Queensland and Queenslanders are different. Just ask them!

They will list many reasons why and quickly remind you that Queensland is ‘beautiful one day and perfect the next’.

While that iconic Queensland government tourist slogan may well be accurate, many of the reasons given as to why the northern state is different are less clear.

Said another way, the examples that Queenslanders will likely give about their state being different to the remainder of Australia may be accurate; however, it’s not the entire picture.

This is particularly true when it comes to the jewellery industry. Indeed, Australia’s second-largest state offers a far more complex economy than any other.

This partly explains why, since 2010, the number of retail jewellery stores – chains and independents - declined from 919 to 680.

This 26 per cent drop was the largest among all states, with NSW, Victoria and WA declining by around 14 per cent. Regarding independent jewellery retailers specifically, the figures are more alarming.

The 2024 State of the Industry Report (SOIR) found that Queensland’s ‘mum-and-dad’ independent retailers declined by 43 per cent (from 577 to 329).

This was more than twice the figure for NSW (19 per cent) and Victoria (21 per cent). The decline of independent stores in WA (23 per cent) and SA (25 per cent) aligned with trends in NSW and Victoria.

So what precipitated the much larger fall in the Sunshine State?

Queensland’s befuddling retail landscape

When questioning why Queensland’s retail sector does not conform to these trends witnessed in other states, it’s important to consider additional data uncovered by the SOIR.

For example, given that independent jewellery stores experienced a sharp decline from 2010 to 2023, what happened to fine and fashion chain stores?

Over the past 13 years, NSW (47 stores) and Victoria (33 stores) each ‘lost’ 11 per cent of their chain stores. Meanwhile, Queensland’s chain store count remained consistent. Declining from 316 in 2010 to 309 in 2023, this two per cent drop over the period was negligible.

Indeed, it’s fascinating that Queensland has more jewellery chain stores (309) than Victoria (272) despite the difference in population. If you need further proof that Queenslanders seem to have more affinity with chain store products and shopping, then consider the fashion jewellery category.

Despite the considerable difference in population compared with NSW (2.9 million more people) and Victoria (1.4 million more people), Queensland more than holds its own regarding fashion jewellery stores.

Queensland has the same number of fashion jewellery stores as Victoria (71), while NSW (73) has just two more stores.

On the surface, Australia’s two largest fashion jewellery chains – Lovisa and Colette – appear to have a similar strategy regarding stores in Victoria and Queensland. Coincidentally, both chains have the same number of locations in Queensland as they do in Victoria despite the difference in population.

The SOIR recorded 43 Lovisa stores in Queensland and 43 in Victoria, while Colette had 16 locations in Queensland and, like Lovisa, the same number in Victoria (16). As they say in the movies: “Now, here’s the thing!”

Consistent with population statistics, NSW has more buying group members (200) and buying group stores (225) than Queensland (109 and 132). That said, once again, the Sunshine State’s figures exceed Victoria’s, with only 106 members and 131 stores.

It’s important to remember that these results follow a 43 per cent decline in the number of ‘mum-and-dad’ independent jewellery stores since 2010!

With that said, this is not a new trend. Jeweller’s 2016 and 2018 Buying Group Reports indicated that more Queensland retailers were members of one of the three buying groups compared to Victoria.

The plot thickens further when considering brand-only stores. Given that fine and fashion jewellery chains have a strong presence in Queensland, it’s fair to assume that a similar trend would be reflected in brand-only stores, right?

Wrong! In another baffling contradiction, the number of brand-only stores in Queensland is only about half that of NSW and Victoria.

Between 2010 and 2022, Queensland’s population increased from 4.49 million to 5.41 million, meaning around 20 per cent of the country’s population calls the state home.

With that said, we find conflicting information across each subdivision of the industry.

Queensland hosts just 16 per cent of all independent jewellery stores, 24 per cent of fine jewellery stores, and 27 per cent of fashion jewellery retailers.

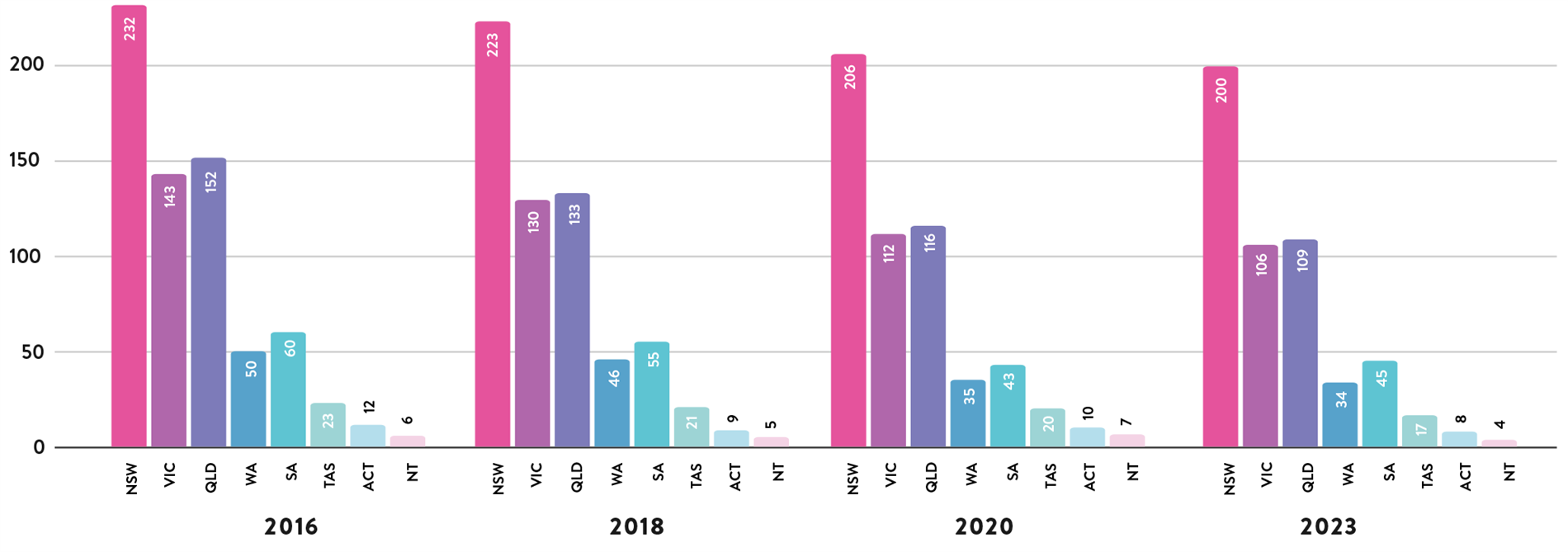

CHART 1: BUYING GROUP MEMBERSHIP - STATE-BY-STATE |

|

| Chart 1 shows a state-by-state comparison of buying group membership between 2016 and 2023. It's interesting to note that despite Victoria (6.7 million) having a significantly larger population than Queensland (5.4 million), the latter has consistently had more members (and stores). |

Why is this happening?

It’s clear that Queensland is running its own race when it comes to the jewellery industry, and it’s expected that similar results will be found in other retail categories such as fashion, white goods, and so on. The question is - why?

For starters, Queensland is the only state in Australia where most of the population does not live in the capital city. This detail often guides the retail landscape in other states.

Local and international tourism are vital to Queensland’s economy. Comparing statistics across the states is challenging; however, more international tourists land in Sydney than Brisbane.

However, that can be deceptive because many international tourists visit Queensland from Sydney, usually because flights from their home country to Sydney are their only option.

Queensland has seven international-level airports - stretching from Coolangatta on the Gold Coast right up the eastern seaboard to Cairns - compared to NSW’s three city airports.

For comparison, Victoria has two international airports – Tullamarine and Avalon – but arguably, they are both in the state’s capital city – Melbourne.

With more international standard airports than any other state, it’s evident that tourism is vital to Queensland’s economy. The need for seven airports also reflects the often understated size of the state. With an area of 1,727,000 square kilometres, it’s more than twice as big as the US state of Texas and seven times the size of Great Britain!

Queensland is the second-largest state in Australia after WA. For reference, WA only has three international airports.

The salient point is that based on the size of Queensland and the number of regional cities and towns, more retail opportunities are found in this style of population distribution.

For example, ten of the 30 largest urban areas by population in Australia are found in Queensland, compared with just seven in Victoria and six in New South Wales.

When a state's population is concentrated in its capital city, the expansion of chain stores is restricted, mainly due to competitive risks and the threat of sales cannibalisation.

This is less of an issue in Queensland, and thus, chain stores have maintained a firm and stable grasp on the market while independent jewellery stores have declined.

The COVID-19 Sledgehammer

It’s worth considering why focusing on the number of airports is essential to understanding the decline of small Queensland jewellery stores.

Tourism is a crucial cog in Queensland’s economy, and that tap was turned off during the pandemic.

According to research by Business Queensland, more than 27 million domestic and international overnight visitors came to Queensland in the year ending March 2023.

Tourism is a $22 billion industry in Queensland, with domestic and international visitors spending $90.1 million daily. The tourism industry directly and indirectly employs 206,000 people in Queensland. This equates to roughly one in 15 people.

For jewellery and gemstones specific to the Queensland region, such as the opal and sapphire industries, tourist spending is vital – and the closure of international and interstate travel during the pandemic was a crushing blow.

One example is Opal Gallery, located on Cavill Avenue on the Gold Coast. Managing director Hide Kojima documented the challenges faced by his business during the pandemic.

“Our storefront was located at 45 Cavill Avenue, Surfers Paradise Queensland, a location very popular for international tourists. We’ve been there for many years now, so I considered that my second home,” writes Kojima.

“This meant that we’d been targeting our products and advertisements for these tourists for as long as I could remember. Many of our tourists came from places like China, Japan, and India, and we had many interstate tourists each day as well.

He continues: “In March 2020, when the coronavirus became a real threat to Australia, our business immediately felt the impacts of it. Few people were visiting Cavill Avenue, and it soon became a ghost town. Honestly, we all felt a little lost.”

The impact of COVID-19 on Queensland’s coastal tourist cities was devastating. From the Gold Coast and Sunshine Coast in the south to Cairns and Port Douglas in the north to Airlie Beach, Townsville and Mackay, significant income disappeared overnight.

For those already considering closure before the pandemic - whether because of weak sales or retirement plans - the prospect of an indefinite period without tourism spending was likely a strong motivation for change.

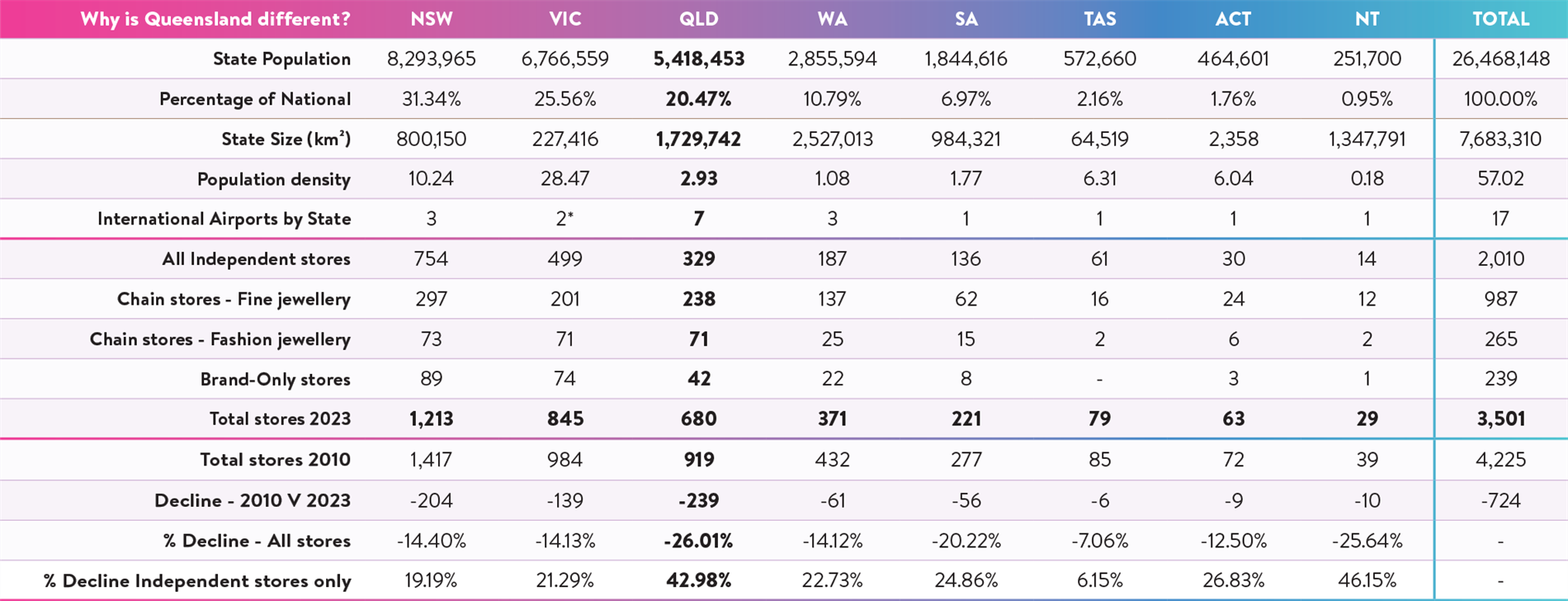

TABLE 1: 2023 POPULATION COMPARISON |

|

| This table is a comprehensive analysis that demonstrate the many ways that Queensland differs from all other states when it comes to the jewellery industry. Over the past decade, independent jewellery retailers in Queensland have declined at a greater rate (43 per cent) than in all other states. What's not well recognised is that Queensland has more fine jewellery chain stores than Victoria, and an equal number of fashion jewellery chain stores, despite the significant population difference between the two states. |

| * Victoria has two international airports; however, they are both in Melbourne. Queensland, because of its size and population spread, has seven. |

It’s important to remember that while many of Queensland’s jewellery stores may not directly depend on tourism spending, chances are that many of the loyal customers of these stores rely on tourism for income.

As a flow-on effect, reduced discretionary spending from customers dependent on tourism for employment was another crushing blow for jewellery stores.

Showcase Jewellers has 31 members in Queensland, representing 47 stores. Managing director Anthony Enriquez said that he was surprised the decline of independents was as dramatic as the figures demonstrate.

He also said it’s understood that the sudden evaporation of tourism spending was a devastating blow for many jewellery retailers.

“The decline in store numbers being larger for Queensland is a little surprising, as Showcase did not have a significantly higher number of member stores closing in Queensland over that period compared with other states,” he explains.

“In many of those cases, the reason for closure was mainly the retirement of owners, which is generally happening across the industry. With that said, the impact of COVID-19 - particularly the border closures and lockdowns - limited tourist spending dramatically.

“Visitor numbers, particularly from overseas, were slow to return, which could have had a greater impact in Queensland [compared with other states].”

In that regard, it’s not surprising that in a 2020 survey conducted by the National Retail Association, 95 per cent of business owners surveyed reported that they either ‘strongly agree’ or ‘agree’ that “it is very difficult to ensure financial stability right now.”

One-two punch

While it’s widely understood that the impact of the global pandemic had on international tourism, it is not well recognised that Queensland tourism suffered an earlier blow.

The Chinese government began punishing Australia over a diplomatic dispute that included imposing a $20 billion trade ban.

China also banned group tours to Australia, and it has previously been reported that 1.4 million Chinese tourists spent $2.1 billion in Australia in 2019, $581 million spent by participants of China’s Approved Destination Status (ADS) or tour group scheme.

Although this ban was eventually lifted, Chinese tourists visiting Australia are still at just a fraction of pre-pandemic levels even though the borders reopened in January.

Tammy Keers is an independent jeweller who was not surprised to learn about Queensland's decline in jewellery retailers. She connected the phenomenon with several key developments in recent years.

The owner of Artisans Bespoke Jewellers in Brisbane said, “There were many jewellers and suppliers that we knew and heard of doing it tough before COVID, so when the opportunity came to renew their leases, I think they took it as their queue to exit,” she tells Jeweller.

“The shift in consumer preferences since 2010 has increased demand for custom and bespoke designs. Handmade custom jewellery has been a part of our story since we opened our doors in 2006, so we are not new to this style of manufacturing.

“Unfortunately for jewellers who did not have a strong hand-making and design background this meant that they would have been unable to compete with those who could.”

These insights were reflected in Jeweller’s survey of more than 200 retailers on the industry's pressing issues.

Retailers were asked: Custom-made jewellery has increasingly become an important part of my business in the 5-10 years.

More than 77 per cent of retailers stated that they either ‘strongly agreed’ or ‘agreed’ with that statement.

Keers also noted the significance of retirement, suggesting that many businesses closed their doors for the final time due to a lack of succession opportunities.

“Since 2010, family-owned jewellery businesses have also had to close their doors due to the next generation choosing not to take on the business or due to retirement,” she explained.

Coincidentally, this was also highlighted by Jeweller’s retailers survey. Retailers were asked: I intend to retire or sell my business in the next five years.

A startling 38 per cent of respondents indicated that they ‘strongly agreed’ or ‘agreed’ with this statement.

Nationwide Jewellers managing director Colin Pocklington suggests that Queensland’s overall decline in independent jewellers can be partly attributed to an ‘exodus’ from shopping centres. Nationwide has 64 members in Queensland, accounting for 71 stores.

Pocklington agreed with Keers and connected the decline to the importance of custom-made and bespoke jewellery.

“There are very few independents in shopping centres as it is. There are many reasons why this is the case; however, a factor you can’t ignore is the extra rent you pay compared with the customers you attract to your stores as an independent compared with a chain store,” he explains.

“I think many jewellers have discovered that it’s not worth paying for the premium rent of a shopping centre location because your customers will find you for custom-made jewellery and repairs at a high street location all the same.”

Pocklington continues: “I think this decline is also a continuation of the growing importance of custom-made jewellery as a part of the business.

"Selling finished merchandise, which is more of a shopping centre practice, has become less important for independent jewellers.”

Chain store equation

Based in Fortitude Valley in Queensland, Mark Cotterell is the owner of Mark Cotterell Master Jewellers.

“Social media has allowed greater visibility for small non-storefront jewellers to be seen and build business bases whilst many traditional bricks-and-mortar ‘family style’ jewellers had limited workshop facilities and little to no designer elements to their businesses,” he says.

“Queensland has a strong base of chain jewellers, probably more so than other states. The jewellers that buy jewellery and have no craftsman on site are the shops that have been exposed to a much larger extent, and there aren't a lot of well-trained jewellers left.

“Many of those now work for themselves and are active on social media.”

Cottrell’s view is backed by the SOIR research that, as indicated above, Queensland has more fine jewellery and fashion chain stores than Victoria.

For example, Angus & Coote has more stores in Queensland (32) than it does in Victoria (20), as does Goldmark (22 and 8). Both chains are owned by New Zealand’s James Pascoe Group, which also owns Prouds, which has 67 stores in Queensland and only 47 in Victoria.

Likewise, Shiels, the 50-store South Australian-based chain, also favours Queensland over Victoria despite the latter’s larger population. There are 16 Shiels stores in Queensland and none in Victoria, which would suggest that the size of the state and the fact that most of the population lives in the many varied cities offers better expansion opportunities.

The only chain that goes against the trend is Michael Hill International, which – at the time of the SOIR research – had 28 Queensland stores compared to 34 in Victoria.

Closing remarks

Despite the challenges of the past few years, the Queensland economy has continued to expand at an impressive pace.

Increased retail productivity is expected to coincide with the ongoing population explosion; however, independent jewellers seem the ‘odd one out’.

The decline of independent jewellers in Queensland has occurred for many reasons. COVID-19 encouraged many businesses considering closure – whether it was because of weak sales or retirement plans – to do so.

The challenges of the pandemic also encouraged many jewellers to consider shutting up shop in favour of a studio or workshop, with social media serving as the basis for meeting new customers, as opposed to a front door on a high street.

Pocklington also points to a shortage of manufacturing bench jewellers nationwide, with the shortage most likely worsened in regional Queensland. Independent jewellers have also abandoned shopping centres, partly due to an increased focus on bespoke and custom-made jewellery.

Customers seeking personalised jewellery will discover retailers on a high street or on social media just as easily as they would in a shopping centre, where mass-produced jewellery is more popular.

With the above factors in mind, it’s important to note that just because Queensland’s independent jewellery retailers are declining overall, that does not mean the industry is ‘unhealthy’ or in trouble.

Logic dictates that if discretionary spending has remained strong in Queensland, then the jewellery stores that have remained open should enjoy improved sales because of the decreased competition.

Said another way, if a more significant percentage of the industry achieves improved sales, is this not an argument for a healthy industry?

It’s another reminder that everything is a matter of perspective, including store closures.

STATE OF THE INDUSTRY REPORT ADDENDUM EXPLAINED This article is an addendum to the State of the Industry Report published in December 2023. The purpose of the six-month study into the Australian jewellery industry is two-fold – it’s a historical document offering an in-depth examination of the trade from which a glimpse of the future may be obtained. As is often the case with studies of this nature, the research often uncovers unexpected insights. These include significant changes due to advances in technology, the evolution of consumer habits and expectations, and the unforeseen impact of an unprecedented global pandemic. In some cases, the space allocated to specific sections of the report was insufficient because of the additional detail and information obtained. This article is one such case where it was noted that the decline of independent jewellery retailers in Queensland far exceeded declines in other states. This was deemed worthy of further analysis. There is a host of additional information uncovered during the SOIR research period, which was also unable to be included in the initial report due to space and time limitations. Jeweller will continue to publish addendums to the SOIR to analyse and clarify an ever-changing industry. |

STATE OF THE INDUSTRY REPORT

Published dec 2023 - jan 2024

|  |  |

A Snapshot of the

Australian jewellery industry

| To better understand the findings of the State of the Industry Report, it's important to be aware of the changes to the industry and how they affect the methodology. |

| Independent Jewellery Stores:

How many are there in Australia?The results are in and you will be surprised.

How has the retail jewellery market fared over the past decade? How does it compare to other areas of the jewellery industry? |

| Jewellery Buying Groups: The ups and downs of this vital sectorThe nature of buying groups has changed significantly in the past decade and there's an important question to be answered.

Can Australia support four buying groups? |

|

|  |  |

Jewellery Chains:

Stronger and stronger... for some!| The fine jewellery chains have performed well over the past decade; however, consolidation could be on the horizon as the 'big fish' look for new customers via retail brand differentiation. |

| Fashion Jewellery Chains:

Examining explosive collapsesThe past 10 years have been a rollercoaster ride for fashion jewellery chains, defined by rapid expansions and dramatic collapses.

That said, the carnage continues in 2024. Is anyone safe? |

| Brand-Only Watch & Jewellery Stores: Is the sky the limit?

| The most significant change over the past decade has been the expansion of the big international watch and jewellery brands as they take control of their public perception via a vertical market model. |

|

|  |  |

Births, Deaths & Marriages:

See you on the other side!

| No market is immune to change and no one escapes death. It’s time to reflect on the 'comings and goings' of the Australian jewellery industry over the past 13 years. |

| Shopping Centre Conflict:

Haven't you heard? We're at war!

| Australia’s shopping centres are a towering figure in the retail sector and fine and fashion jewellery stores have played an integral part in their speciality store 'mix'. |

| Jewellers Association of Australia:

Where does the JAA go from here?

| It's been a brutal decade for the Jewellers Association of Australia and much of the damage has been self-inflicted. Worse, the JAA's missteps don't seem to end. |

|

|  |  |

Jewellers Association of Australia:

Does it represent the industry? | As membership continues to fall, the JAA is increasingly seen as a club of like-minded people rather than a peak body. |

| Jewellers Have Their Say: Prepared to be surprised and intrigued! | What do jewellers say about the past, present, and the future? A survey of retailers and suppliers revealed fascinating results. |

| Crystal Ball 2030: Bold predictions for the future of retail| Change is inevitable; however, progress is optional. How can your business benefit from upcoming changes in the jewellery industry? |

|

|  |  |

Provenance or Proof of Origin: Does anyone seriously care? | Provenance or proof of origin is a hot topic. Conventional wisdom says it's an important issue, but in this digital era it's also important to challenge tradition. |

| You’ll never understand the universe

if you only study one planet | More often than not, the questions are complicated, but the answers are simple. Publisher ANGELA HAN reflects on the creation of the State of the Industry Report. |

| Listen to what is not said,

for there, the true story lies | Editor SAMUEL ORD explains some of the behind-the-scenes work that went into this State of the Industry Report and discusses expectations and reality. |

|

STATE OF THE INDUSTRY REPORT - ADDENDUMS

SINCE JANUARY 2024

|  |  |

Questions of legacy and accomplishment for the JAA| The structure of the JAA is unique, which causes complexity in measuring its success. To look to the future, one must recognise the success and failures of the past. |

| Why is Queensland so different? Well, the answer is: Because it is!| Over the past decade, Queensland's number of jewellery stores decreased dramatically more than any other state. Why? The answers are intriguing. |

| Grey areas: Jewellers operating without a retail storefrontAs trends emerged and consumer shopping habits changed, so too has retailing.

The COVID pandemic probably hastened the move towards specialist jewellers, those that do not require a storefront. |

|

| |  | |

| | WHAT! You are telling me that your business doesn't have a website?| If you had to guess, how many of Australia's independent jewellery retailers don't have a website? Would you say 100, 200, or even 300? How about 400, 500, or 600? |

| |

Hover over eMag and click cloud to download eMag PDF

PREVIOUS ISSUES