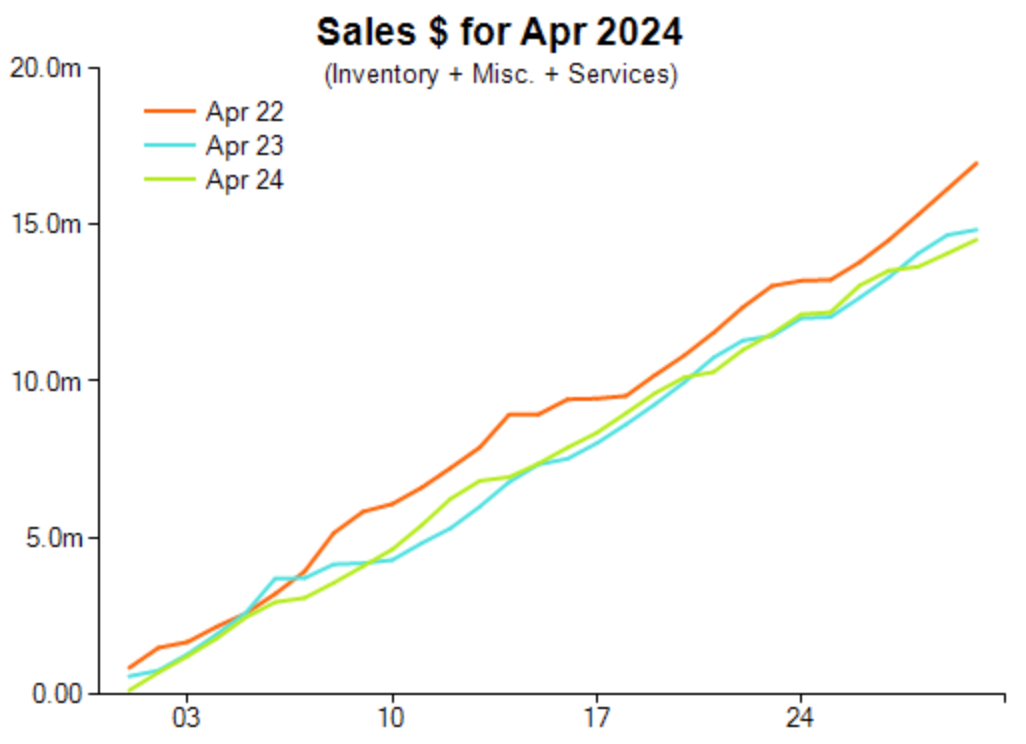

Across more than 400 independent stores, analysis found that sales decreased by 2.1 per cent on a year-on-year comparison.

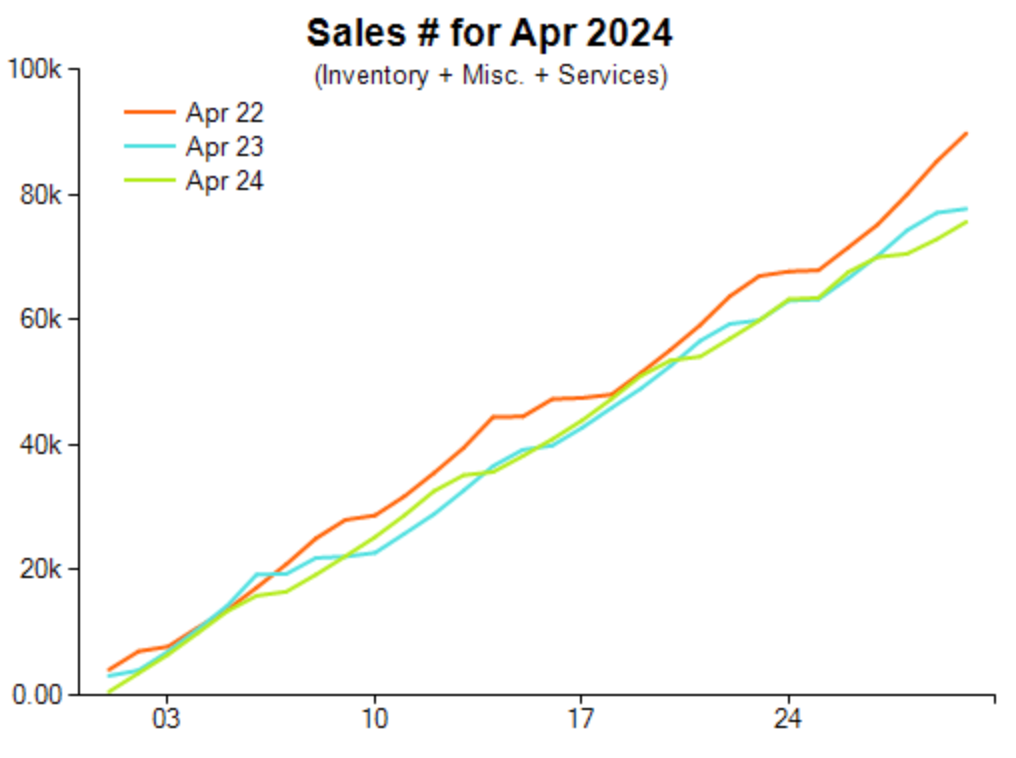

Unit sales decreased by 2.7 per cent compared with the previous year in what has become an established trend – with a decline occurring in April for three consecutive years.

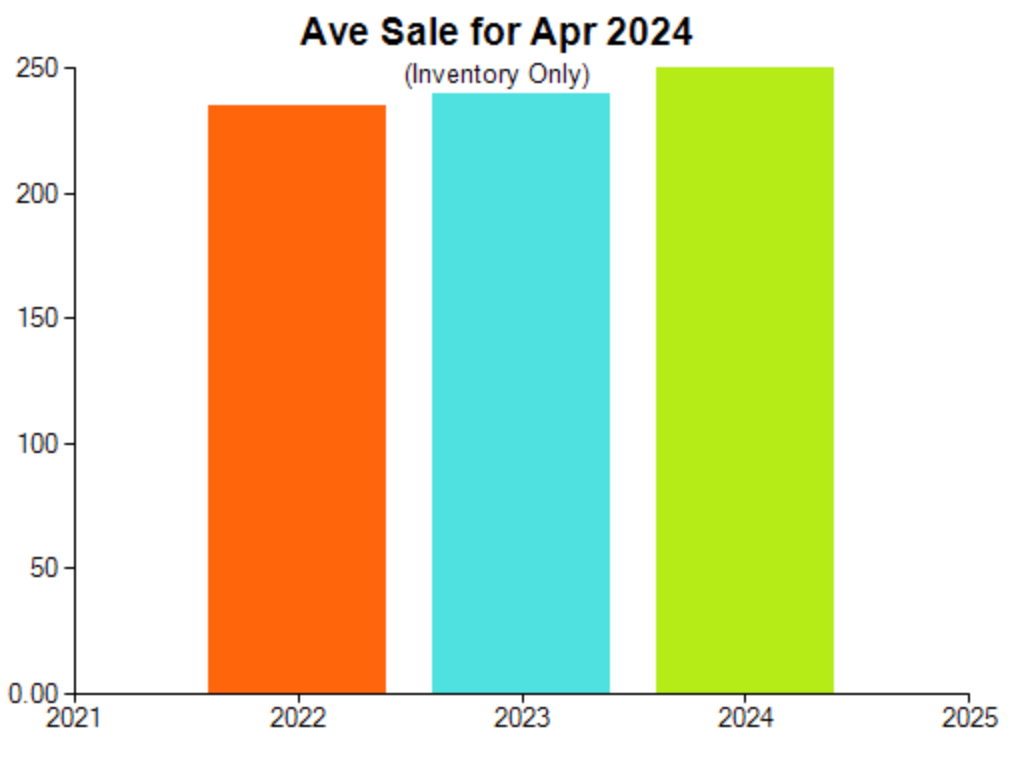

General manager Leon Van Megen said that retailers are selling generally fewer items at a higher retail price. This was reflected in the average sale comparison, which increased by 4.2 per cent to $250.

Another decrease was observed in the sale of diamond jewellery, declining by 23 per cent on a one-year comparison and 43 per cent on a two-year comparison.

“This significant decline in the largest jewellery category continues to impact total jewellery business performance,” Van Megen explained.

“Managing diamond inventory remains critical to managing your total inventory, which continues to be the single biggest driver of the accumulation of aged stock.”

Colour gemstone jewellery decreased by 25 per cent on a one-year comparison, while silver and alternative metal jewellery improved by 11 per cent. Precious metal jewellery without a gemstone or diamond declined by 3.2 per cent.

Van Megen added: “Managing aged stock with a plan and buying items with a sales strategy in mind will help jewellers avoid a cashflow squeeze.”

Regarding laybys, a decrease of 20 per cent in sales dollars between new orders and pickups and cancellations was noted. It was a similar story in services, including repairs, which decreased by 23.1 per cent on a year-on-year comparison.

Special order numbers were close to neutral, with a 1.7 per cent difference in dollar terms between new orders and pickups and cancellations.

2024 Jewellery Retail Sales April Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Proceed with caution: Latest Australian jewellery sales insights

Manage stock, buy well: Latest analysis for Aussie jewellers

Consumer confidence: Intriguing sales performance for jewellers

Challenging December for Australia’s independent jewellers

Pleasing trends in jewellery sales ahead of holiday season

Silver linings in latest Australian jewellery market analysis

Australian jewellery retailers wrestling with decreasing sales