The international diamond market has never been as complex as it is today. Many issues must be resolved, and forecasting the industry's future has become increasingly difficult.

The news recently broke that Anglo American has been targeted by mining behemoth BHP Group Limited for a potential takeover.

This headline event supersedes all over diamond industry news. As the proposal is in its early stages, the complete impact of what may happen is not yet understood.

Anglo American, the 85 per cent owner of the De Beers Group, received an unsolicited $USD39 billion bid offer from BHP, a company with a market cap that is eight times larger than its own.

The board of Anglo American unanimously rejected the bid, suggesting it significantly undervalued the company. While this was major news for the mining world and potentially bigger news for the diamond industry, it is not unprecedented.

Other companies have expressed interest in Anglo American in the past; however, it appears that more serious action may be on the horizon.

BHP has since made a second, improved bid of around $USD43 billion - which the Anglo board immediately rejected - and rival parties such as Glencore and Rio Tinto may enter the fray with their own offers.

There are always many different moving parts when these bids occur, and other potentially interested parties also tend to surface.

Interestingly, the media’s reaction to the bid was not particularly dramatic. The deal seems to ‘make sense’ in some regards; however, some quirks will need to be ironed out.

What happens next between BHP and Anglo American remains to be seen. BHP is principally interested in copper assets in Chile and Peru and not in the South African iron ore or platinum assets, which are excluded from the offer.

South Africa faces challenges with a troubled economy, rampant unemployment and political strife, and elections are just a few weeks away.

It must be said that De Beers, as the owner of the Venetia mine in the Limpopo Province in South Africa - among other mines in its portfolio located elsewhere — is also in the mix. I strongly suspect that De Beers will be sold if BHP wins out.

BHP exited the diamond industry willingly in 2012 when it sold its 80 per cent share of the Ekati mine in Canada, which accounted for 6 per cent of global diamond supply, for $USD500 million. A decision was made at the time to focus on larger, longer-life assets.

|  |

| The De Beers Group is the owner of the Venetia mine in the Limpopo Province in South Africa. The mine was opened in 1992. | BHP Group exited the diamond industry in 2012 when it sold its 80 per cent share of the Ekati mine in Canada. The mine was opened in 1998. |

It is, therefore, difficult to imagine them retaining the world’s most important diamond producer, which the company has indicated would be subject to a strategic review following a possible takeover. Right now; however, nothing is certain.

Ironically, De Beers has among the best long-life diamond assets in production volumes, reserves, and position on the cost curve.

These would typically be seen as a prized asset to acquire; however, it is complicated by producer government shareholdings, ever-declining profit arrangements with its local partners, and increasing beneficiation pressures.

The latest development is that Anglo American has announced that it will slash its portfolio to focus on copper, iron ore and polyhalite (a form of potash); and confirmed that, among others, De Beers will be either sold or spun off to unlock value.

And so this immediately begs the question – what exactly will happen to De Beers?

Most observers seem to think now that De Beers will be sold, irrespective of what happens with BHP. Will it be spun separately and listed? Anglo has a history of successfully spinning off parts of its structure.

Will another company acquire De Beers? What companies want it?

There have already been many interesting suggestions. These include acquisition by the Botswana government, which is a 15 per cent owner of De Beers and 50 per cent owner of Debswana. Botswana is arguably the stakeholder with the most to lose or gain. This, in my opinion, will be a critical piece of the next stage of the jigsaw puzzle.

Other mining companies, as well as Gulf sovereign wealth funds and luxury companies, have also been mooted as possible suitors.

The Botswana government has been eager to diversify from its significant reliance on diamonds; however, it may feel compelled to invest in protecting its future.

Diamonds have been increasingly volatile in recent years, so only a committed player will have a reason to make a move.

It should be said that an independent or new benevolent owner of De Beers would be seen by many as a positive for the diamond industry juggernaut.

At this point, nothing is certain; however, it’s a development that has shaken the diamond industry. It is undoubtedly the hottest topic of conversation in the cutting centres as the industry waits for further news.

Who would have imagined De Beers potentially becoming a ‘transactional orphan’ in a battle between major mining companies? And yet, that is what is on the cards here.

BHP was given until 22 May to make public a firm intention to offer. Even if the BHP acquisition does not occur, there are strong rumours that Anglo American has already spoken with potential buyers about an exchange of De Beers’ assets.

Timing is everything

It must be said that this news comes at an inopportune time for the diamond trade.

In the past, when I was asked what I expected from the diamond market in the first half of this year, I said that I thought “stability would be a success”. The sudden potential change in ownership or structure of De Beers is not exactly what I would call industry stability!

The past year was terrible for the rough diamond market. Many issues of late have badly buffeted it, and sentiment is extremely cautious. The following were key developments:

Oversupply of rough: There was simply too much rough available on the market, more than the trade required.

Decline in demand: A decrease in natural polished demand was caused by global macro-economics.

Rivals gaining momentum: The increased production and marketing of lab-created diamonds has generated a significant consumer uptake.

This is particularly true in the US, which is by far the world’s largest diamond jewellery market. This has created a gaping hole in the natural diamond industry.

Falling rough prices: Declining rough prices was a natural effect of the oversupply and stagnant polished situation.

Decreasing polished prices: Bloated polished stocks encouraged discounting in the competitive polished environment.

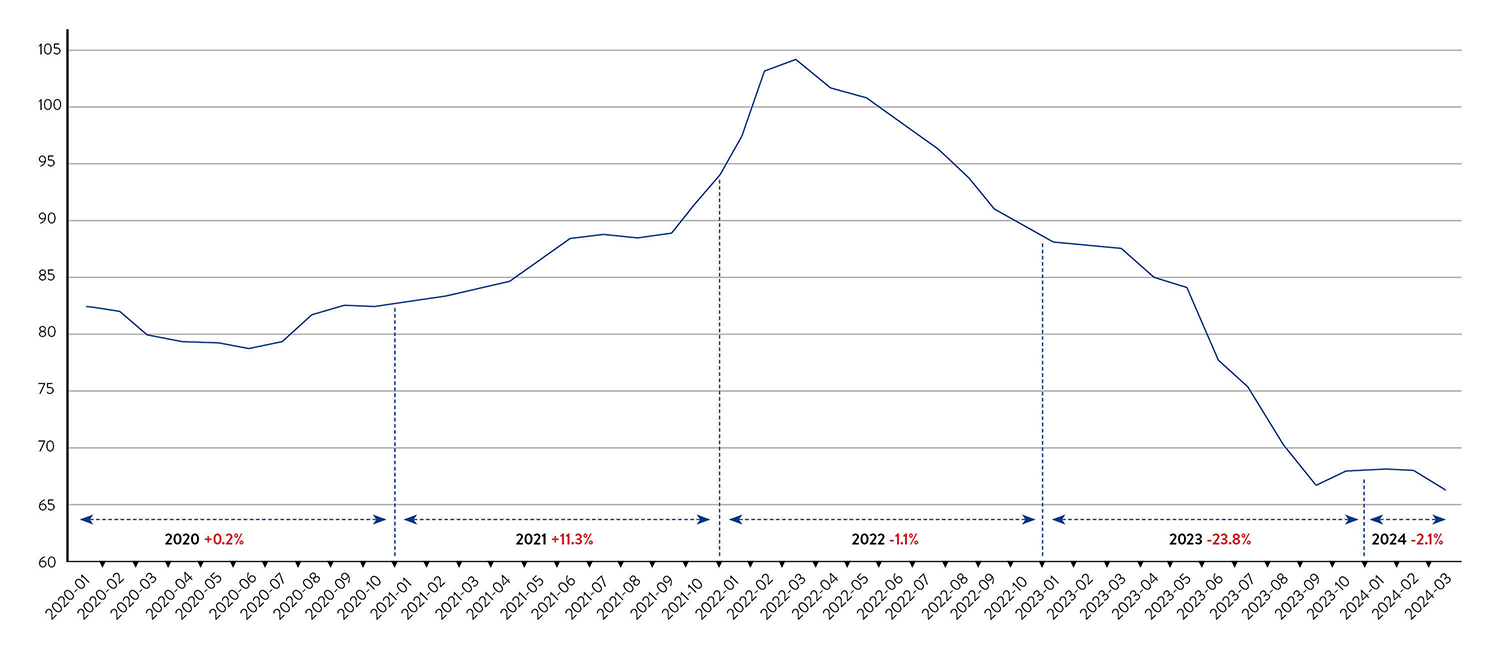

The chart from I. Hennig, the diamond broker, shows the average polished diamond price index has decreased by around a one-third in the past two years.

CHART 1: AVERAGE POLISHED INDEX |

|

| Chart 1 shows the average polished diamond price from January 2020 onwards. Bloated polished diamond stocks lead to discounting in a competitive market, and this chart demonstrates the significant fall in prices over the past two years. This data was compiled by Hennig and Co Ltd from a number of proprietary and public sources. |

China’s changing priorities: Demand for polished diamonds in China, an important market, has decreased with a shift in consumer interest in gold jewellery.

India’s import ban: An informal two-month rough import ban until mid-December gave India’s polishing industry breathing space. This was the third time this had occurred in 15 years.

Rough market paralysis: The two-month rough import ban forced all producers and suppliers – both large and small – to cease selling rough until ‘better times’ in 2024.

As a result of the above developments, statements from mining companies were understandably impacted. De Beers announced a sizable decrease in annual sales, decreasing from $USD6 billion to $USD3.6 billion.

Profitability decreased from $USD1.41 billion to $USD72 million, followed by $USD100 million in cost-cutting and a reduction in budgeted 2024 production from 29-32 million to 26-29 million carats.

While this unfolded, Russian diamond producer Alrosa announced a 9.2 per cent increase in turnover, as well as a 15 per cent decrease in profit to $USD925 million. This included its first shareholder dividend in two years.

Where do we go from here?

The industry started this year in a ‘better mood’ than it finished 2023 with. The rough moratorium had its desired short-term effect.

- The rough market stabilised at new levels in January, with De Beers dropping its prices to align more with the market.

- Sales returned to relatively healthy levels, and the market started to move and absorb rough again.

- Polished sales have been slightly better, and prices have more or less stabilised.

Thinking back to my mantra for the first half of this year – stability would be a success – these developments suggest that the industry has found surer footing.

The industry is now entering the seasonally quiet period, and demand is expected to decrease slightly over the coming months — this is not cause for alarm.

Casting aside the issue of BHP and Anglo American and what may happen next, the natural diamond industry needs to start fighting back.

The industry's leadership must resolve the ‘Russian issue’ to the best of its abilities and position natural diamonds against lab-created diamonds in a more advantageous manner.

Rebalancing the rough production profile against demand is also needed to drive natural diamond demand again.

To achieve these objectives, the industry needs leadership, vision, and positive tailwinds from factors outside of its control. The importance of De Beers to the industry in this regard should not be underestimated. Many people may not agree with De Beers’ approach to the challenge of lab-created diamonds; however, no other company comes close to attempting to lead the diamond industry.

Marketing remains critical; however, this is an expensive strategy requiring much effort and time. India and China remain the markets where I see the best opportunity for incremental demand. These markets are still capable of driving additional demand for natural diamonds.

Structural changes in the diamond industry are inevitable. One thing is certain — we need more than just hope.

Editor's Note: This story is a preview of a longer feature that is scheduled to be published in the June issue of Jeweller. It was published in advance due to the time-sensitive nature of the information.