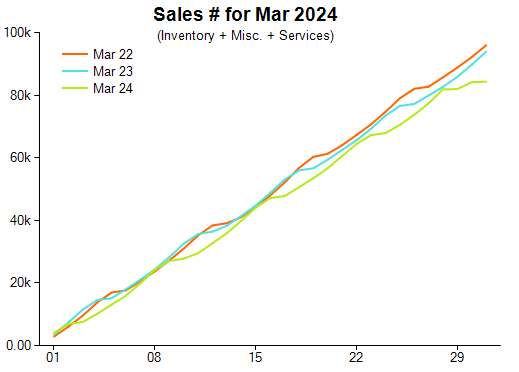

Analysis of data collected from more than 400 independent retailers revealed that sales in March declined by 5 per cent on a year-on-year comparison and 7 per cent on a two-year comparison.

Retail Edge general manager Leon Van Megen said that measuring against any month in 2022 and early 2023 is a comparison with what’s known as the ‘COVID-19 bubble’.

“As we work our way into more directly comparable periods, we should start to see sales come broadly in line with the most recent non-COVID time period,” he explained.

These insights followed established trends in the sales analysis from February, which documented a 4.3 per cent decline.

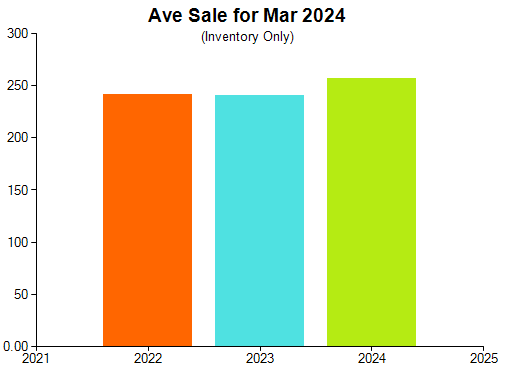

In a positive outcome, the average sale was $257, a 7 per cent improvement compared with the past year ($241). Unit sales for the month decreased by 10 per cent, marking a third consecutive year of decline in March.

Among the specific categories, diamond jewellery recorded a 12 per cent decline on a year-on-year comparison and a 28 per cent decrease compared with 2022.

“This major decline in the largest category continues to impact total business performance. Managing diamond stock remains critical to managing your total inventory, which continues to be the single biggest driver of the accumulation of aged stock,” Van Megen added.

“Managing aged stock with a careful plan will help jewellers avoid a cashflow squeeze. It’s about buying strategically and selling well.”

Silver and alternative metal jewellery improved by 1.1 per cent year-on-year, while colour gemstone jewellery was close to neutral, with a 0.4 per cent decrease by the same comparison.

Precious metal jewellery without a gemstone or diamond declined by 0.9 per cent on a one-year comparison and 19 per cent when compared with 2022.

The pattern in laybys was highlighted by a 5.8 per cent increase in dollar terms between new orders and pickups or cancellations. Services, including repairs, decreased by 37 per cent.

There was also a 7.5 per cent increase for special orders in dollar terms between new orders and pickups or cancellations.

2024 Jewellery Retail Sales - March Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Manage stock, buy well: Latest analysis for Aussie jewellers

Consumer confidence: Intriguing sales performance for jewellers

Challenging December for Australia’s independent jewellers

Pleasing trends in jewellery sales ahead of holiday season

Silver linings in latest Australian jewellery market analysis

Australian jewellery retailers wrestling with decreasing sales