This representation among the broader market has remained consistent over the past two decades. As such, these groups are uniquely positioned to offer insight into the most common trials and tribulations the ‘average’ jewellery retailer may encounter.

Among the typical concerns voiced by independent jewellery retailers are the depressed levels of consumer confidence and discretionary spending and the transient nature of product preferences.

These are not new challenges; however, increasing competition from e-commerce businesses and the rising necessity of digital marketing as technological disruptions to conventional retail practices are more pressing emerging obstacles.

The good news is that Australia’s three buying groups are not only able to relay these concerns – they’re also in a position to suggest solutions based on the experiences of their members.

Nationwide Jewellers is Australia’s largest buying group, with 290 members and 343 stores. The group is also well represented in New Zealand, with 73 members and 80 stores, and has one member with five stores in Fiji.

General manager Glen Pocklington says the cost-of-living crisis and the associated adverse retail environment have affected consumer purchasing patterns, particularly discretionary or luxury products such as jewellery and watches.

With that in mind, he also says that there’s a new issue facing today’s jewellery retailers – adjusting to the rise of Black Friday Sales as a disruption to the traditional end-of-year sales cycle.

“Black Friday as a retail event continues to expand each year, and it’s shifting consumer spending patterns by bringing forward purchases that would traditionally take place closer to Christmas,” he tells Jeweller.

“While it presents opportunities for promotions and strong sales, it also disrupts the traditional holiday sales period, creating both opportunities and risks for jewellers.”

While adjusting to Black Friday’s increasing importance may be a headache for some retailers, it’s also an opportunity to capitalise on a wave of consumer interest in these events.

Put simply, when customers tell you what they want, give it to them!

Pocklington also highlighted the steady rise of custom and bespoke jewellery as a pivotal opportunity for jewellery retailers.

“On a more positive note, the demand for custom design and bespoke manufacturing has remained strong and consistent,” he says.

“This trend, which began gaining momentum about 15 years ago, has become a core service offering for many of our members, allowing them to differentiate themselves from mass-market retailers.”

Pocklington explains that with inflation almost under control and interest rate cuts expected early this year, jewellers must start planning for growth.

He says Nationwide’s strategy for supporting members with new digital tools to prepare.

“Our member portal in our new accounts system gives members easy access to their Nationwide account, simplifying their interaction with our accounts team,” he explains.

“In mid-2025, we will also launch our completely revamped ‘Dashboard’, which will give members 24/7 advanced access to all our resources via desktops and mobile devices.

“Members will be able to easily search for, find and be directed to our preferred suppliers within each jewellery category.”

He adds: “On the marketing front, Dashboard will host our library of social media-ready images and video content, allowing members to browse, download and post from their devices with ease.”

Back to basics

Showcase Jewellers is Australia’s second-largest buying group, accounting for 126 members and 155 stores in Australia, as well as 18 members and 19 stores abroad in New Zealand and Vanuatu.

Managing director Anthony Enriquez highlighted the ongoing challenges in securing stock and managing inventory levels due to global supply chain issues.

Enriquez believes this was one of many areas where buying group membership can be critical, as members can leverage strong relationships with key suppliers to overcome or at least limit this challenge.

“There’s also a growing preference for online shopping, which has necessitated a stronger digital presence and e-commerce capabilities, and Showcase has focused on supporting members more in this area,” he explains.

“Many members are grappling with interest rates and inflation that have constrained consumer spending, especially on discretionary items such as jewellery. Increased competition from direct-to-consumer brands and global online marketplaces is also commonly reported.

It’s important to go back to the basics when problem-solving because it removes complexity.

It’s easier to identify the underlying issues instead of wasting time merely addressing symptoms.

Enriquez says that for jewellery retailers entering the digital marketing arena, a simplified approach often leads to more effective, actionable solutions that are easier to implement and sustain.

“Showcase encourages members to invest in user-friendly websites and robust online customer service,” he says.

“Ensure staff are well-trained to deliver excellent customer service and effectively communicate the values of the business, especially in premium categories such as bridal jewellery.”

A comprehensive digital marketing strategy allows jewellers to capitalise on valuable customer data. This might involve tracking purchasing frequency and rewarding loyal customers with exclusive offers at the most basic level.

Feedback or ‘satisfaction’ data can improve products, services, and customer experiences.

“Retailers can use customer data to tailor marketing strategies, predict trends, and optimise inventory,” Enriquez continues.

“This may involve memorable in-store and online experiences through customisation, loyalty programs, and targeted marketing campaigns. Although a little more advanced, leveraging tools such as virtual try-ons and providing detailed product descriptions can further enhance the online shopping experience.”

Showcase offers a digital marketing toolkit, a suite of customisable assets that assists members in creating impactful online campaigns.

A virtual showroom enables members to showcase products to customers online with detailed 3D views and customisation options.

This is paired with a platform consolidating sales and customer data, providing actionable insights for better decision-making.

Pairing physical and digital

The Independent Jewellers Collective (IJC) is Australia’s newest buying group, formed in 2020. It’s been a rapid rise for the group, expanding to 82 members and 102 stores in Australia within half a decade.

The enthusiasm around the group has undoubtedly been driven in part by the industry experience of CEO Joshua Zarb, who formed IJC after departing Leading Edge Group in 2018.

Zarb echoed the sentiments of Pocklington and Enriques and believes there has been an undeniable increase in interest in custom and bespoke jewellery.

“The current retail climate is one of the most inconsistent I have seen over the past 20 years,” he explains.

“Our retailers have to compete with lower margins on sales, fewer clients through the door, and competition from ‘smaller footprint’ and online only retailers,” he explains.

“Over the past two years, we have seen a noticeable increase in boutique custom-design retail spaces that typically have a destination focus with lower rents and fewer stock holdings than traditional mainstream jewellery retail.”

Jeweller’s 2024 State of the Industry Report highlighted retailers operating without a traditional storefront as an important aspect of the market.

These businesses include jewellery designers and manufacturing (bench) jewellers operating from professional workshops or studios. They do not usually carry stock and often deal in niche markets.

“They rely on clever and effective marketing strategies, which has always been a struggle for independent jewellery retailers to do well, as they wear so many hats within their businesses,” Zarb explains.

“Our stores have to ensure that they cover all bases and continue to offer a unique experience in-store, especially in the bespoke jewellery design space.”

Zarb encourages jewellers to assess their in-store experience and recommends offering a personalised, welcoming environment wherever possible.

Customers prefer a memorable and engaging experience over a limited selection, attentive service and a comfortable atmosphere.

“It’s not a one-size-fits-all model, unfortunately, but I would say that ‘all’ current independent jewellery retailers need to look at what their in-store experience is currently,” he explains.

“Ask yourself: Would you rather buy engagement jewellery from a small range of rings sitting on a shelf ready to go? Or would you choose to walk into a beautiful environment and be greeted by an enthusiastic staff that is excited to choose a ring with you? Or even better, design a ring alongside you? This is where we need to be better.”

A refined approach to in-store strategy must be coupled with digital marketing that accurately represents what the business offers.

Since its inception, IJC has focused on this ‘unified vision’ approach. Zarb says that retailers without a comprehensive digital marketing strategy are missing out on the opportunity to connect with consumers.

“IJC spends time visiting, working with, and setting up stores with the above considerations in mind. We like to think that we are leaders in retail experience and marketing initiatives to support our stores,” he says.

“Over the past two years, we introduced a marketing subscription offer to support our stores with thousands of modern bespoke jewellery designs, physical samples, images, videos, social media and website content to assist them in bespoke design.”

Prepare for better days

Australia’s jewellery retailers face numerous challenges: some well-known and others unfamiliar.

The industry’s buying groups are uniquely positioned to observe these issues. Furthermore, they can identify the solutions retailers may consider when bidding to convert these challenges into opportunities.

Each buying group has responded to evolving preferences in recent years by enhancing its digital capabilities and offering new marketing tools.

While each group may have its unique areas of proficiency, together, they provide a collective insight into the problems the average retailer faces and can provide solutions.

It’s proof that the old adage of ‘strength in numbers’ is still relevant today, as these groups strive to help jewellery retailers adapt and thrive in a rapidly changing retail environment.

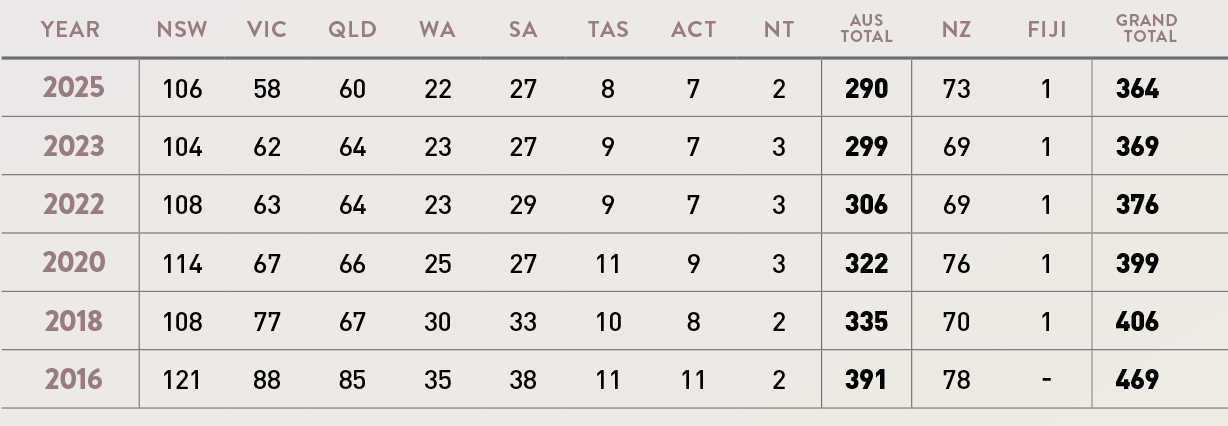

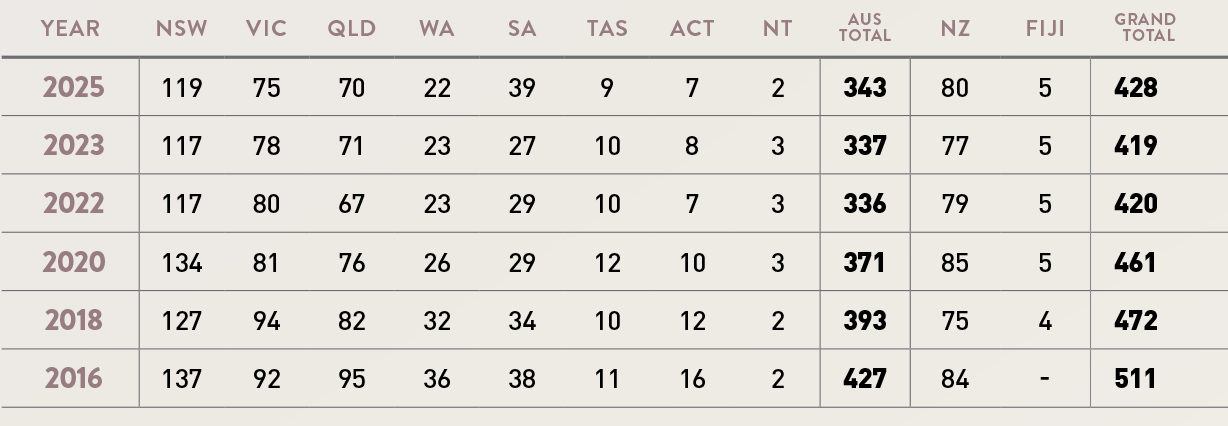

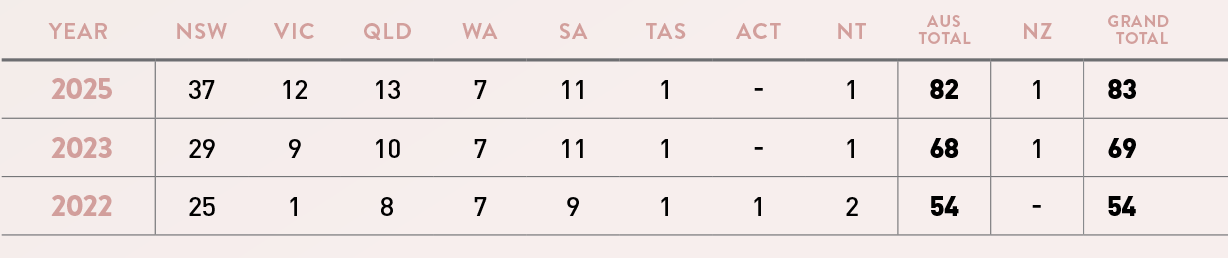

Nationwide Jewellers

MEMBERS - STATE BY STATE & TOTAL |

|

| |

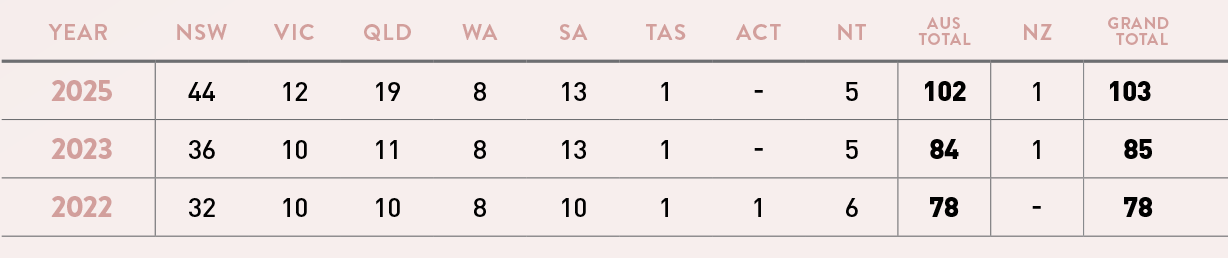

STORES - STATE BY STATE & TOTAL |

|

| |

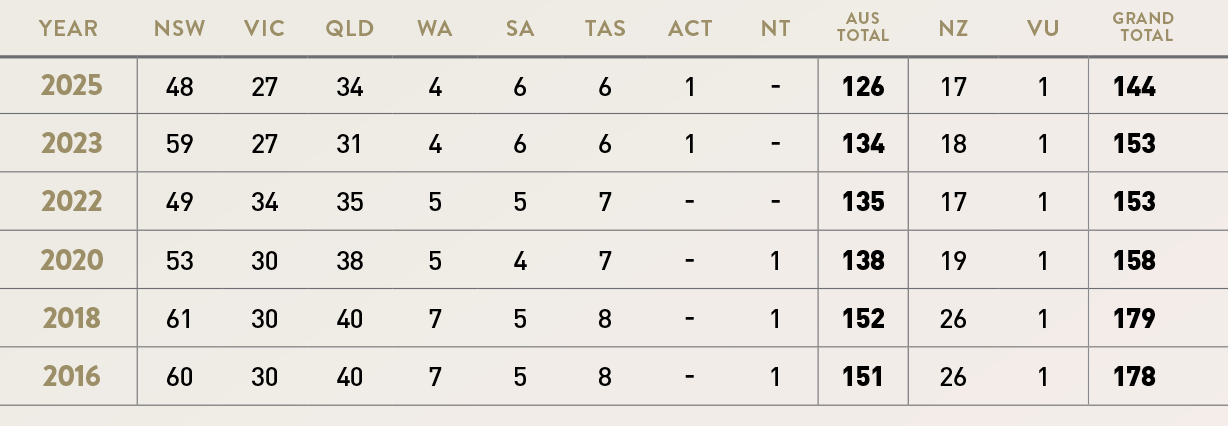

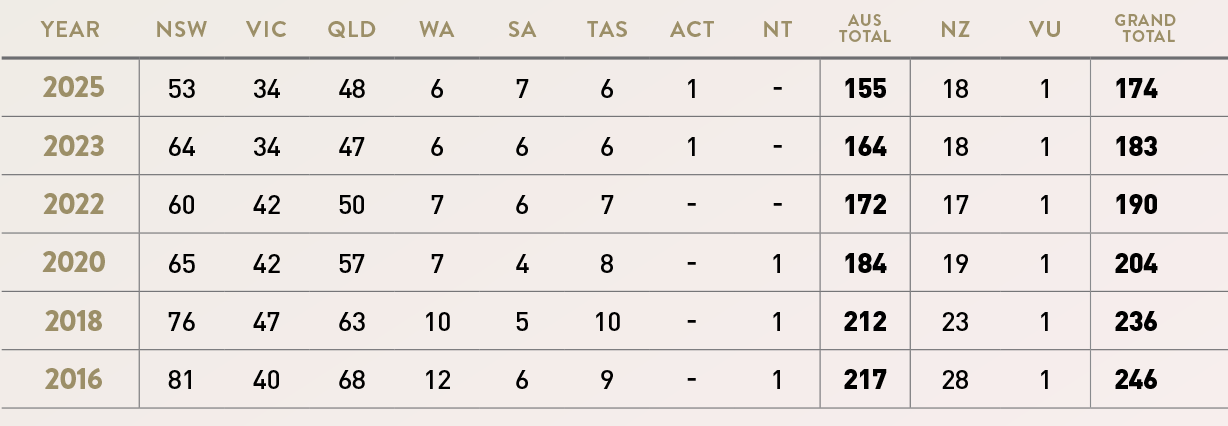

Showcase Jewellers

MEMBERS - STATE BY STATE & TOTAL |

|

| |

STORES - STATE BY STATE & TOTAL |

|

| |

Independent Jewellers Collective

MEMBERS - STATE BY STATE & TOTAL |

|

| |

STORES - STATE BY STATE & TOTAL |

|

| |

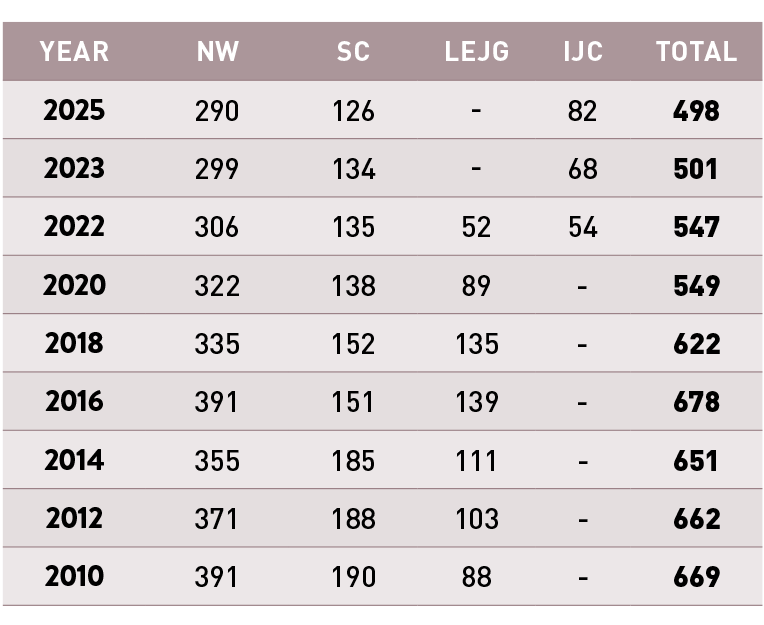

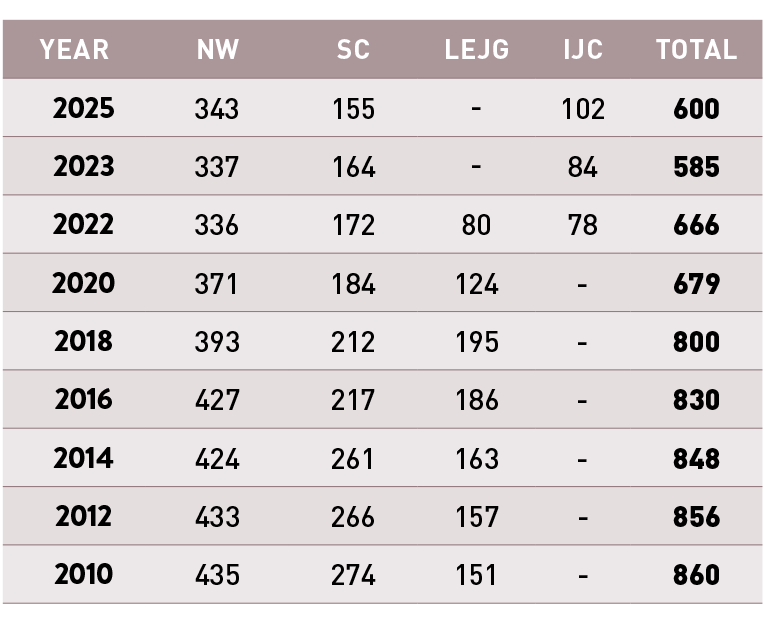

Figures Through Time: History In Numbers

The enduring presence of three retail jewellery buying groups paints a fascinating picture of the Australian jewellery industry.

The retail environment is vulnerable to rapidly changing consumer preferences, weakened consumer confidence and discretionary spending, and broader economic pressures; however, the data clearly shows that Nationwide Jewellers, Showcase Jewellers, and Independent Jewellers Collective each must be doing something right.

Collectively, these three organisations continue to represent a significant share of the market, underscoring the enduring appeal of their unique membership models for retailers, even during ‘tough times’. The key is the percentage of stores they represent across the national retail store count.

If we turn back the clock to 2010, Australia’s three buying groups — which at the time included Leading Edge Group and not the Independent Jewellers Collective — accounted for 32 per cent of the local independent jewellery retail market, which consisted of 2,699 jewellery stores, excluding chain and brand-only stores.

By the time of Jeweller’s 2024 State of the Industry Report, that market had shrunk to 2,010 independent stores, a decline of around 26 per cent.

MEMBERS HISTORICAL TREND - AUSTRALIA |

|

Despite the market’s contraction, membership remained at 523 members and 607 stores across three buying groups – with Independent Jewellers Collective replacing Leading Edge Group - around 29 per cent of the market.

This percentage continuity suggests that, even in the face of a shrinking independent jewellery retail base, membership in a buying group remains an attractive proposition for business owners seeking stability and support.

This conclusion remains justifiable today, as the three buying groups represent 498 members and 600 stores across Australia.

Some recent - and yet to be finalised - research points to the closure of more stores in the past 12 months, as poor worldwide economic conditions have impacted consumer confidence and discretionary spending.

If these trends hold true by the time this research is concluded, the three groups will represent approximately 30 per cent of the market as of 2025, which remains consistent with the 2010 study.

International appeal

Nationwide Jewellers, Australia’s largest buying group, has seen a decline in membership since the COVID-19 pandemic. As of December 2024, Nationwide Jewellers accounted for 290 members and 343 stores in Australia.

It should be noted that since the data was collected for the 2024 State of the Industry Report (November 2023) this represents a minor decrease of nine members and an increase of six stores.

STORES HISTORICAL TREND - AUSTRALIA |

|

» NW: Nationwide Jewellers

» SC: Showcase Jewellers

» LEGJ: Leading Edge Group Jewellers

» IJC: Independent Jewellers Collective |

A key factor in Nationwide’s ability to weather the volatility of the modern market, according to general manager Glen Pocklington, was the formation of the Global Jewellers Network.

“Together with the Independent Jewelers Organisation[USA] and The Company of Master Jewellers [UK], Nationwide formalised the ongoing networking between three of the leading jewellery groups in the world,” he tells Jeweller.

“After the COVID-19 pandemic, our groups have been able to interact face-to-face, with Colin Pocklington visiting the Company of Master Jewellers headquarters in 2023 and Jeff Roberts [IJO] bringing a group of his members to the International Jewellery Fair at Darling Harbour in 2024.”

He continues, “The ongoing collaboration of our three groups helps us identify new suppliers, trends, and marketing initiatives to develop for our respective member stores.”

As a way to continue strengthening these relationships, Glen Pocklington will attend the upcoming IJO Show in Palm Springs, US.

Sticking with the fundamentals

It’s been a similar story for Australia’s second largest buying group, Showcase Jewellers, which, as of December 2024, boasts 126 members and 155 stores.

Since late 2019, the group has experienced a relatively modest decline of 12 members and 29 stores.

Managing director Anthony Enriquez attributes this resilience to the importance of fundamental retail support.

“There’s value in centralised buying power and negotiating competitive terms with suppliers to help members manage costs plus ensure the best product selection to meet market needs,” he explains.

“Showcase offers targeted training and workshops led by experts on topics including digital marketing, customer engagement, and product trends. We also provide a range of pre-designed campaigns and templates for members to use across social media and traditional platforms to strengthen marketing efforts.”

“We’ve also partnered with software providers to streamline inventory management, point-of-sale systems, and e-commerce platforms and offer members rewards through a tiered program of benefits.”

The group has taken steps to streamline inventory management, point-of-sale systems, and e-commerce platforms while offering members a rewards program based on tiered benefits.

New kid on the block

Last but certainly not least, the Independent Jewellers Collective, founded by CEO Joshua Zarb in 2020, has seen impressive expansion since its inception. As of December 2024, the group comprises 82 members and 102 stores.

While Zarb insists that the group isn’t interested in a rapid rise to market dominance and has instead focused on partnerships with only the most suitable retailers, it’s clear that something is attracting waves of business owners to the group.

“We have come a long way since 2020. I would say that the most significant change for IJC members would be in our support of custom jewellery design,” Zarb explains.

“We have really focused on developing a complete toolkit to support our stores in this space. This includes physical printed marketing point of sale support, digital marketing support, e-commerce support and database communications.”

He continues: “We also have an in-house CAD design team to offer our stores specialist assistance. This is integrated into our IJC dashboard and allows stores to get consistent, high-quality CAD/CAM files manufactured by their preferred manufacturing partner.”

Many hands make light work

Australia’s jewellery industry buying groups continue to have strong representation in the retail market despite unpredictable trading conditions.

Jeweller’s research indicates that the percentage of retail jewellers that identify the benefits of a ‘strength in numbers’ approach has remained consistent for 15 years, sitting at around 30 per cent of the market.

While pessimism about the economy persists, it has not undermined the perceived value of membership within these groups.

Conversely, this data suggests that these adverse conditions may have even encouraged retailers to embrace the support of a buying group rather than face the fight alone.

REFLECTION & CHANGE

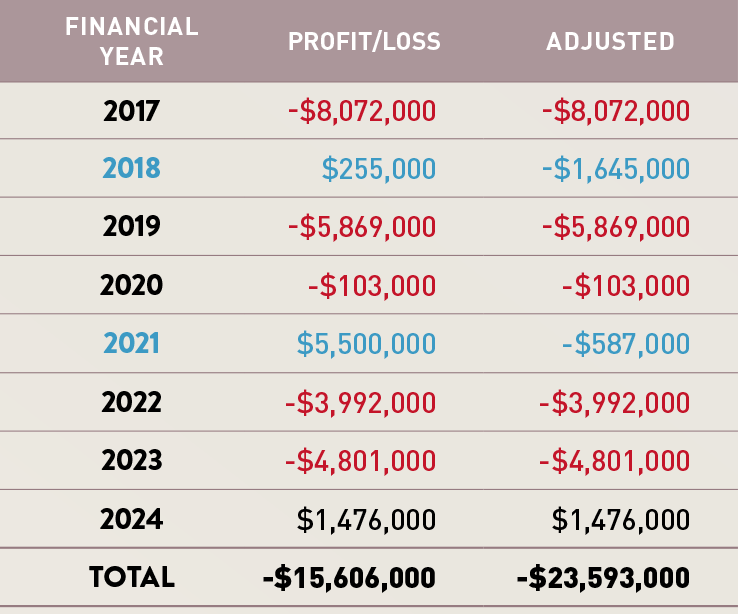

Former Buying Group Shifts Strategy During the research phase of the 2024 State of the Industry Report, the status of Leading Edge Group Jewellers as an industry buying group was reviewed. Leading Edge Group Jewellers (LEGJ) is the jewellery ‘division’ of the parent entity Leading Edge Group Limited, which has members from seven retail categories, including computers, appliances, electronics, and books. After deliberation, it was determined that LEGJ would no longer be considered a genuine jewellery industry buying group. This decision was reached based on two factors. The first was the significant decline in membership within the group in the years before the report. Leading Edge collapsed from 135 members and 195 stores in 2018 to around 20 members and stores in late 2023. The second and perhaps more salient point was Leading Edge’s decision to launch two wholesale businesses: Troy Australia in 2021 and Diamond Republic in 2023. These companies provided wholesale products to the broader retail jewellery channel and not exclusively to members. This positioned LEGJ as a competitor to the preferred suppliers previously supporting the group. More confusing, having established Troy Australia - Leading Edge Group Limited then announced that it had appointed it as a preferred supplier - which meant the company had appointed itself as its own preferred supplier! In recent weeks, another change to Leading Edge’s business model has provided evidence that the decision to ‘revoke’ the group’s status was correct. The Dream CollectionRIVERWISE PTY LTD |  | Riverwise Pty. Limited, the parent entity of Leading Edge Group, has reported losses of more than $16 million since 2017. Profits in 2018 and 2021 can be attributed to the sale of two businesses. Factoring that in, adjusted P&L figures are shown above. |

Jeweller was informed of the emergence of a new online jewellery retailer. It soon became apparent that this otherwise unremarkable business had more to it than meets the eye. The Dream Collection showcases a variety of jewellery, including rings, pendants, bracelets, earrings, and necklaces, with retail prices ranging between $14 and $1,199. The website offers consumers very little information about with whom they are dealing – not even an email address or phone number. The website listed four social media accounts. The TikTok was not operational while it was discovered that, of the 15 Instagram accounts following The Dream Collection, at least 12 appear to be Leading Edge employees. Further investigation revealed that Leading Edge Group Limited (ABN 68 093 019 213) registered the website (www.thedreamcollection.com.au) as an “Incorporated Association.” Interestingly, at the time of Jeweller’s initial report (14 January), neither the Australian Business Register nor ASIC displayed a record of The Dream Collection as a company or business. The Dream Collection website states that it is a division of The Dream Collection Group Ltd; however, government regulators do not show any record of such a business. However, on 21 January, five days after the report was published, Leading Edge Group Limited registered the business name ‘Dream Collection Jewellery’ with the government regulator. With that said, the so-called The Dream Collection Group Ltd remains a mystery! Confusing matters furtherThe same day Jeweller published the initial report concerning The Dream Collection, an advertorial-style (promotional/advertisement) article appeared in Jewellery World. The article described the Dream Collection as primarily targeting direct consumers. However, statements from Claire Packett, former head of category at Leading Edge Group and current general manager of Diamond Republic, appeared to contradict claims made on its website. Confusingly, Packett suggested that despite The Dream Collection operating as a direct-to-consumer jewellery business, it can ‘benefit’ competing retailers because it will be available at wholesale prices. It should be noted that Diamond Republic’s website does not mention The Dream Collection, and it is not listed on the brand page. Likewise, The Dream Collection website does not mention Diamond Republic. These matters were further confused by additional comments Packett made about Leading Edge Group. “The launch of Dream Collection is the latest milestone in Diamond Republic’s impressive turnaround story,” the article reads. “Guided by its parent company, Leading Edge, the business has restructured to achieve consistent profitability, reporting a +$2 million profit last year and recording monthly profits ever since.” It’s worth noting that Diamond Republic began operating in 2023. If the above statement is accurate, it suggests that Diamond Republic was unsuccessful for its first two years. That matter aside, there is further confusion around the claim that Diamond Republic made more than $2 million in profit over the past year. Firstly, it is unclear whether the article refers to gross profit or net profit. Assuming this information is accurate, then it paints an interesting picture of Leading Edge Group Limited, which as mentioned, reported a $1.4 million profit across the entire group as at 30 June 2024. In 2023, Jeweller reported that Leading Edge Group Limited had lost nearly $10 million in just two years. The company’s financial statements revealed a loss of $5.06 million in 2023 and $3.99 million in 2022. The company’s most recent financial statements (FY24) record a net profit of $1,476,000 on income of $97,927,000, a 1.5 per cent profit margin. Arguably, this was the first profit in eight years. Leading Edge Group Limited has recorded losses of nearly $16 million since 2017. Its $255,000 profit in 2018 resulted from selling a business unit (TBC Group Pty Limited) for $1.9 million. It was a similar story when a $5.5 million profit was recorded in 2021 after a New Zealand telecommunications business was sold for $6.3 million. Based on these adjusted profit and loss figures, the trading results for the past eight years have jumped from a $15 million loss to a $23 million loss - an average deficit of $3 million annually. Jeweller contacted Packett seeking clarification on these comments, specifically to ensure that the reporting in Jewellery World accurately reflected the financial status of these companies. At the time of publication, she had not responded. Charlie Davey, CEO Leading Edge Retail Australia was also contacted about the background of The Dream Collection and other matters; however, as at the time of publication he had not responded to these requests. The launch of The Dream Collection indicates that Leading Edge Group was not only competing with its preferred suppliers via Diamond Republic and Troy Australia, now it also competes with the broader retail market by operating a direct-to-consumer jewellery business. As such, the decision to no longer classify Leading Edge Group Jewellers as a buying group has been vindicated. |