One of the most significant changes in the jewellery and watch industries over the past 20 years, but most notably over the past decade, is the development and evolution of brand-only stores. What began as a new concept has become a prominent ‘player’.

Jeweller defines a brand-only retailer as a fine or fashion jewellery store – or group of stores – that sells and markets its own brand of jewellery and/or watches.

It is usually a vertical-market operation, does not utilise local suppliers, and does not distribute to third-party stockists on a large scale. Intriguingly, the company often started as a wholesaler (supplier) of its product to traditional retail outlets.

Brand-only stores are usually owned and operated by the proprietor of the brand, or they could be operated under licence by local businesses.

Today, that definition still applies, and there has been a dramatic rise in international brands expanding their presence in the Australian market, which, in turn, has resulted in the brand-only store model increasingly competing with independent retailers.

The first State of the Industry Report (SOIR) in 2010 recorded 153 brand-only stores and 17 flagship stores operating in Australia – a total of 170 outlets.

It is important to note that the current report discontinues the flagship store category, which was previously defined in a similar way to a brand-only store.

A flagship store could only be operated by the brand owner (not a third party), and it primarily served as a marketing channel rather than strictly a business in its own right.

Whereas there could be many brand-only stores in one territory or city - think Tiffany & Co or Swarovski - a flagship store is singular. These stores usually stock the most extensive range of its product and are regarded as a ‘landmark store’ or ‘the face’ of a brand.

One of the significant differences between the two business models was that the brand behind a flagship store - think Pandora or Thomas Sabo - was a traditional wholesaler, supplying its products to a range of independent stockists.

Flagship stores take their name from a nautical term referring to the headship in a fleet of vessels – one determined as the fastest, largest, newest, and most heavily armed, or the best known.

In retailing, flagship stores are designed to stand as ideal examples of their featured brand, excelling beyond lesser stores in every way – they have more products, greater access to brand marketing, occupy more floor space and hold a better position in terms of foot traffic.

Said another way, they are designed to be the very best of what a brand has to offer.

Therefore, flagship stores usually form part of a company’s marketing and advertising budget, meaning the store's profitability is less critical than its presence within a specific market.

For these reasons, flagship stores are usually not large in number because, by definition, they are designed to be the lead store – the archetype of the company and the brand. By nature, there can only be one or a few leaders. They are also more expensive to operate.

On the other hand, the products of a brand-only store were not (generally) provided to the broader market, thereby competing with its new stores. That said, the business model can differ slightly from one company to the next.

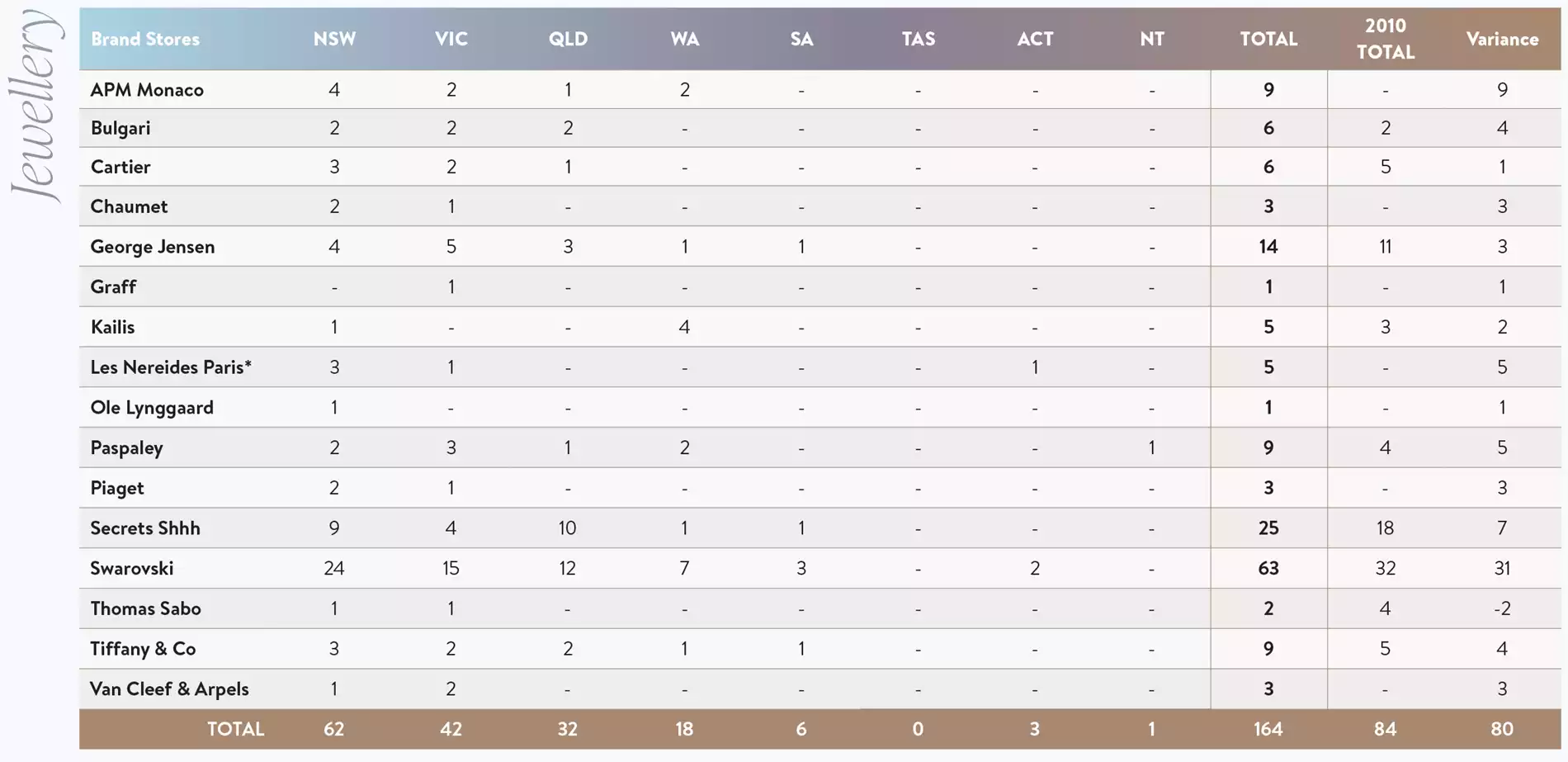

For example, Swarovski jewellery is retailed from 63 brand-only stores in Australia as well as via a range of stockists (independent jewellery stores). On the other hand, Georg Jensen does not supply to other retailers (stockists).

In 2010, flagship stores were more common, and in many ways, Pandora was leading the charge; however, the industry has evolved, and while it's arguable that some flagship stores still exist - the Danish brand Ole Lynggaard still operates a flagship store as well as distributing its range via a small list of stockists - we believe that an all-encompassing brand-only category is more appropriate today.

One final note on the changing nature of the industry, as well as the brand-only business model, is best exemplified by the watch brand Daniel Wellington.

The Swedish company first distributed its popular watch range via a third-party Australian distributor and then switched to a brand-only store model.

The company has moved back to third-party distribution while maintaining two retail stores.

In 2010, it was believed appropriate to distinguish between brand-only and flagship stores; however, after more than a decade of evolution in the market, the difference is arguably irrelevant – particularly in the watch sector, which has changed dramatically over the past five years.

Given these changes and the closure of many flagship stores (Autore, Briel, Storm, Georgini), Jeweller has determined that the distinction between flagship and brand-only stores is no longer substantially significant for an industry report.

The flagship category has, therefore, been discontinued, and all flagship stores will be considered brand-only stores, regardless of the commercial nature of the outlet.

TABLE 1A: BRAND-ONLY STORES STATE-BY-STATE – JEWELLERY BRANDS |

|

| Table shows the state-by-state brand-only jewellery store counts; Swarovski with 63 stores is the largest. |

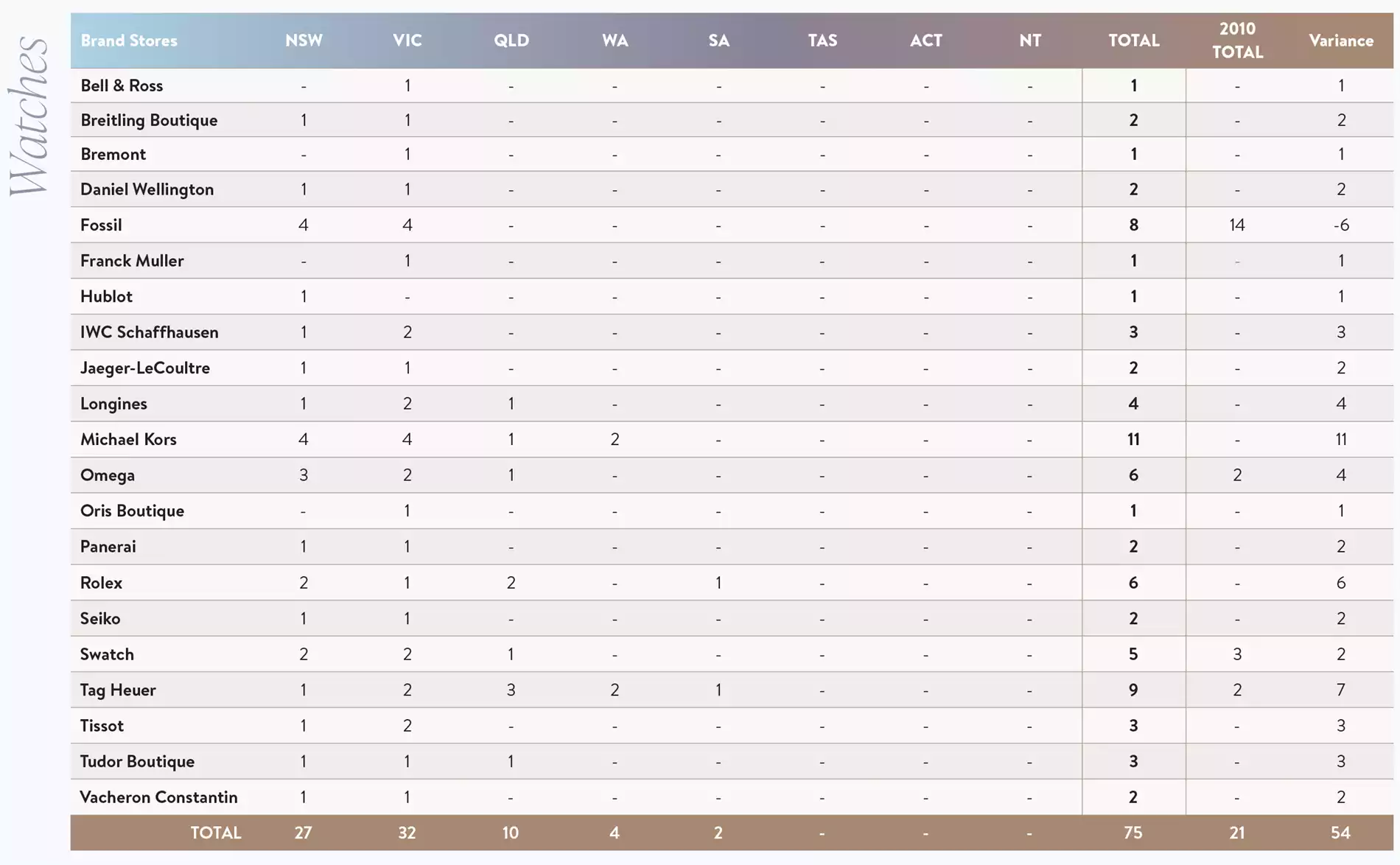

1B: BRAND ONLY STORES STATE-BY-STATE – WATCH BRANDS |

|

| Table shows the state-by-state brand-only watch store counts. It's interesting to note that there are no brand-only watch stores in Tasmania, the Northern Territory or the ACT. |

Perception management

Watch and jewellery brands place tremendous value in controlling the relationship between brand and consumer.

With the cost of product development and marketing in mind, it’s only natural that these brands want to ensure they have a say at the ‘vanguard’ of the relationship – the sales floor.

Furthermore, brands don’t like having their products discounted or utilised by retailers in ‘pricing wars’ to attract customers to the store. Price, after all, plays a massive role in the consumer’s perception of the company and its products.

The more expensive it is, the more desirable it is – discounting attacks the notions of luxury and prestige that marketers and product developers strive to achieve.

The changing nature of the market is best demonstrated by the high-profile watch brands – mainly Swiss. Ten to 15 years ago, they were distributed via a wide wholesale channel to independent stockists/retailers.

TABLE 2: BRAND-ONLY STORES - JEWELLERY AND WATCHES |

|

| Chart shows a comparison of ongoing brand-only watch and jewellery stores in Australia from 2010 to 2023. |

Many watch companies began establishing flagship stores to promote the brand, arguing that the flagship store itself was not a direct competitor to its independent stockists.

However, many jewellers disagreed! While the flagship store strategy can work, especially in jewellery where repeat purchases are common – think charms, for example – it’s more complex for expensive ‘one-off’ purchases, such as luxury watches.

This complexity stems from successful brands often considering their customer as the end consumer, and the ‘bricks-and-mortar’ retailer is merely seen as the delivery method.

While the retailer is undoubtedly an integral part of the transaction, they are viewed as a facilitator of the transaction – they are a conduit between the brand and the consumer.

With that perception in mind, the brand – justifiably – wants to exert more control over its relationship with the customer.

After all, it takes a great deal of time, money and effort to market and develop a product, and a vital component of the product’s image is the perception of value and prestige.

Time to take a stand

Arguably, a $100 watch tells the time in the same way as a $10,000 watch, so why pay the extra cost? These brands invest considerable energy and money to explain exactly why to consumers and do not want to risk retailers inadvertently undermining this messaging.

As a result, the luxury Swiss watch brands began cultivating the flagship store model, establishing high-profile outlets in premium CBD locations as ‘destination’ stores that complemented their wider distribution to independent stockists.

Yet, sometimes, the strategy backfired by souring relationships with those retail stockists.

One notable case was the 2010 decision of luxury conglomerate Moët-Hennessy Louis Vuitton (LVMH) to open new Tag Heuer flagship stores in the Melbourne and Sydney CBDs while simultaneously closing the accounts of neighbouring stockists.

The move was met with howls of protest from retailers who were already worried about losing sales to rival watch and jewellery stores – let alone dealing with direct competition from their own suppliers!

In April that year, jewellery chain Angus & Coote took a stand. Reacting swiftly, the high-profile jewellery chain withdrew the TAG Heuer brand from all its stores.

Asked at the time whether TAG’s decision would affect the way Angus & Coote would select its watch brands in future, Andrew Nock, then-general manager of merchandising and marketing, said, “Yes,” adding, “We see the supply chain as being a partnership; we give respect, and we expect respect in return. We want a win-win situation for all involved.”

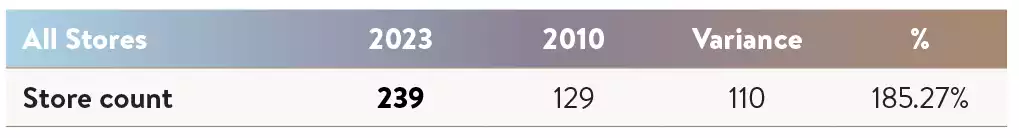

TABLE 3: BRAND-ONLY ALL STORES COMPARISON |

|

| In 2010, there were 129 brand-only stores, and even though a number of brands closed their stores, such as Breil and Storm, that figure has increased to 239 by 2023. Note that Pandora was classified as brand-only in 2010 but is now considered a chain. |

Controversy in the watch market was not new. In 2007, there was a similar uproar when the Swiss watch giant Swatch decided to open an Omega flagship store in Sydney. Although Swatch did not close surrounding Omega accounts, many stockists were up in arms.

It is important to note that, in those days, luxury watch and jewellery brands avoided selling their products online.

With the subsequent change in strategy – and their slow acknowledgement that they would have to embrace e-commerce – luxury watch and jewellery brands believed that consumers would still go out of their way to visit a destination (company) store because of their strong connection to the brand.

The result is that today, in many cases, a luxury watch brand's only remaining distribution channel is via a brand-only store, either company-owned or operated under licence.

In the jewellery sector, Pandora offers another case study into the changes in market dynamics.

The 2010 SOIR listed the Danish company with one flagship store owned and operated by Pandora Australia and 41 brand-only stores – some operated by franchisees and others by Pandora.

Now, 13 years later, Pandora has 129 stores – which it refers to as ‘concept stores’.

In 2020, it announced the closure of its original flagship store in the prestigious Pitt Street Mall retail precinct, which it had occupied since 2010.

The company opted not to renew its lease on the premises at the end of September following lengthy discussions with Scentre Group, Australia’s largest retail landlord and the operator of Westfield shopping centres.

State of play

Even though the flagship category is now redundant, it is still possible to compare the 2010 data with data collected in 2023 by combining the two 2010 categories - brand-only and flagship.

Excluding Pandora, this shows that 13 years ago, there were 20 watch and jewellery brands in the Australian market responsible for 170 flagship and brand-only stores, compared to 40 brands responsible for 239 stores today.

However, Pandora’s business has changed to the extent that we now define its 129 retail outlets as chain stores rather than brand-only stores, in line with the notion that Pandora is not a vertical-market operation.

That is, Pandora still has a wide wholesale channel to independent stockists – unlike, for example, Tiffany & Co., Cartier, and Georg Jensen, which have vertically integrated business models. In 2023, its independent stockists now number 114.

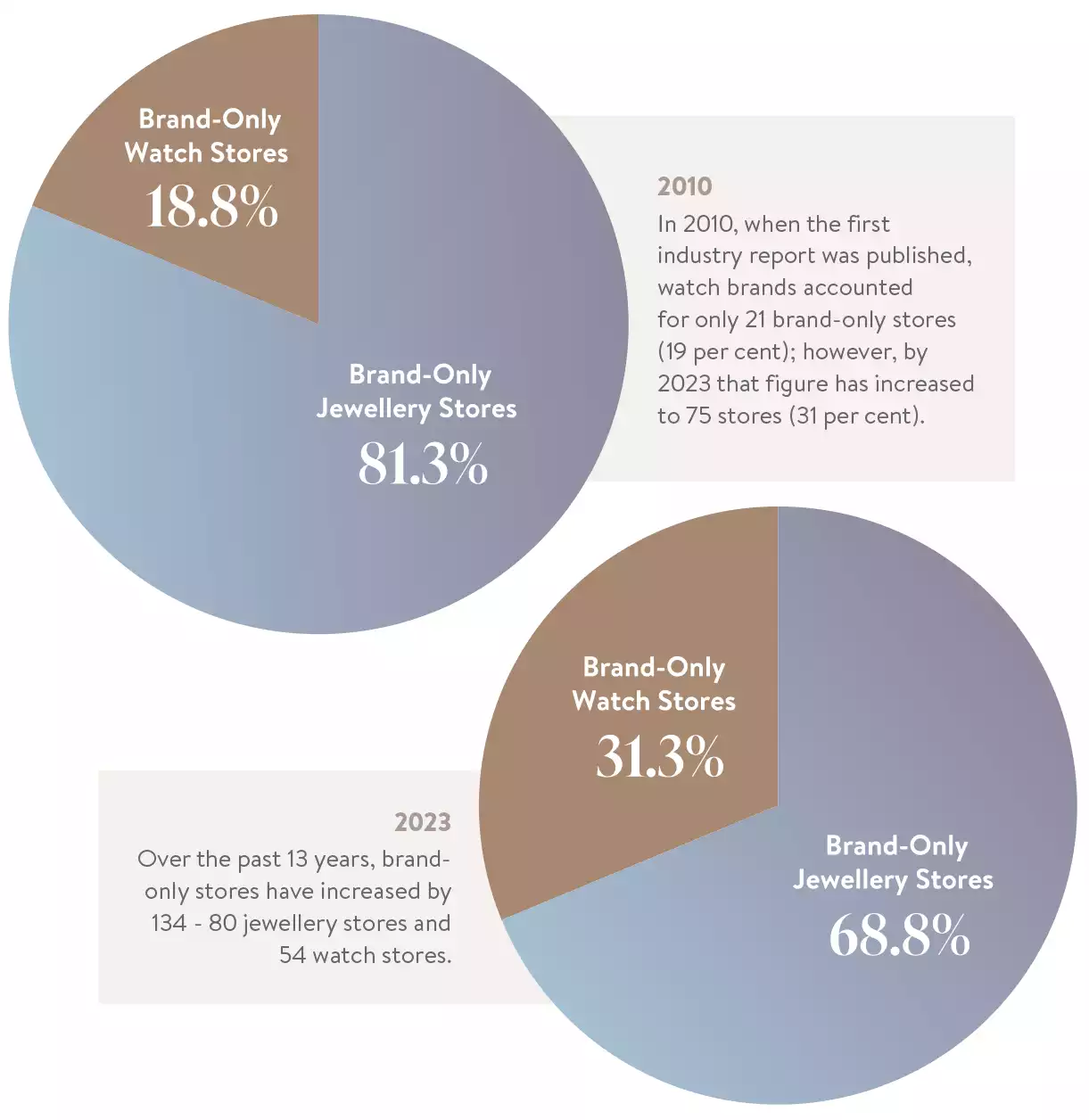

JEWELLERY VS WATCH BRAND-ONLY STORES |

|

TIME FLIES!The above pie charts best illustrate how the international watch brands have focused on the Australian market.A vertically integrated business consolidates multiple steps in the typical distribution process, from manufacturing to consumer purchase. Hence, Pandora stores are now classed as a ‘chain’ for the purpose of our 2024 study. |

This means we can compare apples with apples and observe 129 flagship and brand-only stores in 2010 (excluding Pandora) compared to 239 stores in 2023, which is a substantial incease.

Further, we can see that five of the 19 brands in 2010 (Autore, Briel, Storm, Georgini and Guess) no longer operate any retail stores today.

Despite this contraction, more than 30 new brands have entered the Australian market since 2010, meaning that there are now 40 watch and jewellery companies operating brand-only stores in Australia.

It should be noted here that the increase in brand-only stores has been driven by a number of internationally renowned luxury conglomerates such as Moët Hennessy Louis Vuitton (LVMH) and Richemont, which cover a wide range of products, from jewellery and watches to fashion and leather goods, perfumes and cosmetics.

These groups account for many of the new brand-only stores introduced to the Australian retail economy over the past ten years – including Montblanc, Chaumet, Hublot, Piaget, Van Cleef & Arpels, Jaeger-LeCoultre, and Vacheron Constantin – and increases in the number of existing brand stores, notably Bulgari and TAG Heuer.

International luxury brands such as Chopard and Hèrmes have followed suit.

Notably, Kennedy Jewellers, established in Sydney in 1976, operates eight boutiques (brand-only stores) for Rolex, IWC Schaffhausen, Jaeger-LeCoultre, Panerai and Graff.

These have been included in this section of the SOIR, consistent with Jeweller’s definition that brand-only stores can be owned and operated by the proprietor of the brand or under licence by third parties.

Rolex, for example, has two other boutiques in Queensland operated by Langfords Jewellers, while owner Richemont operates a second Jaeger-LeCoultre brand-only store in Melbourne.

The evolution of the watch and jewellery brand mix over the past decade is also fascinating. Of the 19 brands in the 2010 report, only six were watches; a decade on, that figure has more than tripled to 21 brands. And not all are Swiss!

Japanese watch brand Seiko selected Australia as an early location for its expansion into brand-only stores.

In March 2016, its first store debuted in Sydney’s Queen Victoria Building, and a Melbourne CBD location followed in 2018. Importantly, in December 2019, the company opened a new boutique for its prestige brand, Grand Seiko, at Pitt Street Mall in Sydney.

Today, there are 75 brand-only watch stores; unsurprisingly, approximately 70 per cent of the outlets (59) are in Sydney and Melbourne. Of course, many jewellery brands also offer watches.

Ups and downs, like-for-like

There has been a significant move by international luxury goods brands to establish outlets in Australia. If we analyse the brand-only stores from 2010 to 2023 on a like-for-like basis, we find some interesting results.

Swarovski is the standout performer, having increased its store count by 14, from 32 in 2010 to 63 in 2023. In fact, it has opened 17 stores since 2020!

Paspaley more than doubled its store count, from four to nine – equal to Tiffany & Co.’s local store count also at nine. TAG Heuer operated two retail outlets in 2010; today, it has nine.

Over the same time, Bulgari increased its presence in Australia by four stores (from two to six).

Secrets Shhh has had a topsy-turvy decade. First listed in 2010 with 18 stores, the retailer specialises in cubic zirconia jewellery and reduced its count in the ensuing years; however, its post-COVID presence now stands at 26 stores.

However, that’s not the whole story.

Jane Meredith, along with friend Dietmar Gorlich, co-founded Secrets Shhh in Noosa, Queensland, in 2000. Under a franchise model, it quickly grew to 26 stores across Australia and New Zealand before the 2007–2008 Global Financial Crisis took its toll, as it did on so many retailers.

By 2010, it was down to 18 stores, but a further decline was yet to come. In April 2017, the number of Secrets Shhh stores had fallen to only seven – four company-owned and three franchised.

At that point, former Michael Hill International (MHI) CEO Mike Parsell acquired a majority stake in the business and reinvigorated the retailer.

Parsell was well-placed for the task; he had been with MHI for 30 years and was responsible for establishing the New Zealand jewellery chain in Australia in 1987.

In October 2019, Parsell oversaw the opening of the newest Secrets Shhh store at Robina Town Centre on Queensland’s Gold Coast, bringing the total number of outlets to 17 – nine company-owned and eight franchised – almost to the same store count level as a decade earlier.

However, since January 2020, Secrets Shhh has opened eight new stores, back to its peak around 2007.

Another interesting ‘story’ is that of APM Monaco, a silver jewellery brand with seven Australian stores. It was founded in Monaco in 1982 but is now headquartered in Hong Kong. It first expanded to Australia as a supplier/wholesaler but currently operates as a retailer.

US-based private equity firm TPG Capital, which focuses on leveraged buyouts and growth capital, acquired a 30 per cent stake in 2019.

APM Monaco is not the only retail brand that first attempted a comprehensive wholesale distribution in Australia.

Danish brand Ole Lynggaard entered the Australian market in 2009 – with much fanfare – as a wholesaler. It established a flagship store in Market Street, Sydney, in October 2010 – one of just six worldwide. The others are located in Copenhagen, Stockholm, Singapore and Paris.

The Sydney flagship store is still operating today, and the brand is also stocked by a small number of retailers, including Trewarne Jewellery in Melbourne and McKinney’s in Brisbane.

The continuing expansion of brand-only stores best illustrates the shift from ‘retailer-centric’ to ‘brand-centric’ distribution and marketing – though there is, clearly, still a firm place for independent stockists in the overall strategy.

UPDATES - SIGNIFICANT NEWS SINCE PUBLICATION

Swatch opens new stores - March 2024

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES