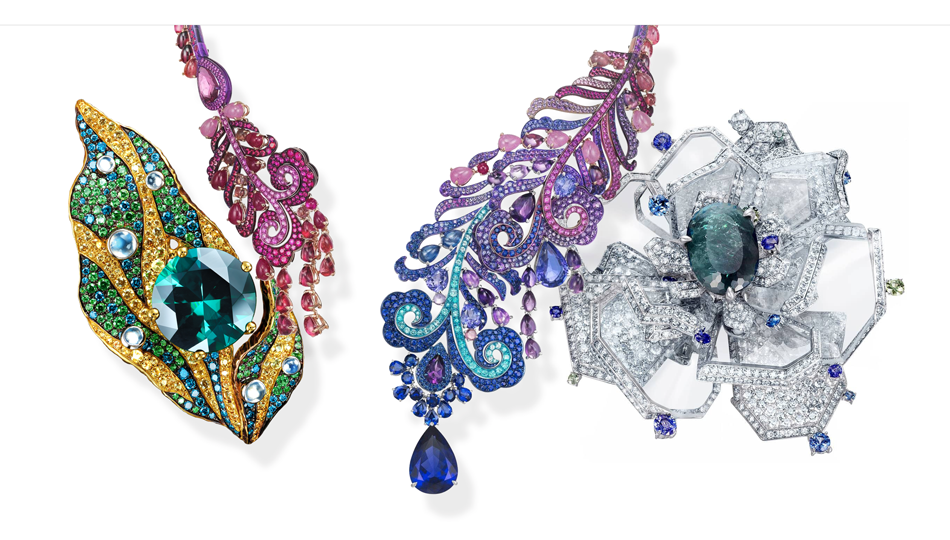

There is no denying the appeal of coloured gemstones. From the high jewellery of Paris Couture Fashion Week to Tiffany & Co.’s Blue Book Collection – the centrepiece of its annual design calendar – the spotlight in 2021 has been firmly focused on vibrant, vivid gemstones in every colour of the rainbow.

Soothing yet magnetic hues of blue and green, captured in aquamarine and emerald, were emphasised at Tasaki and David Morris, while Bucherer painted a perfect pastel picture with soft pink and purple spinel and sapphire.

Inspired by the natural world, Tiffany’s Blue Book – themed ‘Colors of Nature’ – teemed with tanzanite, tourmaline, and garnet.

Beyond pure creativity, the collections also reflect consumers’ – and the wider jewellery industry’s – increasing desire for a varied palette of colour.

“Coloured gemstones become more and more important and sought-after; they express individuality, style, connoisseurship and add colour to your life,” says Raphael Gu¨belin, president of the House of Gübelin – including Gübelin Jewellery as well as the Gübelin Gem Lab, which specialises in the scientific analysis of coloured gemstones.

He adds, “We recognised that people are looking for the so-called ‘big three’ of ruby, emerald, and sapphire, and are also interested in gems such as Paraíba tourmalines and Padparadscha sapphires.

“In our latest Gübelin Jewellery creations you will find rubies, emeralds and sapphires – especially fancy coloured sapphires – often in a sophisticated combination of colours and cuts.”

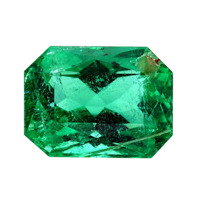

Mauro Carvajal, director Colonial Gemstones – which sources emeralds exclusively from Colombia – told Jeweller, “Emeralds have definitely increased in popularity, and it is getting more and more common to wear an emerald ring for weddings and anniversaries.

“Emerald can be sourced from different places like Zambia, Brazil, Ethiopia, and Zimbabwe and Colombia – though Colombian emeralds are famous for their quality.”

Katherine Kovacs, director K&K Export Import, has observed strong demand for a wide variety of gemstones: “Teal- coloured gemstones have been a strong trend for the past year or two and this shows no signs of slowing down, with sales of blue zircon from Cambodia, tourmalines and particularly Australian sapphire seeing high demand.

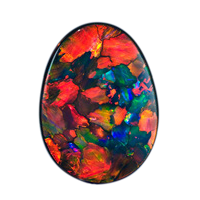

“I’m also personally pleased to see Australian opal of all types enjoying a spike in popularity in the domestic market the likes of which we haven’t seen for a number of years.”

Recent Gemfields auction results have also reflected this increased demand.

Adrian Banks, managing director of product and sales, told Jeweller that Kagem – Gemfields’ emerald mining subsidiary, based in Zambia – had recently recorded its highest auction revenue since March 2016.

“We were very pleased to see such strong demand and pricing. Because operations were suspended at Kagem in March 2020, the world’s largest emerald mine produced no new emeralds for more than a year.”

He added, “Kagem has already surpassed the aggregate auction revenues achieved in the whole of 2020, which stood at just $US22.4 million ($AU28.8 million) as a result of the fall-out from the COVID-19 pandemic.”

Gemfields also operates Montepuez Ruby Mining (MRM) in Mozambique. Banks notes recent results from seven “sequential mini-auctions” had “yielded the third-highest revenue figure of the 14 auctions which MRM has run since June 2014”.

“We are very encouraged by the strong appetite from our clients and by the prices realised,” Banks added.

Outside the ‘big three’, Charles Lawson, director of retailer and supplier Lawson Gems, tells Jeweller, “In the last 12-18 months, we saw demand spread across our whole range of stock rather than our usual bestsellers of Australian sapphire and opal.

“Coloured gemstones appear to be on an ever upward climb in popularity, especially as public knowledge about coloured gemstones beyond the big three increases,” he added.

|

| Left to Right: Anna Hu brooch and necklace; Van Cleef & Arpels brooch |

|  |  |

Above: Jewellery Theatre | Above: Harry Winston | Above: Chaumet |

COVID recovery

Alongside increasing consumer demand, the COVID-19 pandemic has undeniably impacted the gemstone market.

Notes Kovacs, “We’re fortunate that, having been in the gemstone business for more than 50 years, we have a number of long-standing suppliers overseas who are working with us to continue to supply goods.

“Obviously we can’t travel internationally to select goods in person because of COVID-19, so we are very fortunate to have a strong buying network that we can trust to assist with sourcing.”

Lawson observes, “Our biggest issue has been the lack of international travel, as without being able to visit our suppliers and miners and purchase gemstones first-hand, it has made our purchasing procedures much more difficult,” adding, “Shipments of any sort were obviously going to be delayed during COVID-19 restrictions and we did struggle more than usual getting our gemstones from the small mining communities that were hit hard by COVID-19.”

Colonial Gemstones’ Carvajal called 2020 an “unremarkable year” but said his business had largely returned to normal in recent months: “The impact during COVID-19 on Colonial Gemstones was proportional to the rest of the industry, but we still exist – and we are stronger than ever.”

For primary producers like Gemfields, mines were forced to temporarily close or operate at a maintenance – rather than productive – level, while auctions were not permitted to proceed for more than a year.

“As a result of the fall-out from the COVID-19 pandemic, this auction was also our first since December 2019, meaning we realised no sales at all for some 15 months,” Banks says of Gemfields’ ruby division.

“Because operations were suspended at MRM in April 2020, the world’s largest ruby mine produced no new rubies for almost a year... MRM is only now commencing mining for its next mixed- quality ruby auction, which we hope will occur late this year.

Adds Banks, “Gemfields is excited to be back in business after the lengthy pause in both mining and sales and – as always – we extend our sincere thanks to our hard-working teams, to our host governments in Mozambique and Zambia, and to our customers for their ongoing support.”

With the situation far from certain as the pandemic continues, many of Gemfields’ regular clients viewed the early 2021 auctions as a “vital opportunity” to purchase rubies and emeralds.

|

| Above: Van Cleef & Arpels brooch |

|  |  |

Above: Henn Gems | L to R: Van Cleef & Arpels brooches; Tasaki earrings | Above: Carolina Bucci |

Driving progress

As many analysts have noted, there is an ongoing consumer trend toward ethical purchasing – and indeed, the gemstone industry is making significant strides toward transparent supply chains.

Says Gübelin, “Transparency is key when it comes to sustainability and provenance, and transparency is a ‘mega trend’, becoming more and more important.”

Lawson notes, “The last 12 to 18 months have seen some major moments in the battles for both human rights and environmental policy. This is really driving people to start demanding that their gemstones, just like their coffee and their cotton, have been sourced in a responsible manner.”

He adds, “The plight of artisanal miners in developing nations did receive much more publicity due to the impact of COVID-19 on these communities, which has thankfully inspired more consumers to ask the question of how their gemstones were sourced and helped increase the demand for responsibly-sourced coloured gemstones.”

At Colonial Gemstones, emeralds are sourced directly from the Muzo, Coscuez, Chivor, and Gachala Mines.

Says Carvajal, “Colonial Gemstones is involved in every stage of the emerald’s life, from the moment it is extracted from the mine. Our emeralds are cut, polished, and graded in Colombia and then again at their final destination country, if necessary.

“Our customers can have confidence knowing that Colonial Gemstones is involved every step of the way, ensuring that the final product is completely authentic and delivered with care and professionalism.”

Kovacs observes that locally-sourced gemstones have been given an edge, as their provenance can be more easily traced: “Consumers are increasingly conscious of ethical supply chains and I believe that is driving the demand for Australian gemstones across the board,” she says.

The vast majority of the world’s coloured gemstones are mined artisanally, in contrast to the large-scale, regulated mining that dominates the diamond market. This can present challenges when it comes to ensuring an ethical supply chain – or even a traceable one.

“Our industry was struggling [with transparency] because the supply chain is very long, fragmented and complex,” Dr Daniel Nyfeler, managing director Gübelin Gem Lab, told CNA Luxury late last year.

As a gemstone-rich country – from which tanzanite, ruby, sapphire, garnet and tourmaline, among others, are sourced – Tanzania has become a focus for transparency initiatives; it is estimated that approximately 1 million people are employed in its artisanal mining sector.

The Moyo Gems project was established in 2019 between international development organisation Pact, suppliers Anza Gems and Nineteen48, and the Tanzania Women Miners Association (TAWOMA).

“We call Moyo Gems a responsible sourcing initiative,” Cristina Villegas, Pact’s director of mines to markets, explained in a recent webinar. “What we’ve done is establish traceability down to the miner and the broker.”

Participation in the Moyo Gems project involves four components for miners: membership to one of six pre- selected villages, completion of Gemological Institute of America (GIA) training – which can be provided by Moyo Gems – membership of TAWOMA, which is open to both men and women, and finally, proof of work at a licenced mine, or written permission to mine the concession of a licence-holder with Tanzania’s Ministry of Mines.

High-quality gemstones are then selected and sold to Anza Gems and Nineteen48 at regulated Market Days within Tanzania; the project claims miners receive more than triple the value per gemstone selling through Moyo than they would have at a village or regional city market.

|

| Left to Right: Van Cleef & Arpels brooch; Bulgari necklace |

|  |  |

Above: John Dyer | Above: Chris Wolfsberg | Above: Naomi Sarna |

Technology of traceability

The increasing emphasis on sustainable and secure sourcing has also led to an influx of technology- based solutions.

“In 2017, we launched Provenance Proof to enable more transparency to the entire gemstone and jewellery trade,” Raphael Gübelin explains.

It comprises a range of technological services, including the Emerald Paternity Test and the Provenance Proof blockchain platform.

According to Gübelin, it is the first free blockchain platform for coloured gemstones, open to the entire gemstone and jewellery industry: “Our overall aim is to offer a broad and comprehensive range of information that allows the buyer to make a conscious purchasing decision based on reliable data from a trustworthy source,” he says.

The Emerald Paternity Test involves applying nanoparticle ‘labels’ directly to emerald rough at the mine, allowing the material to be traced even after cleaning, cutting and polishing.

The blockchain platform was developed with technology startup Everledger, which also pioneered blockchain solutions for the diamond sector.

Leanne Kemp, CEO Everledger, added, “[The blockchain platform] allows consumers to take pride in that the gemstone in their necklace comes from a certain part of, say, Zambia or Tanzania, safe in the knowledge that the person who mined it was properly compensated.

“As a more ethical and sustainable capitalism rises to the very top of the agenda among Millennials and Gen Z, transparency is surely becoming a commercial imperative.”

Dr Nyfeler added, “Jewellers embrace these transparency technologies because it gives them a rich source of data for their storytelling.”

Gemfields has adopted the Provenance Proof Blockchain, in addition to a number of other initiatives and policies.

Jack Cunningham, Gemfields’ director of sustainability, policy, and risk, says, “Our goal is to operate in a way that contributes positively to national economies, takes a leading role in modernising the coloured gemstone sector and builds lasting livelihoods for the communities around our mines.

He adds, “Responsible sourcing for Gemfields means implementing industry-leading policies and practices across operations, transparency in our auction sales process, an active role in working groups to modernise the sector, projects to improve health, education and livelihoods for the communities around our mines and conservation efforts [for] Africa’s wildlife and biodiversity.”

Further up the supply chain, online B2B gemstone trading platform Gemolith recently introduced a traceability section to specifically cater to the desire for transparently-sourced material, with Greenland Ruby as its first featured producer.

Victoria Favoroso, CEO of Gemolith’s parent company GemCloud, said in a statement, “Today, three out of five jewellery brands we speak with are asking to know the provenance of gemstones and to learn more about the story behind them.”

In April 2021, another online gemstone trading platform, Gembridge – which touts itself as a ‘strictly regulated global digital platform for the transparent trade of colored gemstones, pearls, and jewellery’ – was launched.

The business allows verified members to ‘buy, sell and consign, using a secure and insured door-to-door service’. Based in Singapore, it is compliant with that country’s strict Know Your Customer (KYC) and Anti- Money Laundering (AML) regulations.

Indeed, while it will always be the captivating colour that draws consumers to coloured gemstones, provenance and supply chain transparency offer another selling point for jewellers, providing a compelling story of origin as well as appealing to the desire for ethical products.

|

| Left to Right: Jewellery Theatre brooch; Chopard necklace; Frédéric Mané earrings |

GEMSTONE COLOUR TRENDS

market demand |

Many factors inform the demand for particular coloured gemstones; fashion – inspired by celebrities, media, and 'high jewellery' collections from the likes of Tiffany & Co., Cartier, and Dior – as well as affordability and consumer preferences for locally or ethically- sourced products all influence purchasing patterns. In the past 12 months, suppliers tell Jeweller the most notable trend has been the ongoing popularity of Australian teal sapphire, which now commands far higher prices given the increased demand and more limited supply. Peach gemstones, deep pink rubellite and sapphire, emeralds, and tourmaline also remain desirable to consumers, while Australian opal has seen a resurgence. |

Teal Appeal In particular demand for engagement rings, Australian teal sapphires continue to captivate consumers – as they have done for the past few years. |

Green Light There has been a surge in demand for emeralds – particularly premium Colombian specimens in classic emerald cut, sizes 2–5 carats. Tsavorite and demantoid garnet and green sapphire have also made it into many high jewellery collections. |

Pink Passion Consumers and jewellery designers alike are thinking pink, with bold, saturated pink sapphires, rubellite tourmaline, and ruby making a statement in chandelier earrings and pendant necklaces. |

Rainbow Connection Demand for Australia’s iconic opals has increased, with local consumers and international jewellery houses entranced by its multi-hued play of colour. |

Electric Blue The dazzling sky-blue shades of Cambodian zircon and Paraìba tourmaline are captivating jewellers and consumers. Cornflower-blue sapphires and tanzanite have also been seen in many designer collections. |

Pretty in Peach The peach colour trend – combining softer shades of orange and pink – continues, with Padparadscha sapphire and orange tourmaline at the forefront. |

read emag