White metal is one of the broadest categories in the jewellery market, comprising everything from the most precious and expensive – palladium, platinum and white gold – to affordable silver and stainless steel.

Because of their varied characteristics and prices, white metals are critical to a jeweller’s success and can be used across the spectrum of jewellery products. From engagement and bridal to everyday wear, white metals offer the ability to cater to every customer’s budget and desired aesthetic.

Creating elaborate and unique pieces for the top end of the market, jeweller Paul Amey says, “I personally have been a fan of white metal in creating two-tone articles; it adds colour, depth and definition to my work and it greatly enhances the beauty of the stones and pearls and other exotic materials I endeavour to use whenever possible.”

Amey won the Precious Metal Award at this year’s Jewellery Design Awards with Pink Mist, a bejewelled pen that shows the stunning potential of white metal by using platinum to complement 18-carat yellow gold, pink and white diamonds, and Keshi pearls.

At the other end of the market, consumers and jewellers alike are becoming more enamoured with silver amid soaring gold prices, which recently reached a five year high of $US1,546.10 ($AU2,266.65) per ounce in September.

“Silver is a big category for us,” Pallion operations manager Chris Botha says. “It’s a significant part of our casting cycle and it does seem to be growing, which is related to the gold price. More people are now producing silver goods as gold goods have gone up significantly over the last year.”

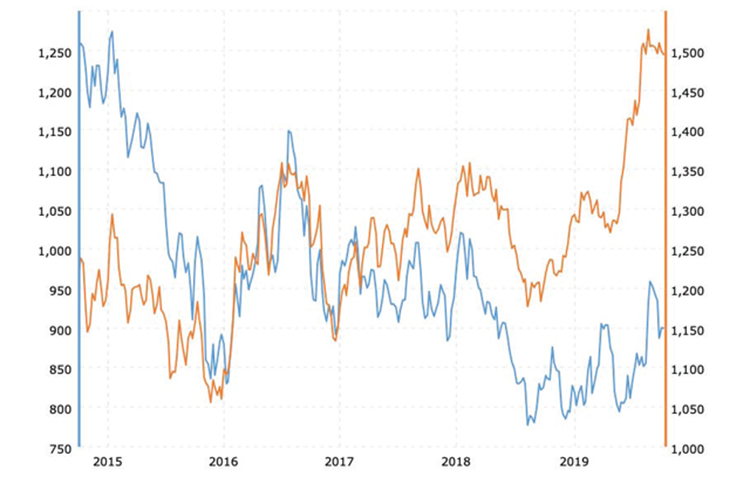

The high gold price is in contrast to the falling price of platinum, which presents another opportunity for jewellers.

Movements in the market

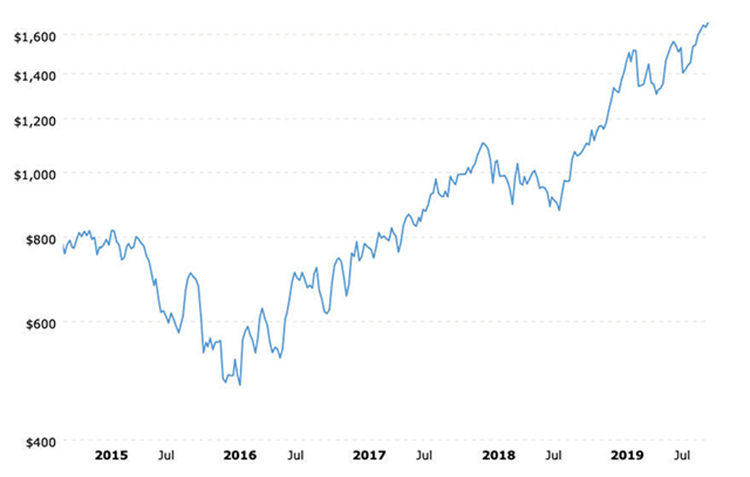

Having perhaps the most significant impact on white metals are commodity prices. In particular, the price of palladium – a key agent in creating white gold, aside from nickel – increased by more than 85 per cent between August 2018 and March 2019, from $US837.20 to $US1,560.40 per ounce.

According to Forbes, palladium has been the best performing commodity for the past two years and its price per ounce overtook gold in January of this year for the first time since 2001.

Such inflation is generally accepted to be because of restricted supply – three-quarters of all palladium is sourced from mines in just two countries, South Africa and Russia.

There is also high demand for the metal in the automotive sector where palladium is a key component the manufacture of catalytic converters, which capture pollutants from engine exhaust fumes. As global emissions regulations tighten, more palladium is required. Morris & Watson operations manager Grant George says, "With the price of palladium so high, a lot of customers are more conscious of the price of white gold that has been whitened with palladium."

Meanwhile, the high price of gold has been attributed to macroeconomic forces, namely global market and political instability, which make the metal attractive to investors as a store of value.

For the jewellery industry, manufacturers and designers must consider whether shoppers will accept the higher price for white gold or embrace alternative white metals, even turning to cheaper alloys.

Rapid Casting’s Ben Farago believes customers are seeking alternatives.

“Over the last year we have seen a dramatic increase in the price of gold and palladium while the price of platinum has stayed fairly steady, if not dropped off a bit. Customers are turning to platinum more often.”

Platinum has also been in higher demand at Pallion.

“Gold has crept up over $US1,500 [per ounce],18-carat white gold is 75 per cent fine gold and 75 per cent of $US1,500 is $US1,125,” Botha explains.

“With platinum, you can buy a 95-percent- pure metal for a cheaper price – approximately $US900 [per ounce] – so you can get a whiter metal that doesn’t need rhodium plating for a similar or even lower price than 18-carat white gold, which is an alloy and does need rhodium plating.”

Yet George notes that white gold remains king in some sectors of the jewellery market.

“Our premium 18-carat white gold, which contains a very high level of palladium and lower level of platinum, is still very popular for the high-end jewellers where the price is of little consequence,” George says.

“In fact, it’s over 35 per cent higher than our platinum price, whereas a couple of years ago this trend would have been reversed. This alloy is very niche since it cannot be cast and only used for the handmade pieces.”

Chemgold director Larry Sher says that 18-carat white gold is still his business’ “most popular premium white metal”.

Chemgold now offers three white gold alloys – one with 15 per cent palladium, one with 13.2 per cent and another with 10 per cent, to give jewellers options based on their individual requirements and taking into account the current high price of fine gold and palladium.

Steven Gades, production manager Pure Casting, has noticed increases in demand for platinum and its 18-carat White Gold Premium alloy and 14-carat white gold.

Meanwhile, Peter Beck, managing director Peter W Beck, notes that the demand for white gold seems to be dependent on fashion trends – in contrast to perennial favourite yellow gold.

|

| Above: Paul Amey |

“We observe that the popularity of white gold jewellery can be cyclic, sometimes trending for years – but then popularity will significantly wane for a period until the upward trend repeats,” he says.

“Some jewellery buyers will also select white gold because the cool-toned colour may blend better with their complexion than warm yellow or rose gold.”

Some jewellers choose gold that is whitened solely with nickel but this presents another potential pitfall.

George points out that white gold jewellery without palladium will cost less; however, the metal will not have the same strength as a palladium alloy.

The presence of nickel can also cause allergic reactions. “The Holy Grail in alloy research is to find a cheaper non-toxic substitute for palladium as a whitener agent for white gold alloys,” George says.

Sher advises jewellers to be mindful of the palladium content within certain 18-carat white gold alloys, noting that those with extremely low palladium content may result in an alloy that is not as white as their customer expected or not have the metal characteristics the jeweller requires.

“Chemgold is 100 per cent transparent with the key fine metals that are contained in our alloys,” he says.

Amey recalls that nickel-based white gold alloys were once the industry standard but this presented many challenges for manufacturing jewellers.

“They were extremely difficult to use and the colour was less than satisfactory. White gold turns yellowish after the rhodium wears off, greatly disappointing clients who don’t like leaving their rings for the time it takes to re-plate them – especially engagement rings,” he says.

“With the fashion trend of white gold engagement rings re-emerging after a near 30-year absence, these problems have also re-emerged.”

Beck adds that white gold was seen as the cheaper competitor for platinum when it entered the industry in the 1960s. Its lower price, fixed to the Gold Standard, led to a boom in consumer demand.

Today, platinum prices are “around 40 per cent less than gold,” Beck explains, leading to an increase in popularity for that reason.

|

| The five-year price movements of palladium. Source: Market Trends |

|

| Five-year price movement comparison of gold (orange) and Platinum (blue). Source: Market Trends |

Platinum potential

Meanwhile, aside from its comparatively low price, platinum offers several significant benefits for manufacturing jewellers.

“In recent times platinum has become my preferred white metal; its exceptional working, finish and colour offers my clients an outstanding result and excellent value for money in the long term,” Amey says. “It eliminates a huge amount of maintenance and the wear-and-tear factor is far superior [to white gold].”

Amey does admit that platinum “has its difficulties”, particularly due to its high melting point. Overall, the metal “requires a great deal more skill and artistry than gold”.

To eliminate some of the difficulties in working with platinum, Chemgold has introduced a new alloy – PlatinumG – which Sher says has “outstanding workability, brilliant white colour and a higher precious metal content” that makes it ideal for soldering and welding and easier for setting.

Gades points to Pure Casting’s new 950 platinum alloy PlatinumOro, which he says has a Vickers hardness of 160.

From a casting perspective, George says both platinum and palladium alloys present challenges.

“With casting, due to the high temperatures involved, specialised investment and casting technologies are required. The casting trees are smaller and often the cast pieces require sprue adjustment and placement in order to achieve the optimum result,” he explains.

“The higher cast charges deal with the inefficiencies and extra time to produce the perfect platinum/palladium casting. Although the white gold casting temperatures can be substantially higher than the yellow gold, the process and technologies are identical.”

Botha, too, points out the added expense of platinum casting: “You use more expensive powders, more expensive casting equipment and the volume of tree material is a lot higher when you’re casting platinum. All that said, it’s still competitive with 18-carat white gold.”

At Pure Casting, an Envision Tec Resin Printer is used to cast platinum and other metals. “Envision Tec resin printers are still considered market leaders in resin printers for print quality and castability,” Gades explains.

When it comes to refining, George says further purification steps are required in order to get consistent results, making the process longer and more expensive: “Due to the metallurgical nature and longer refining cycles for the platinum and palladium, the stock turnover is always slower and requires more skill, experience and different technologies than gold and silver refining.”

Chemgold director Darren Sher reveals, “We are seeing an increase in the number of customers who request we XRF [x-ray fluorescence analysis] their white gold to ensure the palladium content is as expected and on occasion have found it not to be the case.”

In addition, both Darren Sher and George recommend jewellers keep different scrap and lemel separate – white gold, yellow gold and platinum – and to keep a record of the percentage of platinum or palladium in order to streamline the process and avoid extra charges.

|  |  |

| Above: Chemgold | Above: Rapid Casting | Above: Chemgold |

Stable steel and silver

While the top end of the category has been sensitive to macroeconomic trends, silver and stainless steel have seen stable prices and steady demand. This affordability makes these metals popular with retailers and consumers alike.

Ellani Collections offers a large selection of silver and ion-plated steel jewellery. Managing director Paul Hicks says, “Using silver as the base metal as opposed to gold allows the price points to be in line with what consumers are prepared to pay, while larger, heavier designs are done in the steel to keep the price points down.

“Meeting the consumer with a design at a price point that they are prepared to pay is the key to achieving a lot of turnover,” he continues. “Retailers that do the fast seller reports see very good stock turn.”

Hicks adds that consumers have become far more aware and accepting of steel jewellery in recent years and increased demand is reflected in sales.

Cheryle Roberts, managing director Stones & Silver, points out that while price is a significant factor in the demand for sterling silver jewellery, it’s not the only benefit; consumers are also attracted to the aesthetic qualities and versatility of the metal.

“Silver has a bright-white lustrous hue and has been valued as a precious metal since ancient times. The main benefit is that it is highly fashionable and loved by all ages; it mixes well with beautiful coloured gemstones to create unique pieces,” she says.

Indeed, fashion jewellery is a category in which sterling silver and stainless steel naturally shine.

The low cost of production means that retailers can develop a more diverse offering and take advantage of fleeting trends.

“Retailers that stock a good selection of silver and steel jewellery are able to stock current, on-trend designs without a large expense,” Hicks says.

He notes that this type of jewellery often attracts younger consumers with more disposable income, which opens the door to an ongoing retail relationship.

“That consumer often matures and gets engaged, has anniversaries and special occasions that require more expensive jewellery to mark these sentimental milestones in their life and return to the retailer where they have developed a rapport.”

Roberts notes that sterling silver jewellery is not limited to the fashion category and can become a treasured piece on its own merits.

She reveals that Stones & Silver uses German-manufactured 93.5 per cent pure silver in its chain designs – 1 per cent more than standard sterling silver – as well as undergoing extra processing to give it a highshine, non-tarnish finish and extra durability.

“With so much non-sterling silver on the market today, it is important for retailers to highlight and market their sterling silver jewellery,” Roberts adds.

Several different alloys have been developed to overcome the metal’s challenges – tarnish and fire-staining, also known as fire-scale – without losing what Amey calls “that magnifi cent silver white”.

At Pallion, Botha says there are two main silver alloys used in casting: one using germanium and the other copper. “[Germanium-based silvers] have less issues with fire-scale.

“Normal 92.5 per cent silvers with copper are traditional silvers, but there are various alloys available. I’d say on a purely weight basis of what we cast, it’s an even spread between the copper-based and germanium-based silvers.”

Pure Casting’s Anti-Tarnish Silver (ATS) “has been a success” according to Gades, who adds that a new Anti-Tarnish alloy, Brite Silver, is currently in development. “Brite Silver is brighter in colour and longer lasting, as well as being slightly harder than standard sterling silver,” he explains.

Meanwhile, Darren Sher notes that demand for Chemgold’s AGPD alloy – sterling silver with palladium – has been increasing. AGPD offers several advantages, according to Sher, who says it is high-strength, tarnish-resistant and fire-stain free: “AGPD is fantastic for bench work and allows for a better finish that will last longer.”

Indeed, marrying the most expensive of white metals with one of the cheapest sums up the incredible diversity and potential of the category itself. Today, jewellers have more choice than ever with metals and alloys to suit their every need.

MORE PRODUCTS

|  |  |

| Above: Stones & Silver | Above: Peter W Beck | Above: Worth & Douglas |

|  |  |

| Above: Artisan Bespoke Jewellers, courtesy Morris & Watson | Above: Ellani Collections | Above: Stones & Silver |