As part of the review of the Australian jewellery industry over the past 13 years, an analysis of the success and failures of the industry’s trade body – the Jewellers Association of Australia (JAA) – was required.

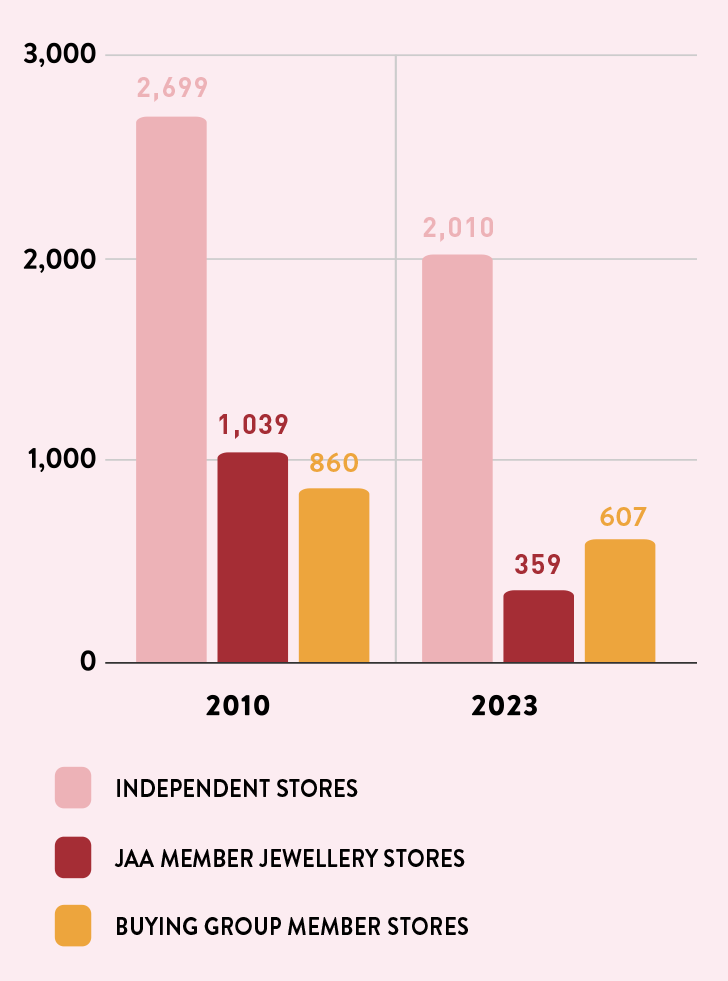

At the height of its powers in 2010, the JAA could rightfully claim the title of ‘peak industry body’ with nearly 1,000 members. Retail membership alone accounted for 1,039 stores across Australia; however, the JAA could claim a mere 350 retail jewellery stores in 2023, a decline of 73 per cent since 2010.

It’s important to understand that the JAA is somewhat unusual and unique as a trade association. The stated aim of representing the entire industry – including retailers, suppliers, manufacturers, distributors and wholesalers – is uncommon among trade associations.

Traditionally, trade associations would represent ‘one side of the fence’, whether wholesale or retail, but not both ‘sides’ - partly because of conflicting interests. That said, for decades, retail members have dominated the JAA, while industry suppliers have accounted for around 20-30 per cent of its base.

It’s worth noting that for 10 of the 13 years covered by the 2024 State of the Industry Report (SOIR), two people ‘led’ the JAA as president – Selwyn Brandt for seven years and Jo Tory for three years. Both are industry suppliers.

For that reason, it was deemed appropriate for this study to offer Brandt and Tory an opportunity to reflect on their time ‘at the helm’.

CHART 1: JAA MEMBERSHIP 2010 V 2023 |

|

| The importance to retailers of the jewellery buying groups has increased at the same time as retail membership to the JAA has decreased over the past 10-13 years. |

To assess the JAA’s position in the industry over the past decade, Jeweller initially contacted Tory on 10 October to gauge her interest in providing information about her time as president, particularly a list of accomplishments and achievements.

Tory is the owner of Najo, a supplier of women’s silver jewellery. She joined the JAA board in 2017 and was president between 2019 and 2021.

The same invitation was also extended to Brandt on that day. Brandt vacated the presidency in 2018 because the JAA Constitution states that no person may serve as president for more than seven years.

Brandt is a director of Australian Jewellery Supplies (AJS), another industry supplier. In 2014, his former business, House of Jewellery, merged with AJS.

He replied to Jeweller’s email on 12 October, stating that he would submit a response “as soon as possible”.

Tory did not respond to the initial 10 October email; however, when the request was resent on 18 October, she responded quickly, stating that she would provide information within the next week.

A week later, on 25 October, Tory was sent a follow-up email asking when this information could be expected. Tory never replied.

Because Brandt had not replied for a week, a follow-up email was sent to him on 18 October. He answered the next day, stating he was busy but would respond soon.

However, two weeks later – on 6 November – Brandt emailed Jeweller with an unexpected response.

“You would have received information from the current JAA president relating to recent achievements, member benefits, mission statements and latest news,” he said.

He added: “My tenure with the JAA was several years ago and does not bare (sic) relevance to the organisation as it is today.”

Brandt was correct. Jeweller had received an unexpected email from JAA president Joshua Sharp on 25 October.

The email contained three documents: a media release announcing the resignation of Tory from the board, a copy of the JAA’s revised Mission, Vision, and Values statement, and the 2023 JAA Achievements and Progress report.

Coincidental timing?

It was intriguing that two weeks after Jeweller first requested a list of accomplishments from Tory and Brandt on 10 October, the JAA opted to prepare a list of "recent accomplishments".

It should be noted that the requests to Brandt and Tory were sent to their business email addresses and were not ‘copied’ to the JAA. As Brandt indicated in his 6 November email, it seems apparent that the requests were discussed with the JAA.

Jeweller contacted Sharp on 13 December to raise this issue. It was suggested that Brandt and Tory contacted the association regarding the story after they had previously agreed to participate.

Sharp responded on 21 December, denying that Brandt and Tory had advised the JAA about the invitation to contribute to the SOIR.

“For the record, both Jo and Selwyn have not been in contact with me regarding you contacting them,” Sharp told Jeweller.

This statement seems to contradict the information provided by Brandt on 6 November, where he advised: “You would have received information from the current JAA president ...”

Sharp continued, “Furthermore, as you are aware, Jo [Tory] and Selwyn [Brandt] are no longer on the JAA board and have no board involvement. Should they wish to not respond to your emails, I guess that is their choice, they have no obligation to do so.”

It should be emphasised that both Brandt and Tory had previously advised Jeweller that they would participate in the study. Brandt withdrew on 6 November with a direction to the information provided by the JAA. Tory stopped replying to emails after 18 October.

Colourful legacies

For the SOIR researchers, it was unfortunate that Brandt and Tory declined the opportunity to offer comments and information about their terms as president, especially considering they steered the JAA for 10 of the 13 years detailed in the report.

During the early years of his tenure, Brandt was lauded for successfully restructuring the JAA’s board in 2014. At the time, the board was criticised for its size relative to membership figures.

It consisted of 13 members - which meant one board member for every 60 members. The JAA was also criticised for its gender disparity, with just one woman serving as a director for six consecutive years.

LEADERSHIP FOOTRINTS |

PRESIDENT 2012-2018 | PRESIDENT 2019-2021 |

|  |

SELWYN BRANDT

SUPPLIER - DIRECTOR

AUSTRALIAN JEWELLERY SUPPLIES | JO TORY

SUPPLIER - OWNER

NAJO |

It was seen as unbalanced for a trade association representing an industry with many successful supply and retail businesses owned and operated by women – let alone millions of female consumers.

Brandt and others convinced the industry that a smaller, six-member board would be more effective. At the same time, a 14-person National Industry Advisory Council (NIAC) was created to represent the many different and diverse industry sectors.

It was a significant achievement for Brandt and the JAA, although the NIAC eventually fell by the wayside over the ensuing years.

While Brandt pushed the JAA in a positive direction in that regard, it was a disastrous period for the association regarding membership and finance.

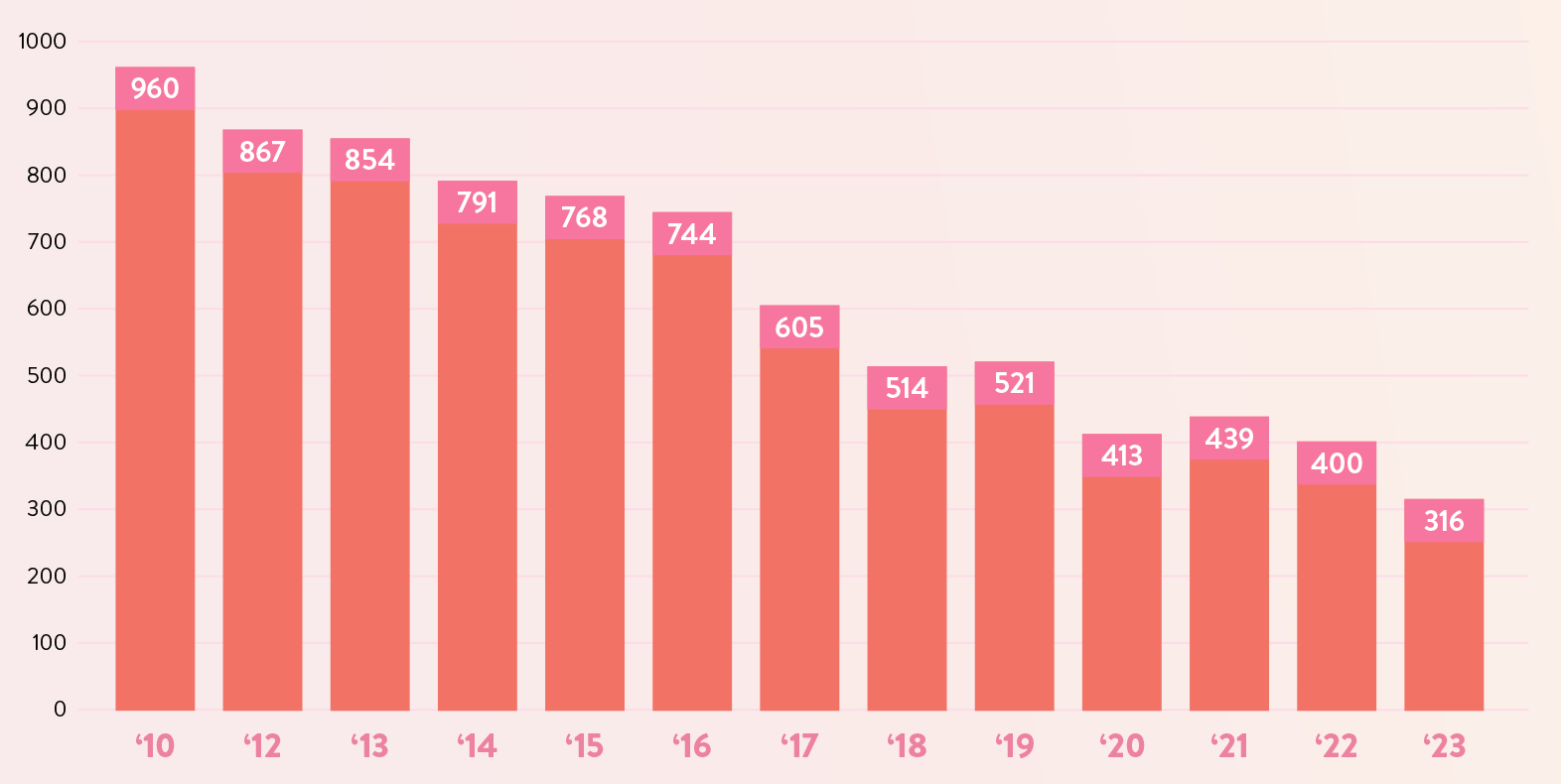

The JAA’s membership declined by 69 per cent (867 to 514) between 2012 and 2018, which led to a decrease in membership income of 60 per cent from $415,000 to $249,000. During the same period, total revenue plunged from $770,000 to $349,000 – a decline of around $380,000, or 50 per cent.

Financial statements show that from 2014 to 2017, the JAA had four consecutive years of losses totalling more than $350,000. The average annual membership income for the same period was $328,000.

However, as previously reported in detail, the board’s decision in May 2016 to terminate a 25-year sponsorship deal with Expertise Events – a move supported and spearheaded by Brandt – had an impact on the JAA that is still felt today.

The association’s additional income, including third- party sponsorship from Expertise Events, Marsh Insurance, and other companies, including Jeweller, all but vanished. Annual revenue went into freefall, and the JAA office was closed as costs were slashed.

As was reported in the SOIR for the first time, over ten years prior to making its decision to walk away from the sponsorship agreement and to run its own (competing) event, the JAA received $1.2 million in cash and an additional $100,000 in non-cash support from Expertise Events. The sponsorship agreement was for the JAA to effectively lend its name to the Sydney trade fair.

There were other adjacent controversies during Brandt’s time as president. In October 2017, the board signed off on a financial report riddled with errors.

It was also discovered that Brandt’s trading company – Australian Jewellery Supplies – was not supporting the JAA’s new jewellery fair – even though he had spearheaded the JAA's walk away from the annual sponsorship income. It was also discovered that AJS was not a JAA member during his tenure as president!

Leadership under crisis

Brandt stood down from the board in December 2018, and Tory assumed the presidency in January 2019.

The first financial statements under her presidency showed a $48,000 loss; however, by the following year, Tory had the JAA back in the black, to the tune of $70,000, mainly by slashing $43,000 of staffing costs (from $132,000 to $89,000).

At the time of its decision to cancel its agreement with Expertise Events (2016), the JAA’s staffing costs were $300,000 per annum, which included an annual salary of $150,000 to its executive director.

It should be noted that 12 months after becoming president, Tory was faced with the global COVID pandemic – a time of relentless uncertainty for jewellery retailers and suppliers.

It was a trading environment unlike any other faced by previous JAA presidents – with Tory forced to navigate an unprecedented event as both the leader of the JAA and as a business owner herself.

Her time as president was impacted by the continuing backlash over the 2016 decision to end the sponsorship agreement with Expertise Events.

For example, by the time Tory had decided to take on the presidency, the JAA’s membership had already fallen by 30 per cent since Brandt’s board voted to commence a rival trade show.

As a result, membership and income suffered – so returning the JAA to profitability by her second year (2020) was a notable accomplishment.

CHART 2: JAA MEMBERSHIP DECLINE FROM 2010 - 2023 |

|

| The chart shows the decline of JAA membership from 2010 to 2023. The 2023 membership figure is a calculation because the association could not, or was incapable of supplying its membership number. Jeweller used the JAA’s membership directory page and other information to arrive at the December 2023 information, which has not been disputed by the JAA. |

These things considered, it was also a time of missed opportunities for the new president. Tory had a chance to ‘heal the wounds’ caused by the failed attempt to launch a new jewellery fair.

Of particular interest was the JAA’s relationship with Nationwide Jewellers, Australia’s largest buying group.

The buying group withdrew from the JAA after Brandt – along with vice-president Laura Moore (nee Sawade) and executive director Amanda Trotman (nee Hunter) signed a media release in September 2016 that alleged a “conflict of interest” by Nationwide Jewellers managing director Colin Pocklington.

In fact, in the seven years since that media release was published, no member of the JAA board has ever contacted Pocklington to discuss the events, let alone apologise.

It is worth noting that when Nationwide Jewellers quit the JAA after a 25-year relationship, it had

469 members (391 Australian) and 511 stores (427 Australian), more than the total number of JAA members and stores today.

Indeed, during Tory’s time as president, no discernable effort was made to ‘extend an olive branch’ to anyone impacted by what was arguably the most shocking time in the JAA’s history.

Therefore, her presidential legacy remains mixed. Perhaps it will be remembered for its impressive achievement of steadying the JAA’s finances during a global pandemic while continuing the disunity and division by choosing not to deal with the past - which she could argue was not her doing.

It is hard to imagine that the damage inflicted on the industry by Brandt, Moore and Trotman’s decision to issue a media release with false allegations can ever be overcome without an apology in the very least.

While making these observations, it is important to note that the president or CEO is just one person

on a larger board of directors who makes the final decision and for which the actions and outcomes should be attributed to the organisation itself and not any single person.

However, just like the buck stops with the coach of a sports team, the CEO or president is remembered for their legacy, whether positive or negative.

It should be noted that Karen Denaro of Brilliamo Designer Jewellery served less than one year as JAA president after quitting the role in October 2022 under unamiable circumstances.

Following her resignation, she expressed concern about the board's governance and suggested she was prevented from meeting with Expertise Events before the 2022 International Jewellery Fair.

JAA - WHO REALLY BENEFITS?

RETAILER SURVEY The retailer survey was undertaken using Survey Monkey, a digital research platform and emailed using Jeweller’s comprehensive database. It began on 31 October and ended on 17 November with more than 200 independent retailers responding, which is estimated to be around 10 per cent of the market. Interestingly, while the JAA represents less than 10 per cent of the entire market (all jewellery stores including chains) its members were overrepresented in the survey at 29 per cent of participants. |

Obligations presented as accomplishments

This leads us to the JAA’s list of recent ‘accomplishments and achievements’ provided by Sharp on 25 October.

It states: “The Jewellers Association of Australia (JAA) has made meaningful achievements and progress in 2023, demonstrating its commitment to supporting and advancing the Australian jewellery industry.”

Apart from listing items that cannot reasonably be described or even viewed as accomplishments, the document also includes ‘everyday’ responsibilities that are expected and for which it is legally obliged to undertake.

For example, the sixth item listed is the appointment of a board member: “New Board Director: JAA welcomed a new Board director, Daniel Anania, to contribute fresh perspectives and expertise. The association continues to seek out additional director candidates, who can contribute to its mission and vision for a stronger industry.”

The JAA is legally obliged to have board members and, therefore, must manage the issue. The appointment of a new board member to replace another is a duty and obligation; it cannot be rightfully described as an accomplishment.

The same can be said of the tenth item on the list – handling consumer complaints - and the following statement: “The day-to-day administration of the Association has been efficiently managed …”

JAA members rightfully expect their annual fees to be “efficiently managed”.

In addition, for something to be described as an ‘achievement’ or ‘accomplishment’, it is reasonable to assume it has concluded. Something you are thinking of undertaking, exploring and/or are still negotiating - and has not been finalised - cannot be called an ‘achievement’.

The JAA lists two expectations as accomplishments: “the promise of future benefits like messaging services and fuel card programs currently in the works” and “investigations into shared workspace and insurance.”

The third item listed is “re-contract with JewelCover”. The JAA announced its partnership with JewelCover in February 2018, meaning that a commitment to continue offering an existing service could hardly be described as an accomplishment. It should be noted that the JAA receives income from JewelCover.

Is it reasonable to describe a contract renewal from which you benefit financially as an ‘accomplishment’? The alternative was to stop receiving financial payments from JewelCover.

One of the ten items listed could be described as an accomplishment: “maintaining a profitable status.” Given the previously documented financial freefall and the JAA’s continuing membership decline, it is a notable achievement for the JAA to stay in the black.

With that said, the real issue is not the JAA’s attempts to present its duties and obligations and future expectations as achievements. The real problem is a question of membership benefits.

JAA - WHO REALLY BENEFITS?

SUPPLIER SURVEY The supplier survey was opened on 9 November and closed on 17 November. While the exact number of jewellery suppliers (wholesalers) is unknown because of the complexities of various business models, it is estimated to be somewhere between 500-750. The survey received 52 responses, which is estimated to be between 8-10 per cent of the market. Interestingly, even though the JAA has been led by supplier presidents for 10 of the past 13 years, suppliers appear to have little regard for the JAA’s support of the wholesaler sector, with around 85 per cent saying it is average to very poor. |

Who benefits?

The pragmatic issue the JAA board faces moving forward is as follows: What value or benefit does a business receive from becoming a JAA member?

If membership in any trade association offers little or no benefit, it will struggle to attract members.

The issue is complex because there are core benefits (which all members enjoy) and ancillary benefits (which some members enjoy).

Herein lies another problem with the JAA in 2024. Because it attempts to represent retailers and suppliers simultaneously, something that might be viewed as a benefit to a retailer may not be used by suppliers, and vice versa.

For example, the JAA listed renewing the contract with Jewelcover as an ‘achievement’. In truth, this ‘service’ is not a core retailer benefit – the product is for their customers - but regardless, it has nothing to do with suppliers.

Another example is the first item listed – the JAA Australasian Jewellery Awards. While it is undoubtedly exciting for the 10-20 jewellery designers who participate, it is of little interest to suppliers who may consider joining the association. It cannot be described as a core benefit from which all members will gain.

The same could be said of many other accomplishments listed in the document – they cannot be seen as a core or ancillary member benefit, which leads to retailers and suppliers questioning the reason to join the JAA. Jeweller contacted Sharp to clarify which accomplishments could be described as a core benefit to jewellery retailers and supplier members.

An example of a fuel card was provided. Members could benefit from a fuel card supplied by the JAA; however, they could also acquire a fuel card from various sources, and thus, it’s not an outright motivation to join the association. Sharp opted not to discuss the matter further.

“It was a general document listing achievements and progress. You mention that you cannot report certain parts as an accomplishment. We are certainly not holding you to any news report,” he said.

“Should you wish to write an article and scrutinise the information, I will leave that to your creativity.”

Public perception challenges

At one time, membership with the JAA was perceived to offer great value to retailers and suppliers, reflected in strong membership figures.

As the recent survey results demonstrated, the perception of the JAA among retailers and suppliers is negative – despite members of the association being overrepresented among the respondents! The 2023 industry surveys reflect the same data as a similar study completed in 2017.

This point to be emphasised is that this is not the ‘editorial’ opinion of Jeweller – this was feedback from current JAA members.

The following was put forward: Membership to a buying group offers more benefits than membership to the JAA.

More than 43 per cent of retail respondents said they ‘strongly agreed’ or ‘agreed’ while only 12.5 per cent said they ‘strongly disagreed’ or ‘disagreed’. It would appear Australian jewellery retailers do not see much benefit in the JAA compared to buying group membership.

Suppliers were asked a similar question: The JAA is my first point of contact for business advice and wholesaling best practice.

More than 65 per cent of supplier respondents said they ‘strongly disagreed’ or ‘disagreed’ while a mere seven per cent ‘agreed’. Around 24 per cent of supplier respondents were JAA members.

If the JAA intends to resurrect its membership figures and represent a large percentage of the industry in the future, this perception must be addressed.

What has the past taught us?

As previously noted, the JAA has always been a trade association dominated by retailers (70-80 per cent). Yet, for 10 of the past 13 years, it was ‘led’ by presidents who owned wholesale businesses - suppliers serving retailers.

When Sharp was announced as president in October 2022, there was a suggestion that change was in the air – as he comes from a retail background as general manager of Ian Sharp Jewellery. The last retail president was Peter Beever in 2012.

That said, Sharp has held the position for more than one year, and the JAA appears to be maintaining the same trajectory it held under previous leadership.

In November 2022, it was reported that Sharp had contacted Expertise Events managing director Gary Fitz-Roy. The telephone call occurred after JAA vice president Ronnie Bauer created another controversy by making statements about Expertise Events.

Only one month into his tenure as president, Sharp found himself issuing a media release titled ‘Retraction on comments made by Ronnie Bauer, JAA Director and Vice President’. Bauer apologised to Fitz-Roy and retracted four comments he had made.

Sharp later told Jeweller, “The JAA is looking to assist in uniting the industry and ensure it prospers in the future. We will work with whomever is willing to help our industry prosper”.

Seven years since the industry JAA divided the industry - and more than one year since Sharp called Fitz-Roy - there has yet to be any indication that industry unity is coming anytime soon.

Like Tory before him, Sharp has also made no attempt to contact Pocklington or resurrect the JAA’s relationship with Nationwide Jewellers.

During the extensive six-month research for the SOIR, Jeweller uncovered other information that indicates the JAA’s focus remains on industry politics rather than benefits for members.It would seem that listing legal obligations and expectations as achievements is merely the tip of the iceberg.

As previously observed, it’s arguable that a State of the Industry Report is a project the JAA itself should be undertaking. With that said, two former presidents opted to remain silent rather than accept an invitation to reflect on the past 13 years so that the industry could better prepare for the future.

It is not possible to solve problems with the same type of thinking that created them. Mistakes have been made; however, the industry will remain divided until the JAA attempts to resolve the conflict it created with Nationwide Jewellers and Expertise Events.

Perhaps the one decision made by the JAA that is supported by this study was the choice to no longer refer to itself as ‘the peak industry body’.

STATE OF THE INDUSTRY REPORT ADDENDUM EXPLAINED This article is an addendum to the State of the Industry Report published in December 2023. The purpose of the six-month study into the Australian jewellery industry is two-fold – it’s a historical document offering an in-depth examination of the trade from which a glimpse of the future may be obtained. As is often the case with studies of this nature, the research often uncovers unexpected insights. These include significant changes due to advances in technology, the evolution of consumer habits and expectations, and the unforeseen impact of an unprecedented global pandemic. In some cases, the space allocated to specific sections of the report was insufficient because of the additional detail and information obtained. This article is one such case where it was noted that the decline of independent jewellery retailers in Queensland far exceeded declines in other states. This was deemed worthy of further analysis. There is a host of additional information uncovered during the SOIR research period, which was also unable to be included in the initial report due to space and time limitations. Jeweller will continue to publish addendums to the SOIR to analyse and clarify an ever-changing industry. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES