While the purpose of a major research project like the State of the Industry Report (SOIR) is to record history, it’s perhaps fitting to attempt to forecast a vision of the future.

As the famous management consultant Peter Drucker once said: “The best way to predict the future is to create it.”

In business, the past does not define the future; however, the lessons learned can help shape it.

It’s hard to believe that we are just six years from 2030, a year that will mark many significant milestones and occasions.

At the political level, 2030 will be a significant year. It is the deadline for the United Nations ‘2030 Agenda’, and The World Bank has set the goal of eradicating global poverty by 2030.

It will be a year for important anniversaries as well – it’s a year that will mark 100 years since the Great Depression began.

The retail landscape will undoubtedly change between now and 2030; however, the degree to which that change occurs and how different the market will appear is what will interest most business people.

For many, the ‘hockey stick’ theory of technology is too poignant to ignore. After a long period of linear development, technology has experienced a remarkably rapid expansion over the past two decades, and there’s little reason to think that rise won’t continue.

Others believe gentle progression will be more likely – and when it comes to retail, the same fundamentals will remain important in seven years.

Since 2010, the jewellery industry has changed significantly. Lab-created diamonds have reshaped the industry, and few would have predicted the extent to which the industry appears to be moving towards bifurcation - separating one entity into two distinct segments.

Market bifurcation occurs when disjointed market movements trend in opposite directions or when high and low-quality securities move out of sync, causing the two segments to operate and perform independently within the market.

In economics, this traditionally involves definitions of high and low value, which is why it started to become a talking point among diamond experts.

Paul Zimnisky, PZ Analytics says, “It is important to remember that lab-created diamonds are creating incremental demand for diamond jewellery that would otherwise not exist — especially at the lower-price points.

“Looking longer-term, this incremental demand will likely continue to grow while the share of lab- diamonds directly cannibalising natural diamond sales will stabilise and level off.”

While a rise in demand contrasted with falling prices may seem counterintuitive, Zimnisky explains this phenomenon by highlighting lab-created diamonds' status as a manufactured product.

That is, pricing is impacted by rising demand and an even faster-increasing supply – and this supply is increasingly accomplished with improved efficiency. The bifurcation will most likely be fought on the marketing front.

“Product marketing by both natural and lab-diamond producers, as well as product positioning by retailers at the jewellery counter, will ultimately determine the level of segregation of the two products and the speed at which the bifurcation plays out,” he says.

While one segment of the jewellery industry - diamonds - is shifting towards an obvious and distinct division, it’s arguable that the watch category is undergoing a similar split, or in this case cleave, as consumers adopt smartwatches, most notably the Apple Watch which did not exist until 2015.

Readers may recall that Swiss behemoth Swatch entered a joint venture with Microsoft - its equivalent in the computer market - in October 2004 and announced the Swatch Paparazzi.

The Paparazzi – which may have been ahead of its time - was a smartwatch based on Microsoft’s SPOT (Smart Personal Objects Technology) technology and could be connected to MSN Direct. It was ‘killed-off’ in April 2008 when Microsoft announced that it did “not have immediate plans to create a new version of the Smart Watch, as we are focused on other areas of our business.”

While some of the changes in the industry were less predictable in 2010, other changes were afoot, even if it took some time for them to be embraced.

For example, offering customers an e-commerce option partnered with your physical store was viewed as a mere compliment to your business – today, it’s close to a requirement.

Cloudy skies blocking the view

This second edition of Jeweller’s State of the Industry Report was ‘delayed’ by three years because of the impact of the global coronavirus pandemic – evaluating the market during such unprecedented circumstances would have presented an unbalanced image.

For Cameron Beever, owner of Ringwood Jewellers in Victoria, it’s still difficult to forecast the industry's future because of the pandemic's impact.

“I think it’s really difficult to make any concrete predictions at this stage; my feeling is that we are still a year or two away from any sense of normality,” he explains.

“Things like cost of living pressures, housing prices, and interest rates have all been impacted by the pandemic, and we still feel the aftereffects. Jewellers are selling a luxury product – it’s not bread and milk – and that’s the reality of the situation.”

Many industry figures have suggested that consumers increasingly sought repairs and other services for jewellery they already owned during the pandemic instead of purchasing new products. Others have suggested this trend was already on the rise in the years before the pandemic and that lockdowns merely accelerated it.

Among those is Nationwide Jewellers managing director Colin Pocklington, who says he expects custom-made and personalised jewellery to remain a priority over the remainder of the decade.

“You would have to assume that there’s going to be an increasing desire from consumers for handmade pieces. The only question is how this will be reflected in the difference between sales of handcrafted jewellery and pre-made pieces,” he says.

Beever says these observations have been reflected in his business over the past three years.

“We’re a fourth-generation family business, so I think it’s safe to say we’ve just about seen it all. I think at the moment people are looking for cheaper jewellery, and the positive, from our perspective, is that it’s leading to more repair work," he explains.

“People are buying jewellery from elsewhere, and if it falls apart or there’s an issue, it’s ending up on our bench. There are a few chain stores around our location that actually recommend customers visit us for repair work and resizing, which is fantastic.”

Gradual progression

It’s only natural to get excited about the future of the retail landscape – fictional works have given us so many brilliant ideas. Whether it’s robots delivering food on The Jetsons, gigantic animated billboards the size of skyscrapers in Blade Runner, or the terrifying 3D advertisements shown in Back To The Future, writers have never been short of ideas!

With that said, others are predicting a more sensible, linear progression. Independent Jewellers Collective CEO Joshua Zarb says that we can expect 2030 to look very similar to 2023.

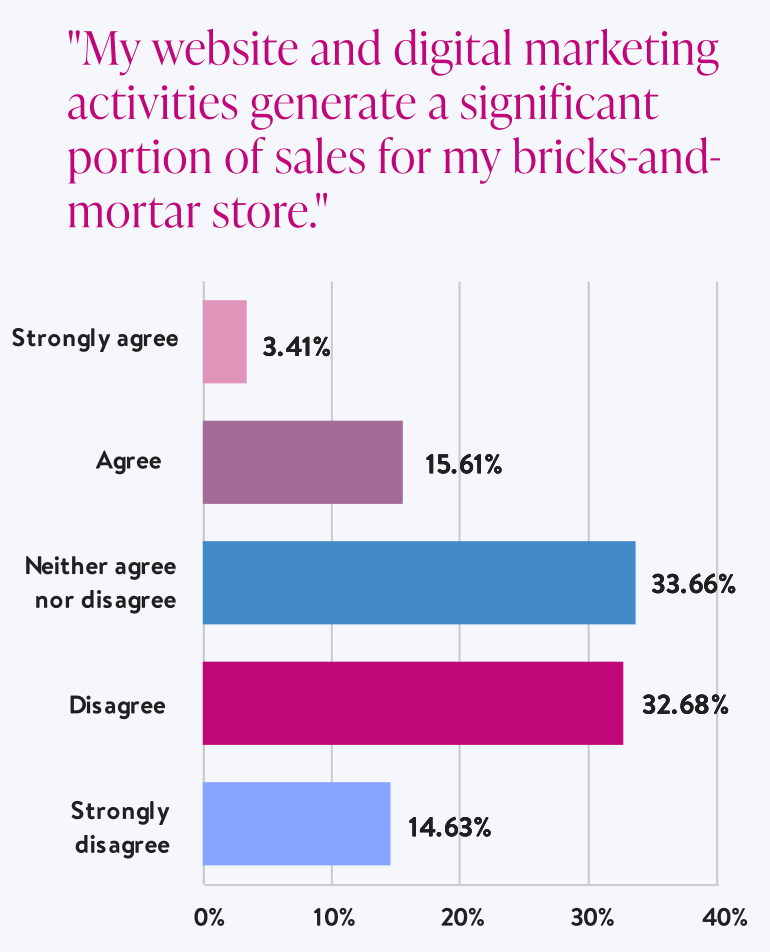

RETAILER - SURVEY QUESTION |

|

| Retailers are yet to connect digital marketing with sales, despite the increased importance of a strong online presence. |

“I don’t think the retail landscape will dramatically differ from where we are today. Unfortunately, I doubt there will be robots serving us dinner or anything like that,” he jokes.

“I think we will see the adoption of a few new ‘technological plug-ins’, whether it be payment systems or perhaps live digital diamond inventories for jewellers. There will be more of a focus on giving customers a chance to ‘design their dream diamond ring’ online, for example.”

Pocklington agrees with Zarb and says that digital marketing will become a necessity for jewellers by 2030.

“The way things are going, I think jewellery stores need to be more engaged with digital marketing than ever. You nearly can’t have a store without a digital presence anymore,” he reveals.

“That’s where the buying groups will evolve, and that will be the most significant change we see in that area of the industry. Once upon a time, we offered trade discounts ahead of everything else.

“Now, the industry needs us to offer support in new areas, namely digital marketing – and we’ll need to meet those demands.” Zarb had one prediction that he was confident would come to fruition – and increased emphasis on design for jewellers.

“There’s no doubt in my mind that design will become a very sharp focus for jewellers,” he says.

“There is always a place for quality customer service, there always has been, because that’s what consumers are looking for. I also think that we will see an overall increase in the digital professionalism of jewellery retailers because it will become an easier process.”

Artificial intelligence

The value of a strong digital presence and the importance of maximising the opportunities presented by emerging technologies and online tools weigh heavily on many within the industry.

Malcolm Scrymgeour, business advisor at Retail Edge Consultants, believes that retailers can discern an image of the future from today's trends.

“There are two ways to view how retail will look in 2030 - fear or excitement,” he says.

“Existing trends indicate what 2030 is likely to look like, and it’s technology-driven. Increased digitisation will be a priority – recall that a decade or so ago, the Yellow Pages were a big deal. Today, customers rely on websites.”

In the past 12 months, artificial intelligence has taken the retail sector by storm, leaving many scrambling to keep up. Retailers are utilising AI programs for everything from virtual shopping assistant services and automated customer service to producing marketing ‘copy’ for products and advertising, and Scrymgeour says that trend will continue.

“The rise of machine learning and AI will see decisions being more informed, more refined to consumers and eventually, lower costs for retailers,” he explains.

“Data intensity will increase, allowing retailers to offer what are known as ‘anticipatory’ services as they can see trends in advance. True independents [stores] with no support will be challenged as data, information, and leveraging buying power become all but impossible to do well on your own.”

Scrymgeour added: “Direct-to-consumer services, where suppliers get closer to customers, enabled by digital technology, will happen. Retailers must add value to suppliers as well as customers!”

Walking a new path

Pocklington also suggested that design will become an increasingly important focus for independents and said that new stores entering the industry will take a different shape for the next generation.

“To meet the rising demand for people wanting handcrafted pieces, we need to see a greater influx of young people entering the industry and starting in design, as opposed to retailing finished goods,” he explains.

“We are already seeing this happen to a certain extent because young people struggle to enter the industry as a conventional jeweller due to the high capital costs associated with starting a small business.”

Pocklington hopes that the next generation of jewellers will begin as designers and manufacturers, honing their skills and building a loyal customer base to the popularity of their bespoke work.

From there, these jewellers are free to evolve into a traditional retailer – offering an increasing range of branded products if they desire.

“There are already many people taking this path, and we are seeing so many self-taught jewellers becoming important contributors to the industry. I don’t think we will see many more of what you would consider a ‘traditional jeweller’ from the 1980s and 1990s. Those that still exist will either change or fail, ” he explains.

This example becomes obvious when considering changes to local shopping districts.

“Once upon a time, you could walk down a high street and see rows of jewellery stores full of windows with diamond rings and jewellery. If you didn’t have that kind of display, you couldn’t sell diamonds,” Pocklington continues.

“Over the past five or so years, jewellers have discovered that they cannot justify that kind of investment anymore. It’s money tied up in stock that may just sit in the window for months at a time. It’s not justifiable, Pocklington says.”

This discussion is missing one crucial element of consideration – consumer behaviour. Purchasing patterns have changed considerably over the past decade, with an increasing preference for online shopping and a rising demand for personalised services.

Romil Patel oversees four jewellery stores as the owner of Jewels Fiji and, as a result, is a keen observer of changes in consumer attitude.

“Everyone agrees that social media has changed the way consumers think, and I believe one of the biggest evolutions is a preference for ‘experience’ rather than product,” he explains.

“People spend so much time on their phones today, and I think it’s completely changed our mindsets. I’m not much of a traveller myself, but when I see photos or videos of my friends in Greece, Spain, or the US, and they’re snowboarding or jet skiing, it’s only natural to wish that was you. I don’t think advertising on social media is as valuable for products as it is for experiences.”

Patel offered a comparison between a diamond ring and a holiday at the beach, both presented as a video on Instagram. He suggested that with a video of a diamond ring online, the consumer may acknowledge that it’s beautiful and wish to own it.

Comparatively, a video promoting a vacation at the beach is a more emotionally provocative visual presentation – it may be unspoken. Still, it represents a break from work and valuable time spent somewhere new and exciting.

This kind of emotional drawing card is more appealing than that of an aesthetic possession, and it’s a consumer preference that was accelerated due to pandemic lockdowns, where new experiences and travel were prohibited.

“I know this to be true from my experiences. I love collecting watches, for example, and once upon a time, I would spend two years saving to add a new high-end Swiss watch to my collection,” he reveals.

“There came a time when I just said ‘enough’. I’ve got kids growing up, and I want them to have an excellent education; I’d like to take my family on pleasant holidays that we will all hopefully remember for the rest of our lives.

“These experiences have become more important than spending money on luxury products, and I think the money has followed these new priorities.”

Scrymgeour also had some insight into the importance of ‘experience’ in consumer spending patterns. Over the past 12 months, the ‘metaverse’ has been a popular talking point within the retail sector.

The metaverse is a vision of what many in the computer industry believe is the next iteration of the internet: a single, shared, immersive, persistent, 3D virtual space where humans experience life in ways they could not in the physical world. When it comes to the retail, it will allow consumers to explore virtual 3D spaces where they can socialise, collaborate, and make purchases.

To date, there’s been no widespread adoption of the metaverse by retailers despite many brands and businesses experimenting with the platform. Scrymgeour believes that will change in the not-so-distant future.

“In 2030, it is likely to be the metaverse, which is a far more fully immersive consumer experience than websites,” Scrymgeour explains.

“To generate visitors to a retail store, consumers will require a better experience than they can get from the metaverse. Retailers will need to have personalised and customised experiences that can’t be achieved online - such as designing custom jewellery.”

The rest is up to you

In many cases, predicting the future is a straightforward affair. Many of the changes in the jewellery industry in the past 13 years have been apparent evolutions of past practices.

Internet marketing has become critical for retailers, and consumers are increasingly evaluating businesses based on digital footprint. Other developments have been far from predictable! Who could’ve expected a two-year global pandemic would entirely reshape the industry?

That said, the crucial insight for retailers is that remaining current is the key to success. Retailers may be unable to control consumer behaviour; however, these businesses can adapt to meet their demands to the best of their ability.

As science fiction writer Isaac Asimov said: “You don’t need to predict the future, just choose a future. Better that you make a good future rather than predict a bad one.”

Who really knows what the future holds?

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES