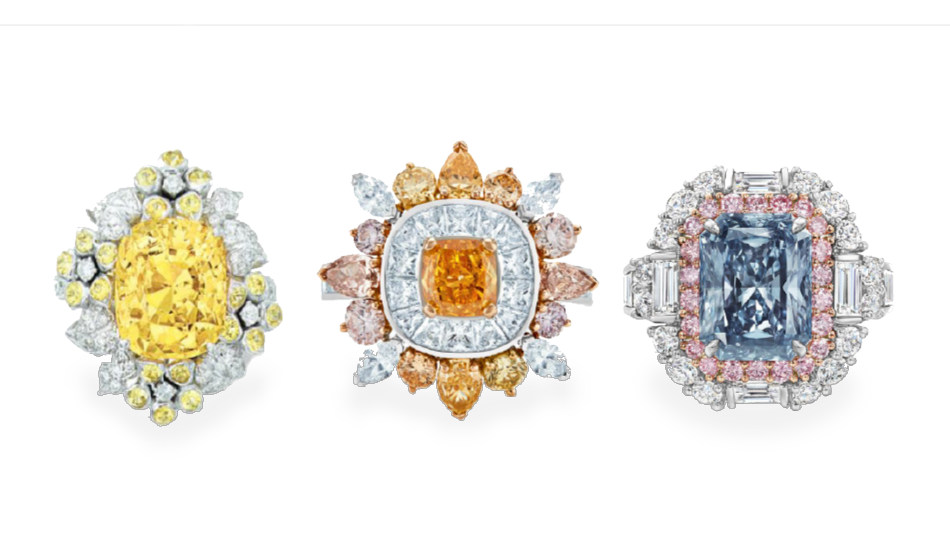

What is the essence of luxury? Today, mere exclusivity is not enough; only the truly unique and personal products epitomise beauty and status. On all counts, fancy colour diamonds exceed the criteria.

Imbued with breath-taking hues in every colour of the rainbow, these rare treasures are as captivating to consumers as they are to jewellers. As a conduit for creativity and flair, with no two exactly alike, they reflect the wearer’s style in an inimitable way.

“It’s ultimately an expression of a person’s individuality and taste – you’re saying, ‘This colour resonates with me.’ It’s a way of standing out from the crowd,” says Olivar Musson, of Sydney’s Musson Jewellers, which is an Argyle Select Atelier.

“I think you have to be confident in your own style and individuality to wear coloured diamonds, and that in itself says something about the wearer.”

That unique quality has made fancy colour diamonds particularly appealing to consumers in recent years, alongside the rise of custom-makes.

Harsh Maheshwari, director Kunming Diamonds, explains, “Fancy colour diamonds are a demand-driven sector, and with the rarity and beauty elements, consumers are becoming more conscious of their preferences, sustaining the industry overall.”

Alan Bronstein, president of the Natural Color Diamond Association (NCDIA), believes jewellery design excellence plays a central role in the fancy colour category: “Where you compete is original designer jewellery – that’s what elevates these diamonds. It’s the jewellery in which the diamond is set, and the story you create around that jewellery,” he says.

Chris Soklich, director, Ellendale Diamonds, explains, “Each coloured diamond is so unique – this lends itself to endless options of personalisation of created jewellery pieces.

“This gives jewellers an exciting opportunity to engage with the consumer, presenting a plethora of different designs, colours and shapes. For example, some fancy colour diamonds do not lend themselves to the traditional round brilliant cut as it does not show off the tonal properties to their full potential – this is an opportunity to introduce the customer to consider fancy cuts such as a radiant or pear.”

He adds, “Creativity is boundless and it can be used to capture the customer’s own unique qualities.”

Indeed, Musson tells Jeweller, “My preference for colour is based on how the stone suits the design, rather than loving one colour more than another. For me, it’s about engaging with an individual as a designer and creating something unique and beautiful that suits their taste and the brief.”

It is estimated that less than 2 per cent of diamonds display noticeable colour; of those that do, the vast majority are yellow, followed by brown – branded as ‘chocolate’, ‘cognac’, and ‘champagne’. Far rarer hues include orange, blue, green, violet/purple, pink, and red.

As a result, the market is far smaller than that of white (colourless) diamonds, yet the attractive margins – particularly for yellow and brown diamonds – make it a worthwhile category for jewellers.

Maulin Shah, director World Shiner, notes several other advantages of the category for jewellers: “As every colour diamond is unique, it’s very hard to match exact pairs – and find a comparable diamond at a different store.

“In general and depending on the colour, fancy colours offer higher margins and higher profit than white diamonds, which provides jewellers with an extra avenue for income.

“And because there is a travel ban in Australia, consumers are not spending money overseas; they are spending on luxury items here in Australia,” Shah explains.

He adds, “It is a good time for local jewellers to try out a colour diamond range.”

Shah names yellow, champagne, cognac, and black diamonds as in-demand colours with excellent margins and creative potential.

Leibish Polnauer, director Leibish, has also observed strong sales for “intense yellows in the 1 to 2-carat size, due to their unique colour, lustre and price point”.

According to Miri Chen, CEO of the Fancy Color Research Foundation (FCRF), which tracks fancy colour diamond prices internationally, yellow diamonds have seen an increase in popularity over the past 18 months due to the “affordable price-per-carat as compared to previous years”.

She explains, “Due to the overall slowdown in economic activity globally during the pandemic, fewer diamonds in circulation means increased demand for market favourites, with yellow being the most affordable.”

However, at the retail level, Bronstein cautions jewellers against marketing yellow diamonds, or any fancy colour, based on price.

“Price is not a point of differentiation; the key is the jewellery and the romance of the stone – and when you have a truly exceptional stone, it sells itself,” he explains. “The first impression should be one of excitement.

Design work is key to broadening the market for fancy colour diamonds, and it’s the biggest opportunity,” he adds.

|

| From top: David Morris; De Beers |

|  |  |

Above: Harry Winston | Above: De Beers | Above: David Michael |

Examining the supply chain

The COVID-19 pandemic not only impacted colour diamond prices, but also the supply chain. Says Chen, “In the first three months of 2020, the industry saw a near complete standstill in both mining and mobility of diamonds.

“As activity slowly returned to the industry, with mines reopening in Canada, Russia and Africa, trade mobility due to air travel restrictions continues to be challenging.”

Meanwhile, Arthur Langerman, founder of Langerman Diamonds, observes, “Countries shutting down and re-opening at different paces, closures – or significant reduction of workers – in mines and polishing centres, meant the movement of color diamonds was greatly reduced through the supply chain, reducing the volume available in the market.

“This resulted in a significant increase in the price of rough diamonds over the past few months and a similar scenario is predicted for polished diamonds during the next quarters.”

Says Maheshwari, “The diamond industry’s supply chain has been broken and disrupted heavily due to COVID-19. Logistical issues, lockdowns, and business closures really rocked the market. Luckily, consumer interests have remained strong.”

Scott West, vice-president LJ West Diamonds, has also observed strong demand but “a hesitation to meet in person to see the stones, along with much higher transportation costs because of COVID-19, which has held back the market”.

“Once people feel more comfortable travelling and meeting each other we think the market will lift significantly.”

West notes that macroeconomic factors have also had an impact on the fancy diamond market: “The ease of money in all major currencies has contributed to the idea of alternative stores of value, as well as the possibility of inflation, which we believe will increase the value of these rare diamonds,” he explains.

The FCRF predicts a “return to normal in the very near future”, with Chen adding, “We are looking optimistically toward a revitalised market in 2022.”

However, with the third wave of the pandemic raging across India – the centre of the world’s diamond cutting and polishing industry – uncertainty still lingers.

Says Polnauer, “The pandemic hit the whole world, and in India, it interrupted the supply of coloured diamonds from Surat, the largest diamond manufacturing centre in the world. As the diamond consumption is increasing worldwide, the supply is substantially less and therefore will lead to price increase in the short and medium-term.”

Langerman adds, “We have yet to see how the new COVID-19 wave hitting India will impact the country’s diamond production. The current scenario could lead to a challenge in meeting their current demand and a possible shortage in the future.”

Shah has already observed shortages in certain categories: “Most colour diamonds are manufactured in India and the situation with COVID-19 has been crazy, so the factories are working at a lesser capacity – 15–40 per cent staff capacity. The high-quality material, in terms of colour, clarity, and size, are selling out quickly and there is a shortage of that material.”

Predicting how the situation will impact the supply chain in the remainder of 2021 and 2022, Shah says, “It all depends on the COVID-19 situation overseas. It’s all up to the manufacturing. We are still getting a consistent supply, but we are not sure about the future.”

Ellendale Diamonds has also maintained consistent supply via a “substantial inventory of fancy-coloured loose diamonds and exquisite jewellery pieces made in Australia,” Soklich says.

Notably, the Ellendale Mine itself – which had lain largely dormant for more than five years – was recently acquired by Burgundy Diamond Mines, which plans to revitalise the site.

“Burgundy believes there is significant potential for the new Ellendale leases to deliver a profitable diamond mining operation, with the intention of becoming Australia’s next diamond producer within the next 24 months,” a statement from the company read.

“Burgundy is currently planning an in-house marketing, cutting and polishing operation, to take full advantage of the remaining iconic and rare fancy yellow Western Australian, Ellendale stones.”

|

| From Left to Right: Bulgari; David Morris; Amrapali |

|

Above: Sotheby’s | Above: De Beers | Above: Harry Winston |

Argyle impacts

Another key factor impacting the fancy colour category is, of course, the closure of the Argyle Mine.

Located in the remote Kimberley region of Western Australia, the world’s premier source of pink diamonds ceased operations in November 2020 after nearly four decades of production.

The popularity of Argyle’s vivid stones – and the associated marketing, via media coverage, promotions, and the annual Argyle Tender – raised considerable awareness for the broader fancy colour category.

“The popularity of fancy colour diamonds has grown over the last few decades; the clever marketing of Argyle in the 1980s led to a major surge in the demand for coloured diamonds,” Soklich explains.

While famous for its pinks, Argyle was also a major source of brown diamonds, which it marketed with creative descriptors such as ‘chocolate’, ‘cognac’, and ‘champagne’.

At Langerman Diamonds, Langerman notes, “We have identified an increase in demand for brown diamonds, varying from champagne to chocolate hues. Brown stones have a strong colour, which you can see clearly from afar, and more people are learning to appreciate its beauty and uniqueness.

“I believe this will continue as the value of brown diamonds is likely to increase as a consequence of reduced supply, following the recent closure of the Argyle Mine.”

The final Argyle Tender was announced in May, with bids closing on 1 September; without new material from the mine, suppliers are looking elsewhere to source fancy stones.

Russian mining conglomerate Alrosa is one such source.

Langerman notes, “[Alrosa] has been the world’s largest producer of rough diamonds for the past few years and has announced its aspiration of assuming the leading position as supplier of fancy colour diamonds.

“Fancy colour diamonds currently account for less than 0.1 per cent of Alrosa’s total output, so only time will tell if their intention of becoming the world’s greatest supplier of fancy colour stones will actually be achieved, or continue to be an aspirational goal.”

He adds, “Colour diamonds found in Russia are usually pinkish purple, yellowish gray, brown and olive. They tend to have an octahedral crystalline structure and a large cleavage.

“The pink stones sometimes have two distinct colours – one part of the stone is brown, and the other is pink, which allows skilled cutters to divide the stone obtaining two diamonds, each with its own colour.”

Says West, “Alrosa has a range of colours. Their pinks have, on average, more purple tones, giving them a lilac appearance. They also have a range of other colours including purples and strong yellows.

“The best of their fancy colours are true specimen diamonds. With Argyle closing, we see collectors looking to Alrosa and South African mines to find the next rare colour diamond.”

In addition to dramatically reducing the supply of pink diamonds and, to a lesser extent, high-quality browns, Argyle’s closure has also left something of a ‘marketing vacuum’.

Without the compelling narrative of the mine itself, nor the glamour of the annual Tender, the jewellery industry must explore other avenues for promoting fancy colours.

The NCDIA’s Bronstein has called for greater investment into marketing and education about fancy diamonds of all colours in the wake of Argyle’s closure.

“The market cannot be the same – and will not be the same – without the halo effect from the marketing of the pink diamonds, from Argyle directly. That was very important. Individual companies can create some publicity for their own products, but it won’t have the same impact.”

In July 2020, the NCDIA appointed four new international ‘ambassadors’ – bringing its total to six – in order to increase the promotional reach and education about fancy-colour diamonds across global markets, including Hong Kong, Singapore, Switzerland, and Italy.

Marco Pocaterra, NCDIA’s Italian ‘ambassador’, noted at the time, “From my experience, Italy remains fertile for education and sales of fancy natural colour diamonds... Their beauty and desirability are strongly underexposed to the public.

“The consequence is that Italian jewellers do not create revenues with these extraordinary and incomparable gems. I am committed to help them inspire their customers and take the opportunity to have new attractive sales conversations.”

Kunming’s Maheshwari also emphasises the need for jewellers to take an active role: “Jewellers need to educate, promote, and make consumers aware that they are well-versed in this category,” he says.

He suggests hosting in-store events and focusing on educating customers about the wide variety of colours available, as well as the unique attributes of each one.

Soklich says education is key for both jewellers and retail staff to create “confidence when designing jewellery pieces, which in turn leads to successful sales”.

Musson says, “Many fancy-coloured diamonds are so rare and valuable, that more significant care must be taken when working with them. Some may have attributes that may make them more susceptible to damage, such as inclusions.

“Or, a variation in cutting has led to a thin girdle or fine corner to maximise carat weight. These nuances may jeopardise durability and present challenges when setting them.”

Ellendale Diamonds stones and jewellery are marketed not only based on beauty and quality, but on guaranteed Australian origin: “The provenance of coloured diamonds is at the core of our ethos, and we proudly promote that our diamonds are sourced from the Argyle and Ellendale Mines,” Soklich explains.

This provides another marketing avenue for jewellers – although provenance cannot always be guaranteed.

Polnauer predicts virtual custom design, based on the customer’s specific “vision” for the piece – a trend that rose to prominence during the pandemic – will continue to feature as a key part of jewellers’ sales strategies.

Indeed, the appeal of fancy colour diamonds largely lies in their ability to captivate the individual; beyond a trend, they are designed to be treasured – and it is up to jewellers to complement their natural beauty by setting them within equally breath-taking jewellery.

|

| Left to Right: Creations Jewellers; Jewellery Theatre; Picchiotti |

|  |

| Clockwise: Kunming; Leibish; Kunming; Kunming | Above: DeBeers |

SPOTLIGHT ON

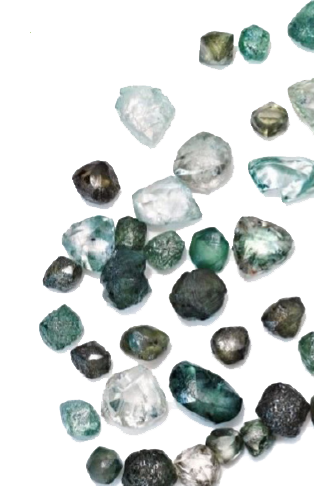

GREEN DIAMONDS

| | Above: De Beers |

Earlier this year, the Gemological Institute of America (GIA) recalled an unspecified number of green diamonds it had graded between January and June 2020. The recall related to a potential new colour treatment of green stones. Alan Bronstein, president of the Natural Color Diamond Association, said, “It is already challenging to assess green diamonds because both natural and treated green stones achieve their colour the same way – through radiation – as opposed to, say, pink diamonds.” Natural pink diamonds achieve their colour through geological phenomena which cannot be replicated, whereas manufacturers can imbue lab- created or natural white diamonds with pink colour through irradiation and/or annealing, making differentiation very simple. Bronstein added, “The challenge of 100 per cent differentiation [of green diamonds]

remains elusive.” Several diamonds owned by Leibish were recalled. Director Leibish Polnauer told Jeweller, “Our gemmologist, Shmulik Polnauer, was consulted by [GIA technical advisor] Thomas Gelb on this matter. We have a small number of stones that the GIA re- checked, but all returned as having natural colour.” Leibish believes that the recall will have a positive effect, explaining, “It will disable the few players who are making questionable manipulations on green diamonds. Luckily, at Leibish, we did not conduct business with such vendors as we sell only natural colours without gimmicks and manipulations.” Arthur Langerman, founder of Langerman Diamonds, lamented the “unethical people in the industry... attempting to forge fancy natural colour diamonds”, predicting the process of certifying green diamonds will become “stricter and more challenging.” He added, “While it is possible that this recall leads to a bit of distrust and scepticism from new customers, those who are searching for green natural colour diamonds will just have to be extra attentive about which companies to trust. “Integrity, knowledge and long-term experience working with natural color diamonds allows companies, such as Langerman Diamonds, to guarantee clients the origin, authenticity and thequality of the green natural colour diamonds.” |

read emag