While many would agree that the retail industry has never been easy, it would appear that recent market conditions have been particularly difficult. There will always be businesses that perform well above trends but general consensus from research conducted by various industry organisations as well as anecdotal evidence suggests that retail trading, and specifically that for jewellery stores, has been flat at best.

As Jeweller reported in February this year, feedback from a cross-section of the industry revealed that Christmas trading in 2016 was on par with, or just below, that of 2015. In addition, most jewellers and industry organisations did not believe conditions would change in 2017 – the ‘new normal’ was a phrase constantly used.

In order to gain a better understanding of the state of the industry, Jeweller recently conducted an in-depth qualitative survey involving 200 Australian jewellery retailers.

The survey was comprehensive, polling jewellers with a wide range of stores nationally. Retailers were asked about a series of issues including business turnover and profitability as well as industry challenges.

Research results revealed

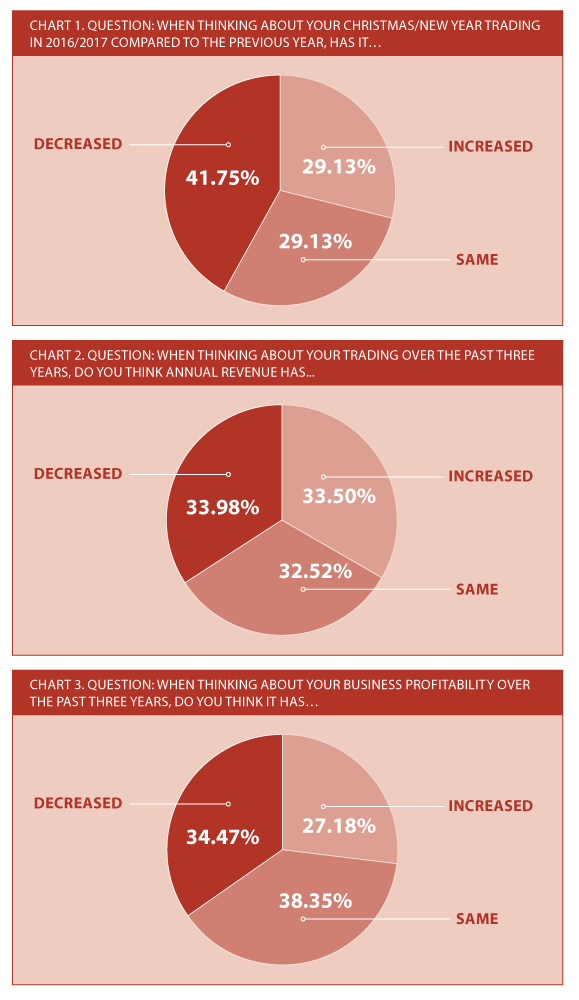

Supporting Jeweller’s earlier reports about trading results during the festive period was the fact that of those surveyed, approximately 42 per cent stated their Christmas and New Year trading in 2016/2017 had decreased compared with the corresponding period the year before (See Chart 1).

Supporting Jeweller’s earlier reports about trading results during the festive period was the fact that of those surveyed, approximately 42 per cent stated their Christmas and New Year trading in 2016/2017 had decreased compared with the corresponding period the year before (See Chart 1).

Only 29 per cent of respondents said trading had increased, while a similar number indicated it was the same as the previous year.

Taking a longer-term view, Chart 2 shows that about one third of jewellers had increased annual revenue over the past three years; however, the more concerning figure was the greater number – 66.5 per cent – who said annual revenue had remained the same or decreased, at 32.5 and 34 per cent respectively.

The results in Chart 3 are noteworthy, recognising that a business’ profitability can decrease at the same time that its annual revenue increases.

When asked about their store profitability over the past three years, almost 73 per cent of jewellers stated that profitability had decreased or remained the same, whereas about 27 per cent believed their profit had increased.

The interesting observation comes about when comparing Chart 2 and Chart 3 – 33.5 per cent of those surveyed stated they had increased annual revenue over the past three years, while only 27 per cent had become more profitable during the same period. Increased revenue does not always translate into increased profitability.

The survey also polled jewellers on the biggest challenges impacting business, and perhaps not surprisingly, many respondents were concerned about the effect of the internet. Although this question was free-form – multiple choice answers were not listed – about 63 per cent of those surveyed nominated the internet as the biggest challenge impacting business.

Competition, the economy and a decrease in demand for jewellery – including changing spending preferences and a cautious spending mentality – rounded out the top four challenges faced by jewellery retailers.

Most interesting was how few people nominated ‘cheap imports’ as a major challenge, something that would arguably have gained more prominence five to 10 years ago.

What’s more, retail leasing costs and landlord negotiations – which has traditionally been a challenging issue for jewellers – was not highly mentioned.

Providing additional industry analysis

While Jeweller acknowledges the survey results can be interpreted in different ways and may only represent a snapshot of the industry, further analysis conducted by software and consulting business Retail Edge Consultants (REC) showed similar findings.

Michael Dyer, sales manager of REC, said the data of more than 300 stores in Australia and New Zealand that REC monitored indicated that although there were businesses reporting same trading or increased trading during the most recent Christmas and New Year period, the overall findings showed a decrease on the previous year.

Dyer also explained that REC’s analysis found an overall increase in sales dollars during the 2014 and 2015 calendar year but a 1 per cent to 2 per cent decrease in the 12-month comparison between the 2015 and 2016 calendar year.

In terms of gross profit dollars, Dyer stated that an overall increase was recorded in the 12 months between the 2014 and 2015 calendar year, while a 2 per cent to 3 per cent decrease occurred between the 2015 and 2016 calendar year.

When asked how he would describe the current local jewellery retail landscape, Dyer said ‘challenging’; however, added that there would always be some retailers who saw opportunity where others saw adversity.

He believed that the internet was arguably the latest major disruptor in the industry since the introduction of GST, and while most retailers weren’t averse to adapting to change, there was no denying that the pressure of continuity and shortening frequency of changes were making conditions increasingly difficult.

“Retail has and always will be challenging; there are no ‘free rides’,” Dyer said, adding, “Whilst the retail outlets – in the world of bricks or clicks – grow at a rate greater than the population and its ability to consume product, there will be more migration of sales rather than overall growth.”

According to Dyer, the consulting side of REC had recently increased and the main business challenges currently highlighted by clients included generating sales while preserving margin, as well as controlling stock levels.

New challenges for consideration

Dyer added that stock management was now more complex because consumers expected to receive product on their terms.

“Historically, retailers may have stopped buying stock to ‘trade’ their way out of cash flow issues,” he said. “[However] in a consumer market that is very ‘now’ driven, being out of fast-seller, consumer-demand product could inadvertently push customers to competitors.

“Fast-sellers are oxygen to the sales and cash flow of a retail business, and if you don’t have them that won’t stop customers buying them, it will just stop them buying them from you.”

The challenges facing the jewellery retail industry are varied, and if Dyer’s analysis and the results from Jeweller’s survey are any indication, store owners and managers would be wise to recognise that the ‘new normal’ has changed the business landscape, which, in turn, will require a review of existing practices.