It’s no secret that it’s been a difficult period for retailers all around the world given the havoc wreaked courtesy of the pandemic. Australian jewellers were not spared from COVID, though it can now be seen that retailers adopted one of two attitudes.

There were those who ascertained they could not survive the ramifications of COVID lockdowns and who decided to close their business, and there were those who were determined to battle on and learn from the circumstances forced upon them by conducting business in a different way.

For example, the jewellery chains ‘used’ the pandemic to rationalise their operations in many ways, including reviewing and reducing store locations.

It is true that prior to COVID-19 the number of independent jewellery stores had been in decline for more than a decade. It’s also true that one cause of store closure has been owners retiring. Another was the decision not to renew leases, as tenancy costs increased, particularly in shopping centres.

The pandemic offered retailers an ideal excuse, and way, to existing tenancy agreements.

The pandemic hastened many more closures including those of some buying group members. However, the irony of the past two years is that the position of the buying groups has been strengthened even though their numbers have fallen!

The numbers

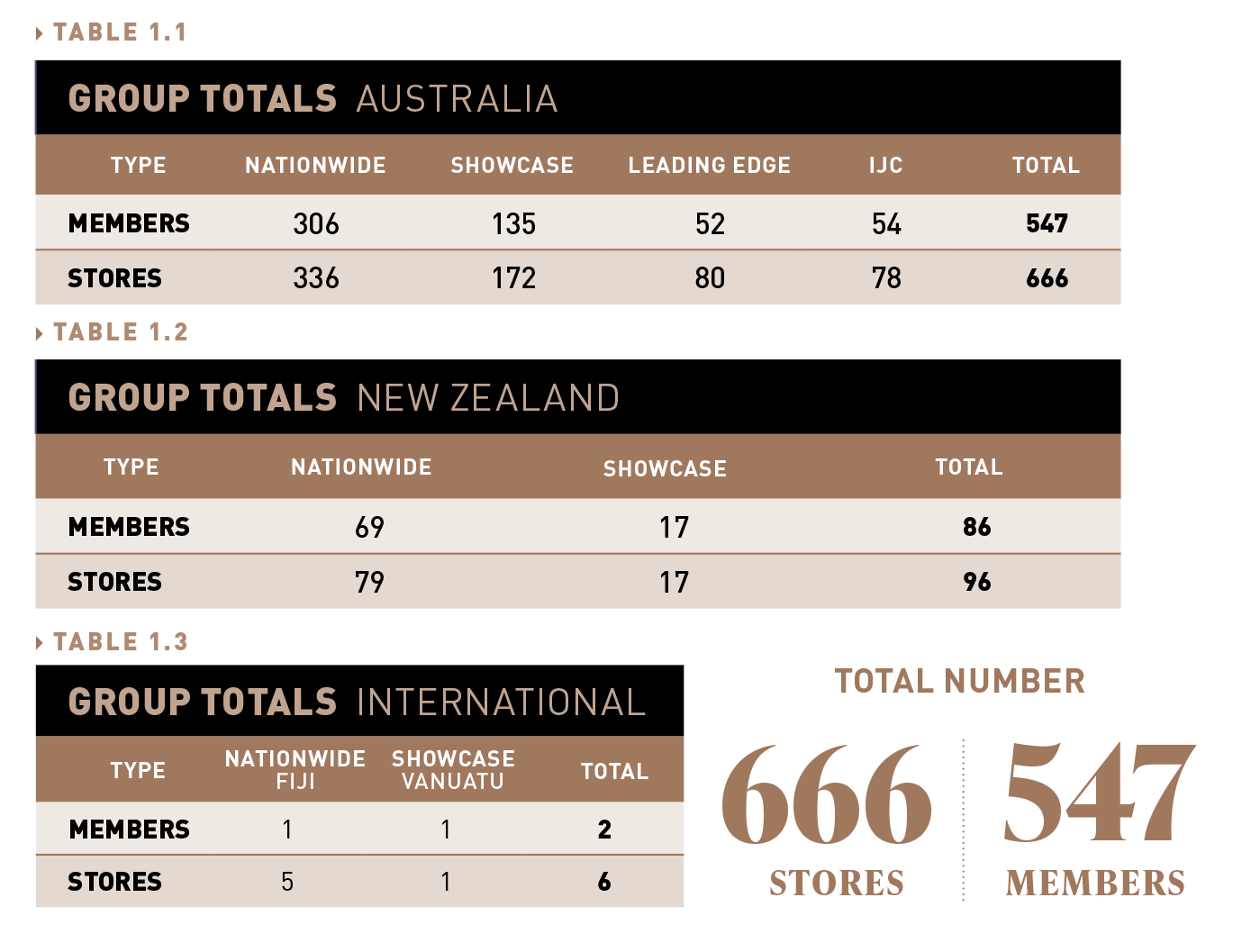

In 2010 Australia accommodated 2,700 independent jewellery stores. Around 32 per cent (860 stores) held membership with one of the three buying groups. Twelve years later the store counts have fallen to 666 Australian stores, meaning that buying groups now represent a greater percentage of the market.

If the total number of independent stores in Australia is 1,758 or 2,000 then buying groups have increased their position from 26 per cent in 2010 to either 33 or 38 per cent by the end of 2022.

Further, and as Nationwide Jewellers’ managing director Colin Pocklington observes, while the number of stores may have decreased - consumer spending hasn’t. This means that fewer stores enjoy a larger slice of a larger pie.

As an interesting aside, while the influence of the buying groups has increased over the past decade, the Jewellers Association of Australia (JAA) has gone in the opposite direction.

At the peak of its powers, the JAA once boasted a membership base of around 1,000; however, that number today sits at around 430 – of which only around 300 are retailers.

One buying group alone (Nationwide Jewellers) outstrips the entire retail membership of the JAA. Correspondingly, fewer suppliers (sellers) elect to join the JAA because it has fewer retailers (buyers).

The JAA’s position has not been helped by a decade of nasty politics, however; fortunately, there’s solace to be found in the support of buying groups

Healthy consumer demand

Australia has had a period of positive consumer sentiment – spending a record-breaking $74.5 billion in the run-up to the holiday period in a signal that increasing prices and interest rates are yet to damage consumer demand.

Retail sales increased 8.6 per cent between 1 November and 24 December on a year-by-year comparison according to figures released by the Australian Retailers Association (ARA).

“This is without a doubt, the biggest festive season spend on record – it is unprecedented. It is remarkable that in this period of economic turbulence, traders have well and truly smashed it out of the ballpark as consumers revelled in ‘freedom’ spending,” Paul Zahra, CEO of the ARA, tells Bloomberg.

This perception of the market was reinforced by the latest analysis from Retail Edge, which collects data from POS software installed in 400 independent jewellery stores around Australia.

Overall the data for January was positive with comparative overall sales dollar performance increasing 7 per cent compared with 2022. The unique services, such as repairs, that jewellers offer performed particularly well.

There was a 27 per cent increase in laybys between new orders and pick-ups or cancellations in January. Data from special orders showed a 33 per cent increase.

Despite this positive news many jewellers, from the major chains to the family-run independents, continue to express trepidation about the road ahead.

|

| Members and stores outside of Australia and New Zealand |

Nationwide

While all groups have lost members in the past two years Nationwide Jewellers remains the largest buying group by far; twice the size of its nearest rival and six times larger than the two smaller groups.

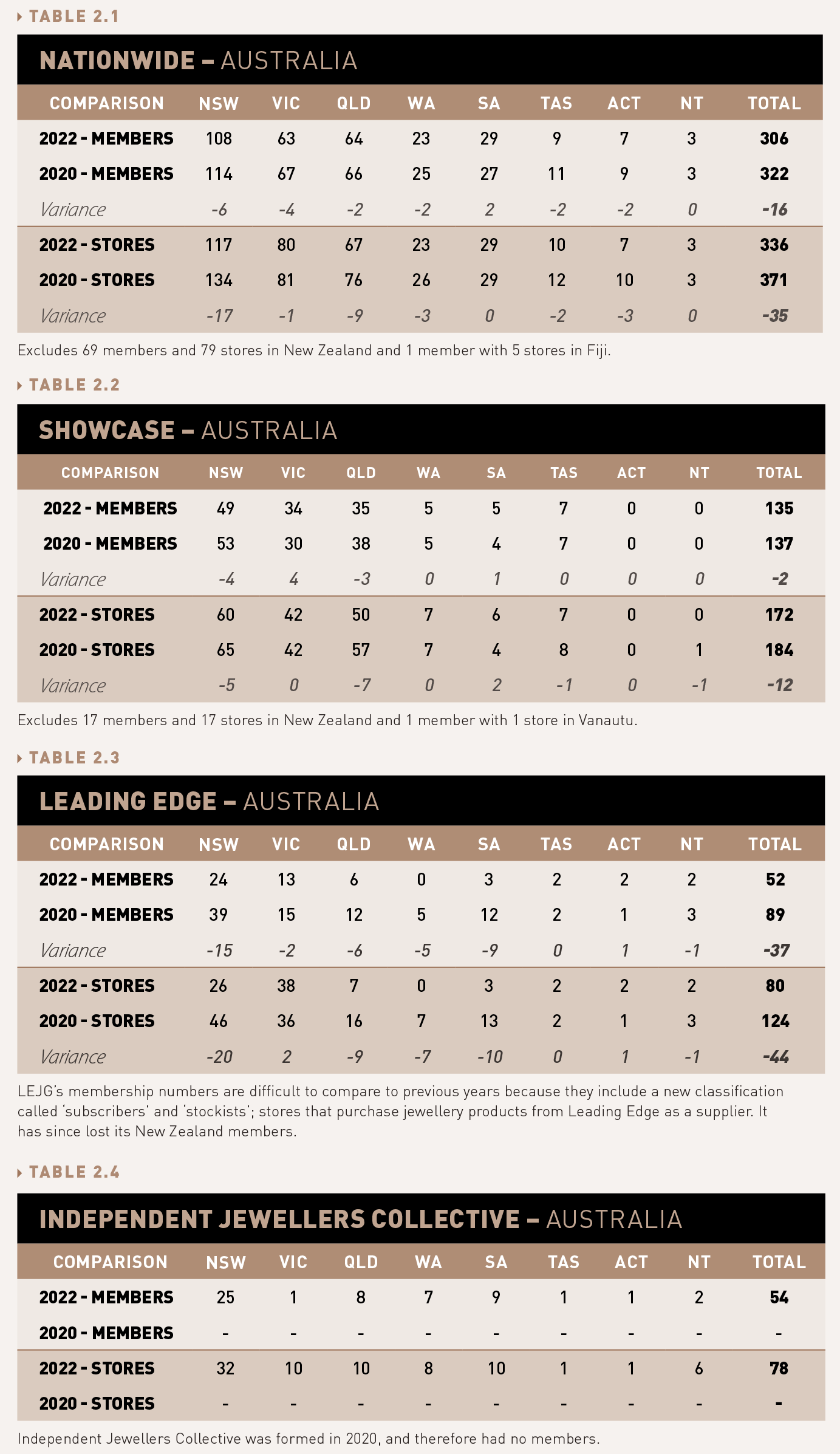

Between 2020 and 2022 the group had a reduction in Australian membership of 16 (5.2 per cent) which represented a loss of 35 stores (10.4 per cent).

Interestingly the ‘good news’ for Nationwide is that the decline was balanced from state-to-state, with no state losing more than six members. There was a decline of 17 stores in NSW, compared to one in Victoria, though representation in SA improved, increasing from 27 members to 29.

For a long time, the group has had a large focus and presence in New Zealand and during the same period Nationwide’s Kiwi membership fell by only seven members and six stores.

As at 31 December 2022, total membership stood at 376 (399 in 2020) and the total store count was 420, a net loss of nearly 10 per cent (41 stores) since 2020. [Table 2.1]

For comparison, in 2010 Nationwide had a total of 391 members with 435 stores.

Pocklington says that during the pandemic it was pleasing to see so many business owners willingly seek assistance, rather than suffer in silence.

“The lockdown periods were difficult for all, with many stores realising the need to enhance their digital presence so they could continue trading effectively,” he says.

“Many stores took up our offers of assistance to help with securing the various government subsidies, and ensuring that landlords provided the rent relief in accordance with the National Mandatory Code of Conduct, and the various enabling acts in each state.”

In order to deal with the issues faced by members, the group offers a ‘retail jewellery business management’ course. Regularly updated to respond to industry trends and forecasts, the course now has a section focussed on inventory optimisation.

“This assist retail jewellers to increase their stock turn rates, adding hundreds of thousands of dollars to profits and cash flow,” Pocklington explains.

“We have also provided access to offshore custom design manufacturing resources to help overcome the backlog in customer orders. Our group events, including our free conference for reward-level members, are designed to deliver essential information that will assist members in increasing sales and adapting to any changes in industry trends. They also benefit from the opportunity to buy new and trending merchandise from our participating preferred suppliers.”

Status of Buying Groups as at December 2022

The tables compare the position of the four buying groups as at 31 December 2022. It should be noted that, at the time of the 2020 Report, the International Jewellers Collective had only begun operation and it was in the process of securing members. In addition, the ‘business model’ of Leading Edge Jewellers has changed, resulting in its figures below including stores that stock its jewellery product. However, they may not be formal members of the group. |

|

Showcase

Showcase seems to have fared well over the past two years. The group reports that it ‘lost’ three members (2 per cent) between 2020 and 2022 which resulted in a loss of 12 stores (7 per cent) within Australia.

Even more impressive is that there has only been a loss of two New Zealand members (from 19 to 17) in the past two years and likewise with Kiwi stores (from 19 to 17).

The largest store loss occurred in SA where there was a reduction in seven across three members.

While Showcase boasted 190 Australian members with 274 stores in 2010, between 2020 and 2022 its total membership (Australia, New Zealand and Vanuatu) fell by five members or 3.2 per cent (from 158 to 153) and it recorded a loss of 14 stores, from 204 to 190 (7.3 per cent). [Table 2.2]

Showcase Jewellers’ chief financial officer Jorge Joaquim says he is thrilled with the way his organisation and members handled the pandemic.

“We performed incredibly well through and post-pandemic. One of the major issues our members did face during this time was staff being off with COVID and leaving their store short-staffed,” he says.

“Staffing continues as one of the major hurdles our members face post-pandemic as they are experiencing difficulty in hiring staff.”

Joaquim explains that Showcase was able to coordinate practical solutions to these issues: “We worked with members and had each store split their staff into different groups and ensured each group was consistently rostered together. This protected the store by ensuring that if COVID hit a staff member in one group the whole staff team was not affected, and the store was able to remain open,” he explains.

“Another option was to shorten store operating hours to reduce the number of staff required each day. During the pandemic, many of our members utilised time at home to focus on improving and building their digital presence adopting new ways to connect with customers virtually.”

Leading Edge

Leading Edge Group Jewellers (LEJG) was the most affected by the changing marketplace over the past two years.

LEJG is part of Leading Edge Retail, one of Australia’s largest buying groups, servicing a number of categories including computers, electronics, appliances and books.

Its three competitors are all focused exclusively on jewellery retailing as a business model and a single category.

That said, from 89 Australian members and 124 stores in 2020, it fell to 52 members and 80 stores in 2022. The loss of 37 members (41.5 per cent) and 44 stores (35.4 per cent) has been a shake-up for LEJG which has traditionally been the smallest group (prior to the launch of IJC).

However, this year LEJG’s membership numbers are difficult to compare to previous years because they include a new classification called ‘subscribers’ and ‘stockists’; stores that purchase jewellery products from Leading Edge as a supplier.

LEJG includes these subscribers and stockists in the data because the stores are granted access to similar services, products, and marketing support enjoyed by members.

The hardest hit territories were NSW where stores decreased from 46 to 26 and SA where membership declined from 12 to 3. LEJG’s representation in WA and New Zealand was lost all together. [Table 2.3]

LEJG general manager Charlie Davey says that for many members an uncertain economy weighed heavily on their minds.

“2022 certainly changed at a rapid pace, the economic outlook was a key issue for our members and the uncertainty of consumer spending habits,” he explains.

“They were very aware their customers would and will be influenced by the change in interest rates and their change in disposable income. Over the course of the year the change to a more normal world, post the pandemic – was a success for all of us.”

The most significant positive for LEJG was found in Victoria where store count increased despite a decline slight decline in membership, while representation improved in Canberra and was stable in Tasmania.

“The positive that then span out from there is more people travelled to regional areas and the tourists returned to an extent. Our members were then able to use their face-to-face selling skills to sell the appropriate products to their customers,” Davey adds.

Independent Jewellers Collective

At the time of Jeweller’s biennial Buying Group Report in 2020, the Independent Jewellers Collective (IJC) had only recently launched. Some questioned the need for a fourth group, however; Josh Zarb, CEO believed there was a niche to be filled.

In March 2020 he said: “We always had a plan to go to market with 40-plus stores. I am pleased to say that we received more than that number of expressions of interest within the first day of our launch announcement being released. We have subsequently presented to even more stores during the state meetings.”

Two years on the stats show the evidence; IJC has 54 members and 78 stores.

Around half of IJC’s members (25) are located in NSW, while the buying group is well represented in Queensland, SA, and WA (24 members). [Table 2.4]

Zarb also warned of shifts in consumer behaviours, a prediction that was soon vindicated.

“Obviously, the pandemic was something none of us could have predicted, however, it did allow for a real cleansing within our industry,” he says.

“Once we started to return to normal staffing was the biggest area of concern for our stores, many had to reduce some numbers in the early period of COVID and finding ‘good staff’ has been a real challenge during and post-pandemic.”

Zarb says that cooperation between members has been the key to the group’s rise.

“The core strength we have as a group is the calibre of stores we have here in the ‘IJC family’ and the freedom of exchange of knowledge throughout the group,” he explains.

“We don’t care who has the largest or the smallest turnover, as all our stores are specialists in what they do. We have such a culture of sharing within our group – this is our most significant success.”

He continues: “We value the relationships we hold with our stores, and the relationships they have with each other immensely. I think we have come a long way in a relatively short period of time, we don’t overcomplicate things for the sake of it and we have great communication with our stores via our IJC dashboard and private Facebook group for knowledge sharing.”

Gifts of practicality

While the national media is once again plagued by economic naysayers - and forecasts have their role to play - what’s more important is those offering actionable guidance on handling the woes of trade.

That advice works best when it comes from an organisation such as a buying group that understands your business and is ‘in it’ for the long haul.

The buying groups have seen it all before and, whether boom or bust, they have the understanding that it will eventually pass.

With buying group representation increasing relative to the decrease in independent jewellery stores, one thing appears clear in an otherwise ‘uncertain’ future – buying groups will continue to play an important role in the industry for many years to come.

|

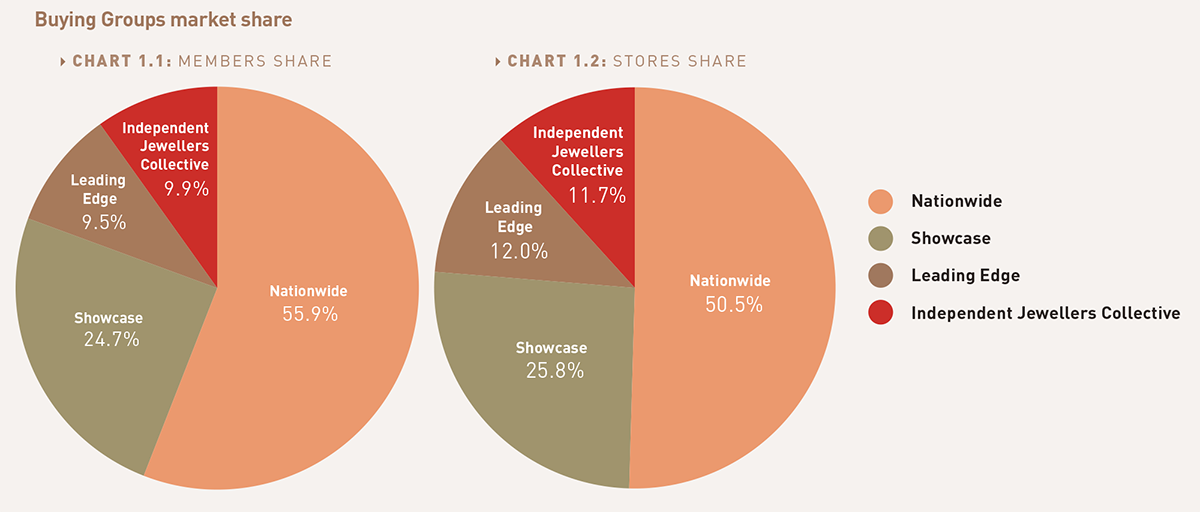

The pie charts above illustrate the ‘market share’ of each of the groups as a percentage of the total number of jewellers who are members of a buying group. Since 2020 LEJG’s membership position has fallen from 16 per cent to 10 per cent while its store count has fallen from 18 per cent of all stores to 12 per cent. |

At a glance: Buying Groups historical trend over 12 yearsOf all the tables presented in this biennial report, the two below best demonstrate the changing nature of jewellery retailing from 2010 to 2022. While buying group membership has fallen across the board over the past two years, the industry now accommodates four groups compared to the three that have serviced the category for decades. |

|