It feels as if it’s every second day that we read about another retailer closing its doors. Economic and financial causes aren’t the only issues at play; Australia has also had to contend with drought, floods, fires and now the coronavirus, all of which have taken their toll on the already fragile retail industry.

Colin Pocklington, managing director Nationwide Jewellers – Australia and New Zealand’s largest buying group – says, “The conservative spending of consumers continues to adversely affect the industry. Until we see real growth in incomes and an easing in cost of living, we are unlikely to see growth of sales.”

He sees tenancy costs as a significant and ongoing issue for the industry, with many of his members “seeking rent reductions to bring their occupancy costs back in-line with industry benchmarks.”

Carson Webb, general manager Showcase Jewellers, provides a good insight into the mismatch between store revenue and retail tenancy costs: “When a jeweller signed a $75,000 lease, say, five years ago, that lease has now risen to around $91,000.

“Have the jeweller’s sales increased proportionally over that period? The statistics will tell you that they haven’t. And what about the legislated wage increases that they have no control over?”

According to Charlie Davey, general manager of members and category management at Leading Edge Group Jewellers, there is another problem facing retailers in large shopping centres. While some landlords may not be increasing rents (though they are not dropping them either), already high tenancy costs have forced many anchor tenants to leave centres.

“Rising rents and increases in basic business costs continue to challenge some retailers who must deal with a decrease in foot traffic, due to some of the bigger players such as Big W pulling out of regional centres,” Davey explains.

It’s a valid point because the number of shoppers who visit the centre in part determines the value of a lease.

If ‘foot traffic’ is declining, while at the same time tenancy costs are rising, it’s a recipe for disaster.

That is one of the reasons large retail chains are closing stores – or worse, being placed into liquidation – sometimes as part of a restructure plan in order to renegotiate existing long-term leases with landlords.

Pocklington points to the number of store closures to illustrate the seriousness of the situation. “More than 300 Australian jewellery stores – representing 10 per cent of all retailers – have closed in the last four years, with the main factor being falling sales.

“Without doubt, the biggest challenge has been the significant drop in jewellery industry sales over the last three to four years.”

He monitors the industry closely, regularly visiting cities and towns and noting stores that have closed or opened, so his finger is firmly on the pulse.

However it’s important to acknowledge that not all the challenges faced by jewellers are economic or financial.

Changes in consumer behaviour

The world has changed largely because of the internet and, along with it, consumer habits.” Over the past two years, I think the changing face of our consumers and their purchasing habits is something that remains challenging for many independent jewellers,” says Josh Zarb, CEO of Australia’s newest buying group, Independent Jewellers Collective (IJC).

“Everyone in retail today needs to really look at their marketing to ensure it aligns with the image of the in-store shopping experience and product offering.

“I am seeing a disconnect, sometimes, between social media content and web content versus the physical store. This confuses the consumer and can lead to lost sales.”

Davey agrees: “Bricks-and-mortar retailers are suffering due to the online shopping experience. With each store closure in regional Australia comes a loss of brands and items someone once purchased.

“This drives consumers online to replenish those items – encouraging online shopping in people who have traditionally shopped locally.

“Customers are also disillusioned with the overall retail experience that they are receiving, as customer service seems to be almost non-existent – especially in chain and department stores.”

While there are many challenges facing the local and international jewellery industry, Webb is quick to address the ‘glass half-empty mentality’ that can permeate any industry during tough times.

“Aside from all the difficulties, the real danger I see is the danger from ourselves, as the retailer, getting stuck in the negative talk and becoming irrelevant to the consumer. The consumer doesn’t need to put up with mediocrity anymore,” Webb explains.

“If you can’t do it, or whinge about it, someone else will do it. You cannot afford to get bogged down in the negative ‘speak’ that floats around our industry about products, brands and even each other.

“A good example is lab-grown diamonds – it’s a massive opportunity for many retailers who are ready to embrace them.”

Webb doesn’t see the current retail environment as an ‘us versus them’ fight: “It’s about transparency and giving consumers a choice [with lab-created diamonds]. Let’s get on with it and stop trying to pull each other down!

“Our amazing industry needs better cohesion and a few more smiles and high fives, not constant beat ups. We have an amazing industry that offers consumers emotional engagement like no other can. Make it count!”

This is perhaps where the benefits of safety in numbers becomes vital; membership to a buying group offers a range of support not readily available to individual stores.

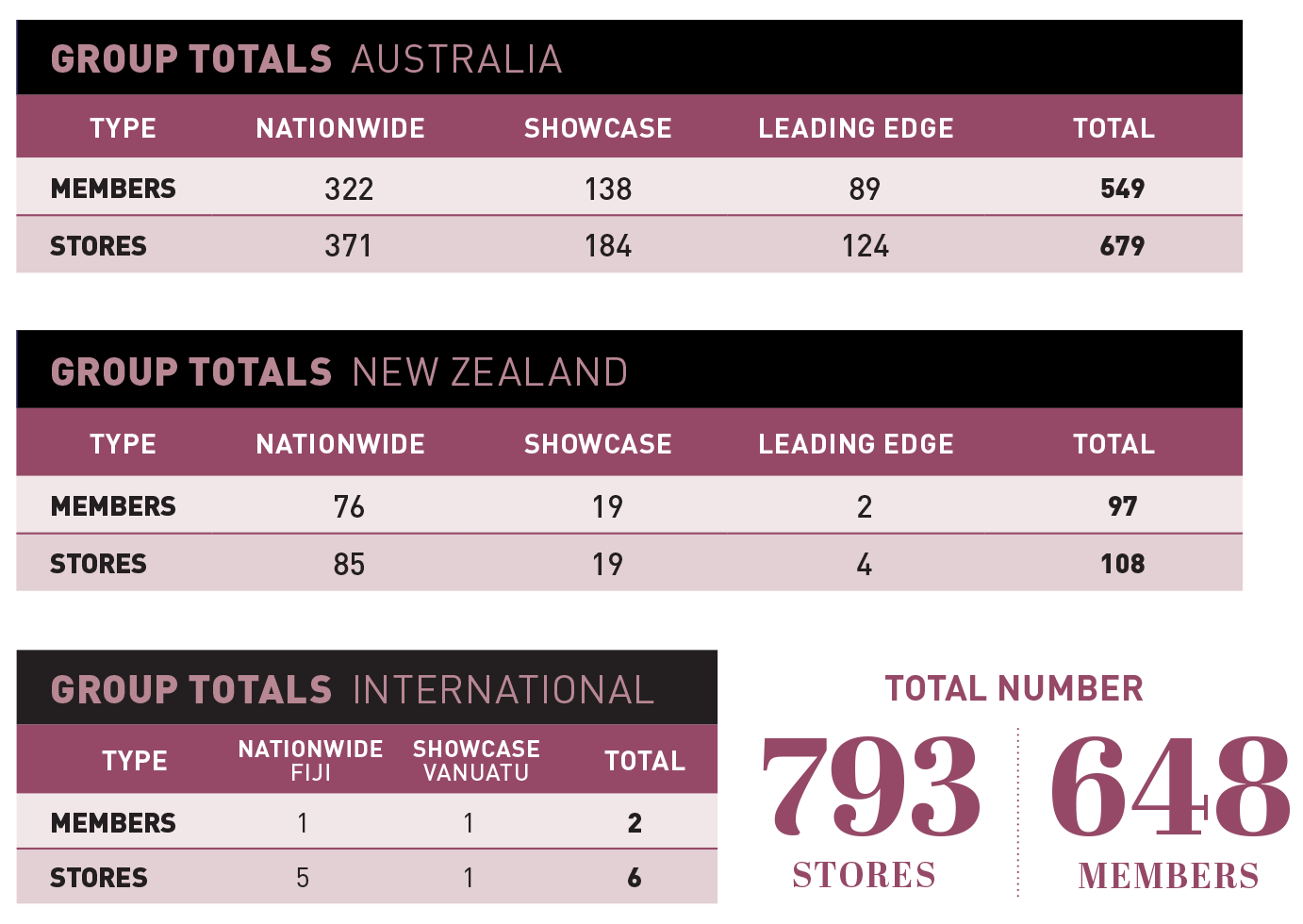

|

| Members and stores outside of Australia and New Zealand |

Searching for solutions

Zarb explains that there is no simple answer to solve the challenges retailers currently face.

“Unfortunately, there is no one ‘magic bullet’ that will be the single solution to thrive in today’s retail climate,” he says.

However, that doesn’t mean there is nothing retailers can do to improve:“If I had to get specific, I would suggest that retailers really focus on identifying who their customer is and start to ensure their marketing targets them.

“I would recommend that, if they are struggling, they reach out for assistance. All the groups offer numerous support services to assist their members.”

Pocklington says, “We recognised the start of these difficult trading conditions back in mid-2016 and started developing strategies, training and marketing initiatives to assist members in maintaining profitability in a declining market.

“We have provided the information and resources for members to implement the seven strategies for retail jewellers that we identified.”

In the new digital world, where consumers are spoilt for choice of product and, more importantly these days, choice of service and customer experience, Pocklington believes retailers should undertake more marketing activity each month, across more channels and platforms.

They should also look to offer different merchandise with different price points than their competitors, especially chain stores.

He advises Nationwide members that better inventory management can also substantially improve profitability.

“Increasing the stock turn by 0.2 can add $250,000 in cash to the average jewellery shop over five years,” Pocklington says.

Webb has similar advice. “To deal with the current retail environment we advise two things. First, work your stock levels smarter. Customers are wanting ‘the same, but different’. Adjust now, or you’ll drown in stock. The average store is sitting at 38 per cent of stock value over two years old.

“Secondly, a really pertinent question to ask is, ‘Why me?’ Why should the customer in your area, town, city or even online, shop with you? Why are you any different or special?

“If you can answer that honestly, and your customer agrees with you, then you’re on the right track indeed.”

Webb says many Showcase members who focus on custom design and manufacture, and specialise in fine jewellery, are performing very well.

“Our retail numbers are 7 per cent up on last year’s results for the last six months, with diamond business now making up more than 36 per cent of total sales.

I remember some eight years ago it was only around 20 per cent. While keeping it simple is the answer, simple isn’t necessarily easy to do!” he says.

Davey says it’s vital for jewellers to concentrate on great customer service and creating unique environments – shopping experiences that can’t be matched by online competitors.

“Focus on providing a seamless customer shopping experience, from the presentation of your store, website and mobile interaction. Continue to review your cost of doing business and review the options available for payments, utilities and rent, and where needed, get help from your network,” he advises.

|

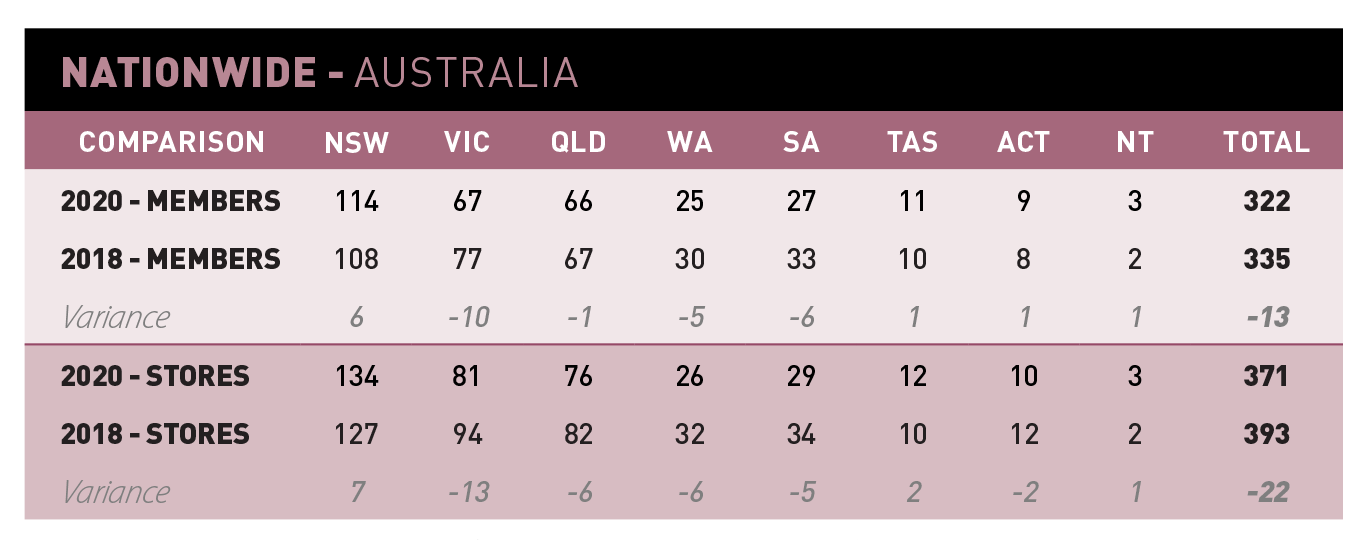

| Excludes 76 members and 85 stores in NZ and 1 member with 5 stores in Fiji |

Choosing a buying group

If consumer confidence is low, retail spending down, and shopping behaviour has dramatically changed, what can independent jewellers do to stem the tide?

There’s no doubt that one answer is the concept of unity, and Australian retailers have long had three distinct buying groups from which to chose, all offering different business models.

However, with the announcement in January this year of Zarb’s new group, Independent Jewellers Collective, there’s now a fourth option.

“IJC is perfect for proactive retailers that want to grow their business and share in a tight network of like-minded retailers. We offer a very simple and inexpensive business model that offers maximum hands-on support in all the areas that they would need help.

“We have a very experienced management team that specialises in assistance for independent jewellery retail, and we also have some unique third-party partnerships that we offer in our IJC Vault of services to ensure they have access to specialists in every area of their business,” Zarb says.

While the other three groups have established membership bases – all of which have been affected by store closures and retirements – Zarb still believes there’s a niche for IJC.

“We have now completed a tour of the country launching IJC officially across five states, with other meetings planned for retailers who had submitted an expression of interest that were not able to make one of the sessions.

“We always had a plan to go to market with 40-plus stores. I am pleased to say that we received more than that number of expressions of interest within the first day of our launch announcement being released.

“We have subsequently presented to even more stores during the state meetings,” Zarb explains.

He notes that while it is still early days, he has been overwhelmed with the positive feedback from retailers.

“We are receiving application forms daily as a result and are now confident that we will meet our minimum store number for launch – and we may even exceed it, based on discussions to date. IJC aims to partner with a smaller number of proactive retailers and grow accordingly as our model is very much about tailored one-on-one support.”

Like all other industries, the original reason for joining a buying group was to take advantage of the trade discounts from suppliers – however, Pocklington says that is a very outdated model.

|

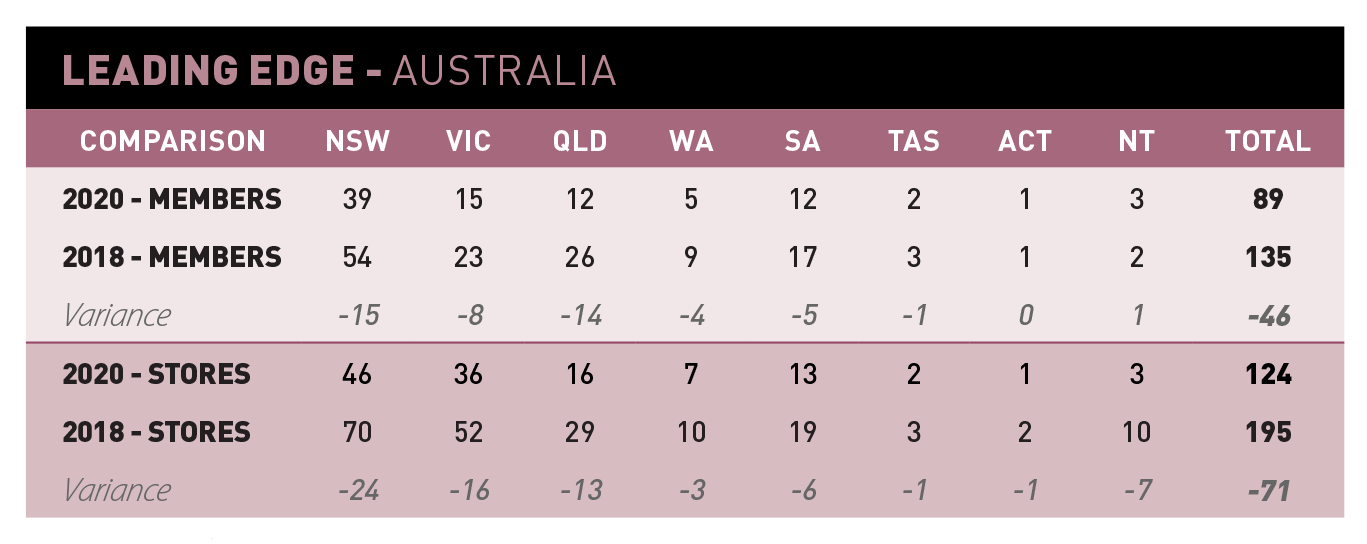

| Excludes 2 members and 4 stores in NZ |

“In the past ten years the main reason for joining has been the need for expert industry support. Our team of highly experienced, jewellery specific professionals cover all disciplines including marketing, merchandise, human resources, and training, as well as business planning and advice.

“Nationwide can provide a wide range of essential support for independent retailers. Having these resources available is always important, but even more so in a difficult economy,” Pocklington adds.

The backing of a buying group when negotiating leases or lease renewals can pay for itself many times over, given the potential savings.

Davey says the main reasons for independent stores to consider membership of a buying group are “to grow and drive sales into their stores, through traditional means and online strategies, for support with marketing, training and development, and for access to central billing with more than 140 suppliers.”

Leading Edge members also receive free membership to the Australian Retailers Association, which Davey says ensures there is a wealth of knowledge and support behind every member.

“Our members receive the best discounts the industry has to offer in terms of payment platforms, EFT rates, shipping costs and exchange rates. In addition, our MMC and Aurora Diamonds ranges offer exclusive jewellery to our members at prices not available to other retailers,” he explains.

Webb agrees that in today’s business climate joining a buying group is not about trade discounts.

“The Showcase model means that members are the owners and shareholders of Showcase, we aren’t privately owned like others. Joining our group should not be just for discounts or finance.

“While they are elements that fit into the bigger picture, I believe that if you join any group for only those reasons, then you’ll be doing the wrong thing for the long-term viability of your business,” he explains.

“Jewellers join to be part of a network of support and training, with focus groups, product assistance, access to exclusive opportunities that they would not get by themselves, marketing resources that are customised to suit them, a centralised account, and amazing travel opportunities such as visiting factories and meeting large retailers around the world.

“Having a large resource of knowledge and support that also cares about you like a family member, and will fight for you, push you, support you, and guide you almost 24/7, is priceless,” Webb adds.

Showcase members also receive free membership to the Australian Retailers Association and its Kiwi members receive membership to the equivalent New Zealand body.

|

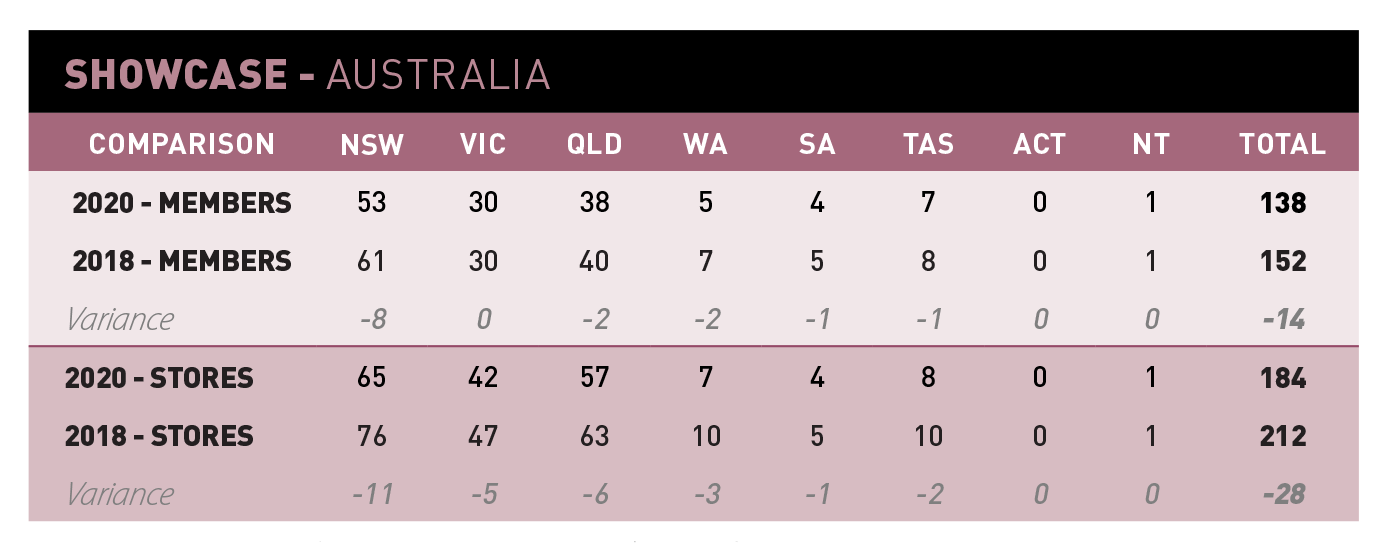

| Excludes 19 members and 19 stores in NZ and 1 member with 1 store in Vanautu |

Equipped for the future

As the business climate has changed, and as traditional retailing has come to grips with digital competition, training and education have become the cornerstones of all the buying groups.

Pocklington explains the importance of being able to benchmark your store against other, similar stores is vital: “In the past two years, we have created a 12-month trading budget for more than 150 of our members, and in the process benchmarked their business and provided them with the precise actions needed to improve their profitability.”

He adds, “Our one-day Retail Jewellery Business Management Course, valued at $5,000 but free for members, is now in its third year and more than 100 members have completed it in Australia and New Zealand.

“The course introduces several important aspects of retail science and shows members how to implement the seven strategies for retail success.”

Before launching IJC, Zarb conducted a review of the marketplace in order to find the new buying group’s niche.

He tells Jeweller, “Everything we offer at IJC aims at specific one-on-one support for our retailer partners – and our business model also ensures that our stores are always accruing funds to make use of our IJC Vault of services.

“Upon joining the Independent Jewellers Collective, partners will receive a free Business Health Check, covering staffing levels, stock holding, merchandising, marketing and overall business performance and profitability – delivered in a ‘real world’ solution package.

“This is at the heart of our offer and recommendations will be provided on which levers to pull, and when, to create the biggest impact on our member’s bottom line,” Zarb adds.

While retail buying groups do not offer the elusive panacea – and may not be the right choice for every independent jeweller – as the business world becomes increasingly competitive and complicated, they do offer a safe harbour within which like-minded business owners can seek protection and assistance in order to flourish.

Better still, jewellers now have a choice of four groups – all with different business models and advantages – to suit their specific needs.

Are discounts the most important factor in joining a buying group? |

“While discounts play a role, other areas of the membership offer are more important. These include experience driving sales into store to increase turnover, and experience developing store-specific clearance strategies that will not undermine gross profit. Gross profit and net profit are benchmarks to determine the health of a business, so any area affecting these benchmarks is vitally important.”

Charlie Davey

Leading Edge Group | “Our vision is unchanged: we believe that members always come first, so we not only provide the largest discount back to the retailer, but any profits made throughout the year are also passed back to our members. Would you prefer an extra 5 or 10 per cent from your supplier, or let the group take that discount and provide you with free marketing, business support, and everything else?”

Carson Webb

Showcase Jewellers | “Discounts are still important, which is why we give a written guarantee that any jeweller joining Nationwide will be financially better off with our trade discounts, member rewards and no-fees-or-charges structure. A recent reconciliation for several new members showed that, depending on the mix of their purchases, they were 2 to 5 per cent better off with Nationwide.”

Colin Pocklington

Nationwide Jewellers | “Discounts are definitely important. However, the reality is that all buying groups offer very similar net discounts after everything is factored in. The real choice is then down to what level of support you would like. IJC falls into the boutique service category, with high-quality, one-on-one service and a smaller number of retailers.”

Josh Zarb

Independent Jewellers

Collective |

'2020 Buying Group Report' Contents »

Read the entire MARCH Issue

PREVIOUS ISSUES