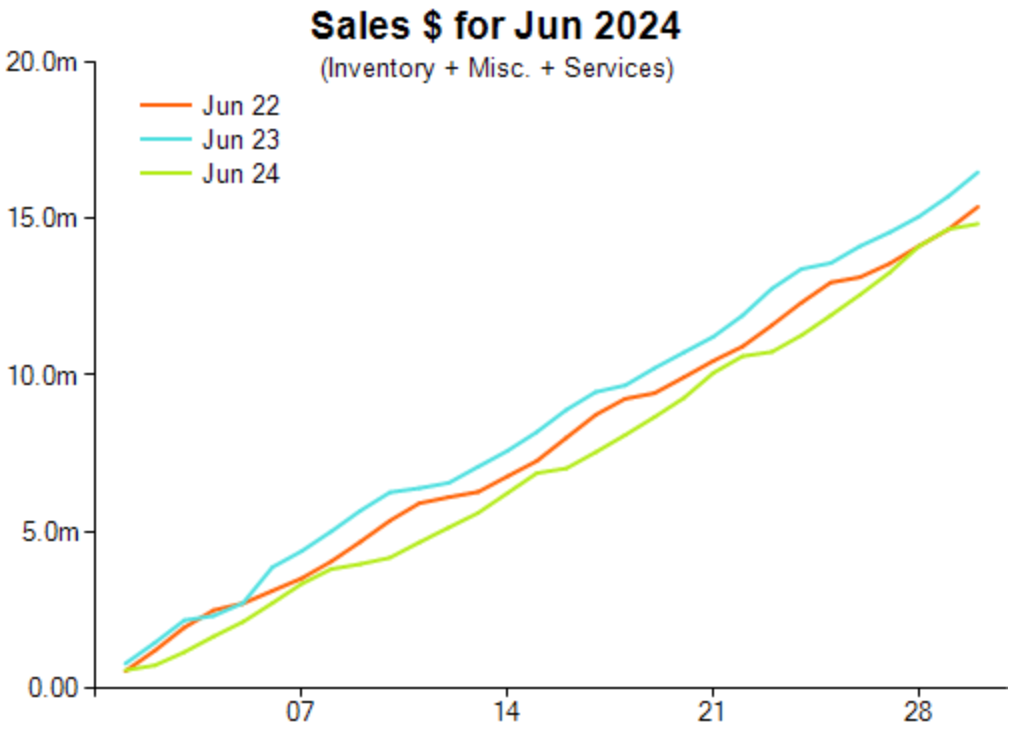

According to the latest research from Retail Edge Consultants, sales in June declined by 10 per cent on a year-on-year comparison. This follows a 1.3 per cent decline in May.

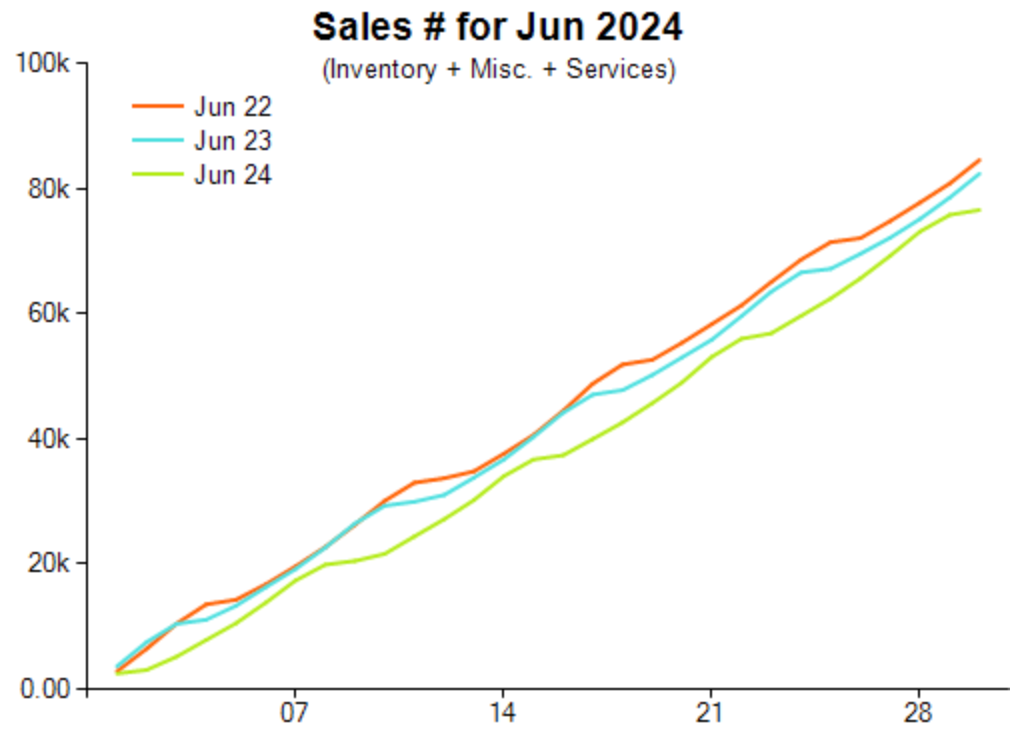

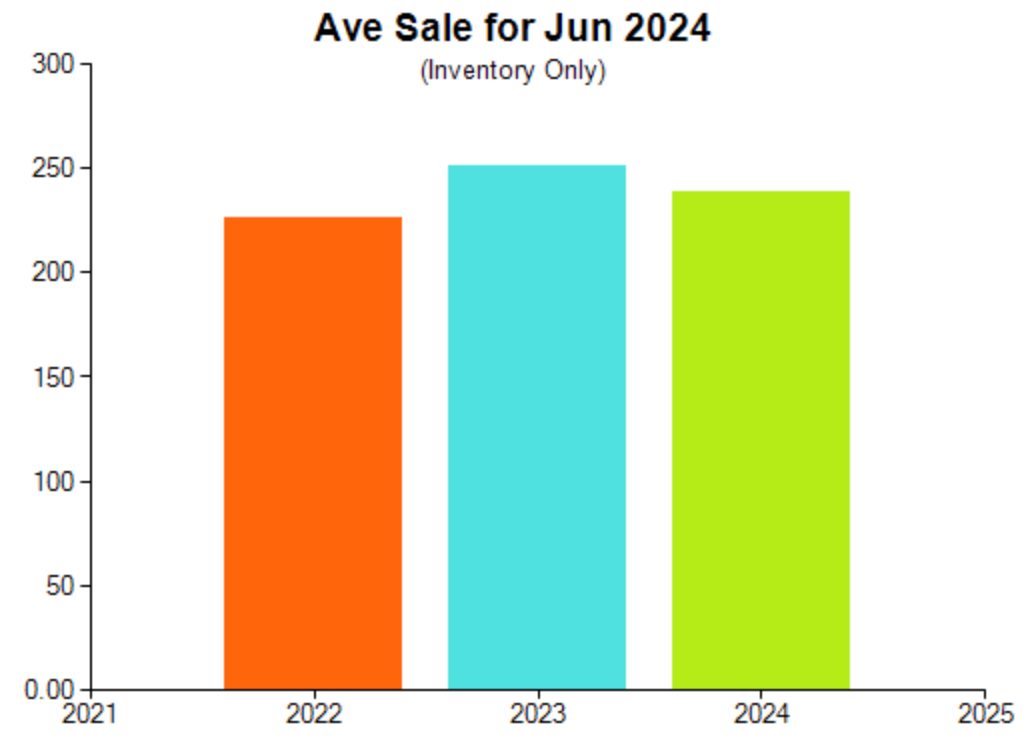

Unit sales in June decreased by seven per cent by the same metric, while the average retail sale price was $239, a five per cent decline from the previous year.

Earlier this year, the average retail sale price had increased month-by-month; however, that was not the case in June.

Diamond jewellery was once again identified as an area of concern, decreasing by 30 per cent on a year-on-year comparison and 13 per cent when compared with 2022.

General manager Leon Van Megen said jewellery retailers must prioritise inventory management to address this issue.

“This decline in the largest jewellery category and continues to impact the total performance of jewellery businesses,” said Van Megen.

“Managing diamond inventory remains critical to managing your total inventory, which continues to be the single biggest driver of the accumulation of aged stock.”

Colour gemstone jewellery increased by 13 per cent, while silver and alternative metal jewellery narrowly (1.3 per cent) decreased. Precious metal jewellery without a gemstone or diamond increased by 4.4 per cent.

Services, such as repairs, were also an area highlighted by the research, decreasing by 31 per cent in dollar terms between new orders and pickups and/or cancellations.

Laybys declined by 5 per cent on a year-on-year comparison, and it was a similar story with special orders, which decreased by 4.5 per cent.

2024 Jewellery Retail Sales June Results

Charts published with permission courtesy of Retail Edge

The charts below are based on data collected via Retail Edge POS software

at more than 400 independent Australian jewellery stores.

More reading

Sales improve in unexpected areas for Aussie jewellery retailers

Diamond jewellery sales remain a concern for Aussie retailers

What takes years to build and seconds to destroy?

Proceed with caution: Latest Australian jewellery sales insights

Manage stock, buy well: Latest analysis for Aussie jewellers

Consumer confidence: Intriguing sales performance for jewellers

Challenging December for Australia’s independent jewellers

Pleasing trends in jewellery sales ahead of holiday season